Spread is one of the key concepts in financial markets—including the cryptocurrency market and the forex market—that every trader must fully understand. Spread refers to the difference between the highest available buy price and the lowest available sell price at a specific moment. In other words, spread represents a portion of the cost that traders pay on every trade, in addition to commissions.

In this article from the Trendo Education Team, we will explain what spread means in cryptocurrency trading. Stay with us.

What Is Spread in Cryptocurrency?

Spread refers to the difference between the buy price and sell price of a trading instrument, such as Bitcoin. In financial markets, this price difference reflects the cost that traders pay to execute a trade. In the crypto market, the concept is the same: it shows the difference between the best available bid price and the best available ask price for a digital asset. Naturally, the best bid price is always the highest buy price, and the best ask price is the lowest available sell price.

It is also important to note that due to the high volatility of cryptocurrencies, their spreads are usually slightly higher than spreads on other assets—something completely normal in this market.

How Do Spreads in Cryptocurrency Work?

In general, there are two types of costs involved in every financial transaction:

1. Trading Commission

This is usually a fixed fee charged by the broker based on trade volume. For reputable brokers, commissions are the primary source of revenue.

2. Spread

Spread results from the difference between the buy and sell prices of a trading instrument.

For example:

If the buy price of Bitcoin is $95,000 and the sell price is $95,020, the spread for this trade is $20. This price difference is essentially the cost that the trader pays to execute the trade.

Download the Trendo Trading Platform and Receive a Free $100 Bonus

Factors Affecting Spread in Cryptocurrency

The most important factors influencing cryptocurrency spreads are market liquidity and price volatility.

-

The higher the liquidity of a digital asset, the lower its spread becomes, as the difference between buy and sell prices narrows.

-

Conversely, when volatility is lower and traders face reduced risk, spreads also decrease because more orders enter the market, creating better balance between supply and demand.

These principles generally apply to reputable brokers. If you choose a broker with low credibility or without proper regulatory oversight, you may face issues such as low liquidity or even manipulation of spreads and commissions. Therefore, choosing a reliable and regulated broker is crucial when trading digital assets.

