What Caused the Decline in the U.S. Dollar?

The unexpected easing in consumer inflation has prompted investors to reconsider the outlook for further rate increases, leading to a weaker U.S. dollar against major global currencies and traditional safe-haven assets such as gold. The market shift also supported higher prices in cryptocurrencies, with Bitcoin seeing gains following the CPI announcement.

Gold Technical Analysis | Significant Resistance at $2,955

to analysts from Trendo, gold prices climbed from around $2,909 to nearly $2,946 following the news. Currently, the market faces significant resistance at the $2,955 mark, a level that has recently halted upward momentum twice.

Analysts suggest that if today’s trading session closes with strong positive momentum—such as forming a bullish Marubozu candle—there’s an increased likelihood of gold breaking above the $2,955 resistance level and continuing its upward trend. However, traders are advised to remain cautious and prioritize disciplined risk management until this critical level is conclusively breached.

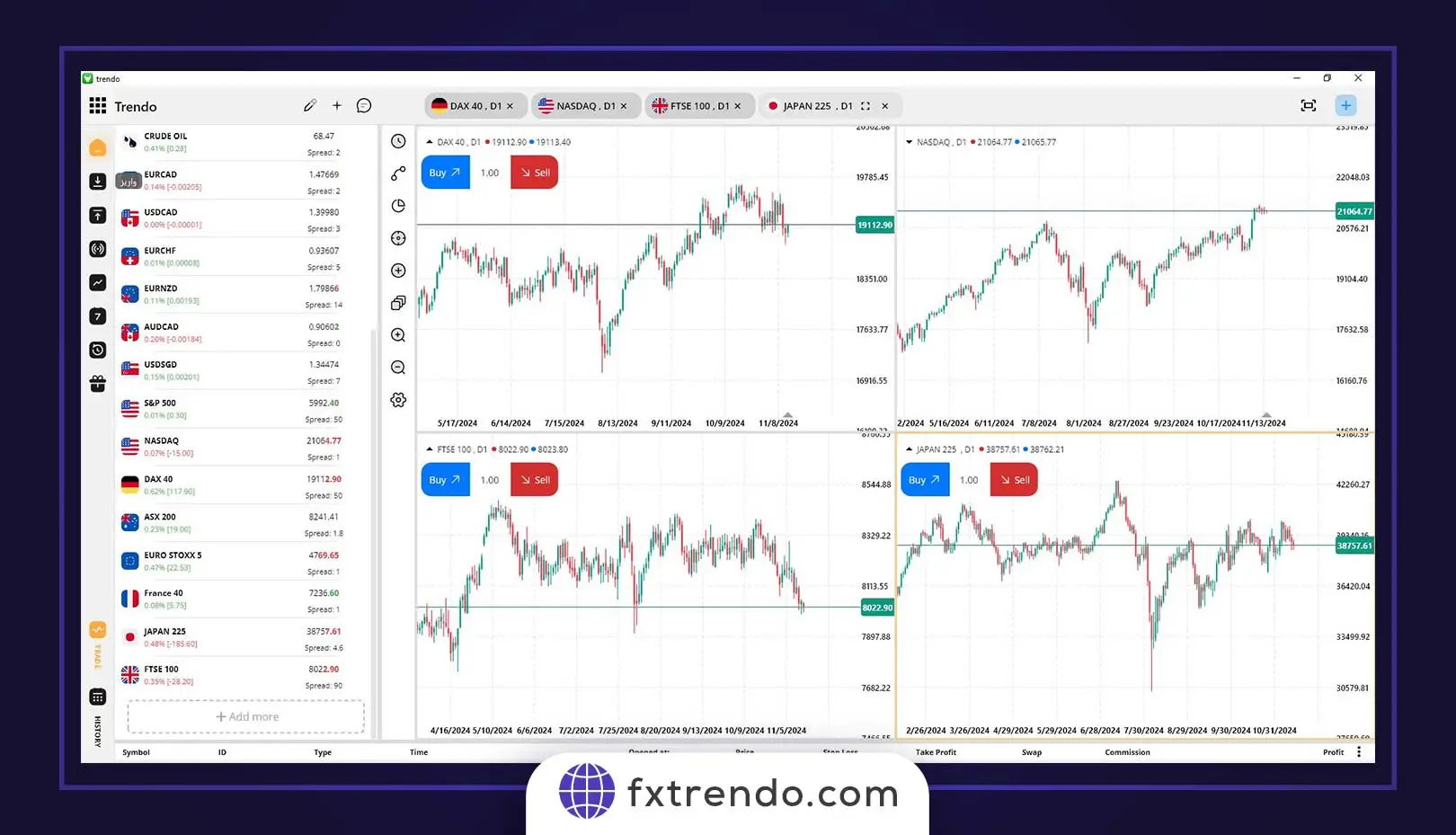

Gold Technical Analysis on Trendo Trading Platform

Today’s Important Event: U.S. PPI Data

Investors’ attention now shifts to the release of the U.S. Producer Price Index (PPI) data, scheduled for (8:30 New York time) today. The PPI data is expected to influence the strength of the U.S. dollar and gold prices directly. Traders are encouraged to monitor these developments closely through Trendo’s trading platform and Forex Economic Calendar, as the data release may cause significant short-term volatility in gold markets.