What are Top Currency Pairs to Trade in Forex?

This comprehensive guide aims to shed light on the top currency pairs to trade in Forex, helping you navigate the complexities of the market with confidence.

Forex, or foreign exchange, is the largest financial market globally, with trillions of dollars traded daily. The allure of Forex trading lies in its accessibility, liquidity, and the potential for significant profits. However, not all currency pairs are created equal. Some pairs offer higher liquidity, tighter spreads, and more predictable movements, making them more attractive to traders.

In this guide, we will explore the most traded currency pairs for 2024, delving into the factors that make them stand out. From the ever-popular EUR/USD to the volatile GBP/JPY, we’ll cover the characteristics, advantages, and potential risks associated with each pair.

Whether you’re looking to diversify your portfolio or focus on the most stable pairs, this guide will provide the insights you need to make informed trading decisions.

Stay tuned as we dive into the specifics of each top currency pair, offering you a roadmap to successful Forex trading in 2024.

Let’s embark on this journey together and unlock the potential of the Forex market!

Contents

What are Currency Pairs?

In Forex trading, currencies are always traded in pairs. This means you are simultaneously buying one currency while selling another. Each currency pair consists of two parts: the base currency and the quote currency.

Base Currency: The base currency is the first currency listed in a pair. It represents the currency you are buying. For example, in the EUR/USD pair, the euro (EUR) is the base currency. The value of the base currency is always considered as one unit.

Quote Currency: The quote currency, also known as the counter currency, is the second currency in the pair. It shows how much of the quote currency is needed to purchase one unit of the base currency. In the EUR/USD pair, the U.S. dollar (USD) is the quote currency. If the exchange rate for EUR/USD is 1.20, it means you need 1.20 USD to buy 1 EUR.

Quote Currency: The quote currency, also known as the counter currency, is the second currency in the pair. It shows how much of the quote currency is needed to purchase one unit of the base currency. In the EUR/USD pair, the U.S. dollar (USD) is the quote currency. If the exchange rate for EUR/USD is 1.20, it means you need 1.20 USD to buy 1 EUR.

Understanding the relationship between the base and quote currencies is essential for Forex trading. When you see a currency pair, the price indicates how much of the quote currency you need to get one unit of the base currency. If the price of EUR/USD increases, it means the euro is strengthening against the dollar, or the dollar is weakening against the euro.

What are Forex Major Currency Pairs?

Forex major currency pairs are the most traded and widely recognized pairs in the Forex market. These pairs involve the world’s strongest and most liquid currencies, making them highly popular among traders.

The major pairs typically include the U.S. dollar (USD) paired with other major currencies such as the euro (EUR), Japanese yen (JPY), British pound (GBP), Swiss franc (CHF), Canadian dollar (CAD), and Australian dollar (AUD).

Here are the primary Forex major currency pairs:

1. EUR/USD (Euro/US Dollar): This is the most traded currency pair in the world. It represents the two largest economies, the Eurozone and the United States. The EUR/USD pair is known for its high liquidity and tight spreads.

2. USD/JPY (US Dollar/Japanese Yen): This pair is popular due to the significant economic influence of both the United States and Japan. The USD/JPY is known for its large pip value and is often influenced by economic policies and market sentiment in both countries.

3. GBP/USD (British Pound/US Dollar): Often referred to as “Cable,” this pair represents the British pound against the U.S. dollar. It is known for its volatility and can be influenced by economic data and political events in the UK and the US.

4. USD/CHF (US Dollar/Swiss Franc): This pair is considered a safe-haven currency pair. The Swiss franc is known for its stability, and the USD/CHF pair is often used by traders during times of market uncertainty.

5. AUD/USD (Australian Dollar/US Dollar): Known as the “Aussie,” this pair is influenced by commodity prices, particularly metals and minerals, as Australia is a major exporter of these resources. The AUD/USD pair is also affected by economic conditions in China, a key trading partner of Australia.

6. USD/CAD (US Dollar/Canadian Dollar): This pair is often called the “Loonie,” and it is heavily influenced by oil prices, as Canada is a major oil exporter. The USD/CAD pair can be volatile, especially when there are significant changes in oil prices.

7. NZD/USD (New Zealand Dollar/US Dollar): Known as the “Kiwi,” this pair is influenced by agricultural exports from New Zealand. The NZD/USD pair can be affected by changes in commodity prices and economic conditions in New Zealand.

These major currency pairs are favored by traders due to their high liquidity, tighter spreads, and the availability of economic data that can help predict their movements.

