به گزارش Investing در روز دوشنبه، ارزش یورو به بالاترین سطح یکماهه خود رسید. این افزایش ارزش، پس از پیروزی حزب محافظهکار آلمان در انتخابات سراسری این کشور رقم خورد. همزمان، دلار آمریکا تحت تاثیر نگرانیها از کاهش رشد اقتصادی، به ضعیفترین سطح خود در دو ماه گذشته سقوط کرد.

پیروزی محافظهکاران در آلمان و واکنش بازار

پیروزی فریدریش مرتس (Friedrich Merz)، رهبر حزب محافظهکار آلمان، در انتخابات ملی، به این معناست که او آماده است تا مسئولیت صدراعظمی این کشور را به عهده بگیرد. اما مرتس باید برای تشکیل یک دولت ائتلافی با چالشهای پیچیدهای مواجه شود، چرا که حزب آلترناتیو برای آلمان (AfD) با کسب رتبه دوم، آراء بیسابقهای به دست آورده است.

در پی این تحولات، یورو در بازارهای جهانی به ۱.۰۵۲۸ دلار رسید، که بالاترین سطح خود در یک ماه گذشته است. این ارز در ادامه با افزایش ۰.۵ درصدی در ۱.۰۵۱۲ دلار معامله شد. به نظر میرسد که بازار به دقت روند تشکیل دولت جدید در آلمان را دنبال میکند. به گفته کارستن برزسکی (Carsten Brzeski)، رئیس تحقیقات کلان اقتصادی در ING Research، «مذاکرات ائتلافی در آلمان به دلیل شکافهای سیاسی، پیچیدگیهای زیادی خواهد داشت. این وضعیت ممکن است فرآیند اصلاحات اقتصادی را طولانی کند.»

سقوط دلار آمریکا؛ نگرانی از آینده اقتصادی

در همان حال دلار آمریکا پیش از انتشار دادههای اقتصادی مهم کاهش شدیدی را تجربه کرد. شاخص دلار که ارزش آن را در برابر سبدی از ارزهای دیگر اندازهگیری میکند، به پایینترین سطح دو ماه اخیر خود یعنی ۱۰۶.۱۲ رسید.

عدم استقبال سرمایهگذاران از دلار : به دلیل تاثیر محدود سیاستهای تجاری در دور دوم ریاست جمهوری ترامپ.

کاهش بازده اوراق قرضه خزانهداری آمریکا : به دلیل افزایش احتمال کاهش نرخ بهره فدرال رزرو در سال جاری.

انتشار دادههای اقتصادی ضعیف: که نشان میدهد فعالیتهای تجاری در ایالات متحده در ماه فوریه تقریباً به حالت توقف درآمده است.

همچنین، تحلیلگران Pepperstone اشاره کردند که نگرانیها در مورد رشد اقتصادی آمریکا بیشتر شده و بازار به دادههای اقتصادی جدید واکنش شدیدی خواهد داشت.

وضعیت سایر ارزهای مهم پس از پیروزی محافظهکاران آلمان

در کنار یورو، پوند انگلیس به بالاترین سطح دوماهه خود در ۱.۲۶۹۰ دلار رسید و ین ژاپن با ثبت سطح ۱۴۸.۸۵ در برابر دلار، به بالاترین مقدار خود از اوایل دسامبر صعود کرد. اگر در بازار فارکس ترید میکنید حتما جفت ارزهای زیر را در نظر داشته باشید:

EUR/USD _ GBP/USD – USDJPY

انتظار میرود در آینده ای نزدیک شاهد نوسانات بیشتری در این جفت ارزها باشیم. شما میتوانید با پلتفرم معاملاتی ترندو تمامی نمودار جفت ارزها را در یک صفحه زیر نظر داشته باشید و از نوسانات آنها استفاده کنید.

