در دنیای امروز، سرمایهگذاری و معاملهگری به یکی از مهمترین روشهای کسب درآمد تبدیل شده است. یکی از محبوبترین بازارهای مالی، فارکس (Forex) است که روزانه حجم عظیمی از معاملات را به خود اختصاص میدهد. این بازار به عنوان یک بستر جهانی برای خرید و فروش ارزهای مختلف، فرصتهای متعددی را برای تریدرها و سرمایهگذاران فراهم میکند. اما فارکس چیست و چگونه میتوان در آن فعالیت کرد؟ آیا ورود به این بازار نیاز به دانش و مهارت خاصی دارد؟ چگونه میتوان بهترین بروکر فارکس را انتخاب کرد و در جفت ارزهای فارکس معامله انجام داد؟ اگر به دنبال یک راهنمای جامع و کامل برای شروع فعالیت در بازار فارکس هستید، این مقاله برای شماست. با ما همراه باشید تا با صفر تا صد بازار فارکس در سال ۲۰۲۵ آشنا شوید.

فارکس چیست؟ راهنمای کامل ورود به بزرگترین بازار مالی جهان

بازار فارکس (Foreign Exchange Market) بزرگترین بازار مالی جهان است که روزانه بیش از ۷ تریلیون دلار در آن معامله میشود. این بازار یک بستر جهانی برای خرید و فروش ارزهای خارجی است که در آن، معاملهگران، بانکها، مؤسسات مالی و شرکتهای بینالمللی فعالیت میکنند.

تعریف دقیق واژه فارکس

فارکس ترکیبی از دو واژه Foreign و Exchange است که به معنای تبادل ارزهای خارجی میباشد. در این بازار، ارزها بهصورت جفتارز (Currency Pairs) معامله میشوند؛ به این معنا که یک ارز را خریداری کرده و همزمان ارز دیگری را میفروشید. برای مثال، وقتی در جفت ارز EURUSD وارد معامله خرید میشوید، به این معناست که یورو را خریده و دلار آمریکا را فروختهاید. اگر نرخ این جفت ارز افزایش پیدا کند، شما سود خواهید کرد.

تاریخچه و پیدایش بازار فارکس

بازار فارکس به شکل امروزی پس از پیمان برتون وودز (Bretton Woods Agreement) در سال ۱۹۷۱ شکل گرفت. تا قبل از آن، نرخ ارزها به طلا وابسته بود، اما بعد از فروپاشی این سیستم، نرخ ارزها شناور شد و بازار ارزهای خارجی بهعنوان یک بازار جهانی برای تعیین قیمت ارزها ایجاد شد. در ابتدا، این بازار عمدتاً در اختیار بانکهای مرکزی و مؤسسات مالی بزرگ بود، اما با گسترش اینترنت و پلتفرمهای معاملاتی، امروزه هر فردی میتواند از طریق بروکرهای فارکس در این بازار فعالیت کند.

برای اطلاعات بیشتر میتوانید به مقاله تاریخچه بازار فارکس مراجعه کنید.

چرا فارکس محبوب است؟ (مزایای بازار فارکس)

بازار فارکس به دلیل ویژگیهای منحصربهفرد خود، یکی از جذابترین بازارهای مالی برای معاملهگران است. در ادامه برخی از مهمترین مزایای آن را بررسی میکنیم:

بازار ۲۴ ساعته:

فارکس از دوشنبه تا جمعه، بدون وقفه و بهصورت ۲۴ ساعته فعال است.

نقدینگی بالا:

روزانه تریلیونها دلار در این بازار جابهجا میشود و نقدینگی فارکس بسیار بالاست.

امکان کسب سود در بازارهای صعودی و نزولی:

در فارکس، شما میتوانید هم از افزایش و هم از کاهش قیمتها سود کنید.

اهرم مالی (Leverage):

در بازار فارکس امکان استفاده از اهرم یا اعتبار معاملاتی وجود دارد.

تنوع بالای ابزارهای معاملاتی:

علاوه بر جفتارزها، بسیاری از بروکرها امکان معامله سهام، فلزات گرانبها، ارزهای دیجیتال و… را نیز فراهم میکنند.