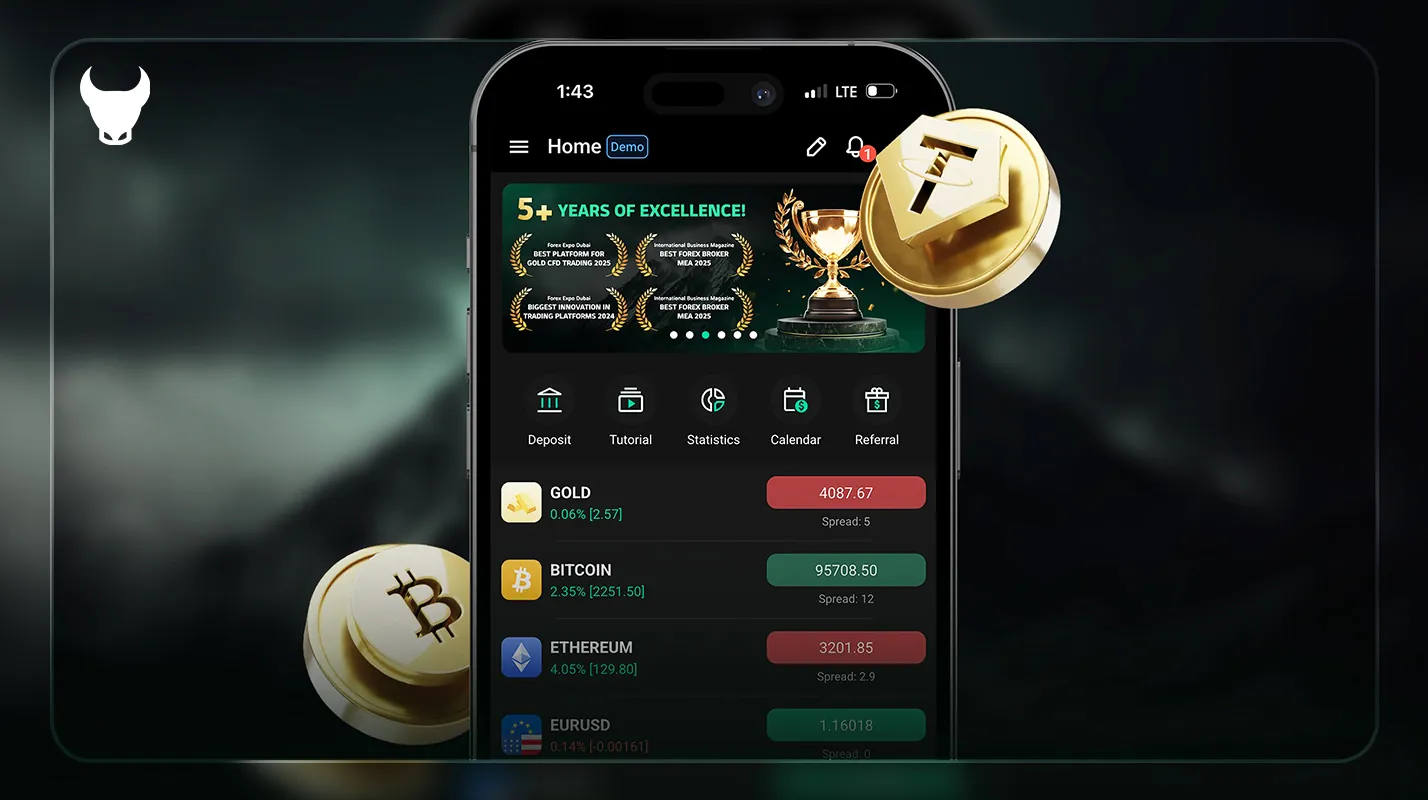

Trendo Broker is recognized as one of the best choices for traders. Through its proprietary trading platform, Trendo offers major cryptocurrencies—including Bitcoin, Ethereum, Ripple, and more—under highly favorable conditions, with some of the lowest spreads and commissions in the market. To view the real-time spreads of these assets, visit the Trendo live pricing page.

It is also worth noting that Trendo Broker supports both deposits and withdrawals via cryptocurrencies and offers a 10% deposit bonus on all crypto-based deposits.

How to Calculate Spread in Cryptocurrency

Calculating spread in crypto is exactly the same as calculating spread in forex and is relatively simple.

To determine the spread, you only need the buy and sell prices and subtract one from the other.

Spread Formula:

Spread = Buy Price − Sell Price

Example:

If the buy price of Ethereum is $3,000 and the sell price is $3,022, the spread for the trade is $22.

