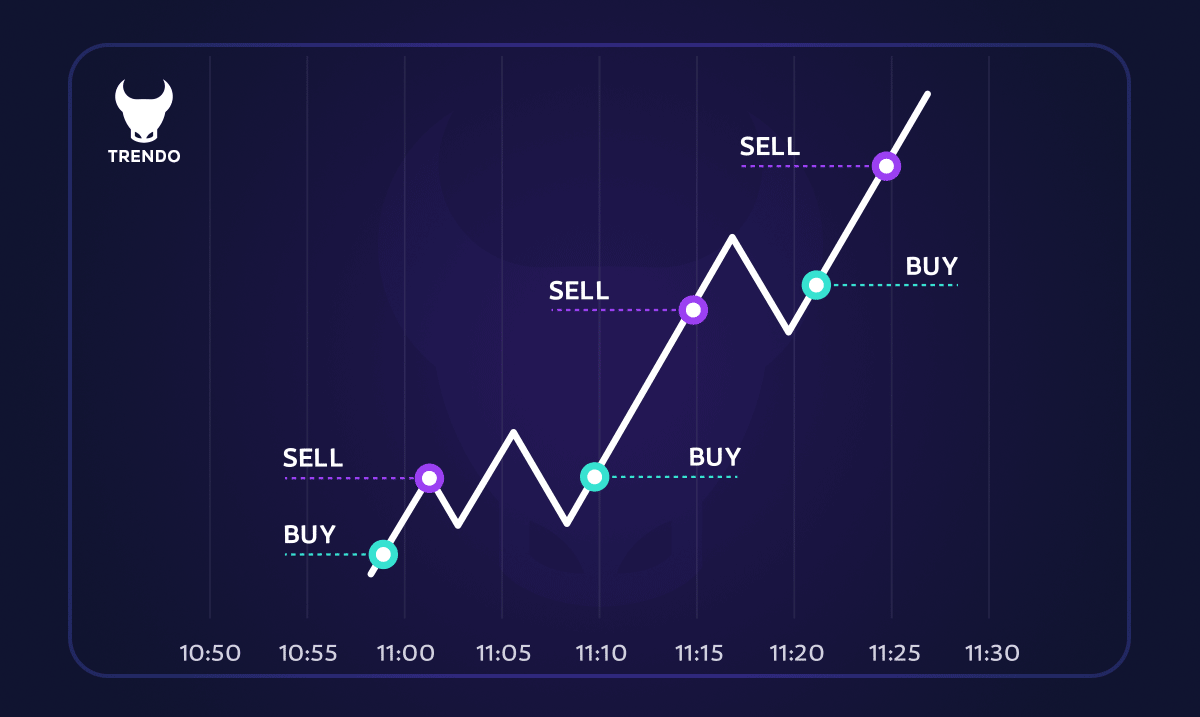

The primary goal of scalpers in trading is to achieve many small profits that add up to substantial gains. Unlike stock or high-volume traders, scalpers focus on numerous small trades.

This method involves holding trades for a very short duration, from a few seconds to a few minutes. In other words, traders using this strategy aim to secure their profits quickly. If the market conditions are favorable, they try to close their positions rapidly to minimize losses.

What is Gold Scalping in Forex?

Gold scalping in Forex focuses on quick trades to profit from small price movements in the gold market. This method leverages gold price volatility, aiming for numerous small gains that add up over time. Scalpers hold positions briefly, often for seconds or minutes.

Gold scalping is fast-paced. Traders use technical analysis, real-time data, and indicators to find entry and exit points. By capitalizing on minor price fluctuations, they can execute multiple trades in a single session. This strategy requires attention to detail, quick decisions, and a robust risk management plan.

Despite its profit potential, gold scalping carries high risks due to rapid market movements and the need for quick reactions.

Advantages of Scalping Gold

Gold scalping offers several advantages for traders who seek quick gains through rapid trades. Here are some key benefits:

1. High Liquidity:

The gold market is highly liquid, meaning there are plenty of buyers and sellers at any given time. This allows scalpers to enter and exit trades with ease, minimizing the risk of slippage.

