This article explores the forex major currency pairs and trading symbols offered by Trendo, helping you optimize your strategy. Whether trading currencies, digital assets, or commodities, you’ll find options to match your goals.

Let’s dive into Trendo’s offerings.

What is a Forex Currency Pair?

The Forex market, being the largest financial market in the world, serves as the primary platform for trading major international currencies such as the US Dollar, Euro, British Pound, and others. In this market, all trading symbols are presented in pairs, which is a fundamental concept for Forex trading. Essentially, the value of any currency or asset in the Forex market is always quoted relative to another currency or asset.

For example, in the currency pair USDCAD, you have two components: USD (United States Dollar) and CAD (Canadian Dollar). The first currency in the pair, USD, is called the base currency, while the second currency, CAD, is referred to as the quote currency or counter currency. If the price of the USDCAD pair is quoted at 1.40, this means that 1 US Dollar is equal to 1.40 Canadian Dollars. The price tells you how much of the quote currency (CAD) is needed to purchase one unit of the base currency (USD).

Read more: What is a Currency Pair? (What is traded in Forex?)

When trading Forex, the way you enter a position depends on whether you are buying or selling the currency pair:

Buying a currency pair (going long):

means that you are buying the base currency and selling the quote currency at the same time. For example, if you buy the USDCAD pair, you are purchasing US Dollars and simultaneously selling Canadian Dollars.

Selling a currency pair (going short)

means that you are buying the quote currency and selling the base currency. If you sell USDCAD, you are selling US Dollars and buying Canadian Dollars.

What Are Major Currency Pairs in Forex?

Forex major currency pairs are the most traded and liquid pairs in the forex market, accounting for over 70% of global trading volume. They always include the US Dollar (USD) paired with another highly traded currency from a major economy. The standard 7 major currency pairs are:

- EUR/USD (Euro/US Dollar)

- GBP/USD (British Pound/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CAD (US Dollar/Canadian Dollar)

- NZD/USD (New Zealand Dollar/US Dollar)

These pairs feature tight spreads, high liquidity, and abundant market data, making them ideal for most traders.

Why USD is Involved in All Major Forex Pairs

The USD dominates as the world’s primary reserve currency, held by central banks and used in international trade (e.g., oil pricing in “petrodollars”). This creates massive demand and supply, ensuring deep liquidity. Pairing other strong currencies with the USD reflects the largest economies, resulting in predictable behavior and lower volatility compared to other pairs.

Euro/US Dollar

Symbol:

EUR/USD

Average spread:

Typically 0.1-0.6 pips (often near zero with competitive brokers)

Liquidity:

Highest in forex; ~25-30% of global volume

Best trading session:

London-New York overlap (8:00-12:00 EST) for peak volatility and volume

EUR/USD, known as “Fiber,” is the most traded pair worldwide, driven by US and Eurozone economic data.

British Pound/US Dollar

Symbol:

GBP/USD

Average spread:

0.3-1.0 pips

Liquidity:

Very high; ~10-12% market share

Best trading session:

London session (3:00-12:00 EST)

“Cable” is known for volatility, influenced by UK economic releases and Brexit-related news.

US Dollar/Japanese Yen

Symbol:

USD/JPY

Average spread:

0.2-0.8 pips

Liquidity:

High; ~13-17% market share

Best trading session:

Asian (Tokyo) session or London overlap

Often a “safe-haven” play, affected by Bank of Japan policy and risk sentiment.

US Dollar/Swiss Franc

Symbol:

USD/CHF

Average spread:

0.4-1.2 pips

Liquidity:

High

Best trading session:

London session

“Swissie” acts as a safe-haven due to Switzerland’s stability.

Australian Dollar/US Dollar

Symbol:

AUD/USD

Average spread:

0.4-1.0 pips

Liquidity:

High; commodity-linked

Best trading session:

Asian/Pacific session

Sensitive to commodity prices (e.g., metals, China data).

US Dollar/Canadian Dollar

Symbol:

USD/CAD

Average spread:

0.5-1.5 pips

Liquidity:

High

Best trading session:

New York session

Heavily influenced by oil prices.

New Zealand Dollar/US Dollar

Symbol:

NZD/USD

Average spread:

0.5-1.5 pips

Liquidity:

High

Best trading session:

Asian/Pacific session

Commodity-driven, similar to AUD/USD.

