What Are the Best Forex Pairs for Swing Trading? Ultimate Guide to Best FX Currency Pairs for Swing Trading

Unlike day trading, which requires constant monitoring, swing trading allows traders to take advantage of market swings without continuous oversight.

Choosing the right currency pairs is crucial for successful swing trading. The right pairs offer the perfect mix of volatility and liquidity, making it easier to predict price movements and execute trades efficiently. By focusing on the best currency pairs, traders can maximize potential gains while minimizing risks.

In this guide, we’ll delve into the essentials of swing trading in Forex. We’ll explore the top currency pairs for swing trading, discuss their unique characteristics, and provide tips on selecting the best pairs for your strategy.

Whether you’re new to swing trading or looking to refine your approach, this guide will equip you with the knowledge you need to succeed. Let’s get started!

Contents

What are Forex Pairs?

Forex pairs, also known as currency pairs, are the foundation of trading in the foreign exchange (Forex) market. A forex pair consists of two currencies: the base currency and the quote currency. The base currency is the first currency listed in the pair, while the quote currency is the second. The value of the forex pair indicates how much of the quote currency is needed to purchase one unit of the base currency.

For example, in the EUR/USD pair, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. If the pair is quoted at 1.20, it means that 1 euro is equivalent to 1.20 U.S. dollars.

Forex pairs are categorized into three main types:

1. Major Pairs: These include the most traded currencies in the world, such as EUR/USD, USD/JPY, and GBP/USD. They are known for their high liquidity and lower volatility.

2. Minor Pairs: These pairs do not include the U.S. dollar but involve other major currencies like EUR/GBP or AUD/JPY. They are less liquid than major pairs but still widely traded.

3. Exotic Pairs: These involve one major currency and one currency from an emerging or smaller economy, such as USD/TRY (U.S. dollar/Turkish lira). They are less liquid and more volatile, making them riskier to trade.