2. Profit Potential:

By taking advantage of small price movements, scalpers can make multiple trades within a short period. Scalpers can potentially realize profits more quickly than long-term traders or swing traders. These small gains can add up to substantial profits over time.

3. Reduced Exposure:

Since scalping involves holding trades for a very short duration, traders are less exposed to market risks and sudden price swings. This can help in managing overall risk more effectively.

4. Frequent Trading Opportunities:

The volatile nature of the gold market provides numerous trading opportunities throughout the day. Scalpers can capitalize on these frequent price movements.

5. Lower Capital Requirement:

Scalping often requires less capital compared to other trading strategies, making it accessible to traders with smaller accounts.

6. Immediate Feedback:

Scalping offers quick results and immediate feedback on trading decisions, allowing traders to learn and adapt their strategies swiftly.

These advantages make gold scalping an appealing strategy for traders looking for fast-paced action and the potential for consistent profits.

The Challenges of Gold Scalping

While gold scalping offers potential benefits, it also comes with several challenges that traders need to be aware of:

1. High Risk:

Due to the rapid nature of scalping, traders face high risks. Quick decision-making is required, and any mistake can lead to significant losses.

2. Market Volatility:

The gold market is highly volatile, which can be both an advantage and a challenge. Sudden price swings can lead to unexpected losses.

3. Emotional Stress:

The fast-paced environment of scalping can be stressful. Traders need to maintain a calm and focused mindset, which can be difficult under pressure.

4. Technical Requirements:

Scalping requires advanced trading tools and platforms that can handle high-speed data and quick executions. Not all traders have access to these resources.

5. Intensive Monitoring:

Scalpers must constantly monitor the market, which can be time-consuming and exhausting. This level of attention to detail is demanding.

6. Transaction Costs:

Frequent trading incurs higher transaction costs, such as spreads and commissions. These costs can accumulate and eat into profits.

Understanding these challenges is crucial for anyone considering gold scalping. Proper preparation, a solid strategy, and a disciplined approach are essential to navigate these obstacles successfully.

What Are the Requirements for Gold Scalp Trading in Forex?

To successfully scalp trade gold in the Forex market, several essential elements are needed:

1. Reliable Trading Platform:

A strong trading platform is your first requirement. Your broker should offer features suitable for scalping, especially low spreads. Ensure the platform provides quick and efficient trade executions.

2. Market Analysis and Understanding:

For gold scalping, a thorough market analysis is crucial. Utilize both technical and fundamental analysis to predict gold price movements. Fundamental analysis helps you anticipate market volatility, protecting against unexpected price swings that can cause significant losses.

3. Scalping Strategy:

Choosing an effective scalping strategy is vital. Learn to determine the best entry and exit points for trades and enhance your trade execution quality.

4. Risk Management:

Risk management is critical in scalp trading. Define how much of your account you are willing to risk on each trade, as this style involves numerous small trades. Effective risk management is different from other trading styles due to the high volume of trades.

5. Experience and Training:

Scalping requires experience and training. Practice on a demo trading account to develop the necessary skills. Additionally, consider taking educational courses on scalping.

6. Initial Capital:

Starting with adequate initial capital is important. Allocate funds you can afford to lose without impacting your financial stability.

Read more:

What is the minimum & standard amount of investment in Forex?

By focusing on these elements and carefully analyzing the market and managing risks, you can engage in gold scalp trading in the Forex market with the potential for profit.

How Important Is Technical Analysis in Gold Scalping?

Technical analysis is crucial in gold scalping in the Forex market and is a fundamental principle for success in this popular trading strategy. This analysis allows traders to identify different price patterns on charts, draw trend lines, and determine the necessary support and resistance levels for trading. When gold reaches its support and resistance levels, trading volumes often increase significantly.

