ارزشگذاری ارز یک کشور در بازار فارکس، عمدتاً تحت تاثیر سیاستهای اقتصادی بانک مرکزی آن کشور قرار دارد. یکی از مهمترین ابزارهای بانک مرکزی برای حفظ پایداری اقتصادی، نرخ بهره است. در این مقاله، از آن جایی که دلار آمریکا به عنوان مهمترین و پرمعاملهترین ارز در بازار فارکس شناخته میشود، قصد داریم نرخ بهره آمریکا را مورد بررسی قرار دهیم. با ما همراه باشید.

نرخ بهره فدرال رزرو چیست؟

نرخ بهره فدرال رزرو نرخی است که بانکهای آمریکایی و دیگر مؤسسات مالی برای قرض دادن وجوه به یکدیگر، شرکتها و افراد استفاده میکنند. از آنجا که بانکها موظف به نگهداری حداقل مقدار مشخصی از پول در ذخایر خود هستند، بانکهایی که ذخایر مازاد دارند، معمولاً به بانکهایی که قادر به تأمین ذخایر لازم نیستند، وام میدهند.

فدرال رزرو، بانک مرکزی ایالات متحده، از نرخ بهره به عنوان ابزار اصلی خود برای اجرای سیاستهای پولی استفاده میکند. این نرخ به منظور کنترل تورم، افزایش اشتغال و حمایت از رشد اقتصادی پایدار تعیین میشود. نرخ بهره تاثیرات گستردهای بر اقتصاد دارد و میتواند بر هزینههای استقراض، مخارج مصرفکنندگان، تورم و سرمایهگذاری تأثیرگذار باشد. نرخ بهره هدف فدرال رزرو، نرخی است که بانکها باید در آن نرخ از یکدیگر وام دریافت کنند، هرچند که نرخ واقعی ممکن است بالاتر یا پایینتر از این نرخ هدف نوسان داشته باشد.

کمیته بازار آزاد فدرال رزرو (FOMC) هشت بار در سال برای ارزیابی وضعیت اقتصادی کشور و تعیین نرخ بهره مناسب جلسه تشکیل میدهد. این کمیته با بررسی شاخصهای مختلف اقتصادی همچون اشتغال، تورم و تولید ناخالص داخلی (GDP) تصمیمگیریهای مبتنی بر دادههایی را اتخاذ میکند که هدف آن رشد اقتصادی پایدار و حفظ یک بازار کار سالم است.