Why Major Forex Pairs Have the Highest Liquidity

Institutional Trading Volume

Major currency pairs attract massive participation from banks, hedge funds, and central banks due to USD’s reserve status and the economic size of paired nations. This creates deep order books and constant flow.

Tight Spreads

High volume allows brokers to offer narrow bid-ask spreads (often under 1 pip), reducing costs and enabling efficient execution even in large sizes.

News Sensitivity

These pairs react strongly but predictably to high-impact events (e.g., NFP, ECB rates), drawing more traders and amplifying liquidity during news hours.

Overall, majors’ liquidity minimizes slippage and supports strategies from scalping to long-term positions.

Minor Currency Pairs

Minor Currency Pairs, also known as Cross Currency Pairs, do not involve the US Dollar but are made up of two major currencies. These pairs offer traders additional opportunities to diversify their portfolios. Some examples of Minor Currency Pairs include:

- EURJPY (Euro / Japanese Yen)

- EURGBP (Euro / British Pound)

- GBPJPY (British Pound / Japanese Yen)

- GBPCAD (British Pound / Canadian Dollar)

- EURAUD (Euro / Australian Dollar)

While these pairs do not include the US Dollar, they still attract considerable trading volume. Since they are typically more volatile than Major currency Pairs, they present additional risk and reward for traders. Traders looking for alternative opportunities can benefit from the fluctuations in these currency pairs.

With Trendo, you can access Minor Currency Pairs with low spreads and commission fees, as well as a robust trading platform designed for seamless execution.

Major Forex Pairs vs Minor and Exotic Pairs

Major currency pairs stand out due to their exceptional liquidity, tight spreads, and moderate volatility, making them the cornerstone of forex trading. In contrast, minor pairs exhibit lower liquidity and wider spreads. Exotic pairs pair a major currency (usually USD) with one from an emerging or smaller economy (e.g., USD/TRY, USD/ZAR), leading to significantly lower liquidity, much wider spreads, higher volatility, and greater susceptibility to sudden price gaps during geopolitical or economic events in the emerging market.

The table below summarizes the key distinctions at a glance:

| Aspect | Major Pairs | Minor Pairs | Exotic Pairs |

|---|---|---|---|

| Examples | EUR/USD, GBP/USD | EUR/GBP, AUD/JPY | USD/TRY, EUR/ZAR |

| Liquidity | Very High | Medium | Low |

| Spreads | Low (0.1-1 pip) | Medium (1-3 pips) | High (10+ pips) |

| Volatility | Moderate | Higher | Very High |

Risk & Spread Differences

The most notable difference lies in trading costs and risk exposure. Forex major pairs benefit from deep institutional participation, allowing brokers to offer ultra-tight spreads (often below 1 pip) and minimal slippage even during large trades. Minor pairs have wider spreads and slightly higher slippage risk, increasing transaction costs. Exotic pairs carry the highest spreads—sometimes 50-100 pips or more—along with elevated risk of sharp, unpredictable moves triggered by low trading volume or country-specific news, making them prone to stop-loss hunting and overnight gaps.

Who Should Trade Which?

Beginners and intermediate traders should focus almost exclusively on forex major pairs: their high liquidity, low costs, and abundance of analysis/resources create a safer learning environment with better risk-reward consistency. Experienced traders seeking diversification or specific macroeconomic plays may incorporate minor pairs, as these offer decent liquidity while avoiding USD-centric bias. Exotic pairs are generally suitable only for advanced traders with strong risk management skills, substantial capital buffers, and a high tolerance for volatility—they can deliver outsized returns but also significant drawdowns, so position sizing and stop-loss discipline are critical.

How to Choose the Best Major Currency Pair to Trade

Choosing the right major currency pair is one of the most important decisions a trader can make, as it directly impacts profitability, risk management, and emotional stress. The “best” pair is highly personal—it depends on your trading experience, schedule, risk tolerance, and preferred trading style. Below are practical guidelines from an experience-centered perspective to help you select wisely.

Based on Your Trading Session and Lifestyle

Your available trading hours should be the first filter. The forex market runs 24/5, but each major pair has a “sweet spot” when liquidity and volatility peak.

