In this game, two key players often dominate the board: spreads and commissions. These financial mechanisms are the bread and butter of trading costs, yet they often lead to a common dilemma for traders – which offers the best value?

At Trendo Broker, we believe in empowering traders with knowledge to make informed decisions. This blog post will delve into the mechanics of spreads and commissions, dissecting their impact on your trading strategy and bottom line.

Whether you’re a seasoned trader or just starting out, grasping the nuances of these costs can be the difference between a checkmate and a stalemate in the Forex market.

Join us as we unravel the mystery and help you determine which option aligns best with your trading goals.

What is Forex Trading?

Forex trading, also known as FX or currency trading, is the act of buying and selling currencies on the global market. It’s the world’s largest financial market, where trillions of dollars’ worth of currency exchanges hands every day. The beauty of Forex lies in its accessibility; it’s open to both big financial institutions and individual traders alike.

At its core, Forex is about the exchange rate between two currencies, known as a currency pair. For instance, when you trade EUR/USD, you’re buying the Euro while selling the US Dollar. The goal? To profit from changes in the exchange rate between these two currencies.

But Forex isn’t just about simple exchanges. It’s a complex, dynamic market influenced by a myriad of factors, from global politics to economic data. Traders use various strategies and tools to predict market movements and make their trades accordingly.

What truly sets Forex apart is its operation hours. The market is open 24 hours a day, five days a week, allowing traders to respond to market changes almost instantly, no matter where they are in the world. This round-the-clock action makes it an exciting and potentially profitable arena for those who seek to understand its rhythms and flows.

Whether you’re looking to hedge your international currency risk, speculate on geopolitical events, or simply diversify your investment portfolio, Forex trading offers a unique and thrilling opportunity.

What are Forex Spreads?

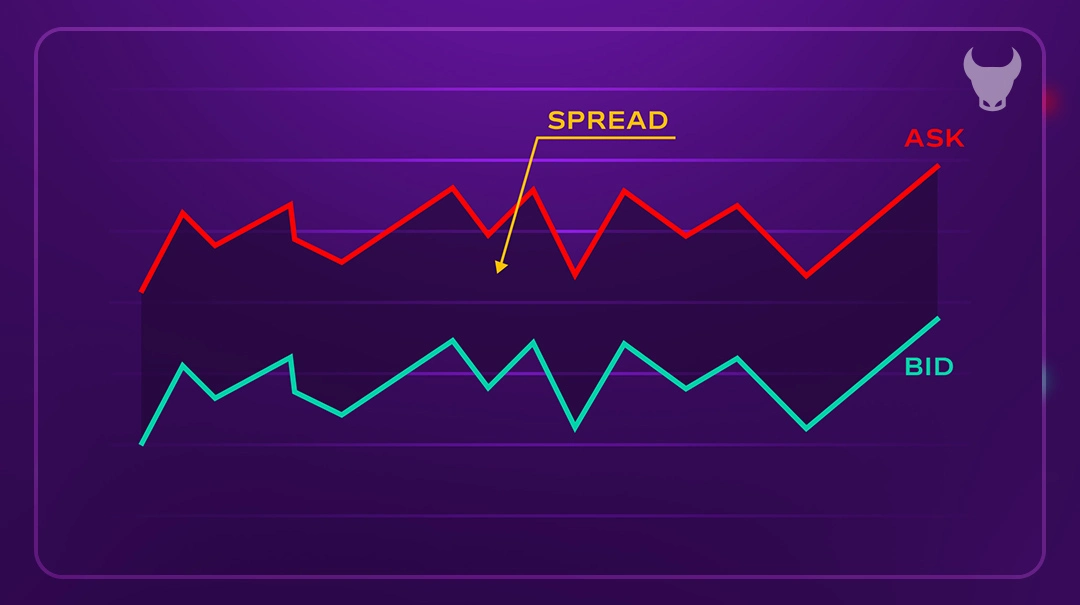

Imagine you’re at a marketplace where prices fluctuate rapidly. In the Forex market, the spread is akin to the difference between the wholesale (bid) and retail (ask) prices of currencies. It’s the bread and butter for traders and brokers alike, representing the cost of trading without being an explicit fee.

How Spreads Work in Forex Trading?

Spreads are essentially the broker’s way of making their cut. When you decide to buy a currency, you pay the ask price, and when you sell, you receive the bid price. The spread is the difference between these two. If the EUR/USD pair is quoted with an ask of 1.1053 and a bid of 1.1051, the spread is 2 pips. It’s a tiny amount, but in the world of Forex, where large volumes are traded, it adds up.