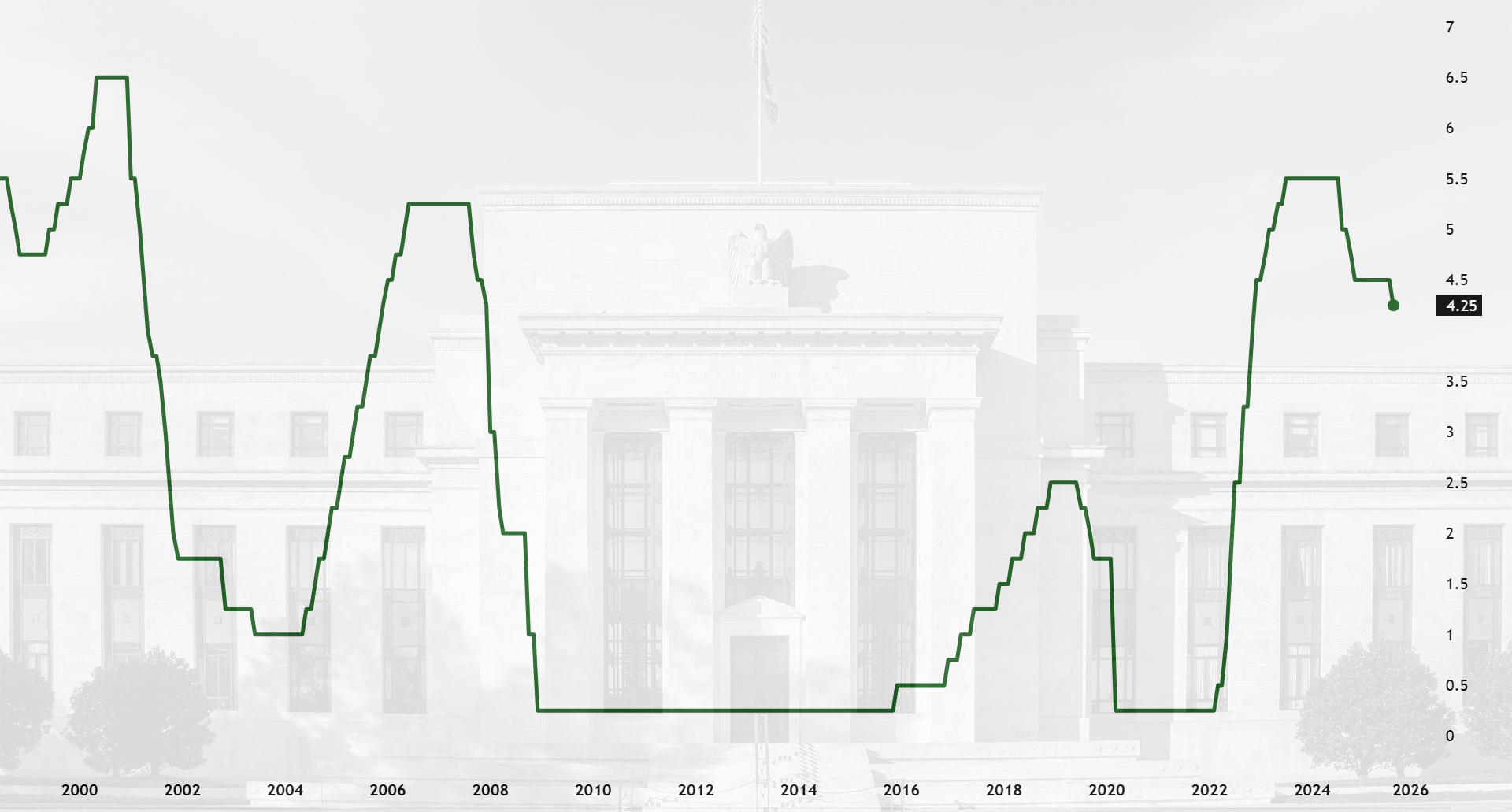

در تصویر زیر نمودار تغییرات نرخ بهره فدرال رزرو از سال 2000 تا سپتامبر 2025 را مشاهده میکنید:

نمودار نرخ بهره فدرال رزرو آمریکا

نرخ بهره فدرال چگونه عمل میکند؟

فدرال رزرو برای تنظیم میزان ذخایر موجود در سیستم بانکی از عملیات بازار آزاد استفاده میکند. این فرآیند بر نرخ بهره واقعی تاثیر میگذارد تا با محدوده هدف تعیینشده همراستا باشد. فدرال رزرو میتواند با خرید یا فروش اوراق بهادار دولتی (مانند اوراق قرضه خزانهداری) مقدار ذخایر موجود در بانکها را افزایش یا کاهش دهد و به این ترتیب بر نرخ بهره اثر بگذارد.

اگر فدرال رزرو قصد داشته باشد نرخ بهره را کاهش دهد، اوراق بهادار خریداری میکند و با تزریق ذخایر بیشتر به سیستم بانکی، نقدینگی را افزایش میدهد. این اقدام منجر به کاهش ارزش دلار به دلیل افزایش عرضه پول در بازار میشود.

در مقابل، اگر فدرال رزرو بخواهد نرخ بهره را افزایش دهد، اوراق بهادار را میفروشد و ذخایر موجود در سیستم بانکی را کاهش میدهد. این اقدام به معنای عدم تزریق پول به سیستم است و در نتیجه، عرضه نقدینگی کاهش یافته و ارزش دلار افزایش مییابد.

