Did you know that many beginner Forex traders focus only on prices and overlook the hidden costs of commission and spread? This simple oversight and misunderstanding of the difference between commission and spread can reduce their daily profits by 30–50%!

As the largest financial market in the world, Forex is a platform for trading major global currencies. In this market, two key factors affect trading costs: commission and spread. Both play a vital role in determining traders’ profits and losses. In this article, we provide a professional analysis of the differences and similarities between commission and spread in Forex and offer tips for making better choices between the two.

What Is the Difference Between Commission and Spread in Forex?

Both commission and spread are costs that Forex traders must pay, but each is applied differently. Commission is a fixed fee charged by the broker for each trade. In contrast, spread is the difference between the buying and selling price of a currency pair or trading instrument. Both factors affect the overall trading costs, and understanding them correctly is essential for success in Forex trading. Day traders who execute short-term trades may prefer lower spreads and higher commissions to minimize their trading expenses.

What Is Commission in Forex?

Commission is the fee that brokers charge their clients for executing each trade. This fee is usually determined as a percentage of the trade volume or as a fixed amount. Different brokers have different commission rates, and some may not charge any commission at all, instead covering their costs through spreads.

How Commission Is Calculated

Commission is generally calculated in one of the following two ways:

-

Percentage of Trade Volume: In this method, the commission is calculated as a percentage of the total trade volume. For example, if the commission is 0.01% and the trade volume is $100,000, the commission paid will be $10. On the Trendo broker platform, for every $100,000 traded, only $3 in commission is charged, which is exceptionally low and highly competitive.

-

Fixed Amount: In this method, the broker charges a fixed fee per lot traded. For example, for trades smaller than one lot, a $5 commission may apply.

Commissions can have a significant impact on trading costs, especially for traders executing high-volume, short-term trades. Choosing a broker with competitive commission rates can substantially reduce trading expenses.

By registering on the Trendo platform, you can enjoy commissions of just $3 per trade.

What Is Spread in Forex?

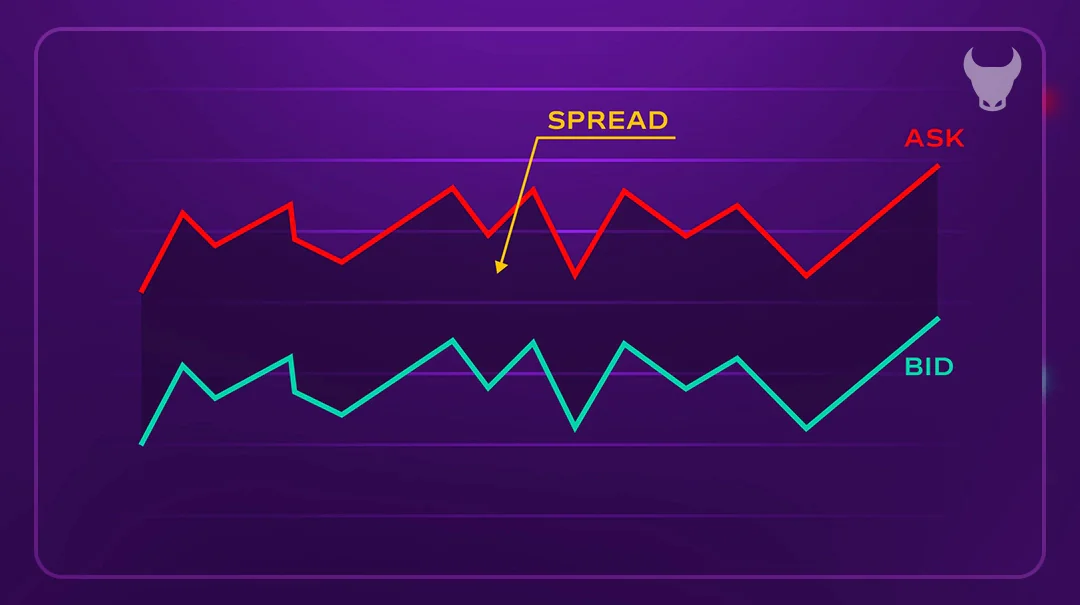

Spread is the difference between the buying and selling price of a currency pair or trading instrument in financial markets. For instance, if the EUR/USD bid price is 1.2000 and the ask price is 1.2003, the spread equals 3 pips. This difference acts as an indirect cost for traders and allows brokers to earn revenue without charging a commission. Spreads can be fixed or variable and may fluctuate depending on market conditions.

Spreads can significantly affect trading costs. A lower spread means lower costs for traders, while a higher spread increases trading expenses and impacts the overall profitability of a trade.

Now that you understand the difference between commission and spread, it’s time to make the right choice and increase your profits. Open your account with Trendo today and enjoy its unique advantages.

Conclusion

In this article, we explored the differences and similarities between commission and spread in the Forex market. Both factors play a crucial role in determining trading costs, and choosing the right approach can help reduce expenses and enhance profitability. Traders should consider these elements in their trading strategies and risk management styles and always aim to minimize trading costs.