کارمزد پایین:

در مقایسه با سایر بازارهای مالی، هزینه انجام معاملات در فارکس بسیار پایین است.

مزایای بازار فارکس

معایب بازار فارکس (چالشهای پیش روی معاملهگران)

همانطور که فارکس به عنوان جذابترین و پویاترین بازارهای مالی جهان مزایای بسیاری دارد، دارای ریسکها و معایبی نیز هست که باید قبل از ورود به این بازار با آنها آشنا شد. در ادامه مهمترین معایب و چالشهای بازار فارکس را بررسی میکنیم:

۱) ریسک بالا و نوسانات شدید

فارکس یک بازار پرنوسان است که در آن قیمتها میتوانند به سرعت تغییر کنند. این نوسانات ممکن است فرصتهای سودآوری خوبی ایجاد کنند، اما در عین حال میتوانند منجر به زیانهای سنگین شوند. برای مثال ممکن است در عرض چند دقیقه، قیمت یک جفت ارز چندین پیپ جابهجا شود و اگر مدیریت ریسک نداشته باشید، حساب شما به سرعت دچار ضرر شود.

راهحل:

استفاده از مدیریت سرمایه و تعیین حد ضرر (Stop Loss) برای کنترل زیانهای احتمالی.

۲) استفاده از اهرم (Leverage) و خطر از دستدادن سرمایه

در بازار فارکس، بروکرها اهرمهای بالا (Leverage) را در اختیار معاملهگران قرار میدهند که میتواند هم سود و هم زیان را چندین برابر کند. مثال: اگر با اهرم ۱:۱۰۰ معامله کنید، میتوانید با ۱۰۰ دلار، یک معامله ۱۰,۰۰۰ دلاری انجام دهید. اما اگر قیمت فقط یک درصد مخالف پیشبینی شما حرکت کند، تمام سرمایه شما از بین میرود.

راهحل:

استفاده از اهرمهای معقول (مثلاً ۱:۱۰ یا ۱:۲۰) و عدم سرمایهگذاری بیش از حد روی یک معامله.

۳) پیچیدگی و نیاز به دانش تخصصی

معامله در فارکس نیازمند دانش و مهارت است. اگر بدون آموزش و تجربه کافی وارد این بازار شوید، احتمال زیان شما بسیار زیاد خواهد بود.

راهحل:

یادگیری مداوم، استفاده از حساب دمو و مطالعه منابع آموزشی قبل از ورود به بازار واقعی.

۴) تأثیر اخبار و رویدادهای اقتصادی

اخبار اقتصادی، سیاستهای پولی بانکهای مرکزی، تصمیمات فدرال رزرو و تحولات ژئوپلیتیک میتوانند باعث نوسانات ناگهانی در بازار فارکس شوند. برای مثال: در زمان اعلام نرخ بهره فدرال رزرو آمریکا، ممکن است ارزش دلار در عرض چند دقیقه نوسانات شدیدی را تجربه کند.

راهحل:

دنبالکردن تقویم اقتصادی، اجتناب از معامله در زمان اخبار مهم و داشتن استراتژی مدیریت ریسک.

تأثیر اخبار و رویدادهای اقتصادی

۵) خطر کلاهبرداری و بروکرهای نامعتبر

متأسفانه در بازار فارکس، برخی از بروکرها معتبر نبوده و با دستکاری قیمتها، عدم پرداخت سود و تأخیر در برداشت وجه، سرمایه معاملهگران را به خطر میاندازند.

راهحل:

تحقیق درباره سابقه بروکر و بررسی نظرات کاربران قبل از ثبتنام و انتخاب یک بروکر معتبر که تحت نظارت نهادهای مالی بینالمللی است.

۶) تأثیر احساسات و هیجانات بر معاملات

ترس، طمع و هیجانات میتوانند باعث تصمیمگیریهای اشتباه در معاملات شوند. بسیاری از معاملهگران به دلیل عدم کنترل احساسات، در زمان نامناسب وارد معامله میشوند یا بیش از حد معامله میکنند (Overtrading).

