انتظارات از نرخ بهره کانادا

طبق پیشبینی اقتصاددانان، بانک مرکزی کانادا احتمالاً نرخ بهره را به ۲٫۷۵٪ کاهش خواهد داد. ماه گذشته این نرخ ۳٫۰۰٪ بوده و کاهش متوالی نرخها نشاندهنده نگرانی بانک مرکزی نسبت به کند شدن اقتصاد این کشور است. بانک مرکزی کانادا در چندین نوبت گذشته، نرخ بهره را بهصورت متوالی کاهش داده و از سطح ۴٫۷۵٪ در جولای ۲۰۲۴ به ۳٫۰۰٪ در ژانویه ۲۰۲۵ رسانده است.

اهمیت بیانیه و کنفرانس خبری

همزمان با انتشار نرخ بهره، بیانیه نرخ بهره (BOC Rate Statement) نیز منتشر میشود. در این بیانیه سیاستگذاران بانک مرکزی دلایل تصمیم خود را توضیح میدهند و چشمانداز اقتصادی آینده کانادا را ترسیم میکنند. معمولاً این بیانیه تأثیر زیادی بر بازار دارد و میتواند مسیر بعدی دلار کانادا را مشخص کند.

همچنین حدود یک ساعت پس از اعلام نرخ بهره، کنفرانس مطبوعاتی بانک مرکزی (BOC Press Conference) برگزار خواهد شد. در این نشست خبری، رئیس بانک مرکزی کانادا به تشریح دلایل تصمیم امروز و جهتگیری سیاستهای پولی آینده خواهد پرداخت.

واکنش احتمالی بازار به نرخ بهره شبانه کانادا

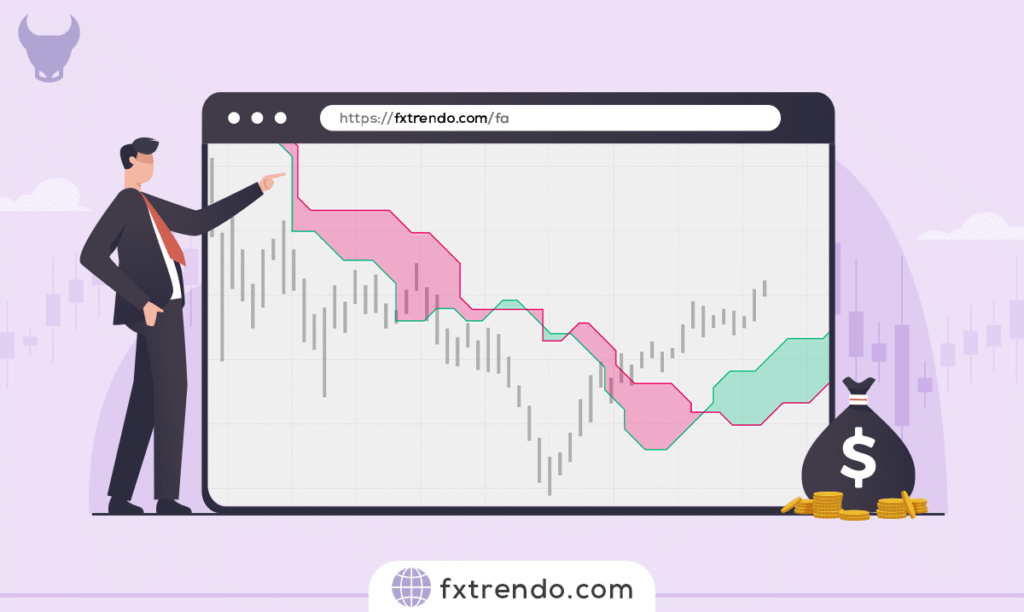

اگر بانک مرکزی نرخ بهره را مطابق پیشبینیها کاهش دهد یا از کاهشی بیشتر از انتظارات بازار خبر دهد، دلار کانادا (CAD) احتمالاً تضعیف خواهد شد. اما اگر بانک مرکزی تصمیم بگیرد نرخ را ثابت نگه دارد یا کمتر از پیشبینی کاهش دهد، ممکن است شاهد تقویت مقطعی دلار کانادا در مقابل سایر ارزها باشیم. معاملهگران باید آماده واکنش سریع و مدیریت ریسک مناسب در لحظه انتشار این داده کلیدی باشند و همچنین به نمودارهایی همچون USD/CAD در پلتفرم معاملاتی ترندو توجه ویژه ای داشته باشند. استفاده از پلتفرم معاملاتی ترندو که همزمان تقویم اقتصادی را هم همراه خود دارد، میتواند برای تریدرها بسیار موثر و کمک کننده باشد.