استراتژی معاملاتی چیست؟

يكک سری از قوانين و تدابيری برای معاملات هر معامله گر است كه در شرايط مختلف و حساس ماركت معامله گر بر اساس آن تصميم ميگیرد كه معاملات خود را چگونه مديريت كند .بنابراين استراتژی معاملاتی يک سری قوانين شخصی است كه هر معامله گر بايد برای خود طراحی كند و اين قوانين مشخص ميكند در چه زمانی و در چه شرايطی وارد يک معامله يا خارج شود و چه ميزان از سرمايه خود را در هر معامله ريسک كند. در ادامه مراحل ساخت استراتژی موفق در فارکس را خواهیم کرد.

مراحل ساخت استراتژی معاملاتی موفق در فارکس

گزینه های زیر مراحلی هستند که باید دنبال کنید تا یک استراتژی برنده در بازار فارکس ایجاد کنید:

۱- شخصیت معامله گری خود را تشخیص دهید.

۲- سبک معاملاتی را انتخاب کنید که برای شما مناسب تر است.

۳- روش ورود/خروج خود از بازار را مشخص کنید.

4- ریسک خود را تعریف کنید.

۵- از سیستم معاملاتی خود بک تست و فوروارد تست بگیرید.

در ادامه هر یک از مراحل را بررسی خواهیم کرد.

چه نوع شخصیت معامله گری دارید؟

دانستن اینکه کدام نوع معامله گر هستید به شما این امکان را می دهد که زمان، انرژی و توجه خود را بر روی توسعه استراتژی های معاملاتی متمرکز کنید که با شخصیت معامله گری شما منطبق باشد. گاهی اوقات یک استراتژی سودده برای یک معامله گر می تواند یک روش بازنده و یک استراتژی ضررده برای یک معامله دیگر باشد.یادگیری نحوه عملکرد معاملات فارکس و نحوه سودآوری آن به اندازه کافی سخت است، بنابراین کار بر روی استراتژی هایی با بیشترین احتمال برد برای شما کل فرآیند را ساده تر می کند و شانس بیشتری برای موفقیت به شما می دهد.

چگونه ویژگی های شخصیت معامله گری خود را تعیین کنیم:

سوالات زیر می تواند در تشخیص شخصیت معامله گری کمک کننده باشد.

چرا در وهله اول می خواهید معامله گری را شروع کنید؟

چه هدف آرزویی از معامله گری دارید؟

دانش کلی شما از بازارها و روابط آنها، معامله گری، مدیریت سرمایه، روانشناسی معاملات، پلتفرم های معاملاتی و کارگزاران فارکس چیست؟

قبل از شروع معامله گری به چه میزان آموزش نیاز دارید؟هر چند وقت یک بار می توانید معامله کنید؟سطح ریسک شما چقدر خواهد بود؟

چقدر می توانید احساسات و استرس خود را کنترل کنید؟

آیا ترجیح میدهید نتایج معاملات خود را در همان روز ببینید یا میتوانید چند روز صبر کنید تا معاملاتتان انجام شود؟

هر چند وقت یک بار ترجیح می دهید معاملات خود را بررسی کنید؟از تحلیل تکنیکال یا فاندامنتال برای تعیین نواحی و در نهایت تنظیمات ورود/خروج خود استفاده خواهید کرد؟

چه مقدار سرمایه می توانید به معاملات فارکس اختصاص دهید؟

پاسخ سوالات بالا باید منطقی و مناسب با شرایط بازار فارکس و شخصیت معاملاتی باشد. به طور مثال انتظار سودهای بسیار بالا در بازار فارکس به همان اندازه ریسک معلات شما افزایش میدهد. بنابراین در ساخت استراتژی باید پاسخ سوالات دقیق و درست باشد.

کدام سبک معاملاتی برای شما مناسب تر است؟

هنگامی که به تمام این سؤالات پاسخ دادید، مشخص خواهد شد که در کدام طیف معاملاتی قرار دارید. چند نوع و دسته بندی مختلف وجود دارد که شما در یکی از آنها قرار می گیرید:

انواع بازه زمانی معاملاتی:

اسکلپر، تریدر روزانه، سوینگ تریدر، پوزیشن تریدر

انواع تحلیل معاملاتی:

تحلیلگر تکنیکال، تحلیلگر فاندامنتال

انواع تحمل ریسک:

ریسک گریز، ریسک خنثی، ریسکی

شما یکی از این چهار نوع معامله گر خواهید بود: اسکلپر، تریدر روزانه، سوینگ تریدر یا پوزیشن تریدر.

