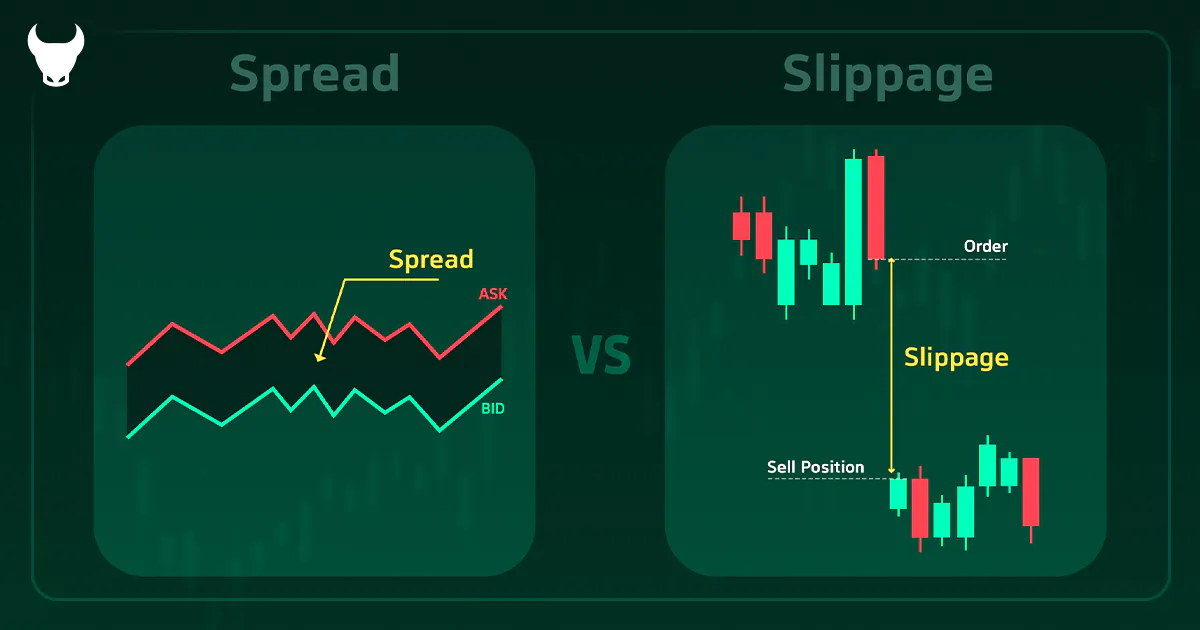

In the Forex market, two key concepts—spread and slippage—play a major role in trading outcomes. The spread represents the difference between the bid and ask prices of an asset and is considered the primary cost of every trade. Slippage, on the other hand, refers to the difference between the expected execution price and the actual price at which the order is filled. Understanding the difference between slippage and spread is crucial for traders to optimize their trading costs and manage risks effectively. In this article, we will explain the differences between slippage and spread, the factors that affect them, and practical strategies to minimize their impact.

What Is Spread?

Spread is one of the most fundamental concepts in financial markets and has a direct impact on trading costs. It refers to the difference between the bid price (the price buyers are willing to pay) and the ask price (the price sellers are willing to accept) of a financial instrument. This difference—present in instruments such as currency pairs, stocks, and cryptocurrencies—is a real cost that every trader incurs in each trade. In other words, the moment a trade is opened, this price difference is applied as an initial cost.

For example, if the bid price of the EUR/USD pair is 1.2000 and the ask price is 1.2003, the spread equals 3 pips. In commodities like gold or indices, spreads may be expressed in numerical values, such as $0.50 per ounce of gold.

Factors Affecting the Spread

-

Market Volatility: During major news releases or high volatility periods, spreads typically widen.

-

Trading Volume: Markets with higher liquidity (greater trading volume) tend to have narrower spreads.

-

Account Type: ECN accounts usually offer tighter spreads but include separate commission fees.

Spread in Stock and Bond Markets

In stock and bond markets, the spread not only represents the cost of trading but also serves as a measure of market liquidity. A narrower spread generally indicates easier trading conditions and lower transaction costs for investors.

