PAMM Account at Trendo Broker

What is the PAMM Account of Trendo and How It Works?

The PAMM account of Trendo is a collaborative structure that connects investors and professional traders on a secure, high-speed platform. The account manager trades from their own account with at least $500 of guaranteed capital, and all orders are copied proportionally to each investor’s share, and profits are distributed accordingly. The manager’s fee is only a percentage of net profit, meaning no fees are charged during loss-making periods. Investors can evaluate each PAMM account’s performance, risk level, and trading history in the “Signal” section. They also have full control to increase, reduce, or withdraw their investment whenever they choose.

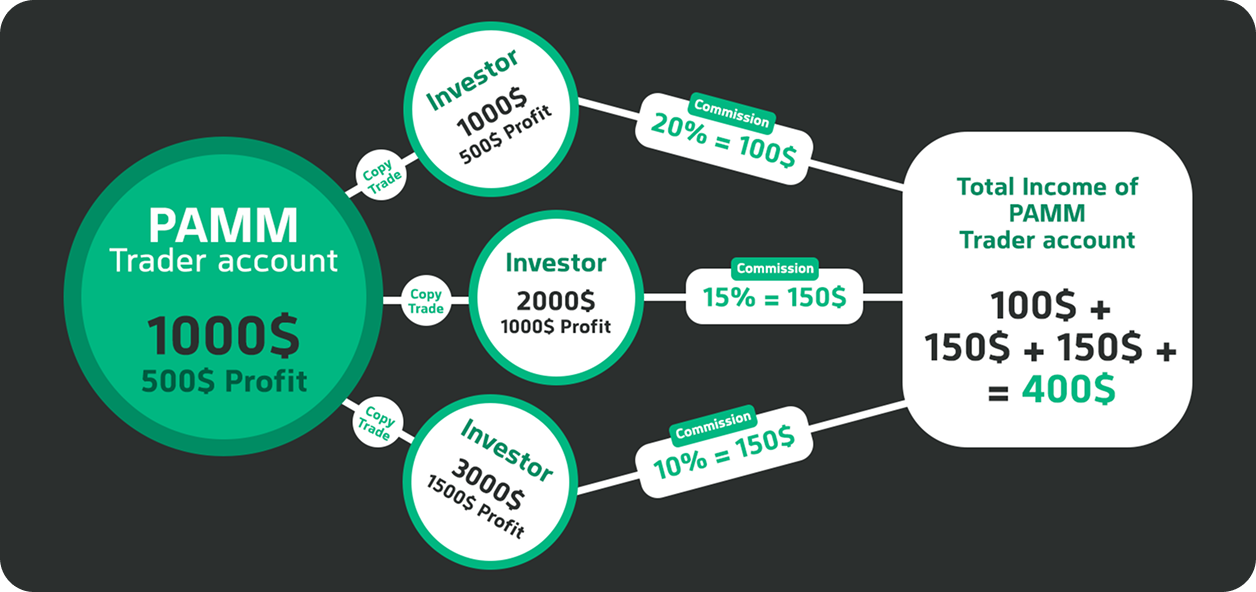

Practical Example of a PAMM Account at Trendo:

Imagine a professional trader on Trendo opens a PAMM account with an initial capital of $1,000 and successfully earns a $500 profit. Three investors have joined this account as well:

- First investor: invested $1,000 and earned $500 in profit. The trader’s commission is 20 % ($100). Therefore, the investor’s net profit is $400.

- Second investor: invested $2,000 and earned $1,000 in profit. The trader’s commission is 15 % ($150); thus, the investor’s net profit is $850.

- Third investor: invested $3,000 and earned $1,500 in profit. The trader’s commission is 10 % ($150). Consequently, this investor receives a net profit of $1,350.

At the end of the period, in addition to the trader’s personal $500 profit, he earns a total of $400 from managing investors’ funds, bringing his overall profit to $900. In this way, all investors and the trader share in the trading gains with full transparency.

Why Do Traders Choose the PAMM Account of Trendo?

Profit-Based Commission Only

The account manager takes a defined percentage only from net profits. No fees are charged during losing periods.

$500 Manager Guarantee

Managers are required to commit at least $500 of their own capital to begin, creating a strong incentive for risk management.

Freedom in Account Managing

You can increase, reduce, or completely withdraw your investment at any time. Full control is in your hands.

Transparent Real-Time Statistics

Track returns, trading history, and risk levels through more than 50 key performance metrics in your dashboard, making informed decisions.

Low-Cost ECN Account

Near-zero spreads and competitive commissions help you retain more of your trading profits.

Managed Leverage of 1:500

A reasonable leverage cap helps control excessive volatility and protects your account from sudden margin calls.

FAQs

What’s the minimum investment for a PAMM account, and can I change it later?

To start PAMM trading, account managers must invest at least $500 of their own capital. If their balance drops below $200, trading will be restricted. Investors, however, face no minimum limit and can adjust their capital at any time.

How is the manager’s commission calculated and when is it deducted?

The manager announces their fee percentage in advance. At the beginning of each calendar month, the system deducts only that percentage from your net profit and transfers it to the manager’s wallet. If the month closes with a loss, the manager does not receive any fee.

What happens to my investment if the manager’s trades result in losses?

Unprofitable trades are copied exactly based on balance and price between the manager and all investors — meaning losses reflect proportionally in every account, with no separate distribution logic. In periods of negative performance, no fees are paid to the manager.

Can I change the leverage on my PAMM account?

The maximum leverage for PAMM accounts is 1:500, set by the broker to limit excessive volatility. Manual adjustments are not allowed.