Factors Influencing Spread Size

Several elements can sway the size of the spread, much like how demand and supply affect the prices in our marketplace analogy:

Liquidity:

Popular currency pairs, much like in-demand products, typically have narrower spreads.

Volatility:

Just as prices can soar or plummet in response to news, spreads can widen with increased market volatility.

Time of Day:

Trading during peak market hours can result in tighter spreads due to higher trading volumes.

Economic Events:

Significant news or events can cause sudden market jitters, leading to wider spreads as the risk for brokers escalates.

What are the Types of Spreads?

In the Forex market, just like in any bustling marketplace, not all price tags are created equal. The spread is essentially the cost of entry into a trade, and it comes in different forms , each with its own set of characteristics and implications for traders.

Fixed Spreads

Fixed spreads are like a fixed menu price in a restaurant – they don’t change regardless of the time or season. They offer traders a sense of stability and predictability. No matter how volatile the market gets, the spread remains the same, allowing traders to strategize without worrying about fluctuating transaction costs.

Variable Spreads

Variable spreads, on the other hand, are like fluctuating market prices for fresh produce. They can change based on market conditions, such as liquidity and volatility. During peak trading hours when high volumes are being traded, these spreads can be tight. However, they can widen during off-peak hours or when significant economic news hits the wires, reflecting the higher risk or lower liquidity.

Commission-Based Spreads

Some brokers offer a hybrid model where they charge a fixed commission per trade in addition to a variable spread. This can be likened to a service fee plus a variable price for the item you’re purchasing. It’s a more transparent way of charging for services rendered and can sometimes offer the best of both worlds – lower spreads plus a clear commission fee.

How Spreads Impact Scalping and Day Trading?

In the fast-paced world of Forex trading, scalping and day trading are strategies that thrive on the hustle and bustle of short-term market movements. For traders who employ these techniques, spreads are more than just a number—they’re a pivotal factor that can make or break a trading session.

The Role of Spreads in Scalping

Scalping is the trading equivalent of a sprint—it’s all about speed and efficiency. Scalpers aim to snatch quick profits from small price changes, often executing dozens of trades in a single day. Here, every pip counts, and a tight spread is the scalper’s best friend. A narrow spread means lower transaction costs, allowing scalpers to capitalize on those tiny, rapid shifts in currency prices.

Spreads and Day Trading Dynamics

Day traders operate on a slightly broader canvas, holding positions for hours rather than minutes, yet they too are acutely aware of the impact of spreads. While they may not transact as frequently as scalpers, day traders still require competitive spreads to ensure their larger, less frequent moves are profitable. A wider spread can quickly erode the gains from a well-timed trade, making it essential for day traders to seek out brokers who offer consistently tight spreads.

What are Commissions in Forex Trading?

In the bustling Forex market, commissions are like the entry fee to an exclusive club. They are the fees that brokers charge traders for executing trades on their behalf. Unlike spreads, which are built into the trade, commissions are charged separately and are often transparent in the cost structure of a trade.

Commissions can be seen as a broker’s service charge, covering the costs of technology, support, and access to the trading platforms and markets. They are usually a fixed amount per trade or a percentage of the trade’s volume. For example, a broker might charge $5 per lot traded, or 0.1% of the trade’s value.

The beauty of commissions lies in their clarity. Traders know exactly what they’re paying for each trade, allowing them to calculate their costs upfront. This can be particularly advantageous for high-volume traders who can negotiate lower commission rates, thus reducing their overall trading costs.

How Commissions are charged?

Commissions are typically charged in one of two ways:

Fixed Commissions:

These are consistent fees charged on each trade, regardless of the size or volume of the transaction. It’s like paying a flat rate for a service, providing clarity and predictability with each trade.

Variable Commissions:

These vary depending on the trade’s volume. The larger the trade, the higher the commission fee, proportional to the trade value.

Fixed vs. Variable Commissions

The choice between fixed and variable commissions depends on your trading style:

Fixed Commissions:

are best suited for traders who appreciate stability and can calculate their costs upfront, making it easier to manage their trading budget.

Variable Commissions:

fluctuate with the market and trade volume, which can be more beneficial for traders dealing with large volumes, as they might pay less per unit traded.

Pros and Cons of Forex Spreads

Forex spreads are a fundamental aspect of currency trading, acting as the cost of opening a position. They can have both positive and negative impacts on your trading experience, depending on various market factors.