چرا نرخ بهره فدرال رزرو در فارکس اهمیت دارد؟

نرخ بهره فدرال رزرو یک ابزار حیاتی برای مدیریت اقتصاد است. وقتی کمیته بازار آزاد فدرال رزرو (FOMC) نرخ بهره فدرال را افزایش میدهد، هزینه وامگیری برای بانکهای کوچک، شرکتها و افراد بیشتر میشود. این افزایش نرخ بهره میتواند موجب کاهش فعالیتهای اقتصادی شود، زیرا کسبوکارها و افراد به دلیل هزینه بالاتر وامها، تمایل کمتری به سرمایهگذاری خواهند داشت. در نتیجه، نقدینگی به سمت سپردهگذاری در بانکها با نرخ بهره بالاتر هدایت میشود، که باعث کاهش نقدینگی در بازار و افزایش ارزش دلار میشود.

در مقابل، زمانی که FOMC نرخ بهره را کاهش میدهد، وامگیری برای بانکها ارزانتر میشود. این کاهش نرخ بهره میتواند فعالیتهای اقتصادی را تحریک کند، زیرا کسبوکارها و افراد به راحتی میتوانند وام بگیرند و سرمایهگذاری کنند. در نتیجه، نقدینگی از سپردهگذاری در بانکها با نرخ سود پایینتر به سمت کسبوکارها و جامعه منتقل میشود، که موجب افزایش نقدینگی در بازار و کاهش ارزش دلار میشود.

نرخ بهره فدرال رزرو همچنین بر سایر نرخهای اقتصادی تأثیرگذار است. به عنوان مثال، نرخ بهره کارتهای اعتباری، وامهای مسکن و وامهای خودرو معمولاً به نرخ بهره فدرال مرتبط است. هنگامی که نرخ بهره فدرال افزایش مییابد، سایر نرخها نیز تمایل به افزایش دارند و برعکس، کاهش نرخ بهره فدرال میتواند باعث کاهش سایر نرخها شود.

ثبتنام در بروکر ترندو و معامله با کمترین اسپرد و کمیسیون

خلاصهای از نقش مهم نرخ بهره فدرال در اقتصاد ایالات متحده

- هزینه استقراض:

نرخ بهره فدرال به طور مستقیم بر هزینه استقراض برای بانکها، مشاغل و مصرفکنندگان تاثیر میگذارد. نرخهای بهره پایینتر میتواند منجر به افزایش وامگیری، سرمایهگذاری و هزینههای مصرفکننده شود، در حالی که نرخهای بالاتر با افزایش هزینههای استقراض ممکن است فعالیتهای اقتصادی را کاهش دهد. - انتقال سیاست پولی:

تغییرات در نرخ بهره تاثیرات گستردهای بر سایر نرخها مانند نرخ وام مسکن، نرخ کارتهای اعتباری و بازده اوراق قرضه دارد. این تغییرات میتواند بر رفتار مصرفکنندگان و کسبوکارها تاثیر بگذارد و در نتیجه بر کل اقتصاد اثر بگذارد. - کنترل تورم:

فدرال رزرو از نرخ بهره برای مدیریت تورم و حفظ ثبات قیمتها استفاده میکند. با افزایش نرخ بهره، فدرال رزرو میتواند فشارهای تورمی را کنترل کند و برعکس، کاهش نرخ بهره میتواند به کاهش روندهای ضدتورمی کمک کند. - ارزشگذاری ارز:

نرخ بهره همچنین بر ارزش دلار آمریکا در مقایسه با سایر ارزها تاثیر میگذارد. نرخهای بهره بالاتر میتوانند جذب سرمایهگذاری خارجی را افزایش داده و دلار را تقویت کنند، در حالی که نرخهای پایینتر ممکن است اثر معکوس داشته باشند.