What are Forex Minor Currency Pairs?

Forex minor currency pairs, also known as cross-currency pairs or crosses, are currency pairs that do not include the U.S. dollar (USD). These pairs involve major currencies like the euro (EUR), British pound (GBP), Japanese yen (JPY), and others, but they are quoted directly against each other instead of the USD.

Here are some common Forex minor currency pairs:

1. EUR/GBP (Euro/British Pound): This pair represents the euro against the British pound. It is popular among traders due to the economic significance of both the Eurozone and the United Kingdom.

2. EUR/AUD (Euro/Australian Dollar): This pair involves the euro and the Australian dollar. It is influenced by economic conditions in both Europe and Australia, including commodity prices, as Australia is a major exporter.

3. GBP/JPY (British Pound/Japanese Yen): This pair is known for its volatility and large pip movements. It combines the British pound with the Japanese yen, making it attractive for traders looking for significant price swings.

4. EUR/JPY (Euro/Japanese Yen): This pair represents the euro against the Japanese yen. It is influenced by economic policies and market sentiment in both the Eurozone and Japan.

5. GBP/AUD (British Pound/Australian Dollar): This pair involves the British pound and the Australian dollar. It is affected by economic data from both the UK and Australia, as well as global commodity prices.

6. CHF/JPY (Swiss Franc/Japanese Yen): This pair combines the Swiss franc with the Japanese yen. It is often considered a safe-haven pair, as both currencies are known for their stability.

7. AUD/JPY (Australian Dollar/Japanese Yen): This pair involves the Australian dollar and the Japanese yen. It is influenced by economic conditions in Australia and Japan, as well as global risk sentiment.

Minor currency pairs offer traders additional opportunities to diversify their portfolios and take advantage of different market conditions. While they may have lower liquidity and wider spreads compared to major pairs, they can still provide profitable trading opportunities.

What are Forex Exotic Currency Pairs?

Forex exotic currency pairs involve one major currency paired with a currency from a developing or emerging economy. These pairs are less commonly traded compared to major and minor pairs, but they offer unique opportunities and challenges for traders.

Here are some common Forex exotic currency pairs:

1. USD/TRY (US Dollar/Turkish Lira): This pair combines the U.S. dollar with the Turkish lira. It is influenced by economic conditions in Turkey and the United States, including interest rates and political stability.

2. EUR/TRY (Euro/Turkish Lira): This pair involves the euro and the Turkish lira. It is affected by economic data from both the Eurozone and Turkey, as well as geopolitical events.

3. USD/ZAR (US Dollar/South African Rand): This pair represents the U.S. dollar against the South African rand. It is influenced by commodity prices, particularly gold, as South Africa is a major gold producer.

4. USD/SEK (US Dollar/Swedish Krona): This pair combines the U.S. dollar with the Swedish krona. It is affected by economic conditions in Sweden and the United States, including monetary policies and economic data.

5. USD/MXN (US Dollar/Mexican Peso): This pair involves the U.S. dollar and the Mexican peso. It is influenced by trade relations between the United States and Mexico, as well as economic data from both countries.

Exotic currency pairs tend to have lower liquidity and higher volatility compared to major and minor pairs. This means they can experience larger price swings and wider spreads, making them riskier but potentially more rewarding.

Factors to Consider When Choosing Currency Pairs

Choosing the right currency pairs is essential for successful Forex trading. Here are some key factors to consider:

1. Liquidity: Liquidity refers to how easily a currency pair can be bought or sold without affecting its price. Major currency pairs like EUR/USD and USD/JPY are highly liquid, meaning they can be traded quickly and with minimal price changes. High liquidity ensures smoother transactions and tighter spreads.

2. Volatility: Volatility measures how much a currency pair’s price fluctuates over a given period. Pairs with high volatility, such as GBP/JPY, can offer more significant profit opportunities but also come with higher risk. Understanding your risk tolerance is crucial when choosing pairs with varying volatility levels.

3. Spread: The spread is the difference between the bid and ask price of a currency pair. Lower spreads mean lower trading costs. Major pairs typically have tighter spreads compared to minor and exotic pairs. It’s important to consider the spread, especially if you plan to trade frequently.

4. Economic Stability: The economic stability of the countries involved in a currency pair can impact its performance. Pairs involving currencies from stable economies, like EUR/USD, tend to be more predictable. On the other hand, pairs with currencies from less stable economies may experience more significant fluctuations.