- If you trade during the London-New York overlap (8:00–12:00 EST): EUR/USD and GBP/USD offer the highest volume and cleanest moves. Experienced traders often say this overlap feels “alive”—price respects technical levels better, and breakouts have follow-through.

- If you’re in Asia or trade the Tokyo session: USD/JPY is usually the cleanest choice. Many seasoned Asian-based traders stick almost exclusively to this pair because news flow is lighter and trends can run smoothly.

- If you trade Pacific hours: AUD/USD and NZD/USD move most actively then. Commodity traders with full-time jobs often build their entire strategy around these two pairs because they can catch the moves in the evening.

Practical tip: As a beginner or intermediate trader, limit yourself to one session and one or two pairs for the first 6–12 months. Switching sessions constantly fragments focus and slows skill development.

Based on Volatility and Your Emotional Tolerance

Different pairs have distinct “personalities” that affect how much heat your account can handle.

- Low to moderate volatility (easier on emotions): EUR/USD and USD/CHF. These are favorites for newer traders because moves are generally smoother, stops are less likely to get hit by noise, and trends develop gradually. Many traders with 1–3 years of experience still keep EUR/USD as their core pair for this reason.

- Higher volatility (more opportunity, more stress): GBP/USD and USD/JPY. These pairs can deliver quick 50–100 pip moves but also frequent fakeouts. Experienced traders often wait for high-impact news (e.g., UK data for GBP/USD or BOJ comments for USD/JPY) to capture explosive moves, but beginners frequently get stopped out chasing them.

Practical tip: Track your win rate and average risk-reward on a demo account for each pair over 50–100 trades. If a volatile pair consistently causes revenge trading or over-leveraging, drop it until you have more experience.

Based on Experience Level

- Beginners (0–1 year live trading): Start exclusively with EUR/USD. It has the tightest spreads, highest liquidity, most educational content, and the largest community. Almost every professional trader you respect began here.

- Intermediate (1–3 years): Add one more pair that complements your session—e.g., GBP/USD if you trade London, or USD/JPY if you trade Asia. Gradually introduce commodity pairs (AUD/USD, USD/CAD) once you’re comfortable reading economic calendars and understanding correlations (e.g., oil prices → USD/CAD).

- Advanced (3+ years): Trade multiple majors rotationally based on the economic cycle. For example, favor USD/JPY during risk-off periods, AUD/USD during risk-on commodity rallies, or USD/CAD when oil inventories move markets.

Practical tip: Never trade more than 2–3 forex major pairs simultaneously until you can consistently profit from one. Mastery of a few instruments beats mediocre performance across many.

By aligning your pair choice with your real-life schedule, emotional capacity, and current skill level, you’ll trade more consistently and progress faster. The most successful traders aren’t the ones who trade every major pair—they’re the ones who know exactly which one suits them best at each stage of their journey.

