The Ultimate Guide to Harmonic Pattern Trading Strategy

Harmonic patterns can help traders develop a strong trading strategy in Forex, provided the trader is proficient in these patterns.

Harmonic pattern trading uses specific price and time structures to identify potential turning points in the market. By recognizing these patterns, traders can make more informed decisions and potentially increase their profits.

Why is harmonic pattern trading so valuable? It provides a clear framework for analyzing market movements, reducing the guesswork involved in trading. It also helps traders identify high-probability trading opportunities, allowing them to enter and exit trades with greater confidence.

Whether you’re a novice or an experienced trader, incorporating harmonic patterns into your strategy can give you a significant edge in the market.

Ready to explore this approach? Let’s dive in!

Contents

What is Harmonic Pattern in Trading?

Harmonic patterns are a method used in technical analysis to predict future market movements. These patterns are based on the idea that price movements follow specific patterns that can be identified and used to forecast future price action.

Harmonic patterns rely on Fibonacci numbers to define precise turning points. By identifying these patterns, traders can anticipate potential reversals in the market.

The most common harmonic patterns include the Gartley, Butterfly, Bat, and Crab patterns. Each of these patterns has a unique structure and specific Fibonacci ratios that define it.

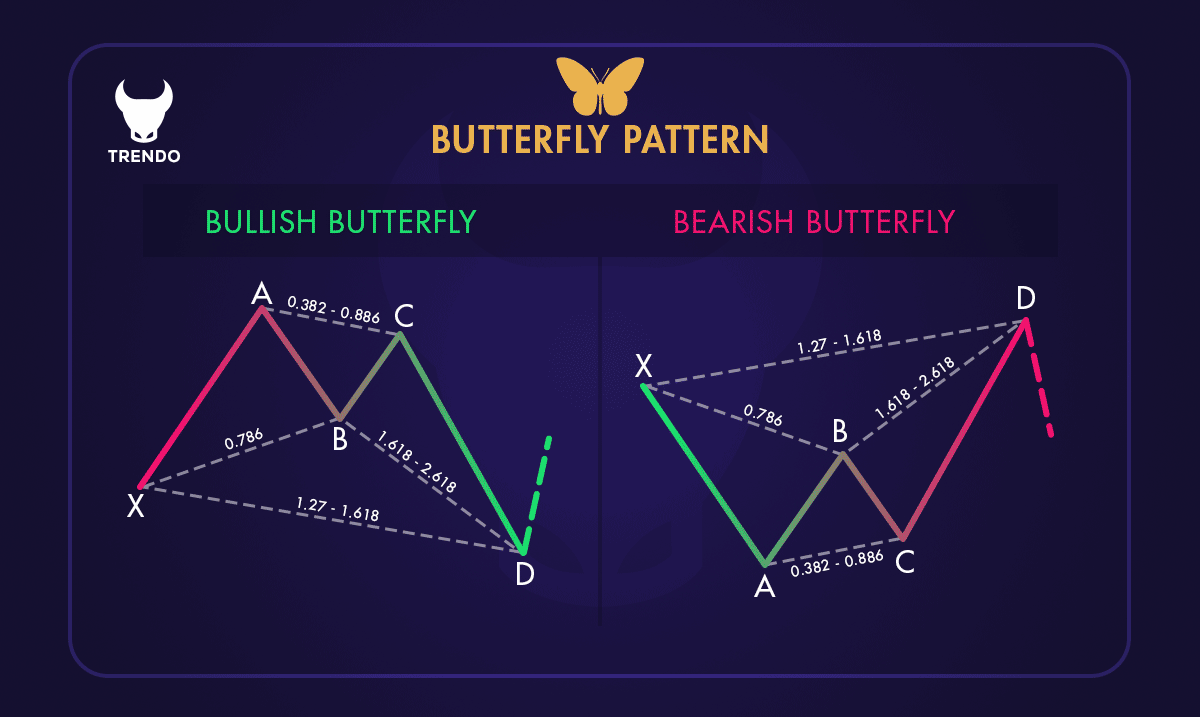

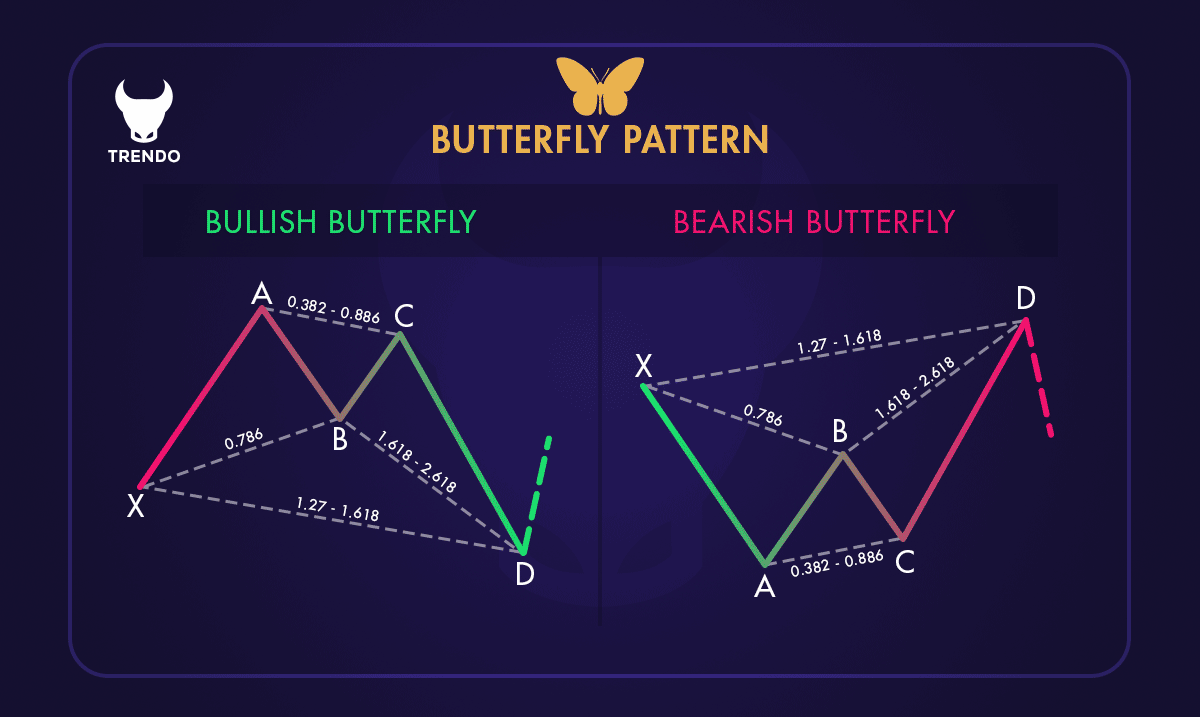

Butterfly Pattern

For example, the Gartley pattern is one of the most well-known harmonic patterns. It is characterized by a specific sequence of price movements that align with Fibonacci retracement levels. When this pattern appears, it suggests that the current trend is likely to reverse.

A Gartley Pattern

Using harmonic patterns can be effective, but it requires practice and a good understanding of Fibonacci ratios. Traders often use these patterns with other technical analysis tools to increase their accuracy.

Types of Harmonic Patterns in Trading

Harmonic patterns are essential tools in technical analysis, helping traders predict potential market reversals. Here are some of the most common types:

1. Gartley Pattern: This is one of the earliest and most well-known harmonic patterns. It is identified by a specific sequence of price movements that align with Fibonacci retracement levels. The Gartley pattern suggests a potential reversal in the current trend.

2. Butterfly Pattern: The Butterfly pattern is another reversal pattern that uses Fibonacci ratios. It typically forms at the end of a price move and indicates that a reversal is imminent. The pattern is characterized by its distinct “M” or “W” shape.