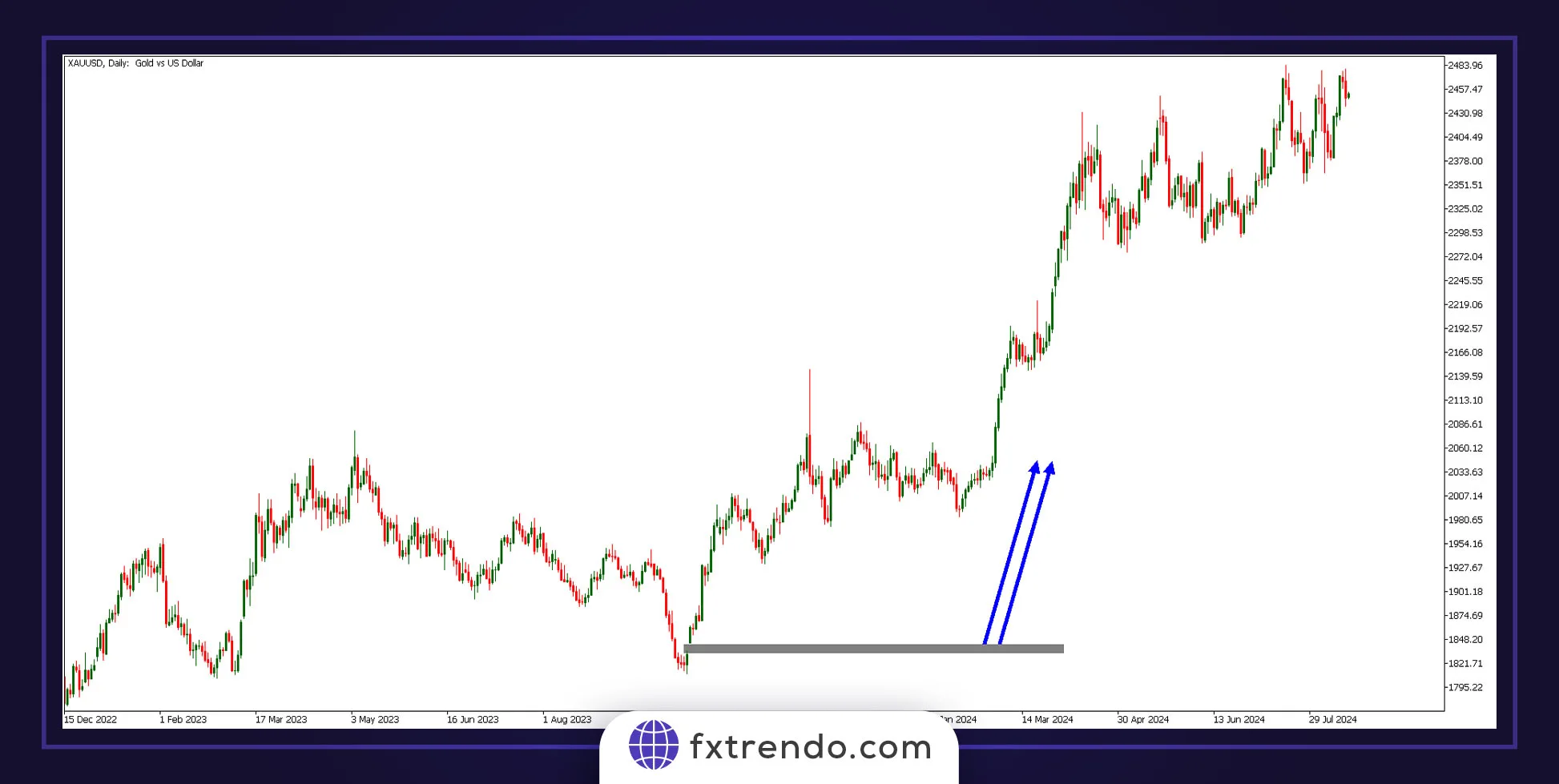

تحلیل یورو دلار در ترندو

تحلیل EUR/USD توسط کارشناسان بروکر ترندو

پیروزی حزب محافظهکار در آلمان باعث تقویت یورو شد، اما مذاکرات پیچیده برای تشکیل دولت ائتلافی میتواند روند اقتصادی این کشور را تحت تاثیر قرار دهد. دلار آمریکا نیز تحت تاثیر نگرانیها از کند شدن رشد اقتصادی و احتمال کاهش نرخ بهره فدرال رزرو با افت شدیدی مواجه شده است. در پیرو اتفاقاتی که رخ داده، اکنون نمودار یورو دلار به یک ناحیه مقاومتی حساس و قدیمی در محدوده 1.0503 – 1.0545 دلار رسیده است. در روزهای آتی اگر قیمت بتواند از این مقاومت مهم عبور کند، امکان رشد قیمتی بیشتر در جفت ارز یورو دلار خواهیم بود.