Spread, as one of the key factors influencing trading costs in financial markets, plays a vital role in a trader’s success. Choosing a broker with competitive spreads can significantly reduce trading expenses. In this article, we will explore the concept of broker spreads and their impact on trading costs, compare spreads among different brokers, and provide practical insights to help traders make informed decisions suited to their trading style.

How Does Spread Affect Trading Costs?

The spread is one of the most important hidden costs in financial markets that directly affects a trader’s profitability and performance. The spread represents the difference between the Ask (selling price) and the Bid (buying price) of any asset — essentially the cost traders pay to open or close a position.

Once a trade is opened, the trader immediately incurs a loss equal to the spread. To exit with a profit, the price must move at least by the spread amount in the expected direction.

In scalping and short-term trading strategies that rely on small price movements, spreads play a crucial role. Even minor profits can be eroded by high spreads. For example, if the EUR/USD pair has an Ask price of 1.1002 and a Bid price of 1.1000, the spread equals 2 pips. This means the market must move 2 pips in your favor to reach breakeven.

Key factors influencing spread size include:

-

Market liquidity

-

Market volatility

-

Type of trading account

-

Broker conditions and regulations

Key Points When Comparing Broker Spreads

Comparing broker spreads is a crucial step to minimizing trading costs and improving profitability. Choosing a broker with competitive spreads can have a significant impact on a trader’s performance. Below are the main factors to consider when comparing spreads:

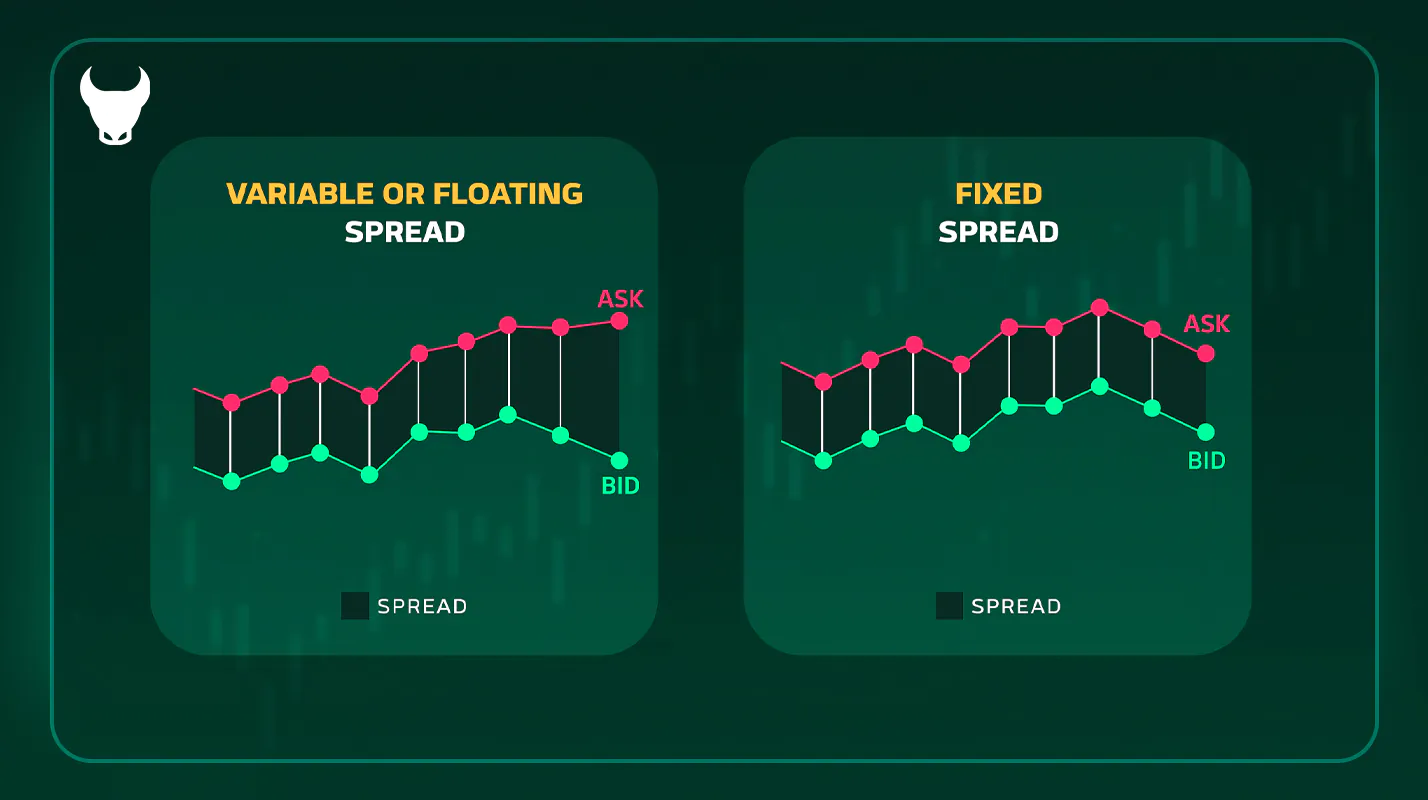

1) Type of Spread: Fixed or Floating

A fixed spread is a predetermined, constant value set by the broker and generally higher than a floating spread. This type suits traders who prefer predictable trading costs.

A floating (variable) spread, on the other hand, fluctuates with market conditions such as price volatility, liquidity, and economic news. It tends to be lower during calm market periods. Short-term traders — especially scalpers — often prefer floating spreads to benefit from tighter pricing when market conditions are favorable.

Spreads also vary by instrument type (currency pairs, commodities, indices, etc.). Major currency pairs such as EUR/USD typically have lower spreads than minors or exotics. Traders should carefully review and compare spreads for their preferred instruments across brokers.

