Many factors affecting gold in the global markets and forex market, which are essential for those who intend to work professionally in the gold market to be aware of. In this article from the Trendo Broker educational team, we will discuss important factors affecting gold price such as changes in the US dollar value, interest rates, and geopolitical events. Stay tuned.

Gold in the international forex market

In the forex market, the XAUUSD symbol, which refers to the global ounce of gold, is one of the most popular trading symbols. This symbol shows the value of one gold ounce to the US dollar. Changes in the value of this symbol are affected by various parameters. Key factors affecting gold prices are:

- Macroeconomic drivers

- Geopolitical and political events

- Correlations with other financial markets

- Supply and Demand

- Banks and investment funds

- Quantitative indicators

- Short-term vs long-term influencers

We will review each of the cases in detail below, helping you understand gold prices and what affects gold prices forex.

Read More:

Macroeconomic Drivers of Gold Price

Macroeconomic indicators form the backbone of gold price movements, reflecting global economic health, policy shifts, and investor confidence, served as an important factor among factors affecting gold. These drivers often interact, creating complex dynamics that savvy traders monitor closely.

Inflation and its Impact on Gold

Gold shines as a premier inflation hedge. When inflation surges—eroding fiat currency value—investors pivot to gold to preserve wealth. This demand spike historically lifts prices, as seen in the 1970s stagflation era and post-COVID recovery, where U.S. CPI peaks above 9% fueled a 20%+ rally. Central banks’ failure to tame inflation amplifies this, positioning gold as “real money” amid currency debasement.

Inflation means a decrease in the value of a country’s currency. When inflation increases, central banks try to control inflation with monetary policies. Changing the interest rate is one of the central banks’ primary solutions in dealing with inflation. The increase in global inflation, especially in the United States, causes the price of gold to rise. As a safe asset, gold experiences good growth in the long term when the dollar’s value and other currencies are decreasing. These are crucial factors affecting gold price.

CPI is an index to measure inflation. Inflation and interest rates are closely related. In times of inflation, central banks tend to increase interest rates to reduce demand for goods and services, which can lead to lower prices. Conversely, central banks tend to lower interest rates to stimulate demand and increase prices when inflation is low. Understanding these helps clarify what affects gold prices forex.

Read More:

The Consumer Price Index or Inflation (CPI)

Interest Rates and Central Bank Policies

The next factor among factors affecting gold is Interest rates. Rising rates, like the Federal Reserve’s aggressive hikes from 2022, boost bond yields and the opportunity cost of holding non-yielding gold, often capping prices. Conversely, low or negative rates—via quantitative easing—flood markets with liquidity, propelling gold higher. ECB and BoJ policies add layers, as global rate divergences influence capital flows toward or away from the yellow metal.

Changes in interest rates have major effects on all financial markets and the gold market. For example, when the Federal Reserve in America lowers or increases the interest rate by 0.25%, the financial markets quickly react, and new trends form. That is why you must constantly monitor the American central banks’ policies and be aware of all the news and events. Technical analysis is helpful, but knowledge of market conditions is also necessary for success in trading. These policies are among the top factors affecting xauusd price.