راهحل:

داشتن استراتژی مشخص، مدیریت احساسات و ثبت ژورنال معاملاتی برای بررسی رفتار خود در بازار.

مهمترین بازیگران بازار فارکس

در بازار فارکس، شرکتکنندگان متنوعی فعالیت میکنند که هرکدام نقش خاصی در این بازار دارند. برخی از مهمترین بازیگران این بازار عبارتاند از:

بانکهای مرکزی:

بانکهای مرکزی کشورها با تعیین نرخ بهره و سیاستهای پولی، تأثیر زیادی بر نرخ ارزها دارند.

بانکهای تجاری و سرمایهگذاری:

بانکهای بزرگ مانند JPMorgan و Goldman Sachs نقش مهمی در تأمین نقدینگی و اجرای معاملات بزرگ دارند.

شرکتهای بینالمللی:

این شرکتهای برای انجام تراکنشهای مالی خود به بازار فارکس وابسته هستند.

بروکرهای فارکس:

این شرکتها واسطه بین معاملهگران و بازار هستند و پلتفرمهای معاملاتی را فراهم میکنند.

تریدرهای خرد:

افرادی که بهصورت شخصی در بازار فارکس فعالیت کرده و با تحلیلهای تکنیکال و فاندامنتال به دنبال کسب سود هستند.

چگونه میتوان وارد بازار فارکس شد؟

۱) آموزش فارکس:

ابتدا باید مفاهیم اولیه فارکس، نحوه تحلیل بازار و استراتژیهای معاملاتی را یاد بگیرید. جهت مطالعه بهروزترین مقالات آموزشی فارکس میتوانید به آموزش فارکس ترندو مراجعه کنید.

۲) انتخاب بهترین بروکر فارکس:

انتخاب بروکر معتبر با اسپرد کم، پشتیبانی حرفهای و امکانات معاملاتی کافی، اهمیت زیادی دارد.

۳) افتتاح حساب معاملاتی:

پس از انتخاب بروکر، یک حساب معاملاتی باز کنید و مدارک هویتی خود را ارسال کنید.

۴) تمرین با حساب دمو:

قبل از ورود به بازار واقعی، از حساب آزمایشی (Demo) برای تمرین استراتژیهای خود استفاده کنید.

۵) واریز سرمایه و شروع معامله:

پس از کسب مهارت کافی، میتوانید سرمایه واقعی خود را واریز کرده و معاملات خود را آغاز کنید.

اگر به دنبال یک بروکر حرفهای با پلتفرمی کامل و پیشرفته هستید، همین حالا در بروکر ترندو ثبتنام کنید و تجربهای متفاوت از معاملهگری در فارکس داشته باشید!

ساعات و روزهای فعالیت بازار فارکس

بازار فارکس یک بازار ۲۴ ساعته است که از دوشنبه تا جمعه بدون توقف فعالیت میکند. این بازار به دلیل ماهیت بینالمللی خود، در مراکز مالی مختلف جهان فعالیت دارد و با بستهشدن یک بازار، بازار دیگری باز میشود. فارکس به چهار سشن (جلسه) معاملاتی اصلی تقسیم میشود که هرکدام در منطقهای خاص فعالیت میکنند. این جلسات بر اساس مناطق زمانی مختلف جهان تنظیم شدهاند:

| نام سشن | زمان باز شدن (UTC) | زمان بسته شدن (UTC) |

|---|---|---|

| سشن سیدنی (استرالیا) | 22:00 | 06:00 |

| سشن توکیو (آسیا) | 00:00 | 06:00 |

| سشن لندن (اروپا) | 08:00 | 08:00 |

| سشن نیویورک (آمریکا) | 13:00 | 21:00 |

جدول ساعت مهمترین سشنهای معاملاتی فارکس

اگر معاملهگر روزانه (Day Trader) به دنبال نوسانات بالا و نقدینگی زیاد هستید، بهترین زمان برای معامله در فارکس ساعات همپوشانی سشنهای لندن و نیویورک (۱۳:۰۰ تا ۱۶:۰۰ UTC) است.