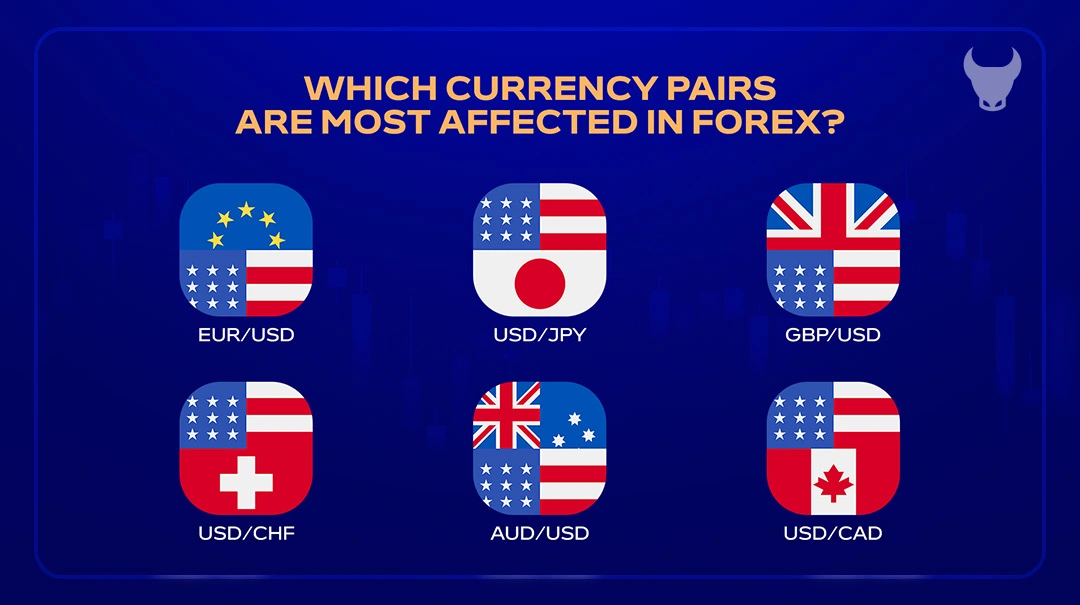

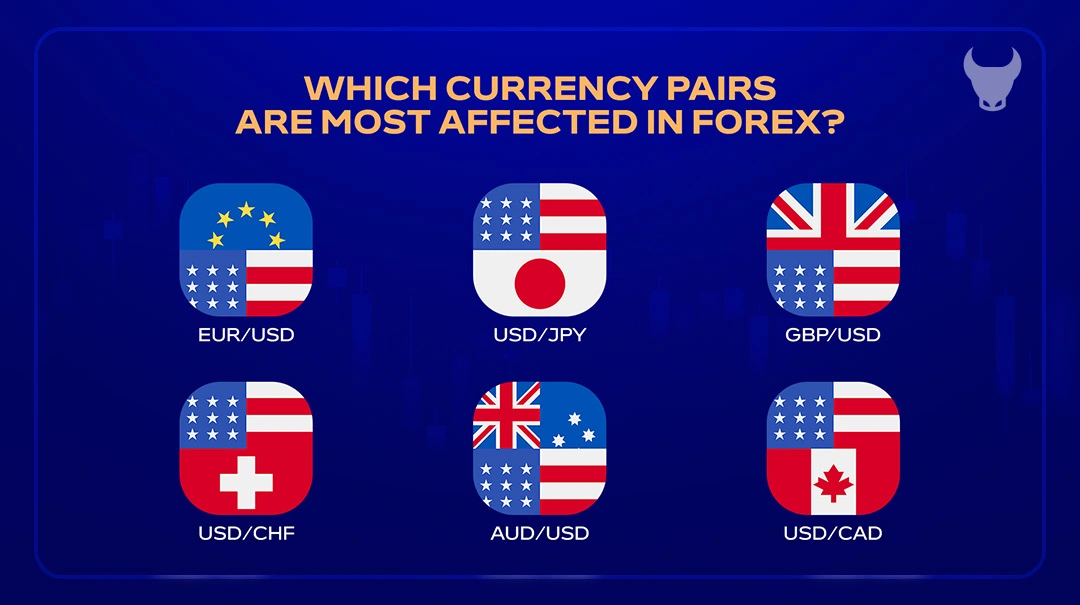

Which Currency Pairs are Most Affected in Forex?

In Forex market, certain currency pairs are more affected by economic events, geopolitical developments, and market sentiment. These pairs are typically the most traded and include major currencies from the world’s largest economies.

1. EUR/USD (Euro/US Dollar): This is the most traded currency pair in the world. It is heavily influenced by economic data from the Eurozone and the United States, such as GDP growth, employment figures, and interest rate decisions. Political events in either region can also cause significant price movements.

2. USD/JPY (US Dollar/Japanese Yen): This pair is sensitive to economic indicators from the US and Japan. The Japanese yen is often seen as a safe-haven currency, so it tends to strengthen during times of global uncertainty. Conversely, it weakens when investors are more willing to take risks.

3. GBP/USD (British Pound/US Dollar): Known as “Cable,” this pair is affected by economic data from the UK and the US. Brexit developments, Bank of England policies, and US economic performance are key factors that influence its movements.

4. USD/CHF (US Dollar/Swiss Franc): The Swiss franc is another safe-haven currency. This pair is influenced by US economic data and global risk sentiment. During times of market turmoil, the Swiss franc tends to appreciate.

5. AUD/USD (Australian Dollar/US Dollar): This pair is impacted by commodity prices, particularly those of metals and minerals, as Australia is a major exporter. Economic data from China, a key trading partner, also plays a significant role.

6. USD/CAD (US Dollar/Canadian Dollar): The Canadian dollar is closely tied to oil prices, as Canada is a major oil exporter. Economic indicators from both the US and Canada, as well as changes in oil prices, can cause fluctuations in this pair.

What is Swing Trading?

Swing trading is a strategy that aims to capture short- to medium-term gains in financial markets. Unlike day trading, where positions are held for just a few hours, swing trading involves holding positions for several days to weeks. This approach allows traders to benefit from price swings in the market.

Swing traders primarily use technical analysis to identify potential trading opportunities. They analyze charts, patterns, and trends to predict future price movements.

The goal of swing trading is to capture a portion of a potential price move. Traders look for stocks or other financial instruments that show signs of an upcoming price change. Once they identify a promising opportunity, they enter a position and hold it until the price reaches a desired level, then exit to secure profits.

Swing trading offers a balance between the fast pace of day trading and the long-term approach of investing. It requires less time commitment than day trading, making it suitable for those who cannot monitor the markets constantly. However, it still demands a good understanding of market dynamics and technical analysis to be successful.

Differences between Swing Trading and Other Trading Styles

Swing trading, day trading, and scalping are popular trading styles, each with its own approach and time frame. Understanding these differences can help traders choose the style that best suits their goals and lifestyle.

Swing Trading:

Time Frame: Positions are held for several days to weeks.

Strategy: Focuses on capturing short- to medium-term price movements. Uses technical analysis to identify trends and patterns.

Commitment: Requires less time than day trading, making it suitable for those who cannot monitor the market constantly.

Risk and Reward: Balances risk and reward by aiming to profit from market swings without the need for constant oversight.