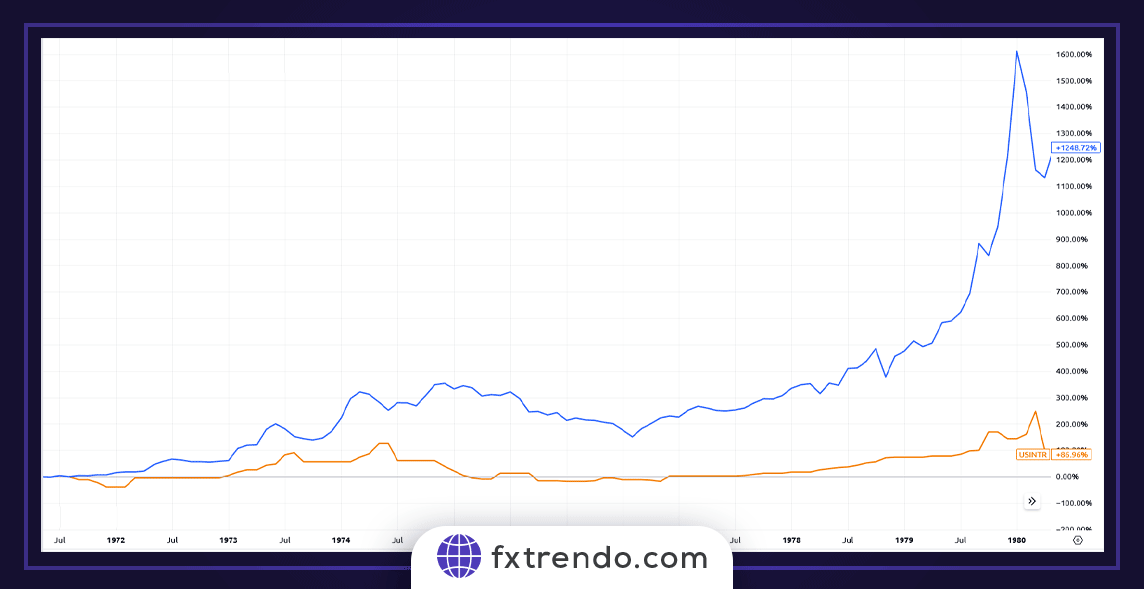

You can see the connection between the Federal Reserve interest rate changes and the global ounce in the picture below. Of course, you must note that only the US dollar interest rate does not affect the price of gold. Generally, we can say that if the global conditions are such that the general interest rate is high, capital will leave safe assets and go to currencies with high interest rates, and this will cause the global gold price to decrease. This dynamic is key to understand gold prices.

Changes in the Federal Reserve interest rate and the global ounce

Currency Strength (USD) and Gold Price

Gold’s USD denomination makes it hypersensitive to the greenback’s fortunes. A robust USD, tracked via the DXY index, raises gold’s cost for international buyers, dampening demand and prices—evident in 2023’s dollar strength amid U.S. resilience. Weakening USD, often from dovish Fed signals or trade imbalances, unlocks buying from emerging markets, driving rallies. This interplay underscores gold’s role in currency wars.

The US dollar and global gold have an inverse affinity in the forex market. Whenever the US dollar increases, we face a decrease in the price of gold and vice versa. The reason for this relationship is that, for example, when the dollar’s value decreases, investors invest in other financial markets, such as gold, to avoid the decrease in the value of their capital, and this causes an increase in the demand for gold (XAUUSD), which in turn leads to price growth. That is why professional traders constantly monitor the Federal Reserve and the US economic conditions to make correct and timely trading decisions if they see signals for changing the dollar’s value.

Geopolitical and Political Factors Affecting Gold

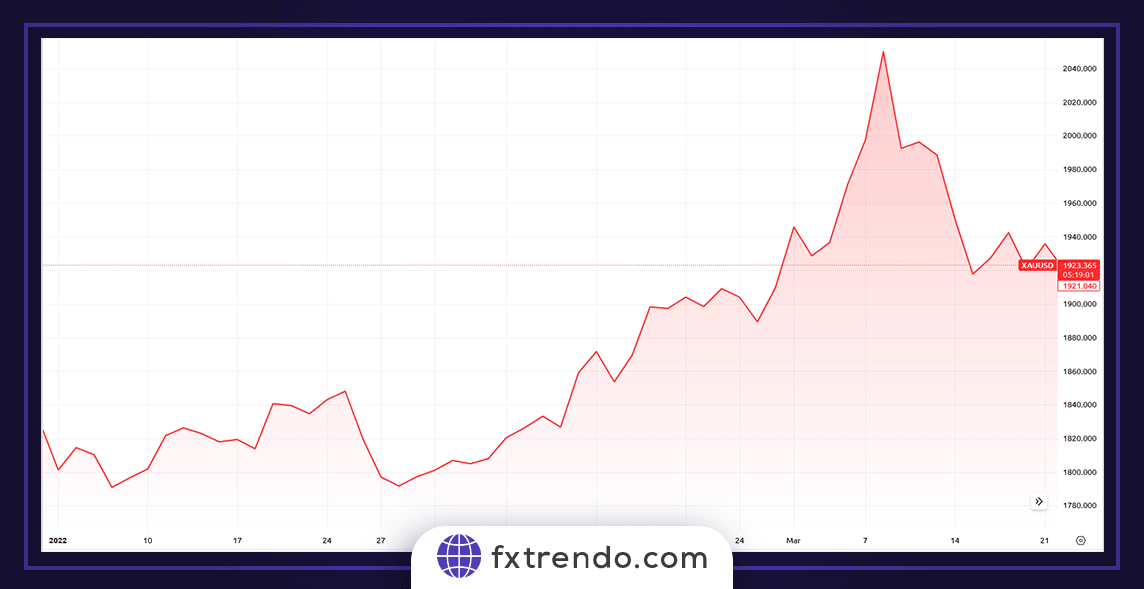

Gold was always known as a haven for investment during geopolitical and political events. For example, during the occurrence or threat of war, the gold price is immediately affected, because only in such a situation does the investment risk increase, but war also means excessive printing of money and increased government spending. As you can see in the image below, with the start of the Ukraine-Russia war, global gold experienced significant growth. These events are significant factors influencing xauusd price.

