Spread, as one of the fundamental concepts in financial markets, plays a key role in shaping trading strategies and managing costs. The spread not only reflects market conditions but also directly impacts trading outcomes — making the right type of spread essential for success. In this article from Trendo Broker’s educational team, we take a professional and in-depth look at the types of spreads in Forex, their characteristics, the differences between fixed and floating spreads, and how each affects trading performance.

Types of Spreads in Forex

In the Forex market, the spread represents the cost a trader pays to open a position.

This price difference is usually measured in pips (the smallest unit of price movement in Forex).

Lower spreads mean lower trading costs — and therefore higher potential profits.

The main types of spreads in Forex are:

-

Fixed Spread

-

Floating Spread

It’s worth noting that fixed spreads are no longer widely offered by most brokers. Due to the greater advantages of floating spreads, most traders now prefer them. However, we will review both types in detail below.

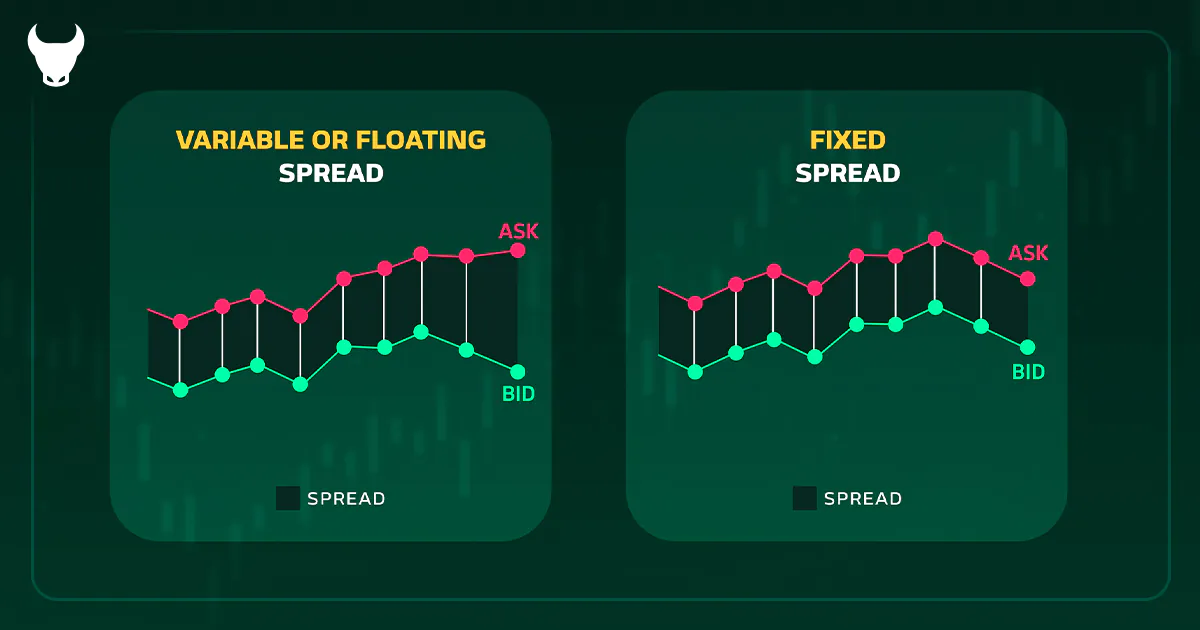

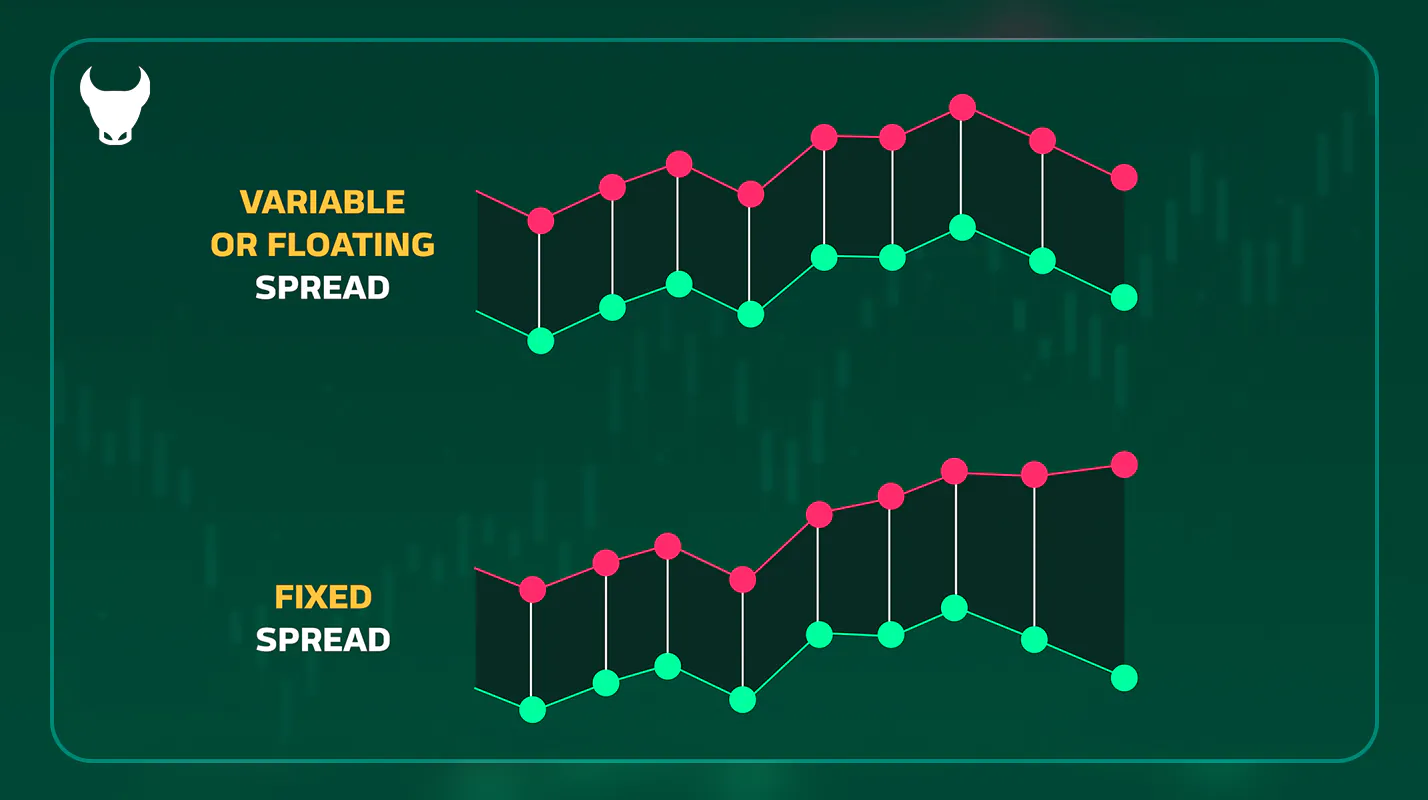

Fixed Spread

As the name suggests, a fixed spread remains constant and is determined by the broker. It does not fluctuate with market volatility. This type of spread is typically offered in Standard or Micro accounts and is ideal for beginner traders or those who prefer precise cost calculations.

Advantages of Fixed Spreads:

-

Predictable Costs: Traders can plan their strategies confidently, knowing their transaction costs in advance.

-

Beginner-Friendly: Due to its simplicity and stability, it’s suitable for novice traders.

-

Protection Against Volatility: During high-impact news events or market fluctuations, fixed spreads prevent sudden cost increases.

Disadvantages of Fixed Spreads:

-

Higher Costs: Fixed spreads are usually wider than floating spreads under normal conditions.

-

Limited Scalping Efficiency: They may not be cost-effective for short-term traders or scalpers.

-

Broker Dependency: Some brokers compensate for fixed spreads by charging additional commissions or fees.

Floating Spread

A floating spread — often found in ECN accounts — means that the difference between the bid and ask price fluctuates based on market conditions. When market liquidity and trading volume are high, the spread is minimal; however, during high volatility or reduced liquidity, spreads may widen.

Advantages of Floating Spreads:

-

Greater flexibility and the potential to benefit from lower spreads during normal market conditions.

Disadvantages:

-

Unpredictable trading costs, especially during high-volatility periods, when spreads can widen significantly. Traders should always be prepared for sudden changes and employ effective risk management strategies.

