On Tuesday, October 28, 2025, the AUD/USD currency pair is fluctuating around the 0.6550 level. This movement occurs as traders await the release of key inflation data and upcoming monetary policy decisions from the Reserve Bank of Australia (RBA) and the U.S. Federal Reserve — two major factors likely to shape the future direction of interest rates and, consequently, the trend of this currency pair. In this analysis from the Trendo education team, we review both the technical and fundamental aspects of the market to provide a clearer outlook on the current situation and possible future trends. You can also access the Trendo trading platform and use its advanced analytical tools and features to perform your own analyses with greater accuracy and confidence.

Technical Analysis of AUD/USD – October 28, 2025

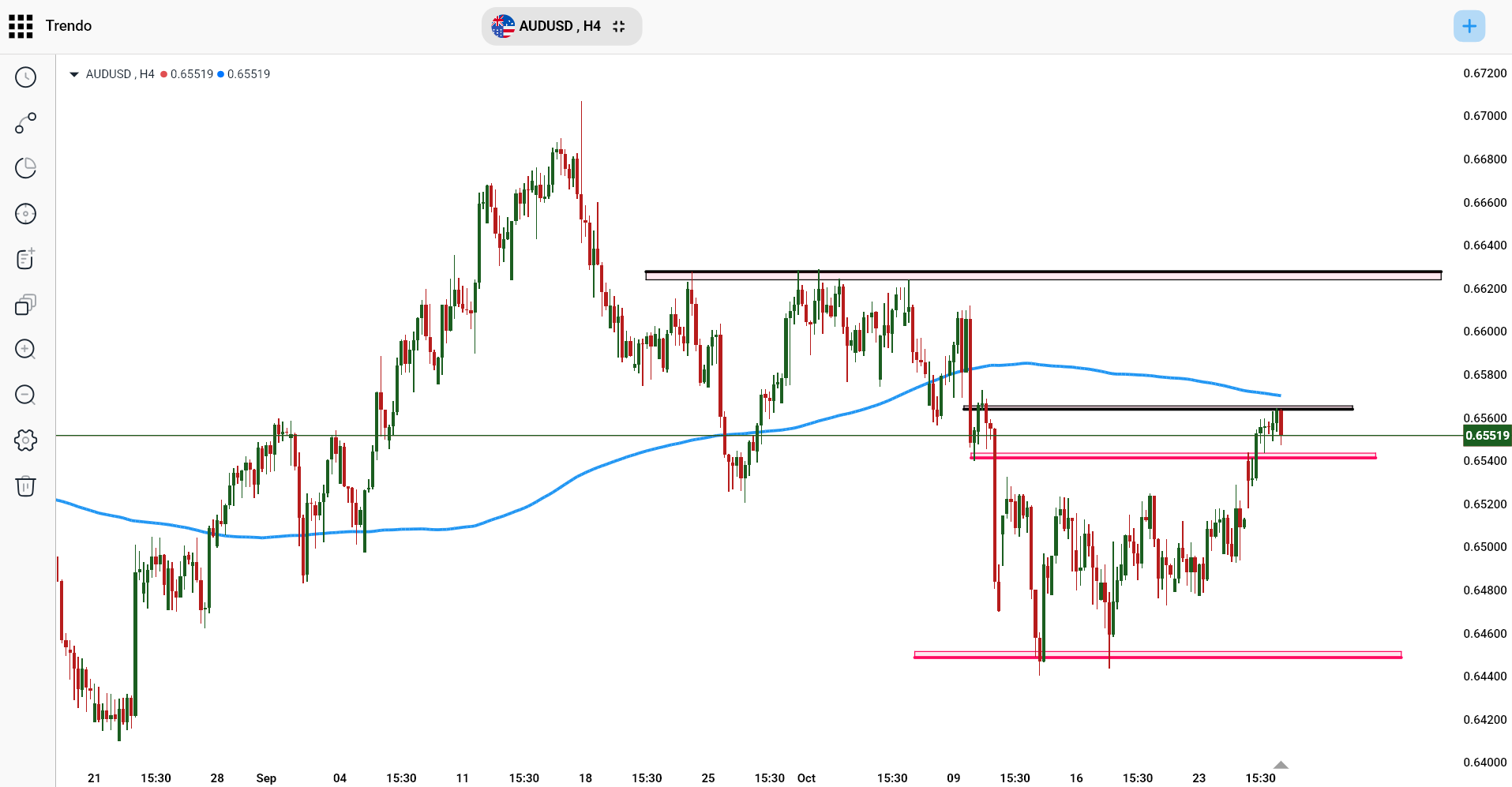

From a technical perspective, the AUD/USD pair is consolidating within a tight range between 0.6542 and 0.6563, reflecting a phase of market stabilization and anticipation of a new fundamental catalyst. Currently, the price is trading above the short-term moving averages, indicating a temporary dominance of bullish momentum. The 0.6563 level remains a key psychological resistance, and a confirmed breakout above it could pave the way for further upside targets. Conversely, the 0.6540–0.6448 zones are identified as initial support areas that could limit downward movement if selling pressure increases.

Technical Chart of AUD/USD – Trendo Platform (H4 Timeframe)

Fundamental Analysis of AUD/USD – October 28, 2025

From a fundamental standpoint, three main variables currently shape the direction of the AUD/USD pair: Australia’s monetary policy, U.S. monetary policy, and the overall global risk sentiment and commodity market conditions. In Australia, the central bank has indicated that if core quarterly inflation for Q3 rises to around 0.9% (compared to the estimated 0.6%), it would signal persistent inflationary pressure and significantly reduce the likelihood of a rate cut. Furthermore, consumer inflation expectations increased to 4.8% in October, reflecting ongoing concerns over price pressures. On the other hand, in the United States, the market has strengthened its expectations for a more dovish Federal Reserve, with growing anticipation of rate cuts in the coming months. This outlook has weakened the U.S. dollar, thereby supporting commodity-linked currencies such as the Australian dollar. At the same time, the modest recovery in commodity prices and increased investor risk appetite act as additional supportive factors for the AUD.

Overall, from a fundamental viewpoint, the Australian dollar is currently influenced by two opposing forces:

- On one hand, a weaker U.S. dollar and improved global risk sentiment may drive further gains in the AUD.

- On the other hand, persistent domestic inflation in Australia or a delay in RBA rate cuts could limit the upside potential and trigger renewed selling pressure.

Conclusion

In the short-term outlook, the AUD/USD pair stands at a critical juncture both technically and fundamentally. Sustaining price action above 0.6520 could support continued bullish momentum and a potential test of 0.6600 resistance. However, a breakdown below current supports would raise the risk of a deeper retracement. The key market drivers in the coming days will be the Australian inflation data and the RBA’s policy tone, while U.S. dollar volatility will likely play a secondary but reinforcing role in shaping the short-term trend.

For more precise market analysis and low-spread, low-commission trading execution, you can use the Trendo platform and benefit from its advanced technical and fundamental analysis tools to experience a more professional trading environment.

Disclaimer: This analysis is provided for educational and informational purposes only and should not be considered as financial advice or a recommendation to buy or sell any financial instrument.

Download the Trendo Platform and Trade with the Lowest Spread and Commission