اسکلپ و معاملات روزانه

این دو نوع معامله فعال ترین و تهاجمی ترین نوع معاملات ارزی هستند، زیرا در هر دو مورد تمام موقعیت های معاملاتی شما در یک روز معاملاتی باز و بسته می شوند. اسکلپ در بازار فارکس در مورد خرید و فروش جفت ارز با هدف چند پیپ است که بیش از چند دقیقه یا حتی چند ثانیه فعال نمی باشد. اما معاملات روزانه پیپ های بیشتری را هدف قرار می دهد و پوزیشن ها می توانند برای چند ساعت باز باشند. این سبکهای معاملاتی با استراتژیهای معاملاتی بسیار کوتاهمدت کار میکنند تا سودهای کوچک اما ثابتی به دست آورند و از طریق اهرم بالا بازدهی را افزایش دهند. هر دوی این استراتژی ها می توانند استرس زا باشند و مستلزم این هستند که بتوانید در هنگام معامله در مقابل میز ترید خود بسیار متمرکز و در دسترس باشید.

اسکلپ و معاملات روزانه برای شما مناسب است اگر:

دوست ندارید موقعیت های خود را بیشتر از یک روز نگه دارید و معاملات روزانه را ترجیح می دهید.

دوست دارید بدانید که آیا در پایان روز معاملاتی خود سودده یا ضررده بوده اید.

می توانید سطح بالایی از ریسک بازار و اهرم را تحمل کنید.

برای حضور در مقابل بازار و واکنش سریع به فرصت های بالقوه در دسترس هستید.

می تواند با سطح نسبتاً بالایی از استرس مقابله کند.

سوینگ ترید

این سبک معاملاتی یک رویکرد میانمدت است که مبتنی بر بهرهگیری از تغییرات حرکت جفت ارز در روند اصلی است. معامله گران سوینگ معمولا موقعیت هایی را از چند روز تا چند هفته حفظ می کنند. معاملات سوینگ به صبر و حوصله زیادی نیاز دارد، زیرا شما موقعیت های معاملاتی خود را (معمولاً با یک درجه اهرم مناسب) برای چندین روز یا هفته حفظ خواهید کرد. این نوع برای معامله گران پاره وقت ایده آل است، زیرا آنها همیشه زمانی برای تحلیل بازار به صورت روزانه ندارند.

معاملات سوینگ برای شما مناسب است اگر:

شما وقت زیادی ندارید که هر روز جلوی نمایشگرها بگذرانید.

می توانید روزها/هفته ها پوزیشن های خود را باز نگه دارید.

شما طرفدار تحلیل تکنیکال هستید.

معاملات پوزیشن

این سبک معاملاتی یک رویکرد بلندمدت مبتنی بر استفاده از تغییرات قیمت بلندمدت یک جفت ارز است. معامله گران معمولاً برای چند هفته، ماه و حتی سال ها پوزیشن را حفظ می کنند و در مورد نوسانات کوتاه مدت قیمت اذیت نمی شوند. معمولاً این موقعیت ها یا در بازار آتی ارز و با مقدار محتاطانه اهرمی گرفته می شود. معامله گران پوزیشن تنها ممکن است هر ماه یا بیشتر تحلیل خود را انجام دهند و به دنبال شناسایی و معامله روند های بزرگ هستند.

معاملات پوزیشن برای شما مناسب است اگر:

شما وقت زیادی ندارید که هر هفته جلوی نمایشگرها بگذرانید.

شما می توانید ماه ها یا سال ها پوزیشن های خود را باز نگه دارید.

شما نمی خواهید از اهرم زیادی استفاده کنید.

شما طرفدار تحلیل فاندامنتال هستید.

هنگام تشخیص اینکه کدام سبک معاملاتی برای شخصیت شما مناسب تر است، باید همه عناصر زیر را در نظر بگیرید: برنامه فعلی، دامنه توجه و ریسک گریزی شما. در نتیجه، باید بازه زمانی انتخابی خود را با سبک زندگی و شخصیت خود مطابقت دهید.

در معاملات پوزیشن، ممکن است با استفاده از تایم فریم روزانه معامله کنید. در معاملات سوینگ، ممکن است از چند روز تا چند هفته در پوزیشن خود بمانید، در حالی که از نمودارهای 4 ساعته تا روزانه استفاده می کنید. در ترید اسکلپ و معاملات روزانه، از چند ثانیه تا یک روز، با استفاده از نمودار ثانیه ای تا نمودار ساعتی، در پوزیشن خواهید ماند.