These patterns can indicate future price changes, helping traders make better decisions for entering or exiting scalping trades. A commonly used strategy in scalping is multi-timeframe analysis, where traders confirm entry points across different timeframes to ensure a reliable position for trading.

Technical analysis also enables the use of indicators like RSI, MACD, MA, EMA, and SMA to identify the highs and lows of gold prices. Each indicator has its own advantages and disadvantages, and traders should use them according to their specific strategies.

For those seeking a particular trading style, technical analysis in gold scalping can provide vital information that aids in making better trading decisions and achieving market success. Gaining experience in scalping strategies can turn trading into a quick and profitable opportunity.

Practical Gold Scalping Strategies

Below, we introduce six effective and widely-used strategies for gold scalping (XAUUSD gold scalping trading strategy). Each strategy has its own unique strengths and weaknesses that traders should understand before implementation.

EMA 200/1000 Strategy (Trend-Following Trading)

How it works: This gold scalping strategy uses two exponential moving averages (200 and 1000 periods) on the 1-minute timeframe. The trend direction is determined by the position of these two EMAs relative to each other.

Entry Conditions:

- Buy: When EMA200 is above EMA1000 (uptrend) and price reaches a support level.

- Sell: When EMA200 is below EMA1000 (downtrend) and price reaches a resistance level.

- Warning: If the two EMAs cross each other, the market is ranging—avoid trading.

Strengths:

- Clear and simple trend identification

- Reduces counter-trend trades

- Reliable signals in strong trends

Weaknesses:

- Poor performance in ranging markets

- Requires patience for clear trend formation

SMA 20 + MACD Strategy (Double Confirmation)

How it works: This best gold scalping strategy combines the 20-period Simple Moving Average on the 5-minute timeframe with the MACD indicator for signal confirmation. The trend direction is determined on the 1-hour timeframe.

Entry Conditions:

- Buy: Price above SMA20 + bullish MACD crossover (signal line crosses from below)

- Sell: Price below SMA20 + bearish MACD crossover (signal line crosses from above)

Strengths:

- Double confirmation from two different tools

- Suitable for beginners

- Reduces false signals

Weaknesses:

- Delayed entry into trades

- Requires multiple timeframe analysis

Multi-Timeframe Price Action Strategy

How it works: Analyze price charts across all timeframes from 4H to 1M without using any indicators. Confirmation is obtained from candlestick patterns across all timeframes.

Entry Conditions:

- Buy/Sell: Must observe aligned patterns on 4H, 1H, 15M, 5M, and 1M timeframes

- Support and resistance levels must align across all timeframes

Strengths:

- Very high accuracy (75%+ win rate)

- No indicator lag

- Significantly reduces false signals

Weaknesses:

- Time-consuming analysis

- Requires high experience in pattern recognition

- Fewer trading opportunities

Single Timeframe Price Action (Best for Gold Scalping Without Indicators)

How it works: Focus on support and resistance levels and candlestick patterns on a single timeframe (5 or 15 minutes). Patterns like Pin Bar, Engulfing, and False Breakout are used.

Entry Conditions:

- Buy: Price reaches support + bullish reversal candle (Bullish Engulfing or Hammer)

- Sell: Price reaches resistance + bearish reversal candle (Bearish Pin Bar or Shooting Star)

Strengths:

- Fast decision-making

- Quick signals without delay

- Suitable for 5-15 minute timeframes

Weaknesses:

- Requires pattern recognition experience

- False signals in ranging markets

Moving Average Crossover Strategy (How to Scalp Gold in Forex)

How it works: This XAUUSD gold scalping trading strategy uses the crossover of two moving averages with different periods (9 and 21, or 13 and 26) to identify entry points.

Entry Conditions:

- Buy: Short-term MA (9/13) crosses above long-term MA (21/26) from below

- Sell: Short-term MA crosses below long-term MA from above

Strengths:

- Clear and understandable signals

- Suitable for beginners learning how to scalp gold in forex

- Good performance in strong trends

Weaknesses:

- Signal delay

- False signals in ranging markets

RSI + Bollinger Bands Strategy (Best Indicator for Gold Trading)

How it works: This best gold scalping strategy combines RSI for identifying overbought/oversold conditions with Bollinger Bands for precise entry points.