نرخ بهره فدرال رزرو ایالات متحده

چگونه نرخ بهره فدرال رزرو اشتغال را به حداکثر میرساند؟

هنگامی که فدرال رزرو نرخ بهره را کاهش میدهد، به این سیاست “سیاست پولی انبساطی” گفته میشود. با کاهش نرخ بهره، بانکها نرخهای پایینتری را برای انواع وامها، از جمله وامهای کارت اعتباری، وامهای دانشجویی و وامهای خودرو ارائه میدهند. وامهای مسکن با نرخهای قابل تنظیم ارزانتر میشوند که به بهبود بازار مسکن کمک میکند. در این شرایط، صاحبان خانه احساس ثروتمندی میکنند و بیشتر خرج میکنند. آنها همچنین میتوانند به راحتی وام مسکن بگیرند و این پول را برای خرید خانه یا خودروهای جدید خرج کنند. این اقدامات باعث افزایش تقاضا و تحریک اقتصاد میشود.

با افزایش تقاضا، کارفرمایان به نیاز به نیروی کار بیشتر پی میبرند و به همین دلیل تعداد بیشتری کارگر استخدام میکنند. این امر منجر به کاهش نرخ بیکاری میشود و توانایی مصرفکنندگان برای خرج کردن افزایش مییابد. در نتیجه، تقاضا برای کالاها و خدمات بیشتر میشود و اقتصاد به حرکت در میآید. پس از آن، فدرال رزرو محدوده هدف جدیدی را برای نرخ بهره تعیین میکند تا سطح بیکاری و تورم در حد سالم باقی بماند.

برای مثال، در واکنش به بحران اقتصادی ناشی از همهگیری COVID-19، کمیته بازار آزاد فدرال رزرو هدف نرخ بهره را در سال 2020 به طور مؤثر به صفر رساند. این اقدام بهمنظور کاهش تأثیر منفی همهگیری کرونا بر اشتغال و هزینهها و جلوگیری از یک بحران اقتصادی بود.

نتیجه سیاست پولی انبساطی، افزایش نقدینگی در سطح جامعه است که منجر به رونق اقتصادی و رشد کسبوکارها میشود. با این حال، از آنجا که این سیاست میتواند باعث افزایش تقاضا و فشار بر قیمتها شود، احتمال افزایش تورم نیز وجود دارد. در ادامه، به سیاستهای فدرال رزرو برای کنترل تورم خواهیم پرداخت.

چگونه نرخ بهره فدرال رزرو تورم را مدیریت میکند؟

زمانی که فدرال رزرو نرخ بهره را افزایش میدهد، به این سیاست «سیاست پولی انقباضی» گفته میشود، زیرا این اقدام باعث کند شدن فعالیتهای اقتصادی میشود. با افزایش نرخ بهره، هزینه وامگیری بالا میرود و در نتیجه، مصرفکنندگان و کسبوکارها تمایل کمتری به گرفتن وام خواهند داشت. بهویژه وامهای مسکن با نرخهای قابل تنظیم گرانتر میشوند، که این امر ممکن است باعث کاهش توان خرید خریداران مسکن شود و در نتیجه، بازار مسکن را کند کند. با کاهش تقاضا، قیمت مسکن پایین میآید و صاحبان خانهها سهام کمتری در املاک خود خواهند داشت. این وضعیت میتواند باعث کاهش هزینههای مصرفکنندگان و در نهایت، کند شدن بیشتر رشد اقتصادی شود.

نتیجه سیاست پولی انقباضی این است که نقدینگی از طریق کاهش فعالیتهای کسبوکارها به سمت سپردهگذاری در بانکها با نرخهای بهره بالاتر هدایت میشود. این تغییر موجب کاهش نقدینگی در سطح جامعه میشود، که یکی از نتایج آن کاهش تورم است، زیرا تقاضا کاهش یافته و فشار بر قیمتها کم میشود.