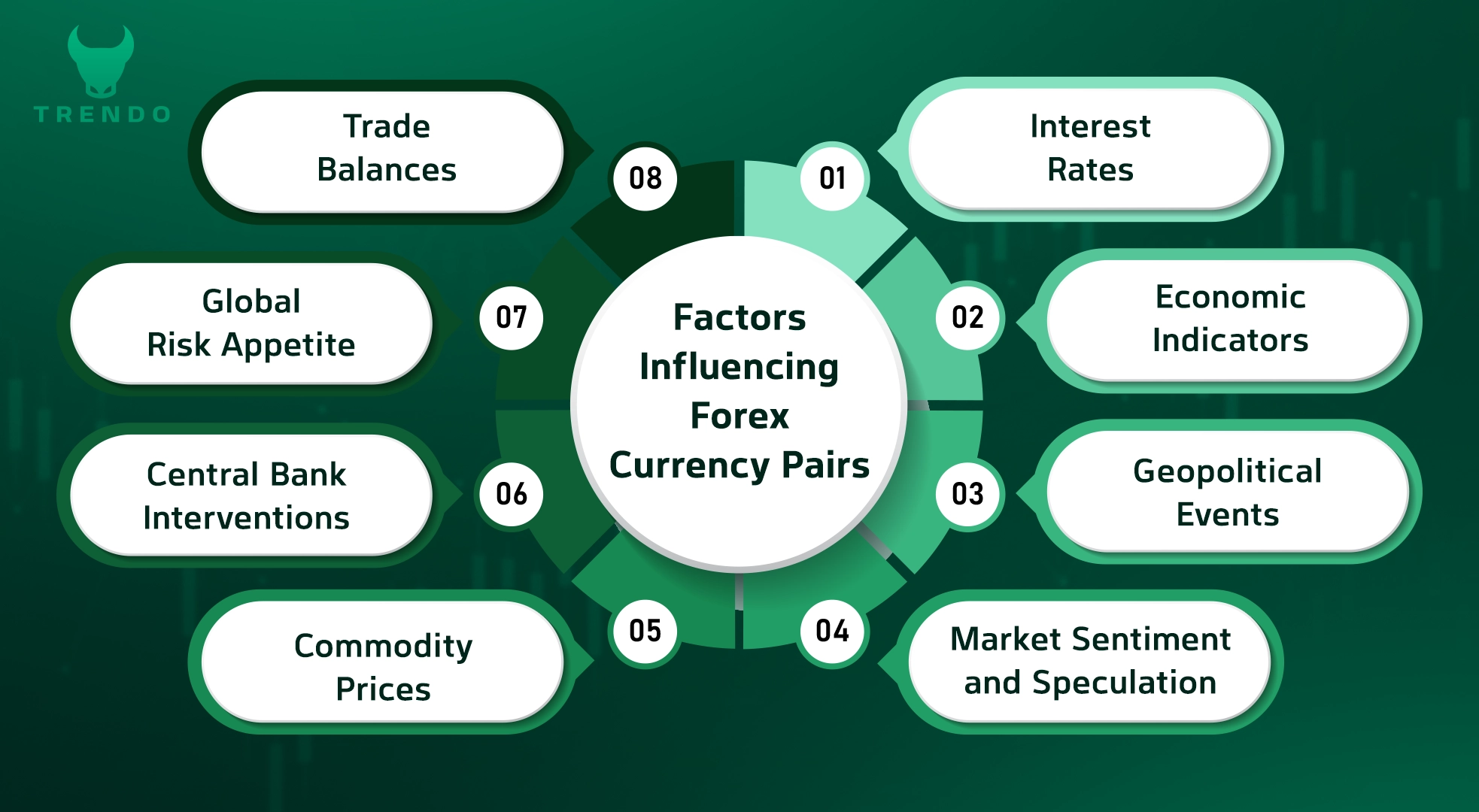

Factors Influencing Forex Currency Pairs

Currency pairs in the Forex market are influenced by several key factors. Understanding these factors can help traders make informed decisions and predict market movements. Here are the main factors that affect currency pairs:

1. Interest Rates

Interest rates set by central banks have a direct impact on currency values. Higher interest rates attract more foreign investment, increasing demand for the currency and strengthening it. Lower interest rates tend to weaken the currency, as investors seek higher returns elsewhere.

For example, if the Federal Reserve raises interest rates, the USD typically strengthens as investors move money into the US to take advantage of higher returns.

When the European Central Bank cuts interest rates, the EUR often weakens as investors move to other currencies with higher yields.

2. Economic Indicators

Economic indicators like GDP, inflation, and employment data provide a snapshot of a country’s economic health. A strong economy usually leads to a stronger currency, while a weak economy can cause a currency to decline.

GDP Growth:

Strong GDP growth often leads to a stronger currency, as it signals a growing economy and attracts foreign investment.

Inflation:

High inflation erodes purchasing power, weakening a currency, while low inflation supports currency strength.

Employment Data:

A low unemployment rate is generally a sign of economic stability, which can boost the value of a currency.

3. Geopolitical Events

Geopolitical events, such as elections, wars, or international agreements, can create uncertainty in the Forex market. Political instability often leads to a weaker currency, as investors seek safer assets.

Events like Brexit caused volatility in the GBP due to the uncertainty surrounding the UK’s departure from the European Union.

Positive geopolitical developments, such as trade agreements or peace treaties, can boost investor confidence and strengthen a currency.

4. Market Sentiment and Speculation

Market sentiment and speculation are key drivers in currency price movements. Traders often buy or sell currencies based on future expectations rather than current economic conditions. If investors believe a currency will rise in value, they may start buying it, driving up the price.

For instance, if traders expect an interest rate hike by the Federal Reserve, they may buy the USD in anticipation, which strengthens the currency even before the actual rate change.