Gold price growth immediately after the war started between Ukraine and Russia

Read More:

What is a commodity?

Correlations with Other Financial Markets

Gold’s price dynamics reveal intricate ties to other assets, aiding traders in spotting hedging opportunities and portfolio risks. These correlations fluctuate with market regimes, from risk-on rallies to safe-haven flights, and are important factors affecting gold price.

Gold and Equity Markets

Gold and equities often move inversely, especially in downturns. As a classic safe haven, gold rallies when stocks falter—think 2008’s financial crisis, where S&P 500 plunged 37% while gold climbed 5%. Long-term correlation hovers low at ~0.14 over 20 years, per Morningstar data, though it spikes positively in liquidity-fueled booms. This decoupling enhances diversification and helps understand gold prices.

Gold and Commodities

Sharing inflation and growth drivers, gold correlates positively with commodities like oil. Both surge amid economic heat, as in the 2022 energy crunch. Historical ties are strong, yet ratios vary; gold’s current premium (78:1 vs. oil) highlights its monetary edge over industrial fuels. Short-term divergences underscore gold’s unique store-of-value status.

Sharing inflation and growth drivers, gold correlates positively with commodities like oil. Both surge amid economic heat, as in the 2022 energy crunch. Historical ties are strong, yet ratios vary; gold’s current premium (78:1 vs. oil) highlights its monetary edge over industrial fuels. Short-term divergences underscore gold’s unique store-of-value status, illustrating what affects gold prices forex.

For example, as you can see in the following image, the geopolitical tensions in late January 2026 contributed to surges in gold and oil prices primarily revolved around U.S. foreign policy actions and regional conflicts. The key events were U.S. Intervention in Venezuela, Escalating U.S.-Iran Tensions, and ongoing Russia-Ukraine conflict.

Gold and Cryptocurrencies

Bitcoin, dubbed “digital gold,” vies for similar investor dollars but behaves more like equities. Correlations are low and volatile—recently -0.29 over 12 months—rising in bull runs (2023-2024) before diverging in stress. Gold’s stability prevails in crises, while crypto amplifies risks, positioning both as complementary alternatives. This comparison sheds light on factors affecting gold.

