The gold spread in the Forex market refers to the difference between the bid and ask prices of the gold pair (XAU/USD). In this guide, you will learn how to calculate the gold spread in detail and explore methods to reduce spread costs with Trendo.

One of the key concepts in Forex trading is the gold spread meaning, which plays a decisive role in profitability and cost management. Spread, as a hidden trading cost, is influenced by various factors such as market liquidity, price volatility, and broker policies. In this article by the Trendo educational team, we take a precise and in-depth look at the concept of gold spread, how it is calculated, the factors affecting it, the best trading times to minimize costs, and key tips for smarter gold trading.

What Is Gold Spread?

Let’s find the answer to the “what is spread in gold?” question. Gold spread refers to the difference between the bid (buy) and ask (sell) prices of gold (XAU/USD) in the Forex market. In practice, this price difference represents the cost traders pay when opening a gold trade and is one of the key elements affecting overall profitability.

As mentioned, the gold spread in Forex is influenced by factors such as market liquidity, price volatility, and broker conditions. For example, spreads widen during highly volatile markets, while they usually narrow in stable conditions. A clear understanding of gold spread meaning helps traders manage trading costs more effectively and design optimized trading strategies.

General and Technical Concept of Spread in Financial Markets

Alongside commissions, spread is a major determinant of trading costs and reflects both market liquidity and efficiency. To fully understand spread, you should also be familiar with the concept of the Order Book.

An order book records all buy and sell orders for an asset in real time. It typically consists of two columns:

-

Ask column: sellers’ offers (lowest price first).

-

Bid column: buyers’ offers (highest price first).

The highest current bid is referred to as the Bid price, and the lowest current ask is the Ask price.

Therefore, a lower spread indicates a more active market with lower trading costs, while a higher spread increases costs and reflects lower liquidity.

Technical Definition of Gold Spread

The most straightforward concept of what is spread in gold trading is here. The gold spread is the difference between the bid and ask prices of XAU/USD in Forex, as derived from the order book.

This cost, which traders pay when trading gold, is usually displayed in pips or pipettes.

Register with Trendo and trade gold with spreads below one pip!

Types of Gold Spread in Forex

To find the answer to the “what is the spread on gold” question, we have to be familiar with the types of spreads in the market. As one of the trading costs in Forex, the spread in gold is offered in different types:

-

Fixed Spread

-

Floating (Variable) Spread

-

Zero or Near-Zero Spread

Fixed Spread

A fixed spread in gold provides stable and predictable trading costs. Determined by the broker, this type remains unchanged during normal market conditions and is ideal for beginner traders who want cost certainty. However, during major economic events, fixed spreads may still adjust. Fixed spreads are often higher than variable spreads, and most brokers do not widely offer them due to low demand.

Floating Spread

A floating (variable) spread changes with market liquidity and volatility. During peak trading hours, spreads tighten, lowering costs, but during volatile periods such as major news releases, spreads may widen. Most brokers provide floating spreads on gold.

Zero or Near-Zero Spread

Common in ECN accounts, these spreads can approach zero under high-liquidity conditions, especially in major Forex pairs like EUR/USD. At Trendo, major pairs during the London and New York sessions offer zero spreads.

Note: Zero spreads are still a type of variable spread.

How to Calculate Gold Spread

Calculating gold spread in Forex is simple:

Spread = Ask Price – Bid Price

For example, if the best bid for gold is $2,300 and the best ask is $2,300.20, the spread equals $0.20 or 2 pips.

Most trading platforms automatically calculate and display spreads in real time, so manual calculation is rarely necessary.

Converting Spread to USD or Percentage

-

Spread to USD: Multiply the spread (in pips) by the pip value.

-

Example: 3 pips × $10 per pip = $30 spread cost per 1 lot trade.

-

-

Spread to %: Divide the spread by the ask price and multiply by 100.

-

Example: Spread of 3 pips with an ask of $3,200 → 0.09%.

-

Factors Affecting Gold Spread

Several factors influence the spread in gold. Understanding these helps traders minimize costs:

-

Market Liquidity – Higher liquidity (e.g., London/New York overlap) narrows spreads.

-

Market Volatility – High volatility (e.g., major news releases) widens spreads.