5. Commodity Prices

Commodity prices are linked to currencies in countries that are major exporters of natural resources. The Australian Dollar (AUD), Canadian Dollar (CAD), and New Zealand Dollar (NZD) are particularly sensitive to commodity price changes.

A rise in crude oil prices, for example, can strengthen the CAD, as Canada is a major oil exporter.

Similarly, a rise in gold prices can lead to a stronger AUD, as Australia is one of the world’s largest gold producers.

6. Central Bank Interventions

Central banks can directly influence currency prices by intervening in the Forex market. These interventions are usually aimed at stabilizing the currency or achieving specific economic goals, such as controlling inflation or boosting exports.

For example, the Swiss National Bank has intervened in the past to prevent the CHF from appreciating too much, which could harm Switzerland’s exports.

Countries may also devalue their currency intentionally to make their exports cheaper, increasing demand for their goods.

7. Global Risk Appetite

Risk appetite refers to how willing investors are to take on risk. In times of uncertainty or crisis, investors tend to move their money into safe-haven currencies like the USD, CHF, or JPY, which are considered stable.

During periods of global financial instability, the USD and JPY often strengthen as investors seek safer investments.

In more stable times, investors may seek higher yields from riskier currencies like the AUD or NZD, leading to a decline in safe-haven currencies.

8. Trade Balances

A country’s trade balance also affects its currency. Countries that export more than they import (trade surplus) typically see their currency appreciate, as demand for their goods also increases demand for their currency.

If a country like China has a trade surplus with the US, the demand for the CNY rises, which strengthens its value.

On the other hand, countries with a trade deficit, where imports exceed exports, may see their currency weaken due to lower demand for their goods and currency.

By considering these factors, traders can better anticipate market changes and improve their chances of success in Forex trading.

Precious Metals in International Financial Markets

Precious metals, particularly gold, are highly popular in international financial markets. Traders around the world frequently engage in trading gold (XAUUSD), silver (XAGUSD), and other commodities like oil, especially through Forex brokers.

While Forex markets primarily involve currency pairs, brokers often provide access to commodities and precious metals as part of their offerings. This makes it possible for traders to diversify their portfolios by including metals like gold, silver, palladium, and platinum.

These assets are considered safe havens during periods of economic uncertainty and are actively traded in the global markets.

Gold (XAUUSD) in Forex

Gold is one of the most traded precious metals in the financial markets. It’s widely recognized as a safe-haven asset, which means it tends to hold or increase its value during times of economic or political instability.

For example, during global crises, wars, or economic recessions, gold prices typically rise as investors seek to protect their capital from market volatility. Gold’s appeal as a safe asset is largely driven by its historical stability and ability to maintain value when other investments are volatile.

The gold market (XAUUSD) is also highly liquid, meaning that traders can buy and sell it easily without large price fluctuations, making it an attractive asset for both short-term and long-term traders.

Since gold is traded in US dollars, the value of the USD plays a crucial role in determining the price of gold. When the US dollar strengthens, gold prices often fall, and when the dollar weakens, gold tends to rise.

For gold trading, choosing a broker is very important, you can check the important points in choosing a broker for gold trading in the Features of the Best Broker for Trading Gold article.

The Trendo broker undoubtedly offers one of the best trading conditions for the gold symbol and the main currency pairs of the Forex market. In the image below you can see the spreads of the most important Forex market symbols on the Trendo platform:

Other Precious Metals: Silver, Palladium, and Platinum

Silver (XAGUSD), like gold, is considered a precious metal with significant market interest. While silver is more volatile than gold, it shares similar characteristics as a safe-haven asset, responding to economic uncertainty in much the same way. Silver is often seen as a more affordable alternative to gold, attracting smaller investors who want exposure to precious metals without the higher price tag of gold.

Palladium and platinum are also important in the precious metals market, though they are less commonly traded than gold and silver. These metals are primarily used in industrial applications, such as the production of catalytic converters in automobiles. Their prices can be influenced by demand from the automotive industry, making them more susceptible to industrial trends and economic cycles.

Trading Precious Metals with Brokers

When trading precious metals, selecting the right broker is crucial. A good broker provides access to competitive spreads, high liquidity, and the ability to trade a variety of precious metals.