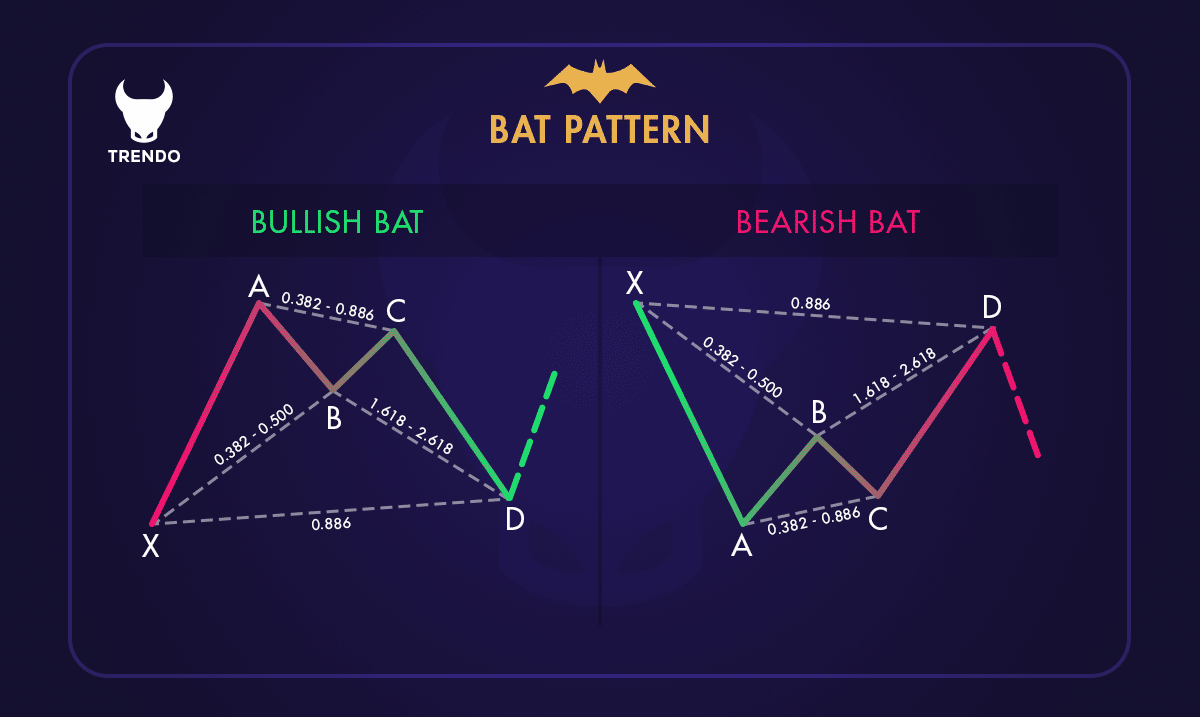

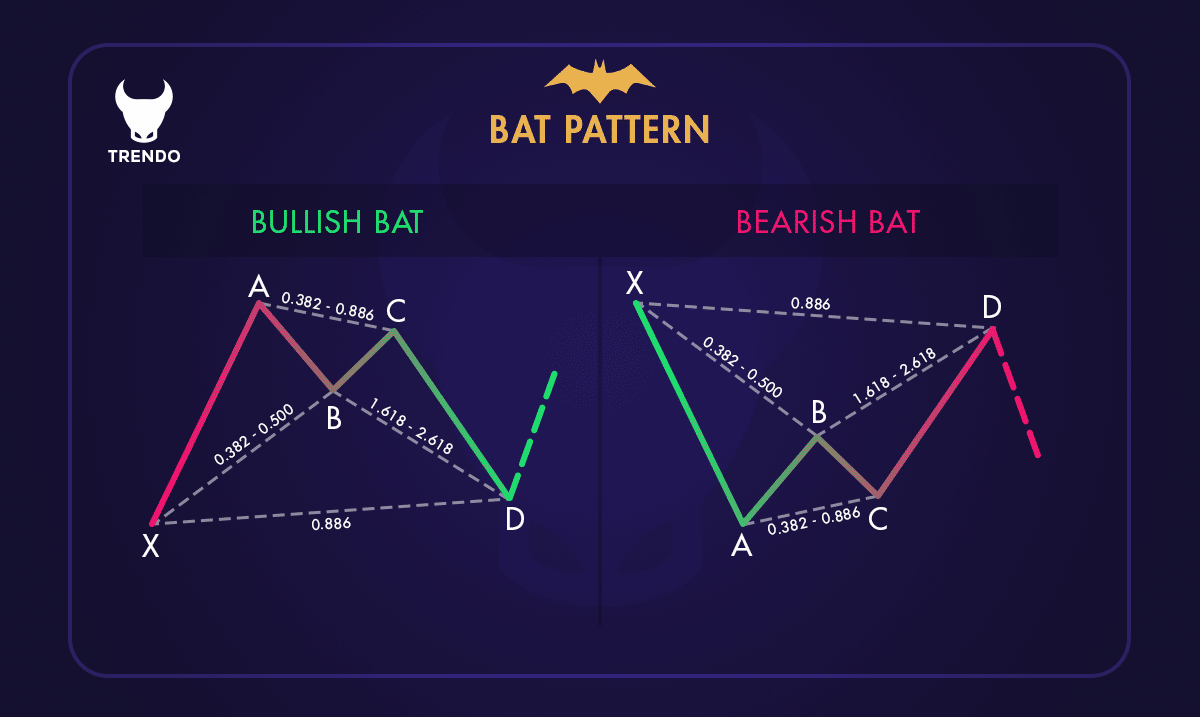

3. Bat Pattern: The Bat pattern is similar to the Gartley pattern but has different Fibonacci ratios. It is known for its high accuracy in predicting reversals. The Bat pattern usually forms when the price retraces to 88.6% of the previous move.