. روانشناسی معامله گران در بازار و روانشناسی خود از مهمترین مسائل فعالیت در بازار فارکس می باشد. در واقع هر معامله گری باید توانایی تسلط بر احساساتی چون ترس، طمع و اضطراب و استرس را داشته باشد. چرا که در اغلب موارد احساساتی چون ترس و طمع موجب ضرر معامله گران می شود. در بازار فارکس باید قاطعانه و مسلط بر احساسات خود عمل کنید تا بتوانید در لحظات حساس بدرستی فکر کنید و تصمیم بگیرید. حال در حساب دمو هیچ از یک از این احساسات تجربه نمی شود و معامله گر با آسودگی خاطر پوزیشن خرید یا فروش باز می کند.

برای ورود/خروج خود از معامله از چه روشی استفاده می کنید؟

سبک های تحلیلی مختلفی وجود دارد که می تواند برای شخصیت شما مناسب باشد. شما می توانید یک معامله گر نوسانی، یک معامله گر سنتیمنت یا احساسات بازار و یک معامله گر آربیتراژ باشید، اما رایج ترین آنها معامله گران تکنیکال و معامله گران فاندامنتال هستند.

بیشتر بخوانید : تحليل سنتیمنتال در فارکس

معامله گران تکنیکال

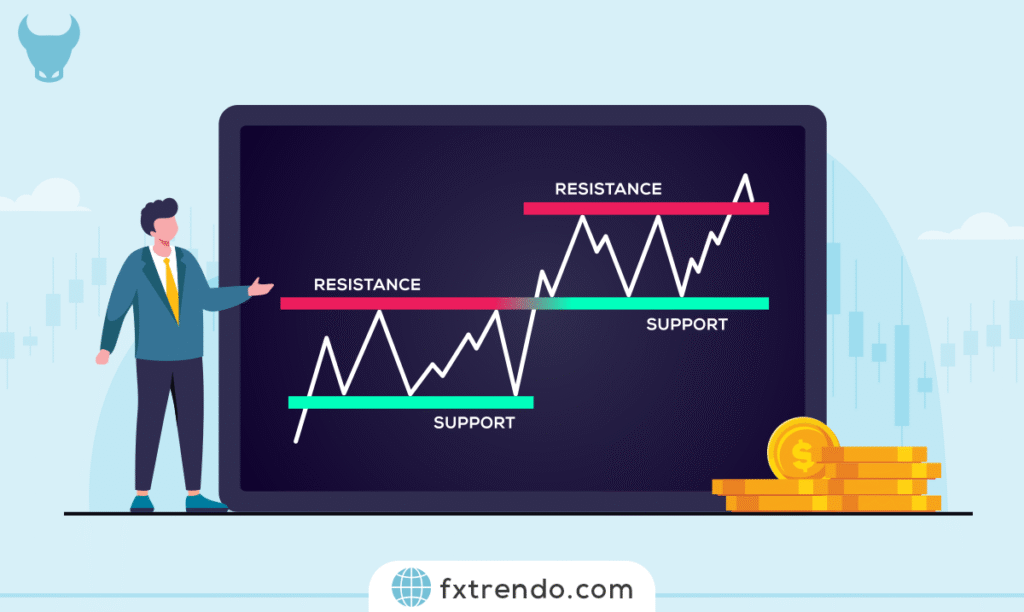

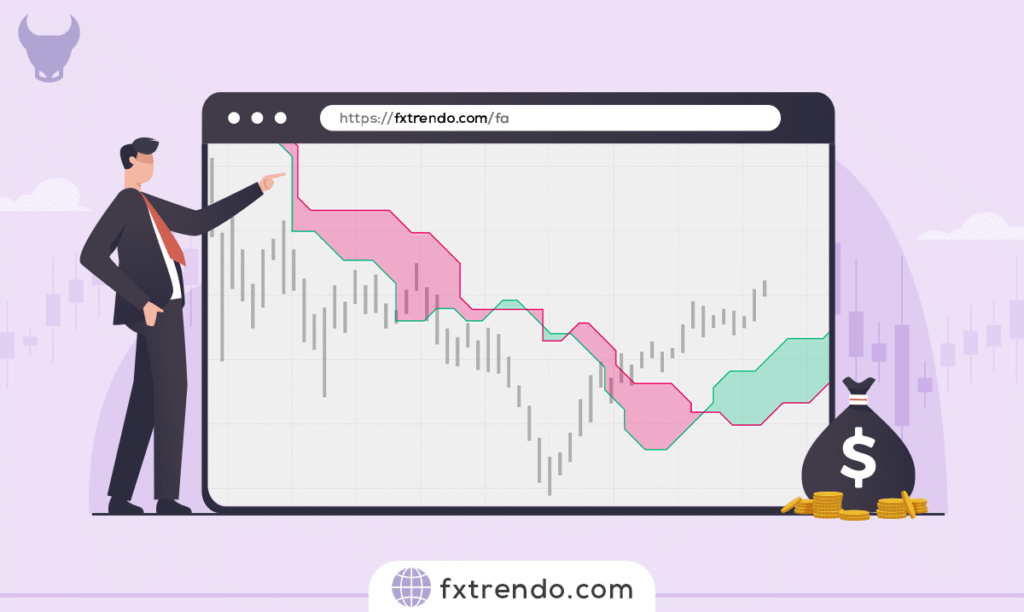

معامله گران تکنیکال از تحلیل تکنیکال برای تجزیه و تحلیل حرکات قیمت دارایی با استفاده از قیمت های گذشته برای پیش بینی عملکرد قیمت آینده استفاده می کنند. آنها از تجزیه و تحلیل روند، تجزیه و تحلیل نواحی حمایت و مقاومت و همچنین اندیکاتورهای ریاضی و تکنیکال، تحلیل کندل های ژاپنی، تئوری بازار و تحلیل الگوی قیمت برای معامله گری استفاده می کنند.

بیشتر بخوانید : تحليل تکنیکال در فارکس و انواع تحلیل تکنیکال

معامله گران فاندامنتال