5. Trading Sessions: Forex trading is active 24 hours a day, but different currency pairs are more active during specific trading sessions. For example, EUR/USD is most active during the European and U.S. sessions. Understanding when your chosen pairs are most active can help you plan your trading strategy.

6. Correlation: Currency pairs can be correlated, meaning they move in similar or opposite directions. Positive correlation means pairs move in the same direction, while negative correlation means they move in opposite directions. Understanding correlations can help you diversify your trades and manage risk more effectively.

7. Economic Indicators: Economic indicators such as GDP growth, employment rates, and inflation can influence currency values. Keeping an eye on these indicators can help you anticipate market movements and make informed trading decisions.

By considering these factors, you can choose currency pairs that align with your trading strategy and risk tolerance. This approach will help you navigate the Forex market more effectively and increase your chances of success.

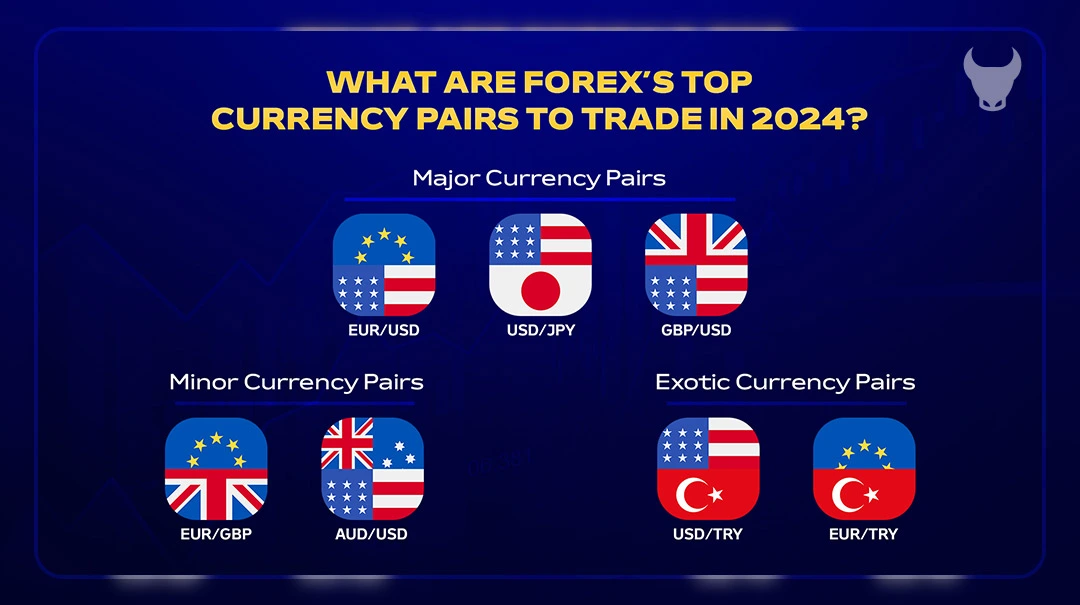

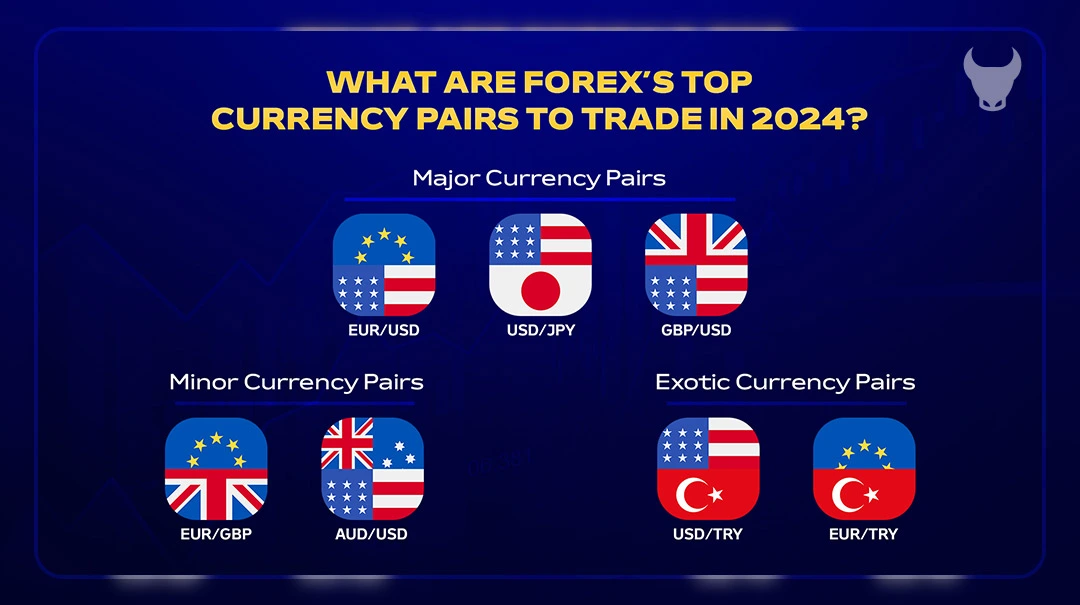

What are Forex’s Top Currency Pairs to Trade in 2024?

