Pip and spread are two fundamental terms in forex trading. A pip, as the smallest unit of change in the price of a currency pair, is a standard measure for calculating price fluctuations as well as profit and loss in trades. On the other hand, the spread, which represents the difference between the bid and ask price of a currency pair, is considered the cost traders pay to execute their trades. In this article, we will explain what a pip is, how to calculate its value, and why it matters in risk management.

What is a Pip?

Pip, short for Percentage in Point or in some sources Price Interest Point, refers to the smallest unit of price movement in the Forex market. In most currency pairs, one pip represents a change in the fourth decimal place (0.0001). The way prices and spreads are displayed depends on the broker’s policy. In 4-digit brokers, prices are shown up to four decimal places, with the fourth decimal representing the pip. In 5-digit brokers, prices are shown up to five decimal places; in this case, the fourth decimal is still considered the pip, while the fifth decimal represents the pipette. Each pip is equal to 10 pipettes. Traders can calculate their profits and losses based on these units.

Calculating Pip Value

To calculate the value of a pip, you need to consider the following situations:

- When the quote currency is the same as the account currency:

If your account is in USD and you trade the EUR/USD pair, the value of one pip equals $10. - When the base currency is the same as the account currency:

If your account is in USD and you trade the USD/CAD pair, the value of one pip is also $10, but it must be divided by the current exchange rate of the pair. - When the account currency is not part of the currency pair:

In this case, after calculating profit or loss as in the first scenario, you must convert the result into your account currency using the exchange rate.

These concepts may seem confusing at first. That’s why we recommend checking out our detailed guide on the concept of pips, where we explain pip value calculations with step-by-step examples and show you how to measure profits and losses more clearly.

Using Pip and Spread in Risk Management

Risk management in Forex is one of the main factors behind traders’ success. Two key concepts in this area are pips and spreads. Understanding pips enables traders to calculate their potential profits and losses accurately, thereby determining their position size and setting stop-loss levels. Alongside this, knowing about spreads is also essential, since the spread is considered the cost of the trade, and a trader must at least cover the spread to break even and trade without risk.

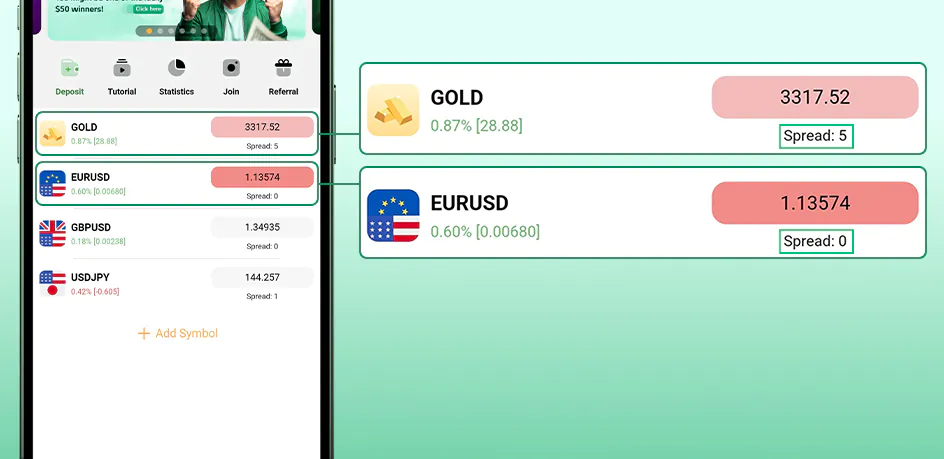

In this regard, Trendo Broker is one of the best options for traders. During market working days (Monday to Friday), you can view Trendo’s competitive spreads directly on the platform. For example, the spread on gold (XAUUSD) is around 23 pipettes with most brokers, while it is on average only five pipettes at Trendo. Moreover, spreads on major currency pairs are often literally zero. In addition, Trendo also offers the lowest commissions (6 USD for opening and closing a trade) and low swaps, creating cost-effective and professional trading conditions for users.

In the chart below, you can see spreads for symbols such as gold, the Dow Jones index, and several major currency pairs offered by Trendo Broker.

Conclusion

Understanding and mastering basic concepts like pip and spread is essential for any trader aiming for success in the forex market. Pip, as the smallest unit of price movement, plays a key role in calculating profits and losses. The spread that is assumed as the cost of trading has a direct effect on overall returns. By learning how to calculate pip value and understanding its relationship with trade size (lot), traders can manage risk more effectively and make smarter, more informed trading decisions.