2) Transparency of Trading Conditions

Transparency in spread presentation and trading conditions is a hallmark of a reputable broker. Some brokers may display misleadingly low spreads (so-called hidden spreads) or alter prices during order execution (requotes), creating unexpected costs for traders.

Reliable brokers offer real, competitive spreads while minimizing requote risk and hidden costs. Traders should choose brokers that provide transparent trading terms, detailed spread information, and clear execution policies.

3) Account Types and Commission Structures

Brokers offer various account types such as Standard, ECN, or VIP, each with different spread and commission models. ECN accounts usually offer ultra-low spreads but charge a separate commission per trade. In contrast, Standard accounts often have no commissions but wider spreads.

Traders should select an account type that balances spreads and commissions according to their trading style — whether day trading, long-term investing, or scalping — and their average trade volume.

4) Execution Speed

A low spread alone is not enough; execution speed and quality are equally important for profitability. In short-term or high-volume trading, even small differences in spreads can greatly impact the final outcome.

Brokers offering low-latency, fast execution are more suitable for scalpers and active traders. When comparing brokers, consider not only the spread size but also the execution speed and platform stability.

In conclusion, when selecting a broker with optimal spreads, traders should consider not just how low the spread is but also factors such as spread type, market conditions, account structure, and pricing transparency.

Types of Spreads

Spreads are generally divided into two main types based on their calculation structure:

1) Fixed Spread

A fixed spread is a constant difference between the Bid and Ask prices, typically set by Market Maker brokers and unaffected by market volatility or liquidity changes.

This model offers predictable trading costs — ideal for beginners — and protects traders from sudden cost spikes in volatile markets. However, fixed spreads are usually higher under normal conditions and carry the risk of requotes and lower price transparency due to broker control.

2) Variable (Floating) Spread

A variable spread fluctuates according to market conditions such as liquidity and volatility and is offered by ECN/STP brokers who source pricing directly from the interbank market.

This type tends to be lower and more competitive during peak trading hours. Due to high transparency and no requotes, it appeals to professional traders. However, spreads may widen during news events or low-liquidity periods.

| Feature / Type of Spread | Fixed Spread | Variable Spread |

|---|---|---|

| Definition | Constant and unchanging | Fluctuates based on market conditions |

| Broker Type | Market Maker | ECN / STP |

| Price Transparency | Low | High, real-market based |

| Requote Risk | Possible | None |

| Cost in Calm Markets | Higher | Lower |

| Cost in Volatile Markets | Stable, predictable | May increase |

| Best For | News-based strategies | Professional & scalping traders |

Spread Types by Trading Strategy

The type of spread plays a vital role in shaping trading strategies. Below is a guide to choosing the suitable spread for each style:

| Trading Strategy | Recommended Spread Type | Reason |

|---|---|---|

| Scalping | Floating | Lower costs in fast trades |

| Day Trading | Floating | Reduces short-term trading costs |

| Swing Trading | Floating / Fixed | Both are suitable |

| Position Trading | Floating / Fixed | Both are suitable |

| News Trading | Fixed | Prevents spread widening during news releases |

According to the table, a fixed spread is suitable mainly for news trading. However, while fixed spreads remain stable during announcements, the DD (Dealing Desk) structure of such brokers may cause significant execution delays. Moreover, this trading style carries high risk and is generally not recommended.

That’s why most professional traders prefer floating spreads with ECN brokers.

Does the Broker’s Spread Affect Profitability?

Yes, the broker’s spread has a direct and significant impact on Forex trading profitability. In fact, the spread is the first cost a trader incurs upon opening a position. The lower the spread, the cheaper it is to enter and exit trades.

Example:

If an asset’s spread at Broker A is 1 pip and at Broker B is 0.3 pips, the total trading cost with Broker A is roughly three times higher. Over time, this difference can substantially affect annual profits.

Which Broker Offers the Best Spread?

Choosing the “best broker with optimal spreads” depends on the trading type (scalping, short-term, or long-term), trade volume, and commission transparency.

Generally, ECN brokers offering near-zero spreads are the best choice for minimizing trading costs.

Introducing Trendo Broker

-

Spreads from 0.0 pips: Almost all major currency pairs on Trendo are offered with floating spreads starting from 0.0, meaning extremely low entry costs.

-

ECN Trading Accounts: All Trendo users have ECN-type accounts with floating spreads from zero — no higher-spread accounts are offered.

-

Low Commissions: Trendo’s trading commissions are highly competitive — $3 per lot per side, with a cashback program.

-

Available Instruments: Forex, cryptocurrencies, stocks, energies, indices, and metals.

-

Minimum Deposit: You can open an ECN account and start trading with as little as $10.

-

Trading Platform: Trendo offers a proprietary, professional trading platform accessible via mobile and desktop.

Spread Analysis of Trendo Broker

At Trendo, spreads are exceptionally low due to direct liquidity-provider connections and an ECN-based structure across all accounts. For major pairs like EUR/USD and USD/JPY, spreads are typically zero or near-zero pips — one of Trendo’s main strengths. Even for gold (XAU/USD), spreads are often below 1 pip!

Final Thoughts

Choosing a broker with the right spreads is a fundamental step toward optimizing trading costs and increasing profitability.

As one of the primary trading expenses, spreads can significantly impact trader performance — especially in short-term and high-frequency strategies.

By carefully evaluating spread types (fixed and floating) and comparing broker conditions — particularly Trendo’s competitive ECN-based model — traders can make well-informed, cost-efficient decisions.

Sign up with Trendo and trade gold with spreads as low as 0.5 pips (5 pipettes)!