As we look ahead to 2024, certain currency pairs stand out in the Forex market due to their liquidity, volatility, and trading opportunities. Here are some of the top currency pairs to consider:

Major Currency Pairs

EUR/USD (Euro/US Dollar)

The EUR/USD pair is the most traded currency pair in the Forex market. Its popularity stems from the economic strength of the Eurozone and the United States, making it highly liquid with tight spreads. Key economic indicators to watch for this pair include GDP growth, inflation rates, and central bank policies from both the European Central Bank (ECB) and the Federal Reserve (Fed).

USD/JPY (US Dollar/Japanese Yen)

The USD/JPY pair is known for its large pip value and is influenced by the economic policies of both the United States and Japan. Market behavior for this pair often reflects investor sentiment towards risk, with the yen typically strengthening during times of market uncertainty. Economic policies, such as interest rate decisions by the Bank of Japan (BoJ) and the Fed, play a crucial role in the pair’s fluctuations.

GBP/USD (British Pound/US Dollar)

The GBP/USD pair, often referred to as “Cable,” has a rich historical performance influenced by the economic and political relationship between the UK and the US. Brexit continues to impact this pair, with ongoing negotiations and trade deals affecting its volatility. Traders should monitor economic data from both countries, including GDP, employment figures, and inflation rates, to anticipate movements in this pair.

Minor Currency Pairs

EUR/GBP (Euro/British Pound)

Trading the EUR/GBP pair involves strategies that capitalize on the economic relationship between the Eurozone and the UK. This pair is influenced by factors such as interest rate differentials, economic data releases, and political events. Effective trading strategies include swing trading and trend following, which can help traders take advantage of medium to long-term price movements.

AUD/USD (Australian Dollar/US Dollar)

The AUD/USD pair is heavily influenced by commodity prices, particularly metals and minerals, as Australia is a major exporter of these resources. Changes in global commodity prices can significantly impact this pair. Traders should also consider economic data from China, a key trading partner of Australia. Trading tips for this pair include monitoring commodity price trends and using technical analysis to identify entry and exit points.

Exotic Currency Pairs

USD/TRY (US Dollar/Turkish Lira)

Trading the USD/TRY pair involves higher risks and rewards due to its volatility. Political and economic considerations in Turkey, such as inflation rates, interest rate decisions by the Central Bank of the Republic of Turkey, and geopolitical events, can cause significant price swings. Traders should be prepared for rapid changes and use risk management strategies to protect their investments.

EUR/TRY (Euro/Turkish Lira)

The EUR/TRY pair offers trading opportunities due to its volatility. Key events to monitor include economic data releases from both the Eurozone and Turkey, as well as political developments. Traders can capitalize on short-term price movements by staying informed about these factors and using technical analysis to identify potential trading opportunities.

By understanding the characteristics and influences of these top currency pairs, traders can make more informed decisions and enhance their trading strategies for 2024.

Tips for Trading Currency Pairs

Trading currency pairs in the Forex market can be rewarding, but it requires a solid strategy and careful planning. Here are some essential tips to help you trade more effectively:

1. Stay Informed: Keep up with global economic news, central bank announcements, and geopolitical events. These factors can significantly impact currency values. For example, interest rate changes by the Federal Reserve or the European Central Bank can cause major movements in currency pairs like EUR/USD and USD/JPY.

2. Understand Market Trends: Analyze market trends to identify potential trading opportunities. Use technical analysis tools like moving averages, trend lines, and support and resistance levels to understand market behavior. Recognizing trends can help you make informed decisions about when to enter or exit trades.

3. Use Technical Analysis: Technical analysis involves studying past price movements to predict future trends. Common tools include charts, indicators, and patterns. For instance, the Relative Strength Index (RSI) can help you identify overbought or oversold conditions in a currency pair.