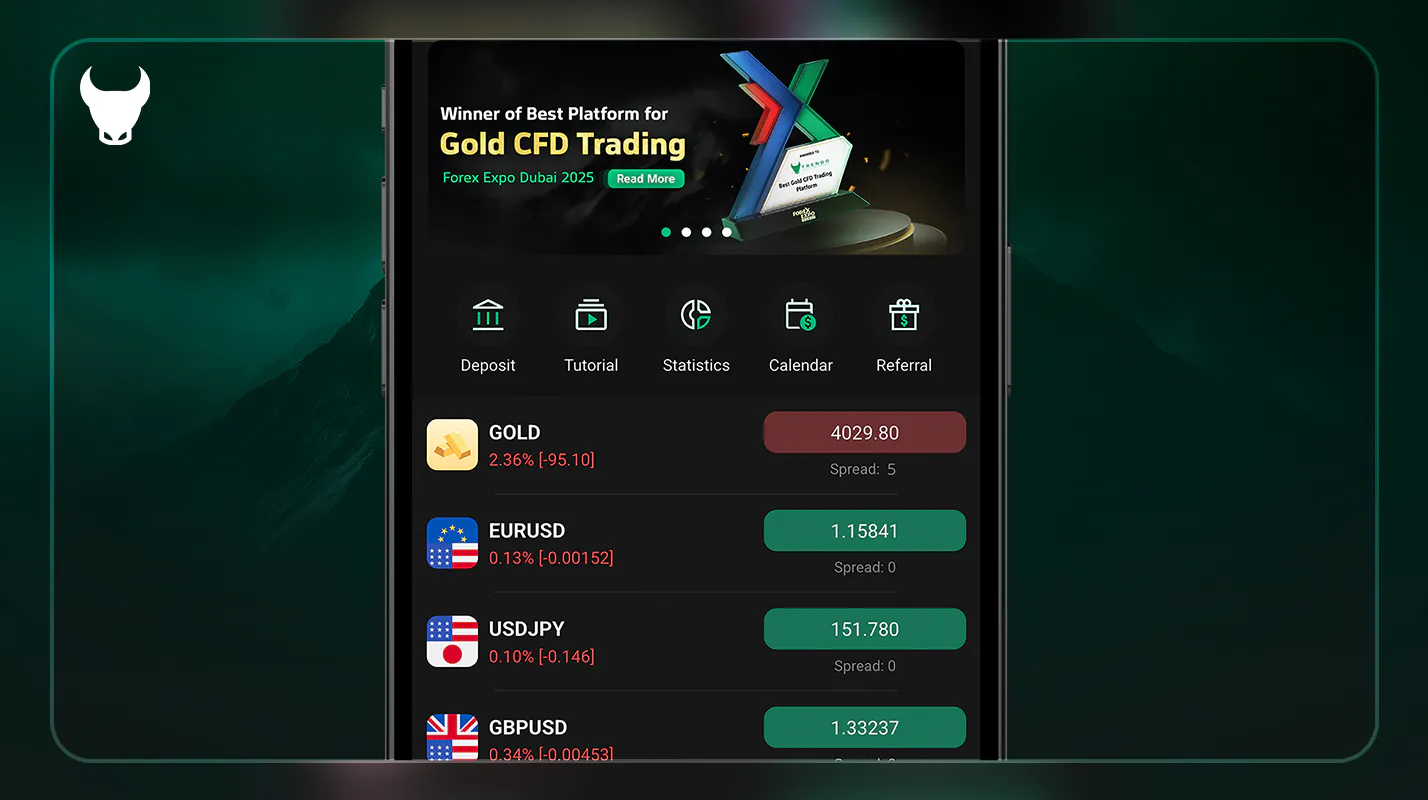

Spreads at Trendo Broker

Since all Trendo Broker trading accounts are of the ECN type, the spreads offered are floating. The spreads provided by Trendo are among the lowest in the market. For example, the spread on major currency pairs at Trendo starts from 0 pip, while the spread on gold (XAUUSD) is at its minimum level — less than 1 pip. To view the spreads of other trading instruments, you can visit the Trendo trading platform. In addition to zero spreads, Trendo offers the lowest commissions and swap rates in the market.

Key advantages of trading with Trendo include:

-

Zero spread on major currency pairs

-

Less than 1 pip spread on Gold (XAUUSD)

-

A dedicated, professional trading platform

-

Free welcome bonus

-

Cashback program

-

Crypto deposit bonuses

-

Support for multiple deposit and withdrawal methods

-

Access to a dedicated economic calendar

How Is Spread Calculated in Forex?

Calculating the spread in Forex is straightforward. The spread is the difference between the ask (buy) price and the bid (sell) price of a financial instrument, measured in pips.

Formula:

(This formula applies to all types of spreads, regardless of whether they’re fixed or floating.)

Example:

If the EUR/USD ask price is 1.1236 and the bid price is 1.1234, the spread equals 2 pips. In this case, trading 1 standard lot would cost $20, since each pip equals $10 per lot.

There’s no need to calculate spreads manually — on the Trendo platform, spreads are calculated automatically and displayed in real time.

Spreads for Major Currency Pairs

In Forex, major pairs are currency pairs that include the U.S. dollar and represent the highest trading volumes in the market. These include:

-

EUR/USD

-

USD/JPY

-

GBP/USD

-

AUD/USD

-

USD/CAD

-

USD/CHF

-

NZD/USD

Due to their high liquidity, major pairs have significantly lower spreads compared to minor or exotic pairs. For instance, the EUR/USD spread typically ranges between 0 and 3 pips with most brokers, while exotic pairs may reach up to 10 pips or more.