Advantages of Trading with Spreads

Cost Transparency:

Spreads offer a clear cost structure. You know the cost upfront, which helps in planning and managing your trades.

Simplicity:

For many, spreads are easier to understand than complex commission structures. It’s a straightforward concept: the difference between the bid and ask price.

Predictability:

Fixed spreads provide consistency, especially useful in volatile markets where you want to predict your trading costs.

No Additional Fees:

With spreads, what you see is what you get. There are no hidden fees or charges.

Disadvantages of Trading with Spreads

Cost Variability:

Variable spreads can fluctuate significantly during major economic announcements or times of low liquidity, which can impact trading strategies.

Potential for Higher Costs:

In less volatile market conditions, fixed spreads can be higher than variable spreads, leading to potentially higher trading costs.

Market Impact:

During times of high volatility, spreads can widen considerably, which can eat into potential profits.

Less Favorable for Scalpers:

Traders who make numerous trades throughout the day (scalpers) may find that the cumulative cost of spreads affects their profitability.

Pros and Cons of Commissions

When it comes to Forex trading, commissions are like the cover charge at a club. They’re the fees you pay for the privilege of trading through a broker. Let’s explore the upsides and downsides of this pricing structure.

Advantages of Trading with Commissions

Lower Overall Costs:

Commissions can often be lower than the cost of spreads, especially when trading major currency pairs or during stable market periods.

Fixed Fee Structure:

Commissions are usually a fixed cost, which means you can predict your trading expenses and manage your budget more effectively.

Transparency:

With commissions, you know exactly what you’re paying for each trade, which adds a level of transparency to your trading costs.

No Spread Manipulation:

Since brokers earn through commissions, they have less incentive to manipulate spreads, which can offer you more competitive pricing.

Disadvantages of Trading with Commissions

Can Add Up for High-Volume Traders:

If you’re making a lot of trades, those commission fees can quickly accumulate and eat into your profits.

Not Ideal for Small Trades:

For those trading in smaller volumes, the fixed commission can take a significant bite out of potential profits.

Complexity:

Commissions can add a layer of complexity to your trading strategy, as you’ll need to account for these costs when planning your trades.

Potential Hidden Costs:

Some commission structures may come with hidden costs, such as inactivity fees or withdrawal fees, which can catch traders off guard.

Spreads vs. Commissions: A Comparative Analysis

When you dive into the world of Forex trading, two of the most common terms you’ll encounter are spreads and commissions. These are the primary ways brokers make money and they directly affect your trading profitability.

Understanding the differences between these two can help you choose the right broker and develop a trading strategy that suits your style.

Spreads are the difference between the bid and ask price of a currency pair. They are variable and can change based on market conditions. Commissions, on the other hand, are fees charged by the broker per trade. They can be a fixed fee or based on the volume of the trade.

Here’s a simple table comparing key aspects of spreads and commissions:

| Aspect | Spreads | Commissions |

|---|---|---|

| Cost Structure | Built into the price of the trade. | Charged separately per trade. |

| Impact on Trading Style | More significant for frequent, small trades (scalping). | More significant for larger volume trades. |

| Predictability | Variable spreads can fluctuate; fixed spreads are predictable. | Usually a fixed cost, offering predictability. |

| Transparency | Cost is less transparent as it’s built into the trade. | Fees are clear and separate from the trade. |

| Suitability | Better for traders who prefer simplicity and integrated costs. | Better for traders who value transparency and fixed costs. |

Understanding these differences is crucial for traders. Spreads may be more appealing to those who make frequent, small trades, as they can avoid the extra commission fee on each trade.

However, commissions might be more cost-effective for those dealing in larger volumes, as the spread can become a significant cost in such cases.

Whether spreads or commissions offer the best value depends on your individual trading style and volume. It’s important to consider these factors when choosing a broker and to understand how each cost structure can impact your trading performance.

Which Offers the Best Value: Spreads or Commissions?

In Forex trading, the debate between spreads and commissions is like comparing two different investment strategies. Each has its own merits and can offer the best value under different circumstances. The key is to understand your trading style and volume to determine which cost structure aligns with your goals.

Spreads are often preferred by traders who operate on a smaller scale or those who engage in scalping, where numerous trades are made throughout the day. The spread is the only cost they incur, and it’s built into the trade itself, making it a one-and-done deal. This can be valuable for those who want to keep things simple and avoid the hassle of calculating additional fees.