Day Trading:

Time Frame: Positions are opened and closed within the same trading day.

Strategy: Relies heavily on technical analysis and charting systems to make multiple trades throughout the day. Aims to profit from small price movements.

Commitment: Requires significant time and attention, as traders need to monitor the market continuously.

Risk and Reward: High potential for both gains and losses due to the fast-paced nature of trading.

Scalping:

Time Frame: Positions are held for seconds to minutes.

Strategy: Involves making numerous trades to profit from tiny price changes. Scalpers often use high-frequency trading techniques.

Commitment: Extremely time-intensive, requiring constant monitoring and quick decision-making.

Risk and Reward: Lower risk per trade due to the short holding period, but requires a high volume of trades to achieve significant profits.

Each trading style has its own advantages and challenges. Swing trading offers a balanced approach, day trading provides opportunities for quick profits, and scalping focuses on frequent, small gains.

Benefits (Advantages) of Swing Trading in Forex

Swing trading in Forex offers several advantages:

1. Flexibility: Swing trading allows traders to hold positions for several days to weeks, providing the flexibility to manage trades without constant monitoring. This makes it suitable for those with full-time jobs or other commitments.

2. Larger Profit Potential: By capturing short- to medium-term price movements, swing traders can potentially achieve larger profits compared to day trading. This is because they aim to benefit from more significant market swings.

3. Reduced Stress: Unlike day trading, which requires continuous attention to the market, swing trading involves less frequent decision-making. This can reduce stress and make the trading experience more enjoyable.

4. Time Efficiency: Swing trading does not require traders to be glued to their screens all day. Analyzing the market for a few hours each day or week is often sufficient, allowing traders to balance trading with other activities.

5. Technical Analysis: Swing trading relies heavily on technical analysis, which can be easier to learn and apply compared to fundamental analysis. Traders use charts, patterns, and indicators to make informed decisions.

6. Adaptability: Swing trading can be applied to various financial instruments, including currencies, stocks, and commodities. This versatility allows traders to diversify their portfolios and explore different markets.

7. Risk Management: With swing trading, traders can set stop-loss and take-profit levels to manage their risks effectively. This helps in protecting their capital and ensuring that losses are minimized.

Disadvantages of Swing Trading in Forex

While swing trading in Forex has its advantages, it also comes with certain drawbacks:

1. Overnight Risk: Swing traders hold positions overnight, exposing them to unexpected news or events that can cause significant price gaps when the market reopens. These gaps can lead to substantial losses if not managed properly.

2. Market Volatility: Swing trading relies on market volatility to capture price movements. However, highly volatile markets can be unpredictable and lead to exaggerated price swings, making it challenging to maintain profitable positions.

3. Fewer Trading Opportunities: Since swing trading involves holding positions for longer periods, there are fewer trading opportunities compared to day trading or scalping. This requires patience and discipline, as traders may need to wait for the right setup.

4. Psychological Challenges: Holding positions for several days or weeks can be mentally taxing. Traders must manage their emotions and avoid making impulsive decisions based on short-term market fluctuations.

5. Missed Long-Term Trends: By focusing on short- to medium-term price movements, swing traders may miss out on longer-term trends that could offer more substantial gains. This can be a disadvantage for those looking to capitalize on major market shifts.

6. Transaction Costs: Although swing trading involves fewer trades than day trading, the costs associated with holding positions overnight, such as swap fees, can add up over time and impact overall profitability.

Factors to Consider When Choosing Forex Pairs for Swing Trading

Selecting the right forex pairs for swing trading is crucial for maximizing profits and minimizing risks. Here are some key factors to consider:

1. Liquidity: High liquidity pairs, such as EUR/USD and USD/JPY, are easier to trade because they have more buyers and sellers. This ensures smoother transactions and tighter spreads, reducing trading costs.

2. Volatility: Volatility measures how much a currency pair’s price fluctuates. Pairs with moderate to high volatility, like GBP/USD, offer more trading opportunities as their prices move more significantly. However, too much volatility can increase risk.

3. Economic Indicators: Pay attention to economic data releases, such as GDP growth, employment figures, and interest rate decisions. These indicators can significantly impact currency prices. For example, strong economic data from the US can boost the USD.

4. Political Stability: Political events and stability in the countries of the currencies you are trading can affect forex pairs. For instance, political uncertainty in the UK can lead to fluctuations in GBP pairs.

4. Political Stability: Political events and stability in the countries of the currencies you are trading can affect forex pairs. For instance, political uncertainty in the UK can lead to fluctuations in GBP pairs.

5. Correlation: Some currency pairs move in tandem due to economic ties. For example, EUR/USD and GBP/USD often move similarly. Understanding these correlations can help manage risk by avoiding overexposure to similar movements.