Bat Pattern

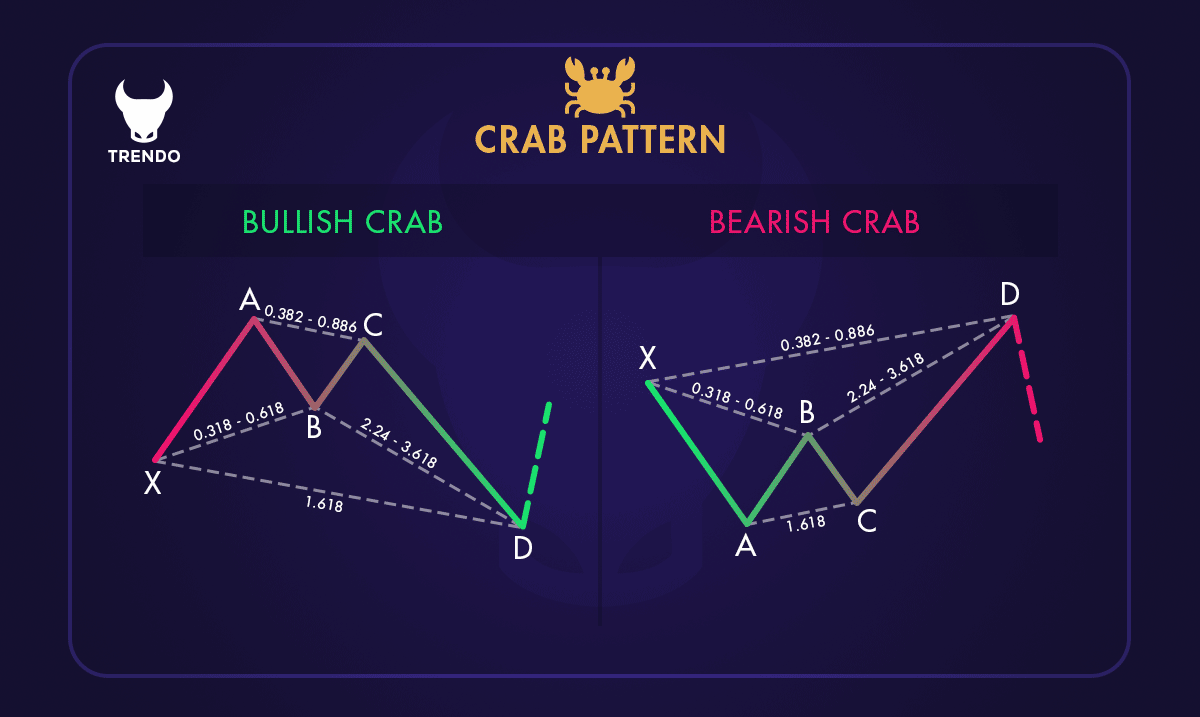

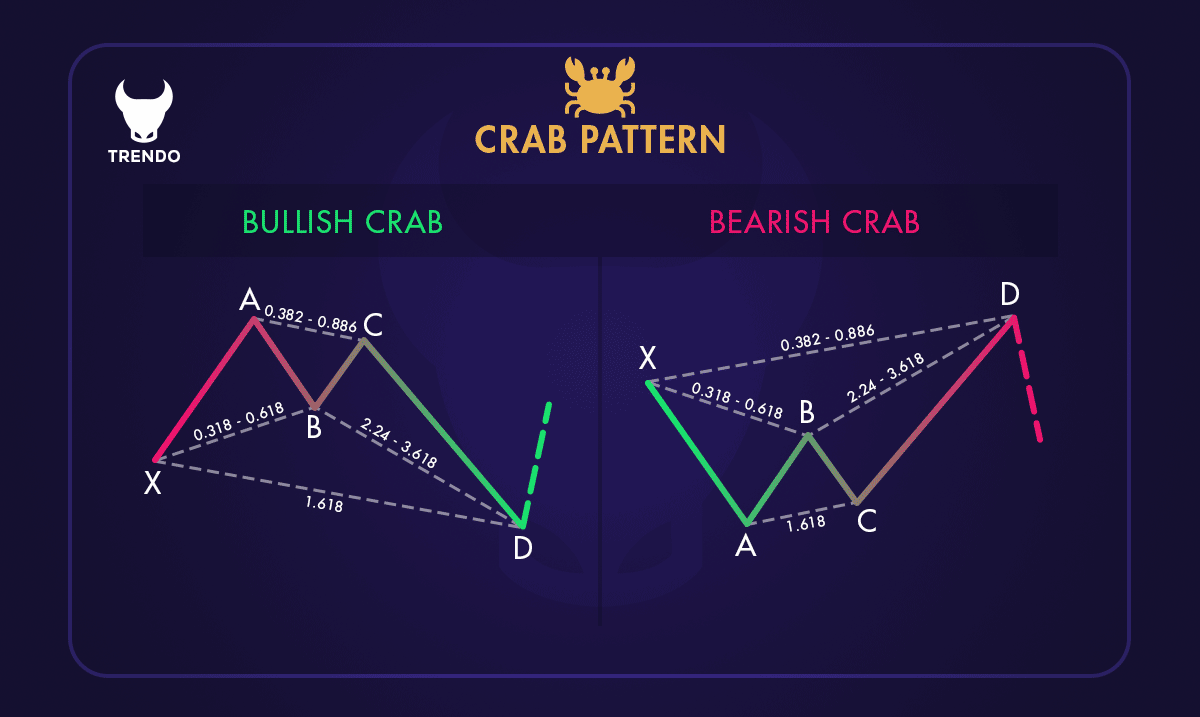

4. Crab Pattern: The Crab pattern is known for its extreme Fibonacci ratios, often leading to significant price reversals. It is one of the most precise harmonic patterns, with the potential for large price movements.

Crab Harmonic Patten

5. ABCD Pattern: This is a simple yet powerful pattern that consists of four points, forming a zigzag shape. The ABCD pattern helps traders identify potential reversal points by using Fibonacci ratios to measure the legs of the pattern.

How to Identify Harmonic Patterns on a Chart?

Identifying harmonic patterns on a chart involves a few key steps. These patterns are based on specific price movements and Fibonacci ratios. Here’s a simple guide to help you spot them:

1. Locate Swing Points: Start by identifying major swing highs and lows on your price chart. These points will form the basis of the pattern.

2. Determine the Pattern Type: Based on the swing points, decide which harmonic pattern you are looking for, such as the Gartley, Butterfly, Bat, or Crab pattern.