Commissions, however, can be more advantageous for high-volume traders. These traders can negotiate lower commission rates, which can significantly reduce their cost per trade. Commissions also offer a level of transparency that spreads do not, as they are a separate, fixed cost that’s easy to account for when planning trades.

Ultimately, the best value depends on your trading approach:

For frequent, small trades:

Spreads may offer better value as they eliminate the need to pay a separate commission on each trade.

For larger, less frequent trades:

Commissions could provide better value, especially if you can negotiate lower rates due to high volume.

Briefly, there’s no one-size-fits-all answer. It’s about matching the cost structure to your trading habits. By carefully considering your trading frequency, volume, and strategy, you can determine whether spreads or commissions will give you the edge in the Forex market.

How to Choose Between Spreads and Commissions?

When it comes to Forex trading, choosing between spreads and commissions is a crucial decision that can impact your trading success. Here are some factors to consider and examples of traders who might benefit from each.

Factors to Consider

Trading Frequency:

If you trade often, spreads may be more cost-effective as they are a one-time cost built into the trade. For less frequent trades, commissions may be more economical.

Trade Volume:

Large volume traders can benefit from commissions, especially if they can negotiate lower rates. Small volume traders might find spreads to be more straightforward and less costly.

Market Volatility:

During volatile market conditions, spreads can widen, which could increase trading costs. Fixed commissions remain the same regardless of market changes.

Strategy:

Your trading strategy also plays a role. If your strategy involves holding positions for a longer time, commissions may be more favorable. For strategies that involve entering and exiting positions quickly, spreads might be more suitable.

Examples of Traders Who Might Benefit from Each

Scalpers:

Traders who make many small trades throughout the day (scalping) might prefer spreads since they can execute many trades without incurring a commission each time.

Swing Traders:

Those who hold trades for several days might benefit from commissions because they make fewer trades, and the spread on each trade could add up over time.

Position Traders:

Traders who take long-term positions might find commissions more beneficial as they don’t have to worry about the spread widening over time.

There’s no one-size-fits-all answer when choosing between spreads and commissions. It depends on your individual trading style, frequency, volume, and the market conditions you typically trade in.

By carefully considering these factors, you can make an informed decision that aligns with your trading approach and helps you minimize costs while maximizing potential profits.

Remember, the best choice is the one that complements your trading strategy and contributes to your overall success in the Forex market.

How Trendo Broker Can Assist in Choosing Between Spreads and Commissions?

Embarking on the Forex trading journey can be as thrilling as it is complex. With so many factors to consider, from market analysis to understanding spreads and commissions, it’s crucial to have a reliable partner by your side.

Enter Trendo Broker , a platform designed to streamline your trading experience.

Trendo Broker is more than just a brokerage; it’s a gateway to the global currency markets, offering a suite of tools and services tailored to enhance your trading.

With advanced charting tools, real-time market data, and educational resources, Trendo Broker equips you with everything you need to navigate the Forex landscape confidently.

One of the standout features of Trendo Broker is its personalized approach to trading costs. Whether you’re a novice trader or a seasoned pro, Trendo Broker helps you understand the nuances of spreads and commissions, ensuring you make informed decisions that align with your trading strategy.

For those who prefer spreads,

Trendo Broker offers competitive rates, with real-time data to help you track and manage your costs effectively.

For traders leaning towards commissions,

the platform provides a transparent fee structure, with the option to negotiate rates based on your trading volume.

Moreover, Trendo Broker’s dedicated support team is always on hand to guide you through the decision-making process, offering insights and advice tailored to your trading style.

With Trendo Broker, you’re not just choosing a broker; you’re choosing a partner committed to your success in the Forex market. Whether you opt for spreads or commissions, Trendo Broker ensures that you have all the information and support you need to trade with confidence and clarity.

Conclusion

In the Forex market, the choice between spreads and commissions boils down to personal trading style and preferences.

Spreads offer simplicity and are embedded in the trade cost, ideal for frequent, small-volume traders. Commissions provide transparency and can be more cost-effective for high-volume traders.

Choosing between the two is not a matter of right or wrong but of aligning with your trading style and goals. Trendo Broker stands ready to assist you in this decision, offering a platform where both options are available, along with the tools and support to help you thrive in the Forex market.

As you ponder your trading journey, consider your approach, weigh the pros and cons, and remember that the best choice is the one that serves your interests and enhances your trading performance.

We invite you to explore the trading options with Trendo Broker, where your financial aspirations become our commitment. Start your journey today, and let’s chart a course to success in the Forex markets together.

Frequently Asked Questions