معامله گران فاندامنتال برای تعیین ارزش ذاتی یک دارایی مالی به عوامل بنیادی نگاه می کنند و تعیین می کنند که آیا ارزش آن کمتر است یا بیش از حد ارزش گذاری شده است و اینکه آیا دارایی باید خریده یا فروخته شود. یک معامله گر فاندامنتال فارکس عمدتاً از استراتژی های معاملاتی خبری یک ارز استفاده می کند، که عمدتاً بر اساس تغییرات نرخ بهره است که بیشترین تأثیر را بر تحول نرخ ارز دارد.

بیشتر بخوانید : تحليل فاندامنتال در فارکس

تحلیل تکنیکال خوب به شما می گوید “چه زمانی” و تحلیل فاندامنتال خوب به شما می گوید “چرا” باید یک دارایی خریده یا فروخته شود. ما فکر می کنیم باید از هر دو روش تحلیل استفاده شود. در بازارهای فارکس، معاملهگران معمولاً برای زمانبندی ورود و خروج از بازار به تحلیلهای تکنیکال تکیه میکنند، در حالی که همچنان تقویم اقتصادی را زیر نظر میگیرند تا از اخباری که میتواند بر نوسانات بازار تأثیر بگذارد و فرصتهای معاملاتی بالقوه را ایجاد کند، مطلع شوند. هنگامی که بدانید از کدام نوع تحلیل بازار برای سبک معاملاتی خود استفاده کنید، باید فازهای بازار را شناسایی و درک کنید. ابزارها و اندیکاتورهای مختلفی وجود دارد که در شرایط خاص بازار بهترین عملکرد را دارند.

با توجه به قوانین صحیح مدیریت ریسک و سرمایه چه میزان ریسک را می پذیرید؟

تعیین ریسک شما به این بستگی دارد که بدانید در هر موقعیت معاملاتی چقدر می خواهید پول از دست بدهید. فکر کردن به ضرر آسان نیست، اما برای یک معامله گر خوب لازم است. دانستن سطح مناسب ریسک به شخصیت معامله گر و توانایی آن در قبول ریسک و همچنین میزان شناخت خود معامله گر بستگی دارد.

قوانینی در ارتباط با مدیریت سرمایه و ریسک وجود دارد که می توانید از آنها پیروی کنید، مانند:

فقط از سرمایه ای استفاده کنید که می توانید از دست بدهید.

مدیریت ریسک خود را با سبک معاملاتی خود تطبیق دهید.

از اندازه پوزیشن مناسب استفاده کنید.