At Trendo Broker, spreads on major pairs are often zero, particularly during London and New York sessions.

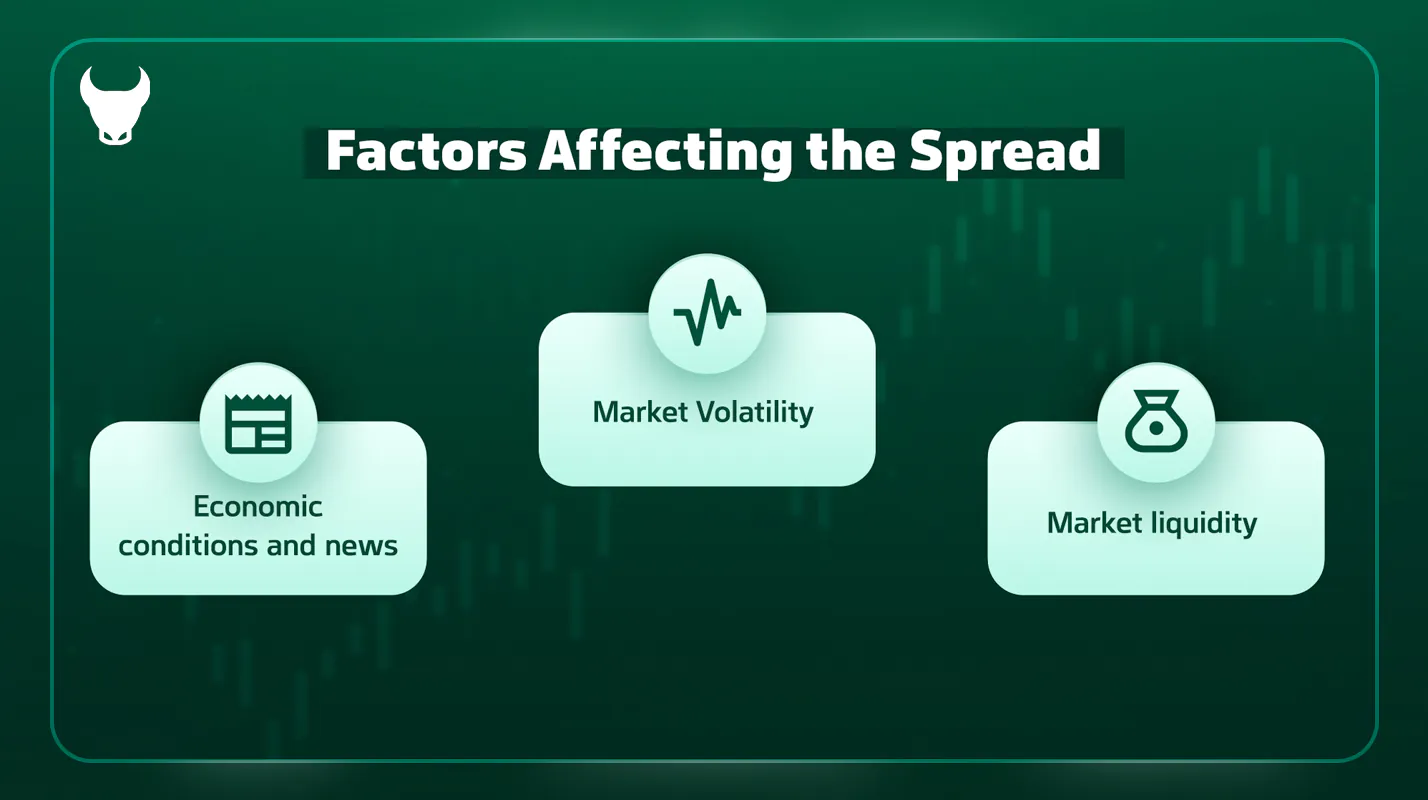

Factors Affecting the Spread

The size of a spread in Forex is influenced by several key factors:

-

Market liquidity: The higher the liquidity, the lower the spread, as more buy/sell orders are available.

-

Market Volatility: During volatile market conditions, spreads tend to widen due to increased uncertainty and risk.

-

Economic conditions and news: The release of major economic data or political events can cause market fluctuations and widen spreads.

Conclusion

In this article, we explored the different types of spreads in Forex, the differences between fixed and floating spreads, and the importance of each in trading performance.

Spread is one of the core concepts in Forex trading, directly influencing trading costs and profitability.

Ultimately, choosing a reliable broker with low spreads, such as Trendo, plays a crucial role in trading success and should be done carefully after thorough evaluation.

Register with Trendo Broker and Get a Free $100 Welcome Bonus