-

Broker Policies – Each broker sets unique spreads. Choosing a transparent broker is crucial.

-

Broker Operating Costs – Higher tech and liquidity providers reduce spreads.

-

Economic & Political Events – Interest rate decisions, inflation reports, or geopolitical tensions increase spreads.

-

Low Commissions – Brokers with lower fees usually offer tighter spreads.

Best Time to Trade Gold to Reduce Spread

The optimal time to trade gold (XAU/USD) is during the London–New York overlap, when liquidity is highest and spreads narrow. Conversely, spreads widen significantly during major news releases such as Federal Reserve announcements or inflation reports.

How Gold Spread Impacts Your Trading Decisions

The Relationship between Spread & Trading Costs

The gold spread (the difference between the buy and sell price of XAU/USD) is one of the main trading costs in the Forex market and has a direct impact on profitability. Every time a trader opens a position, the spread is deducted as an initial cost. For example, if the spread is $0.30 and you trade 1 standard lot (100 ounces), the initial trading cost will be approximately $30. This cost becomes especially significant in scalping or short-term trading strategies, where a high number of trades are executed and spreads can consume a large portion of profits. By offering some of the lowest gold spreads among Forex brokers, Trendo makes gold trading far more cost-efficient for traders.

Real Example of Spread Impact on Profitability

Two traders each open 100 short-term gold trades with a volume of 0.03 lots:

-

Trader 1 with Trendo:

Average spread 0.5 pip + $6 commission per lot → total trading cost: $33. -

Trader 2 with other brokers:

Average spread 1.5 pips + $8 commission per lot → total trading cost: ~$69.

As shown, even small differences in spreads can more than double trading costs and dramatically affect long-term profitability.

Real Take-Profit and Stop-Loss Levels After Accounting for Spread

When setting Take Profit (TP) and Stop Loss (SL) levels, spreads must be taken into account to ensure realistic targets.

For example, if the gold price is $4,450 and the spread is $0.50, and your TP is set $10 higher (at $4,460), the actual profit after deducting the spread will be approximately $9.50.

The same principle applies to sell positions, where a trade may close with a smaller loss than the calculated SL due to the spread. Professional traders always adjust their TP and SL levels by adding or subtracting the spread to maintain a proper risk-to-reward ratio (e.g., 1:2).

Best Entry and Exit Times Based on Spread

Trade timing is also heavily influenced by spreads. During high-liquidity periods, such as the London–New York session overlap, spreads are usually at their lowest (around $0.20–$0.40), making this the best time to enter trades.

In contrast, during low-volume sessions (Asian session) or around major economic news events (such as NFP releases or Federal Reserve decisions), spreads can widen to $2–$5 or more. In these conditions, it is better to avoid market entries or use limit orders instead.

Gold Spread in Different Trading Markets

There are notable differences across markets:

-

Forex market (XAU/USD): Floating spreads, usually low ($0.20–$1 with ECN brokers)

-

Physical gold market: Higher spreads (several dollars plus dealer commissions)

-

Futures market (COMEX): Costs include a fixed commission plus spread, which can widen significantly during high volatility

Gold traders should select brokers with competitive spreads to minimize cost impact and improve long-term trading performance.

How Global Events Influence Gold Spread

Gold reacts instantly to economic and political events:

-

Interest Rate Announcements – Sudden volatility increases spreads.

-

Employment & Inflation Reports – Unexpected data widens spreads on XAU/USD.

-

Geopolitical Tensions – Wars, sanctions, or political crises drive gold demand higher but reduce liquidity, widening spreads.

Practical Strategies to Reduce Gold Spread

-

Trade during high-liquidity hours (London–New York overlap).

-

Use ECN accounts with floating spreads.

-

Avoid trading during major news releases.

-

Choose a trusted broker with low fees.

-

Manage trade size carefully to avoid unnecessary spread costs.

Key Tips for Managing Gold Spread

-

Broker Choice: Select brokers with competitive spreads, fast execution, and strong support.

-

Timing: Trade gold during peak sessions for the lowest spreads.

-

Account Type: ECN and STP accounts provide near-zero spreads.

-

Position Sizing: Use optimal lot sizes to control costs.

At Trendo, average gold spreads are just 0.5 pips, compared to ~1.5 pips at other brokers — nearly 3× higher!