بهترین بروکر معاملات فارکس کدام است؟

انتخاب یک بروکر مطمئن و پیشرفته، اولین و مهمترین گام برای موفقیت در بازار فارکس است. با توجه به تنوع بروکرهای موجود، یافتن گزینهای که هم امکانات پیشرفته ارائه دهد و هم از امنیت و اعتبار بالایی برخوردار باشد، اهمیت زیادی دارد.

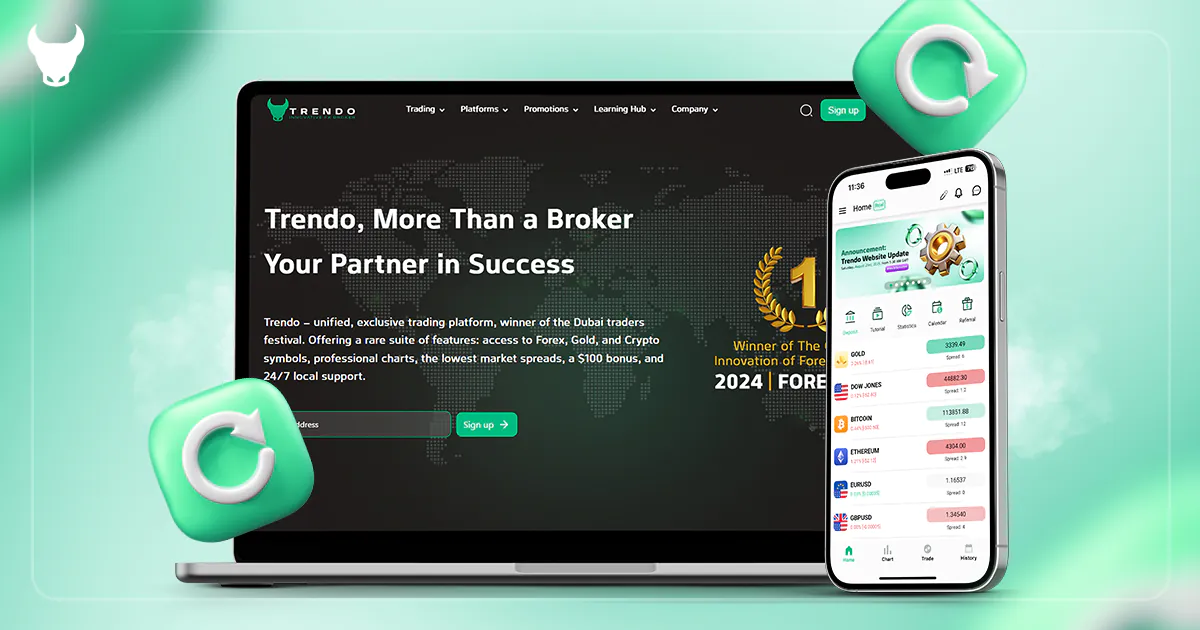

یکی از بهترین و پیشرفتهترین بروکرهای فارکس، بروکر ترندو (TRENDO) است که به دلیل ارائه پلتفرم اختصاصی، جامع و حرفهای، توانسته است نظر بسیاری از معاملهگران را به خود جلب کند. آنچه ترندو را از سایر رقبا متمایز میکند، پلتفرم نوآورانه آن است که تمامی ابزارهای موردنیاز تریدرها را در خود جای داده است. با برنامه فارکس ترندو، معاملهگران حرفهای دیگر نیازی به استفاده از نرمافزارهای جانبی مانند متاتریدر نخواهند داشت، زیرا این پلتفرم، تمامی امکانات ضروری برای تحلیل و معامله را یکجا ارائه میدهد.

با ترندو، با اطمینان معامله کنید!

ویژگیهای متمایز بروکر ترندو عبارتاند از:

پلتفرم اختصاصی و پیشرفته:

طراحی شده برای تریدرهای حرفهای بدون نیاز به نرمافزارهای جانبی.