3. Draw the Pattern: Connect the swing points to form the pattern. For example, in a Gartley pattern, you would connect points X, A, B, C, and D to form the shape.

4. Apply Fibonacci Ratios: Use Fibonacci retracement and extension tools to measure the legs of the pattern. Each harmonic pattern has specific Fibonacci ratios that must be met. For instance, in a Gartley pattern, the AB leg should retrace 61.8% of the XA leg.

5. Confirm the Pattern: Ensure that all the legs of the pattern meet the required Fibonacci ratios. This step is crucial for the accuracy of the pattern.

6. Look for Reversal Signals: Once the pattern is complete, look for additional signals that confirm a potential reversal. This could include candlestick patterns, volume changes, or other technical indicators.

7. Practice and Patience: Identifying harmonic patterns takes practice. Spend time studying charts and practicing your skills to become proficient.

By following these steps, you can effectively identify harmonic patterns on a chart, helping you make more informed trading decisions. Remember, practice and patience are key to mastering this technique.

What are Fibonacci Ratios in Harmonic Patterns?

Fibonacci ratios are mathematical relationships derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones. These ratios are crucial in harmonic patterns as they help identify potential reversal points in the market.

Key Fibonacci Ratios

The most commonly used Fibonacci ratios in harmonic patterns are 38.2%, 50%, 61.8%, 78.6%, and 100%. These ratios are used to measure the retracement and extension levels between different points in a pattern.

Fibonacci Ratios Role in Harmonic Patterns

In harmonic patterns, Fibonacci ratios help determine the specific points where price reversals are likely to occur. For example, in a Gartley pattern, the retracement from point X to A is typically around 61.8%, while the retracement from point A to B is around 78.6%. These precise measurements allow traders to predict potential turning points with greater accuracy.

The accuracy of Fibonacci ratios is what makes harmonic patterns so effective. By adhering to these specific ratios, traders can minimize guesswork and increase their chances of success. Understanding and applying these ratios is essential for anyone looking to incorporate harmonic patterns into their trading strategy.

Trading Strategy with Harmonic Patterns

Using harmonic patterns in your trading strategy can significantly enhance your ability to predict market movements and make informed decisions. Here’s a step-by-step guide to incorporating harmonic patterns into your trading approach:

Step 1: Identify the Pattern

The first step is to identify a harmonic pattern on your price chart. Use Fibonacci retracement and extension tools to measure the price movements between different points. Look for patterns like Gartley, Bat, Butterfly, Crab, or AB=CD. Ensure the price movements align with the specific Fibonacci ratios for the pattern you’re identifying.

Step 2: Confirm the Pattern

After confirming the pattern, determine your entry and exit points. The completion of the pattern (point D) usually indicates a potential reversal. Enter the trade at this point and set your stop-loss slightly beyond the pattern’s extreme point to minimize risk. Use the Fibonacci extension levels to set your profit targets.

Step 4: Monitor the Trade

Once you’ve entered the trade, monitor it closely. Keep an eye on price movements and be ready to adjust your stop-loss and profit targets as needed. Use additional technical indicators, such as moving averages or RSI, to confirm the trade’s direction and strength.

Step 5: Manage Risk

Risk management is essential in any trading strategy. Ensure you’re not risking more than a small percentage of your trading capital on a single trade. Use stop-loss orders to protect your investment and avoid significant losses. Diversify your trades to spread risk across different assets and markets.

Step 6: Review and Refine

After completing a trade, review the outcome and analyze what worked and what didn’t. Keep a trading journal to track your trades and identify patterns in your performance. Use this information to refine your strategy and improve your future trades.

By following these steps, you can effectively incorporate harmonic patterns into your trading strategy. This approach can help you identify high-probability trading opportunities and make more informed decisions, ultimately enhancing your trading performance.

Tools and Software for Harmonic Pattern Trading

Using the right tools and software can enhance your ability to identify and trade harmonic patterns. Here are some popular options:

1. MetaTrader 4/5: MetaTrader offers a range of technical analysis tools, including those for identifying harmonic patterns. It provides customizable charts, automated trading capabilities, and various indicators.