Examples of Gold Spread in Real Markets

Under normal market conditions (with no major economic news), the XAU/USD spread at reputable brokers typically ranges between 20 and 50 pips. For example, in January 2026, when gold was trading around $4,450, many ECN brokers offered spreads in the range of 19–30 pips.

During the release of major economic news (such as NFP reports or interest rate decisions), spreads can widen significantly and may reach 100–200 pips, as liquidity decreases and market makers hedge against increased risk.

In periods of extreme volatility (such as geopolitical tensions that cause sharp moves in gold prices), spreads can expand even further—sometimes reaching 500–2,000 pips. In such conditions, entering trades becomes considerably riskier and requires advanced risk management or avoidance altogether.

Trendo: Your Partner for Smarter Gold Trading

Since speed, accuracy, and security are three critical parameters in trading, choosing a broker that delivers these qualities in practice rather than just in marketing claims is essential. Trendo Broker, with its innovative and commitment-driven approach, has managed to become one of the most popular international brokers in a relatively short period of time. In this section, we review Trendo’s competitive advantages and the key reasons behind its growing popularity—particularly among gold traders.

Trendo Broker’s Trading Advantages for Gold Traders

If you trade gold, choosing Trendo means significantly lower trading costs and higher overall efficiency. Trendo’s ECN accounts offer one of the lowest spread for gold trading on the market (average 0.5 pips) with a commission of only $6 per lot, dramatically reducing trading expenses and directly improving profitability.

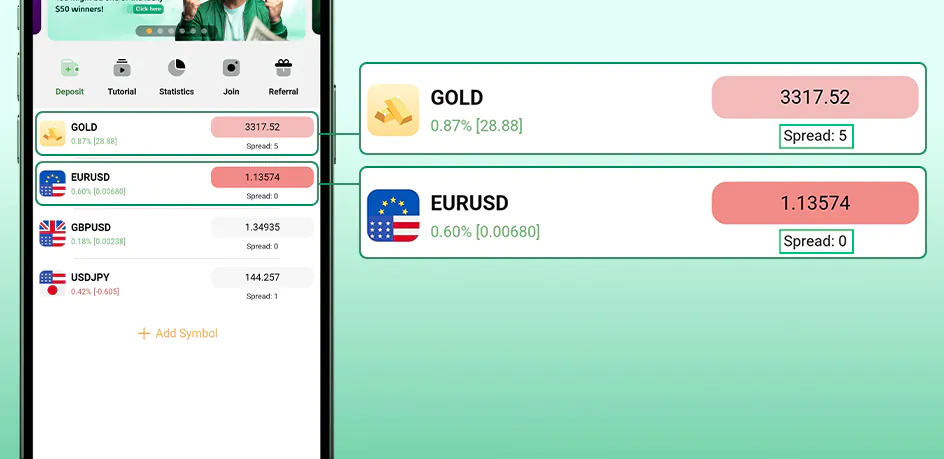

In the image below, captured on January 7, 2026, from Trendo’s trading platform during the New York session, you can see the gold spread at 5 pipettes (0.5 pips) along with a zero spread on the EUR/USD pair.

Additionally, Trendo provides swap-free (Islamic) accounts, which is a major advantage for traders who focus on long-term gold positions. Trendo’s proprietary trading platform—featuring fast order execution, an advanced economic calendar, and professional analytical tools—helps traders identify and capitalize on high-quality opportunities in the gold market.

Conclusion

Gold spread is one of the most important trading costs in the Forex market and has a direct impact on trader profitability. The difference between the Bid and Ask prices of XAU/USD—usually measured in pips or pipettes—varies across brokers and is influenced by factors such as market liquidity, volatility, economic news, and broker execution policies.

Choosing the right trading session (such as the London–New York overlap) and the right broker can significantly reduce trading costs. Trendo Broker, by offering lowest spread for gold trading (around 0.5 pips), ECN accounts with low minimum deposits, competitive commissions, and fast execution, stands out as an ideal choice for gold traders.

Ultimately, smart spread management—from avoiding trades during high-impact news releases to selecting a reliable broker—is the key to long-term profitability. By focusing on brokers that offer low spreads and high transparency, traders can minimize costs and maximize their chances of success in gold trading.