Supply and Demand

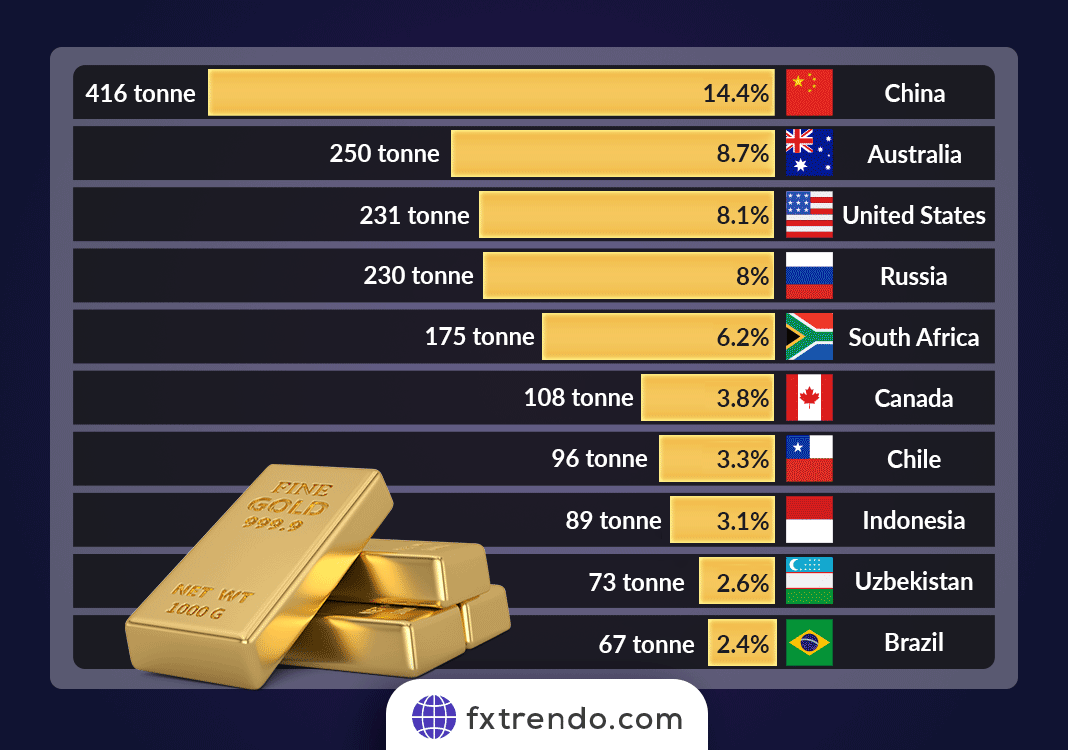

Generally, any factor that disturbs the balance of gold supply and demand in the long and short term, will cause changes in the global gold price. If the gold supply increases, we will face a price decrease. For example, when the price of gold decreases in the global market, there is no economic justification for many large mines to continue operating, and the end of their operation will be the reason for the gold price growth. On the other hand, if the gold price increases, many gold mines that were out of production due to unprofitability will resume mining, and this will increase the gold supply. In this regard, analyzing the world’s major mines in countries such as the United States and Russia can be helpful, because increasing or decreasing the amount of gold extraction can impact market fluctuations. Supply and demand are core factors affecting xauusd price.

The image above shows the amount of gold production in different countries in 2022

On the other hand, if the demand for gold increases, we will face an increase in the gold price. Gold is used in various fields, such as medicine, jewelry production, electronic equipment, space technologies, etc. If there is a significant increase in the demand for gold in these areas, we will see the growth of gold prices. Therefore, always observing the important news of the day and being aware of the market’s general conditions is necessary to understand gold prices.

Banks and investment funds

Banks and investment funds are among the other factors affecting gold price that play a role in gold price fluctuations. When the big banks increase their gold inventory, we see an increase in the gold price. Banks collect all the orders, and this causes the price of gold to grow. By following news and analytical articles from reliable sources, you can grasp such events and increase your trading efficiency by making better decisions, better grasping factors influencing xauusd price.

Quantitative Indicators for Measuring Gold Market Forces

Quantitative metrics distill market sentiment, positioning, and economic health into predictive signals, sharpening gold traders’ edge in 2026’s $5,000+ environment. These indicators are vital for understanding factors affecting xauusd.

Commitment of Traders (COT) Report

CFTC’s weekly COT unveils futures positioning. As of February 10, 2026, large speculators’ net longs fell to 160k contracts—an 11-month low—while commercials ramped up shorts, hinting at profit-taking after the rally. Extreme speculator longs often precede pullbacks; tracking divergences flags reversals.

Volatility Index (VIX) and Gold

VIX spikes signal risk aversion, lifting gold as a hedge—correlation ~0.4-0.6 in crises. At 20.7 recently (up 42% in weeks), it triggered whipsaw gains above $5,000 amid equity sell-offs. Sustained VIX >20 amplifies inflows, but normalization caps upside.

PMI, GDP Growth and Gold Response

PMI and GDP reveal growth pulses: weak readings (e.g., contracting ISM) spark rate-cut bets, boosting gold; strong ones (services PMI 52.4) strengthen USD, pressuring prices. Q4 2025’s mixed 2%+ GDP beats saw consolidation near highs.

Short-Term vs Long-Term Influencers

Gold’s price action splits between ephemeral sparks and tectonic shifts, guiding traders from day-trades to decade-long bets. Distinguishing these is essential for factors affecting gold prices.

Short-Term Price Drivers

News-driven volatility rules: Fed rate decisions, inflation prints, and geopolitical escalations. January 2026’s surge to $5,100+ exemplified this, fueled by Trump tariffs, Ukraine talks, and softer CPI data igniting rate-cut bets.

Significant changes occur in the price of gold at the time of important economic news releases, which is mainly news related to the US dollar. That is why we always recommend checking the economic calendar and considering important news in your trading strategy. One of the most popular websites for tracking important economic news is the Forex Factory website, and you can use the services of this website for free.

For example, as you can see in the image below, on the 13th of February 2024, after the CPI news release at 16:30, we saw an increase in the strength of the US dollar, which resulted in a significant drop in global gold. That is why, as a professional trader, you should monitor the economic calendar continuously and be fully aware of the effects of important news.

Long-Term Structural Trends

Central banks’ relentless buying, retail diversification, and fiat debasement create a floor. Stable mining supply meets rising demand from Asia and ETFs, with analysts projecting $5,000/oz by 2026’s end as a new norm.

Long-term investing in gold is different from short-term trading in the forex market. Gold trading in these markets is done hourly and daily. Since gold trading in forex usually takes place in a short period, professional traders can make good profits from trading in the short term. But this requires a lot of training and experience. Long-term trends help understand gold prices over time.

Summary

Gold has been the focus of humans since ancient times. Trading gold in the forex market is also a good opportunity to profit, and many people worldwide trade gold in the forex market, which is why knowing the factors affecting gold price is particularly important. Investing in gold has different ways, including trading in the forex market, buying ornamental gold, investing in gold financial funds, etc., all of which require a lot of knowledge and experience that one can only obtain through continuous study and activity in the financial markets.