What Is Slippage?

Slippage refers to the difference between the expected price of a trade and the actual price at which it is executed. This phenomenon usually occurs due to rapid market movements, low liquidity, or order execution delays. It is commonly observed in various markets, including stocks, Forex, cryptocurrencies, and other financial instruments.

When a trader places an order at a specific price, the market may move before the order is filled—resulting in execution at a different price. Slippage can be positive or negative:

-

Positive Slippage: Favors the trader—for example, buying at $98 instead of the expected $100.

-

Negative Slippage: Works against the trader—for example, buying at $102 instead of $100.

Main Causes of Slippage

| Cause | Explanation |

|---|---|

| High Volatility | During major news or unexpected events, price gaps between the requested and execution prices widen. |

| Low Liquidity | A lack of enough buyers or sellers can cause orders to be filled at prices different from the intended level. |

| Large Order Size | High-volume orders can move prices in less liquid markets, leading to slippage. |

| Order Type | Market Orders are executed at the best available price and are more prone to slippage, while Limit Orders can minimize this risk. |

| Broker Execution Speed | Slow order execution or platform delays can result in slippage. |

| Price Gaps | Market gaps—especially after weekends or major news—often lead to significant slippage. |

Real Example of Slippage

Imagine you plan to buy Apple (AAPL) shares at $183.53, but due to high-frequency trading, the price jumps to $183.57 before execution. This $0.04 difference (or $4 on 100 shares) represents negative slippage.

The Difference Between Slippage and Spread in Forex

Although slippage and spread both affect trading costs, they are fundamentally different concepts and not directly related. The spread is a fixed and visible cost charged by the broker at the time a trade is opened, while slippage is an unpredictable event caused by market conditions such as volatility or liquidity shortages—and it may not occur in every trade. Therefore, comparing the two directly is not practical. Traders simply need to understand both to manage their costs and risks more effectively.

How to Reduce Spread and Slippage

To minimize spreads and slippage in Forex trading, selecting a reputable broker and using professional trading techniques are essential.

Here are some practical tips to optimize your trading performance:

-

Trade During High-Liquidity Sessions:

The overlap of the London and New York sessions offers the best trading conditions—higher volume, lower spreads, and faster execution. -

Focus on Major Currency Pairs:

Pairs like EUR/USD, GBP/USD, and USD/JPY usually have tighter spreads due to high liquidity. -

Avoid Trading During Major News Releases:

Economic announcements can cause sharp volatility and wider spreads. Avoid market orders during these times or use limit orders instead. -

Use Pending Orders:

Pending orders allow trades to be executed at or better than your desired price, reducing slippage risk. -

Choose a Fast ECN Broker:

ECN brokers eliminate intermediaries and use advanced servers for high-speed, precise order execution, resulting in lower spreads and slippage compared to market-maker brokers. -

Split Large Orders:

Breaking down large positions into smaller trades helps reduce market impact and slippage.

Introducing Trendo Broker: Low Spread and Minimal Slippage

Trendo Broker is a trusted global Forex and CFD broker offering a proprietary trading platform and a wide range of instruments, including currency pairs, precious metals, indices, oil, and cryptocurrencies.

With 24/7 Persian-language support, crypto deposits and withdrawals, and a community of over 500,000 traders worldwide, Trendo stands out as one of the fastest-growing brokers in the market. Trendo also provides demo accounts, copy trading, and PAMM services, along with attractive promotions such as a $100 free bonus and cashback programs, delivering a superior and rewarding trading experience.

Final Thoughts

Understanding and managing spread and slippage—two key factors in Forex trading—can significantly impact overall profitability. By choosing the right strategies and a reliable broker, traders can minimize these costs and improve performance. With ECN execution, lightning-fast order processing, and access to high-liquidity instruments, Trendo Broker is an excellent choice for minimizing spreads and slippage. Backed by round-the-clock Persian support and a dedicated trading platform, Trendo offers a secure and efficient trading experience for Iranian traders and global clients alike.

Download the Trendo Trading Platform and Get a $100 Free Bonus Today.