For instance, with Trendo Broker, traders can access a wide range of commodities and metals under favorable trading conditions. This includes global gold (XAUUSD), silver (XAGUSD), palladium (XPDUSD), and platinum (XPTUSD) pairs.

In addition to offering competitive spreads, Trendo provides trading platforms that make it easy to execute trades efficiently and at the best possible prices.

The choice of broker can have a significant impact on your trading experience, so it’s essential to look for one that offers reliable execution, low commissions, and responsive customer support when trading precious metals.

Key Indicators of Global Markets on Trendo Broker

Trendo Broker offers a range of major stock market indices, alongside Forex and precious metals, giving traders access to broader global markets. These indices are valuable tools for understanding overall market performance and trends. Here are the key indices available on Trendo Broker:

- DOW JONES

- S&P 500

- DAX 40

- NASDAQ

- APAN 225

- ASX 200

DOW JONES and NASDAQ

DOW JONES (DJI or US30)

The Dow Jones Industrial Average is one of the oldest and most recognized stock indices. It tracks the performance of 30 major US companies across a range of industries like technology, finance, and consumer goods. The US30 forex symbol is often used to gauge the overall health of the US economy. It tends to be less volatile than tech-heavy indices but can still react to major economic events, like changes in interest rates or geopolitical tensions.

Read more : What is the Dow Jones Index?

NASDAQ (NAZDAQ or US100)

The NASDAQ Composite index focuses on technology and innovation. It includes major tech companies like Apple, Microsoft, and Amazon, making it a benchmark for the tech sector. The NASDAQ-100 (or US100) tracks the top 100 non-financial companies listed on the NASDAQ exchange. It’s more volatile than the Dow, with movements often tied to developments in the tech industry, offering both high-risk and high-reward trading opportunities.

Other Key Global Indices on Trendo Broker

S&P 500:

Tracks 500 of the largest US companies, offering a broader view of the US economy compared to the Dow. It’s popular among long-term investors.

DAX 40:

Tracks the 40 largest companies on the Frankfurt Stock Exchange in Germany, providing insight into the German economy.

JAPAN 225:

Known as the Nikkei 225, this index covers 225 major companies in Japan, reflecting the performance of the Japanese economy.

ASX 200:

Tracks the 200 largest companies on the Australian Securities Exchange, providing a snapshot of the Australian stock market.

Cryptocurrencies on Trendo Broker

Trendo Broker provides access to some of the most popular cryptocurrencies, allowing traders to participate in the growing digital asset market. In addition to Forex, commodities, and stock indices, Trendo offers a variety of major cryptocurrencies.

Here are the key cryptocurrencies available for trading on Trendo Broker:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Cardano (ADA)

Bitcoin (BTC) on Trendo Broker

Bitcoin (BTC) is the leading cryptocurrency and remains one of the most traded assets. Available on Trendo Broker as BITCOIN (BTC), it offers traders high liquidity and volatility. Bitcoin is considered a store of value and a speculative asset, influenced by factors such as market adoption, regulations, and global economic trends.

Trendo Broker offers Bitcoin with low spreads and commissions, making it an efficient option for traders seeking to capitalize on price fluctuations.

Other Cryptocurrencies on Trendo Broker

Trendo also offers several other well-known cryptocurrencies:

Ethereum (ETH):

The second-largest cryptocurrency by market cap, known for its blockchain that supports smart contracts and decentralized applications.

Ripple (XRP):

A digital payment protocol that facilitates fast and low-cost cross-border payments.

Litecoin (LTC):

A faster and more scalable version of Bitcoin, known for quicker transaction times and lower fees.

Conclusion

The major currency pairs continue to dominate the global forex market. These 7 major currency pairs (EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, USD/CAD, and NZD/USD) are among the most liquid and widely traded, making them the go-to choice for traders worldwide. What sets the forex major currency pairs apart is their exceptional liquidity, ultra-tight spreads, and predictable behavior driven by the US Dollar’s status as the world’s reserve currency. Whether you’re a beginner learning the basics or an experienced trader refining strategies, starting with these major forex pairs provides the best foundation for long-term success. While many brokers also offer indices like the US30 forex symbol, precious metals, and other assets, nothing matches the depth, reliability, and trading volume of the major currency pairs. The major forex pairs remain essential because they offer lower risk, better execution, and more opportunities for consistent profits.