4. Manage Risk: Implement risk management strategies to protect your investments. Set stop-loss orders to limit potential losses and use proper position sizing to control risk. Never risk more than you can afford to lose on a single trade.

5. Diversify Your Portfolio: Avoid putting all your capital into one currency pair. Diversify your trades across different pairs to spread risk. This approach can help you manage volatility and reduce the impact of adverse movements in a single pair.

6. Practice with a Demo Account: Before trading with real money, practice your strategies using a demo account. This allows you to gain experience and confidence without risking your capital. Many brokers offer demo accounts that simulate real market conditions.

7. Monitor Economic Indicators: Pay attention to economic indicators such as GDP growth, employment rates, and inflation. These indicators can provide insights into the economic health of a country and influence currency values. For example, strong employment data in the US can boost the value of the USD.

8. Adapt to Market Conditions: The Forex market is dynamic and constantly changing. Be prepared to adapt your strategies based on market conditions. Flexibility and the ability to adjust your approach can help you stay ahead in the market.

9. Use Leverage Wisely: Leverage allows you to control larger positions with a smaller amount of capital. While it can amplify profits, it also increases risk. Use leverage cautiously and understand its impact on your trading.

10. Keep a Trading Journal: Maintain a journal to record your trades, strategies, and outcomes. Reviewing your trades can help you identify patterns, learn from mistakes, and improve your trading skills over time.

By following these tips, you can enhance your trading skills and increase your chances of success in the Forex market.

Common Mistakes to Avoid when Trading Currency Pairs

Trading currency pairs can be profitable, but it’s easy to make mistakes that lead to losses. Here are some common mistakes to avoid:

1. Lack of a Trading Plan: Trading without a plan is like sailing without a map. A trading plan outlines your strategy, risk management rules, and goals. Without it, you may make impulsive decisions that lead to losses.

2. Over-Leveraging: Leverage allows you to control larger positions with a smaller amount of capital, but it also increases risk. Using too much leverage can amplify losses. Use leverage wisely and understand its impact on your trading.

3. Ignoring Risk Management: Failing to manage risk is a common mistake. Always set stop-loss orders to limit potential losses and use proper position sizing. Never risk more than you can afford to lose on a single trade.

4. Overtrading: Trading too frequently can lead to mistakes and increased transaction costs. Be patient and wait for high-probability trading opportunities rather than trying to trade every market movement.

5. Trading Without Research: Entering trades without proper research and analysis can lead to poor decisions. Always analyze the market, understand the factors influencing currency pairs, and use both technical and fundamental analysis.

6. Emotional Trading: Letting emotions like fear or greed drive your trading decisions can be detrimental. Stick to your trading plan and avoid making impulsive trades based on emotions.

7. Chasing Losses: Trying to recover losses by making larger or riskier trades can lead to even bigger losses. Accept losses as part of trading and stick to your plan.

8. Ignoring Economic Indicators: Economic indicators such as GDP growth, employment rates, and inflation can significantly impact currency values. Ignoring these indicators can lead to unexpected market movements.

9. Not Keeping a Trading Journal: Failing to keep a record of your trades can prevent you from learning from your mistakes. A trading journal helps you track your performance, identify patterns, and improve your strategy over time.

10. Choosing the Wrong Broker: Selecting a broker without proper research can lead to issues like high fees, poor execution, or lack of regulatory oversight. Always choose a reputable broker with good reviews and proper regulation.

By avoiding these common mistakes, you can improve your trading performance and increase your chances of success in the Forex market.

Conclusion

In this guide, we’ve explored the essentials of Forex trading, focusing on the top currency pairs to trade in 2024. We covered major, minor, and exotic currency pairs, highlighting their characteristics, market trends, and the economic factors that influence them. We also discussed effective trading strategies and the importance of risk management.

Start trading with informed decisions. Use the insights and strategies discussed in this guide to enhance your trading skills and increase your chances of success in the Forex market. Continuous learning and adaptation to market conditions are key to thriving in this dynamic financial landscape.

Feel free to share your experiences and ask questions. Engaging with other traders can provide valuable insights and help you grow as a trader.

FAQs

Which Currency Pair is Most Profitable?

What is the Best Currency Pair to Trade Right Now?

What is the Easiest Currency Pair to Trade?

What are the Safest Currency Pairs to Trade?

Which is the Best Currency Pair to Trade in Forex?

Which Forex Broker Offers the Most Currency Pairs?

What is the Most Traded Forex Pair?

Which Forex Pairs are Most Trending?

پست مرتبط

پربازدیدترین ها

0