تاثیر نرخ بهره فدرال رزرو در معاملات فارکس

تاثیر نرخ بهره فدرال رزرو در معاملات فارکس

برای آمادگی در برابر تصمیمات تغییر نرخ بهره فدرال رزرو، معاملهگران باید این دو مرحله کلیدی را دنبال کنند:

-

با اخبار فدرال رزرو همراه باشید

کمیته بازار آزاد فدرال رزرو هشت جلسه منظم در سال برگزار میکند که در آن سیاستها و نرخ بهره مورد بحث و تصمیمگیری قرار میگیرد. همچنین، رئیس فدرال رزرو در جلسات مختلف سخنرانی کرده و در جلسات پرسش و پاسخ شرکت میکند. پیگیری اخبار و اظهارات اعضای فدرال رزرو قبل از این جلسات، بهترین روش برای پیشبینی تصمیمات احتمالی در مورد نرخ بهره و خرید یا فروش دلار آمریکا است. -

با اخبار بازار همراه باشید

مطمئن باشید که تنها شما نیستید که در مورد نرخ بهره گمانهزنی میکنید. پیش از جلسات و اعلامیههای فدرال رزرو، بسیاری از معاملهگران فارکس پیشبینیهایی در مورد وضعیت نرخ بهره انجام میدهند. پیگیری پیشبینیهای دیگران و تحلیل شرایط بازار به شما این امکان را میدهد که دیدگاه و استراتژی خود را شکل دهید و بتوانید منطق خود را به تحلیلهای دیگران اضافه کنید. -

تقویم اقتصادی فارکس را دنبال کنید

علاوه بر اخبار فدرال رزرو و تحلیلهای بازار، بسیار مهم است که تقویم اقتصادی فارکس را نیز بررسی کنید. این تقویم به شما کمک میکند تا از رویدادهای اقتصادی و تصمیمات کلیدی مطلع شوید که میتواند تأثیرات زیادی بر بازار فارکس داشته باشد.

برای دسترسی به تقویم اقتصادی فارکس، میتوانید به پلتفرم معاملاتی ترندو مراجعه کرده و از تقویم فارکس ترندو استفاده کنید.

برای پیگیری اخبار و اظهارات فدرال رزرو و تحلیلهای روز بازار، ترندو را در تلگرام و اینستاگرام دنبال کنید.

هرچند که هیچ روشی برای پیشبینی دقیق تصمیمات نرخ بهره وجود ندارد و ممکن است شگفتیهایی در این زمینه رخ دهد، همیشه مهم است که هنگام معامله در فارکس از سرمایه خود محافظت کنید. بنابراین، ثبت سفارش حد ضرر قبل از شروع معامله و در صورت نوسانات بازار، برای محدود کردن ضررها ضروری است. همچنین باید به پلن معاملاتی خود پایبند باشید، چرا که معامله در زمان اعلام تصمیمات نرخ بهره به دلیل نوسانات شدید و ریسک بالا، میتواند بسیار خطرناک باشد.

سخن پایانی

در نهایت، با توجه به نقش حیاتی نرخ بهره فدرال رزرو در شکلدهی به شرایط اقتصادی ایالات متحده و تأثیر آن بر بازار فارکس، آگاهی از تغییرات این نرخ و درک دقیق سیاستهای پولی میتواند به معاملهگران کمک کند تا تصمیمات آگاهانهتری بگیرند. از آنجا که تغییرات نرخ بهره مستقیماً بر ارزش دلار و دیگر ارزها تأثیر میگذارد، داشتن استراتژی مناسب و رصد دقیق این تحولات، عامل موفقیت در بازار فارکس است.

اگر شما نیز به دنبال یک پلتفرم قابل اعتماد برای شروع معاملات خود هستید، ترندو انتخاب بیش از ۵۰۰ هزار معاملهگر از سراسر جهان است. با پیوستن به ترندو، شما میتوانید با کمترین اسپرد و کمیسیون، معاملات خود را آغاز کنید و از تجربهای حرفهای در دنیای فارکس بهرهمند شوید. ترندو، با ارائه خدمات سریع و مطمئن، به شما این امکان را میدهد که در بازارهای مالی به بهترین نحو عمل کنید و موفقیت خود را تضمین کنید.