After a brief pause in its nine-week uptrend, gold is fluctuating within the $4,080–$4,090 range. Investors are treading carefully and assessing the latest economic data ahead of the Federal Reserve’s key statement expected mid-week. Meanwhile, reports of improving U.S.–China trade relations have slightly reduced demand for safe-haven assets such as gold. In this analysis, the Trendo brokerage education team examines both the technical and fundamental aspects of the gold market to provide a more precise outlook on the current situation and future trends.

You can also use the Trendo trading platform, equipped with advanced analytical and trading tools, to conduct your own analyses with greater accuracy and confidence.

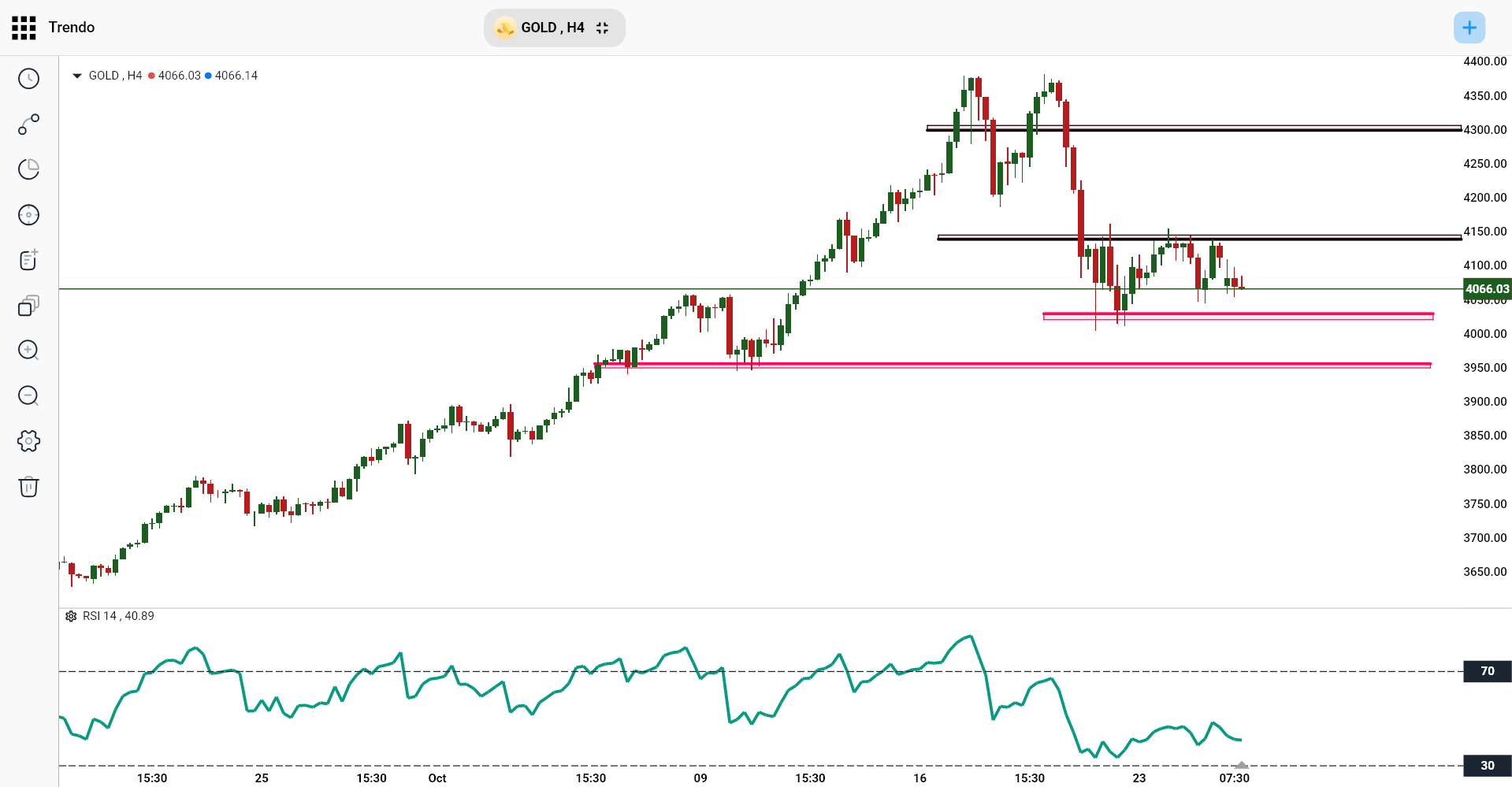

Technical Analysis of Gold (October 27, 2025)

Gold is currently moving within a sideways range between $4,035 and $4,146. A decisive breakout above $4,146 could open the path toward $4,300, while a decline and close below $4,035 would invalidate the short-term bullish scenario. On shorter timeframes, selling pressure has increased. Technical indicators point to a “Strong Sell” condition, and most moving averages (10, 20, 50, 100, and 200 periods) are positioned below the current price. The RSI is hovering around 44, while the MACD remains in negative territory.

Key daily levels:

- Supports: $4,024 and $3,953

- Resistances: $4,142 and $4,300

XAUUSD Technical Analysis – Trendo Platform, H4 Timeframe

Fundamental Analysis of Gold (October 27, 2025)

In today’s session, a stronger global risk appetite and progress in U.S.–China trade talks have weighed on gold demand, pushing its price down by around 0.8%. The modest strengthening of the U.S. Dollar Index has also added to this pressure. However, expectations of a 25-basis-point rate cut at the upcoming Federal Reserve meeting are already largely priced in. The market’s main focus now is on Jerome Powell’s tone and statement, as the next moves in the U.S. dollar and Treasury yields will depend on them. Any shift in the Fed’s communication could determine gold’s next direction.

Possible XAUUSD Scenarios (October 27, 2025)

1) Bullish Scenario: If the price manages to hold above $4,161 and Powell’s tone signals a dovish policy stance, gold could rise toward $4,200, $4,260, and potentially $4,300. In this case, a break above the all-time high of $4,381 would not be out of reach.

2) Bearish Scenario: If gold fails to break through the $4,155–$4,160 resistance zone and falls below $4,004, a correction toward $3,948–$3,900 becomes more likely. A stronger dollar, positive U.S. economic data, or a cautious tone from Powell could reinforce this downward path.

3) Neutral Scenario: If the market lacks a clear catalyst, gold may continue to trade sideways between $4,004 and $4,161. In this case, pivot levels around $4,079 and the daily support and resistance zones can serve as useful entry and exit points for short-term trades.

Summary

Overall, the gold market is entering a decision phase ahead of the crucial Federal Reserve meeting. From a fundamental perspective, a rate cut appears almost certain, while traders’ attention is centered on the Fed’s policy tone and the dollar’s reaction. Short-term traders are advised to act cautiously over the coming days and closely monitor U.S. monetary policy developments. For more precise market analysis and low-spread, low-commission trading, you can use the Trendo platform, which offers advanced technical and fundamental analysis tools for a professional trading experience.

Disclaimer: This analysis is provided solely for educational and informational purposes and should not be considered as investment advice or a recommendation to buy or sell any asset.

Download the Trendo Platform and Trade with the Lowest Spread and Commission