How to Reduce the Impact of Spread in Crypto Trading

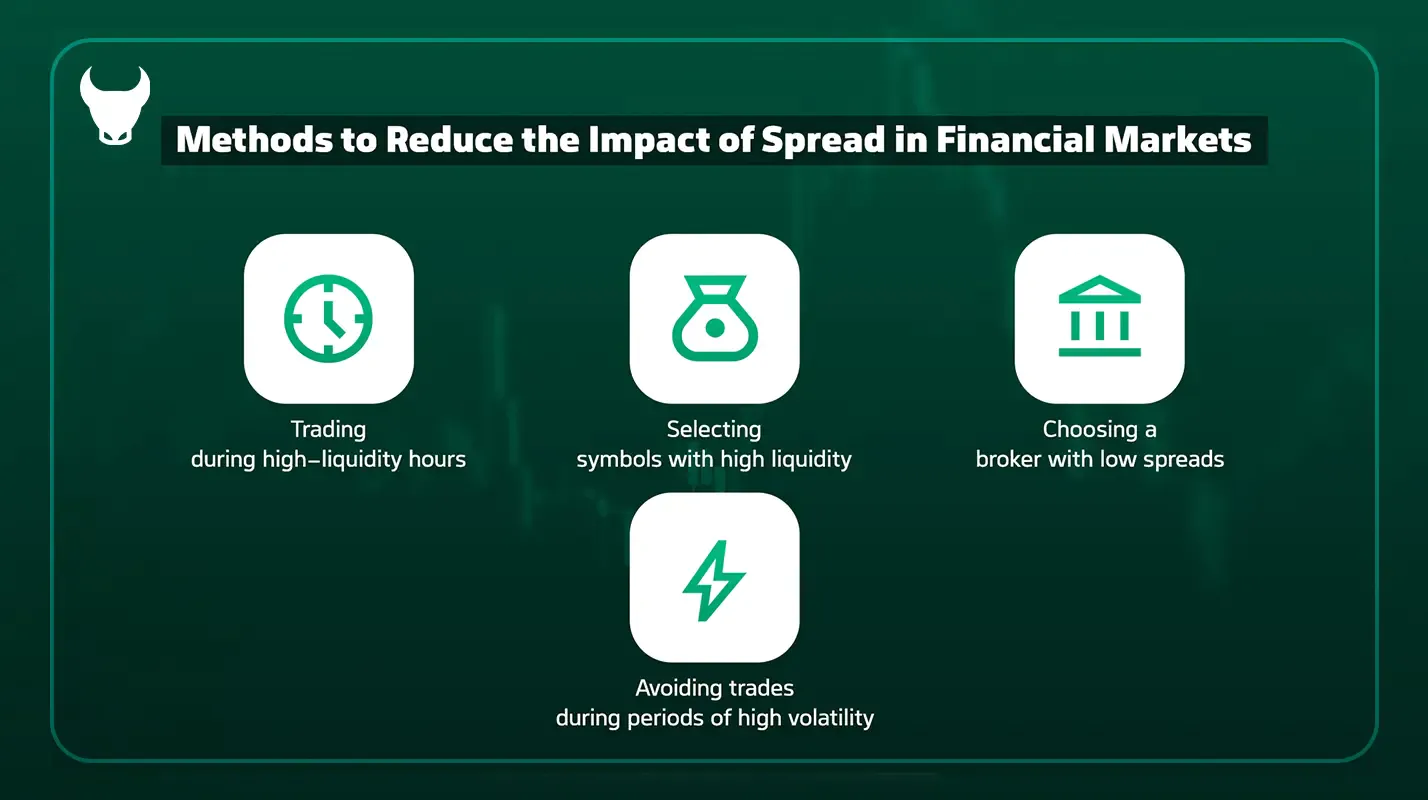

A trader cannot directly change the spread itself, but can reduce trading costs by following these methods:

1) Choose a broker with low spreads

One of the most effective ways to reduce trading costs is selecting a reputable broker with low spreads.

For example, Trendo Broker is known for offering very competitive spreads on cryptocurrencies.

2) Trade assets with high liquidity

Cryptocurrencies like Bitcoin and Ethereum generally have lower spreads due to high trading volume.

It is recommended to focus on well-known assets with high liquidity and avoid low-liquidity or obscure coins.

3) Trade during high-liquidity sessions

Trading when the market has high liquidity helps reduce spreads.

For short-term trades, it’s best to operate during the London and New York sessions.

4) Avoid trading during extreme volatility

Severe market volatility is often accompanied by widened spreads. During major economic announcements—such as the U.S. Non-Farm Payrolls (NFP) report—it is advisable to avoid opening new positions and to manage existing trades using appropriate risk management (such as reducing volume or adjusting take-profit/stop-loss levels). This is why professional traders always monitor the economic calendar closely.

Free Access to Trendo’s Professional Economic Calendar

Conclusion

Spread is one of the most important and influential factors in cryptocurrency trading and can directly impact traders’ profits and losses. Understanding what spread is, how it is calculated, and what factors affect it helps traders make more accurate decisions and reduce trading costs. By choosing a reputable broker like Trendo and trading during high-liquidity periods, you can minimize the impact of spread and create a smoother path toward profitability in financial markets.

Register with Trendo Broker and Trade Cryptocurrencies with the Lowest Spreads