Entry Conditions:

- Buy: RSI < 30 (oversold) + price touches lower Bollinger Band

- Sell: RSI > 70 (overbought) + price approaches upper Bollinger Band

Strengths:

- High accuracy in identifying reversal points

- Suitable for ranging markets

- Double confirmation from two tools—considered the best indicator for gold scalping

Weaknesses:

- Weak performance in strong trends

- Requires precise parameter adjustments

Complete Strategy Comparison Table

| Strategy | Timeframe | Strengths | Weaknesses | Win Rate | Difficulty |

| EMA 200/1000 | 1 minute | Simple trend ID | Weak in range | 60-65% | Medium |

| SMA 20 + MACD | 5 minutes | Double confirmation | Signal delay | 65-70% | Medium |

| Multi-Timeframe PA | 1M-4H | Very high accuracy | Time-consuming | 75-80% | Advanced |

| Single TF Price Action | 5-15 minutes | High speed | Needs experience | 65-70% | High |

| MA Crossover | 5-15 minutes | Beginner-friendly | Signal lag | 60-65% | Beginner |

| RSI + Bollinger | 5-15 minutes | Accurate in range | Weak in trends | 70-75% | Medium |

Tips for Successful Gold Scalping

Gold scalping in the Forex market can be a rewarding strategy when done correctly. Here are some valuable tips to enhance your success:

1. Stay Informed:

Keep up with global economic news and events that can impact gold prices. Being aware of market-moving news helps you anticipate price movements and make timely trades.

2. Use Reliable Indicators:

Utilize technical indicators like moving averages, RSI, and MACD to identify trends and potential entry and exit points. Combining multiple indicators can improve accuracy.

3. Set Clear Goals:

Define your profit targets and stop-loss levels before entering a trade. Having a clear plan helps manage risk and keeps emotions in check.

4. Manage Risk:

Never risk more than you can afford to lose on a single trade. Use proper risk management techniques, such as setting stop-loss orders, to protect your capital.

5. Practice Patience:

Wait for the right trading opportunities rather than jumping into trades impulsively. Patience can help you avoid unnecessary losses.

6. Monitor Market Conditions:

Pay attention to market conditions and adjust your strategy accordingly. Volatile markets may require different tactics than stable ones.

7. Keep a Trading Journal:

Document your trades, including entry and exit points, the reason for the trade, and the outcome. Reviewing your trades can help identify patterns and improve your strategy.

8. Stay Disciplined:

Stick to your trading plan and avoid making decisions based on emotions. Discipline is key to long-term success in scalping.

9. Use Proper Tools:

Invest in a reliable trading platform with fast execution speeds and real-time data. The right tools can make a significant difference in your trading performance.

10. Continuously Learn:

The market is always evolving, so continuous learning and adapting are essential. Stay updated with new strategies and techniques to remain competitive.

By following these tips, you can enhance your gold scalping strategy and increase your chances of achieving consistent profits in the Forex market.

Conclusion

In this article, we have explored the benefits of scalping, the essential requirements for success, and the use of indicators as fundamental tools. Gold scalping in Forex is a highly effective trading strategy that allows traders to profit from small price movements. The necessary conditions for gold scalping include frequent trading opportunities throughout the day and the use of indicators such as EMA, SMA, and MACD for analyzing trade entries and exits.

We also presented some of the best gold scalping strategies in Forex that can lead to quick profits and success in the gold market. With practice, careful market analysis, and adherence to risk management principles, traders can enhance their performance and achieve consistent income as skilled scalpers in the Forex market.

By integrating these strategies and staying disciplined, traders can navigate the complexities of gold scalping and potentially reap the rewards of this fast-paced trading approach.