2. TradingView: TradingView is a web-based platform with powerful charting tools and a user-friendly interface. It offers a wide range of indicators and drawing tools to help you identify harmonic patterns. The platform also has a large community of traders who share insights and strategies.

3. Harmonic Pattern Collection: This specialized software automatically detects harmonic patterns on your charts, highlighting potential patterns and providing detailed information about each one. It saves time and increases accuracy.

4. Harmonic Scanner: A harmonic scanner automatically scans the market for harmonic patterns, providing real-time alerts and detailed analysis. Some scanners also offer backtesting features for testing strategies on historical data.

5. NinjaTrader: NinjaTrader supports harmonic pattern analysis with advanced charting capabilities, automated trading, and a range of technical indicators. It is known for its flexibility and extensive customization options.

6. Fibonacci Calculator: A Fibonacci calculator helps you calculate the Fibonacci retracement and extension levels, which are crucial for identifying and confirming harmonic patterns.

7. Charting Software: Platforms like Thinkorswim and eSignal offer tools for harmonic pattern analysis, advanced charting features, real-time data, and various technical indicators.

By using these tools and software, you can improve your ability to identify harmonic patterns and make more informed trading decisions. Each tool offers unique features, so choose the ones that best fit your trading style and needs.

Common Mistakes in Harmonic Pattern Trading

Trading with harmonic patterns can be highly effective, but it’s essential to avoid common mistakes that can undermine your success. Here are some pitfalls to watch out for:

1. Ignoring Pattern Validation

One of the most common mistakes is failing to validate the pattern. Ensure that the price movements align with the specific Fibonacci ratios for the pattern you’re identifying. Skipping this step can lead to false signals and poor trading decisions.

2. Overlooking Market Context

Harmonic patterns should not be used in isolation. Always consider the broader market context, including trends, support and resistance levels, and other technical indicators. Ignoring these factors can result in misinterpreting the pattern and making incorrect trades.

3. Poor Risk Management

Effective risk management is crucial in trading. Avoid risking too much of your capital on a single trade. Use stop-loss orders to protect your investment and set realistic profit targets. Failing to manage risk can lead to significant losses.

4. Overtrading

Overtrading is a common mistake, especially for beginners. Stick to your trading plan and avoid entering trades based on emotions or impatience. Overtrading can lead to increased transaction costs and reduced overall profitability.

5. Lack of Practice

Identifying harmonic patterns takes practice. Spend time analyzing historical charts and practicing pattern recognition. Jumping into live trading without sufficient practice can result in costly mistakes.

6. Ignoring Confirmation Signals

Relying solely on harmonic patterns without looking for additional confirmation signals can be risky. Use other technical indicators, such as moving averages or RSI, to confirm the pattern and increase the likelihood of a successful trade.

7. Failing to Adapt

Markets are dynamic, and conditions can change rapidly. Be prepared to adapt your strategy based on new information and changing market conditions. Sticking rigidly to a plan without considering market changes can lead to missed opportunities or losses.

By being aware of these common mistakes and taking steps to avoid them, you can improve your harmonic pattern trading strategy and increase your chances of success.

Conclusion

Harmonic pattern offers a structured and precise approach to predicting market reversals. By understanding and applying these patterns, traders can enhance their decision-making process and improve their trading performance.

This guide has covered the essentials, from identifying key patterns like Gartley, Bat, Butterfly, and Crab, to understanding the significance of Fibonacci ratios.

By incorporating these strategies into your trading plan, you can minimize risks and maximize potential profits.

With dedication and the right approach, harmonic pattern trading can become a valuable tool in your trading arsenal.

Frequently Asked Questions (FAQs)

What is the best harmonic pattern to trade?

What are the main types of harmonic patterns?

What is the difference between harmonic patterns and chart patterns?

What is the success rate of harmonic patterns?

Can beginners use harmonic pattern trading strategies?

How long does it take to master harmonic patterns?

What is the most effective harmonic pattern?

How to master harmonic pattern?

پست مرتبط

پربازدیدترین ها

0