اعتبار و امنیت بالا:

ثبت قانونی در چهار کشور: قبرس، ارمنستان، انگلیس و سنت لوسیا.

برنده جایزه بهترین پلتفرم اختصاصی فارکس:

در نمایشگاه فارکس اکسپو دبی ۲۰۲۴، ترندو جایزه بزرگترین نوآوری در پلتفرم معاملاتی فارکس را کسب کرده است.

انتخاب بیش از ۲۰۰,۰۰۰ معاملهگر:

جامعهای گسترده از تریدرهای موفق که ترندو را بهعنوان بروکر مورداعتماد خود انتخاب کردهاند.

همین حالا پلتفرم معاملاتی ترندو را دانلود کنید و ۱۰۰ دلار بونوس خوشآمدگویی رایگان دریافت کنید.

رایج ترین اصطلاحات فارکس چیست؟

اگر میخواهید به یک معاملهگر موفق در فارکس تبدیل شوید، آشنایی با این اصطلاحات پایهای اولین قدم برای تصمیمگیریهای دقیقتر و مدیریت بهتر معاملات شماست:

لات (Lot): واحد اندازهگیری حجم معاملات در فارکس که استاندارد آن ۱۰۰,۰۰۰ واحد از ارز پایه است، اما میکرو لات (۱,۰۰۰ واحد) و مینی لات (۱۰,۰۰۰ واحد) نیز وجود دارند.

اسپرد (Spread): تفاوت بین قیمت خرید (Ask) و قیمت فروش (Bid) یک جفتارز که نشاندهنده هزینه معامله در فارکس است.

اهرم (Leverage): ابزاری که به معاملهگران اجازه میدهد با سرمایهای کمتر، حجم بیشتری معامله کنند؛ مثلاً با اهرم ۱:۱۰۰، میتوان با ۱۰۰ دلار، معاملهای به ارزش ۱۰,۰۰۰ دلار انجام داد.

مارجین (Margin): مقداری از سرمایه که برای باز کردن یک معامله، نزد بروکر بهعنوان وثیقه نگه داشته میشود و با اهرم رابطه مستقیم دارد.

حد ضرر (Stop Loss) و حد سود (Take Profit): سفارش خودکار برای بستن معامله در یک سطح قیمتی مشخص بهمنظور جلوگیری از زیان بیشتر یا بسته معامله برای کسب سود معین.

سواپ (Swap): هزینهای که برای نگهداشتن معامله در طول شب پرداخت یا دریافت میشود، بر اساس اختلاف نرخ بهره بین دو ارز در یک جفتارز.

سخن پایانی

بازار فارکس یکی از بزرگترین و پرحجمترین بازارهای مالی است که ارزهای مختلف کشورها را در سطح جهانی جابهجا میکند. این بازار ۲۴ ساعت شبانهروز و پنج روز در هفته فعال است و معاملهگران میتوانند در آن به خرید و فروش ارزها بپردازند. در فارکس، جفتارزها با یکدیگر معامله میشوند تا مشخص شود کدام ارز ارزش بیشتری پیدا میکند و کدام یک از ارزش خود میکاهد. در حالی که بزرگترین بازیگران بازار نقش اصلی را دارند، سرمایهگذاران خرد هم میتوانند با درک صحیح از سیستم بازار و انجام تحقیقات مناسب، به سود قابل توجهی دست یابند.

با توجه به اینکه هزینه ورود به بازار فارکس نسبتا پایین است و امکان استفاده از لوریج برای افزایش سود وجود دارد، این بازار میتواند فرصتی جذاب برای سرمایهگذاری باشد. البته باید توجه داشت که اهرمها میتوانند ریسکها را نیز افزایش دهند و در صورت عدم مدیریت مناسب، ممکن است منجر به زیانهای بیشتر شوند. به همین دلیل، سرمایهگذاران باید با احتیاط عمل کنند. اگر شما هم میخواهید وارد دنیای فارکس شوید و از این فرصتهای معاملاتی بهرهمند شوید، همین حالا در ترندو ثبتنام کنید و معامله در فارکس را آغاز کنید!