همیشه از سفارش های حد ضرر استفاده کنید.

نسبت ریسک/پاداش خود را حداقل 1:2 (اگر معامله گر سوینگ یا پوزیشن هستید 1:3) تنظیم کنید.

حداکثر 1% از سرمایه معامله گری موجود خود را در هر پوزیشن ریسک کنید. از اهرم بیش از حد خودداری کنید.

اهرم یا لوریج ابزاری عالی برای افزایش سود بالقوه است، اما زیان های احتمالی شما را نیز افزایش می دهد، بنابراین از مقدار مناسبی از اهرم برای سرمایه معامله گری و تحمل ریسک خود استفاده کنید.

از سیستم خود بک تست و فروارد تست بگیرید

هنگامی که مشخص کردید که چه نوع معامله گر فارکسی هستید و چه نوع سبک معاملاتی برای شخصیت شما مناسب تر است، باید استراتژی معاملاتی خود را با داده های تاریخی (بک تست) و همچنین با شرایط فعلی بازار و معاملات واقعی (فروارد تست) آزمایش کنید. این به شما کمک میکند تا مطمئن شوید که از سیستمی استفاده میکنید که سودده است، و همچنین کشف کنید که چه شرایطی از بازار سودآورتر است. همچنین قابلیت اطمینان استراتژی معاملاتی خود را آزمایش کرده و ایجاد هرگونه تغییر لازم برای بهبود کارایی آن قبل از استفاده از پول واقعی در حساب معاملاتی زنده امکانپذیر است.

بک تست چیست؟

بک تست آزمایش استراتژی معاملاتی شما بر روی مجموعه ای از داده های تاریخی است، به گونه ای که گویی در آن زمان با استفاده از استراتژی انتخابی خود معامله می کنید. اگر نتایج سودآور باشد، پس از استراتژی معاملاتی شما انتظار نتایج مثبتی بوجود می آید و در آن زمان با آن درآمد کسب می کردید. برای به دست آوردن بهترین نتایج ممکن، می توانید برخی از پارامترهای خود را اصلاح کرده و مجددا آزمایش کنید.

فروارد تست چیست؟

در حالی که بک تست بر روی مجموعه خاصی از دادهها با شرایط خاص در گذشته تمرکز میکند، فروارد تست استراتژی را روی داده های زنده آزمایش میکند. فوروارد تست، که اغلب به آن ترید کاغذی می گویند، از یک محیط بازار شبیه سازی شده برای آزمایش سیستم معاملاتی شما در شرایط دنیای واقعی بدون به خطر انداختن پول واقعی استفاده می کند. این کار با ثبت تمام تصمیمات معاملاتی خرید و فروش که مطابق با سیستم معاملاتی خود می گیرید، کار می کند و مشاهده می کند که اگر به صورت واقعی معامله کرده باشید، سود “کاغذی” شما چقدر خواهد بود.

یکی از راههای ترید کاغذی، باز کردن یک حساب دمو است (یک حساب معامله گری که شرایط بازار و معاملات در زمان واقعی را با صندوقهای مجازی تقلید میکند، بنابراین میتوانید تعیین کنید که آیا استراتژی شما ممکن است سودآور باشد یا خیر). چه یک معامله گر مبتدی یا پیشرفته تر باشید، ترید کاغذی در سفر معامله گری شما ضروری است. به عنوان یک معامله گر بدون تجربه قبلی، ترید کاغذی برای عادت کردن به بازارها و نحوه عملکرد معاملات و همچنین برای پیشرفت بدون ریسک کردن پول واقعی عالی است. اگر تجربه بیشتری دارید، ممکن است ترید کاغذی برای اصلاح سیستم معاملاتی خود بدون به خطر انداختن پول مفید باشد.

سخن آخر

هنگام تصمیم گیری در مورد نحوه شروع معاملات فارکس، به یاد داشته باشید که این 5 مرحله را دنبال کنید:

تعیین کنید که کدام نوع معامله گر هستید.

سبک معاملاتی را انتخاب کنید که برای شما مناسب تر است.

روش ورود/خروج خود از بازار را مشخص کنید.

ریسک خود را تعریف کنید.

از سیستم خود بک تست و فوروارد تست بگیرید

همیشه به یاد داشته باشید، چه از یک استراتژی ساده فارکس استفاده کنید، چه از یک استراتژی پیشرفته تر، باید قبل از شروع معاملات واقعی بر آن تسلط داشته باشید.