6. Trading Hours: Forex markets operate 24 hours a day, but liquidity and volatility can vary during different sessions. Knowing the best times to trade your chosen pairs can enhance your trading strategy.

7. Technical Analysis: Use technical analysis tools like moving averages, trend lines, and indicators to identify potential entry and exit points. Pairs that respond well to technical analysis can provide more reliable trading signals.

What are the Best Forex Pairs for Swing Trading (& Why)?

Choosing the best forex pairs for swing trading is essential for maximizing profits and minimizing risks. Here are some of the top pairs and the reasons why they are favored by swing traders:

1. EUR/USD (Euro/US Dollar): This is the most traded currency pair in the world, known for its high liquidity and relatively stable price movements. The EUR/USD is influenced by economic data from the Eurozone and the US, making it predictable and ideal for swing trading.

2. GBP/USD (British Pound/US Dollar): Known as “Cable,” this pair is popular due to its volatility and liquidity. Economic data from the UK and the US, along with political events like Brexit, can cause significant price swings, providing ample trading opportunities.

3. USD/JPY (US Dollar/Japanese Yen): This pair is favored for its liquidity and the influence of economic indicators from the US and Japan. The Japanese yen is often seen as a safe-haven currency, which can lead to predictable movements during times of market uncertainty.

4. AUD/USD (Australian Dollar/US Dollar): The AUD/USD is influenced by commodity prices, particularly metals and minerals, as Australia is a major exporter. Economic data from China, a key trading partner, also impacts this pair, making it suitable for swing trading.

5. USD/CAD (US Dollar/Canadian Dollar): The Canadian dollar is closely tied to oil prices, as Canada is a major oil exporter. This pair offers good liquidity and is influenced by economic indicators from both the US and Canada, as well as changes in oil prices.

6. GBP/JPY (British Pound/Japanese Yen): This pair is known for its high volatility, providing numerous trading opportunities. It is influenced by economic data from the UK and Japan, as well as global risk sentiment.

These pairs are favored by swing traders due to their liquidity, volatility, and the availability of economic data that can be used to predict price movements. By focusing on these pairs, traders can develop effective strategies to capture short- to medium-term gains.

How to Analyze Forex Pairs for Swing Trading?

Analyzing forex pairs for swing trading involves a combination of technical and fundamental analysis. Here are the key steps:

1. Technical Analysis:

Chart Patterns: Look for patterns like head and shoulders, double tops and bottoms, and triangles. These patterns can indicate potential price movements.

Indicators: Use indicators such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) to identify trends and potential entry and exit points.

Support and Resistance Levels: Identify key support and resistance levels on the chart. Prices often bounce off these levels, making them potential entry and exit points.

2. Fundamental Analysis:

Economic Indicators: Monitor indicators such as GDP growth, employment data, and interest rate decisions. These can influence currency values and help predict future price movements.

News Events: Stay updated with global news that can impact the forex market. Political events, economic policies, and natural disasters can cause significant price fluctuations.

3. Trend Analysis:

Identify Trends: Determine if the currency pair is in an uptrend, downtrend, or moving sideways. This helps in making informed trading decisions.

Trend Lines: Draw trend lines to visualize the direction of the trend. Trend lines can also act as support and resistance levels.

4. Risk Management:

Set Stop-Loss and Take-Profit Levels: Determine your risk tolerance and set stop-loss and take-profit levels accordingly. This helps in managing potential losses and securing profits.

Position Sizing: Calculate the appropriate position size based on your risk tolerance and the size of your trading account.

5. Backtesting:

Historical Data: Test your trading strategy using historical data to see how it would have performed in the past. This helps in refining your strategy and increasing its effectiveness.

By combining these analysis techniques, you can develop a comprehensive approach to analyzing forex pairs for swing trading. This will help you make informed decisions and improve your chances of success in the forex market.

Tools and Resources for Swing Traders

Swing traders need a variety of tools and resources to analyze the market, execute trades, and manage their positions effectively. Here are some essential tools and resources:

1. Trading Platforms: Reliable trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer advanced charting tools, automated trading options, and real-time market data.

2. Charting Software: Charting tools help traders visualize price movements and identify trends. Popular software includes TradingView and NinjaTrader, which provide a wide range of technical indicators and drawing tools.

3. Economic Calendars: Economic calendars, such as those from Forex Factory and Investing.com, keep traders informed about upcoming economic events and data releases that can impact the forex market.

4. News Feeds: Staying updated with the latest market news is essential. News feeds from sources like Bloomberg, Reuters, and CNBC provide real-time updates on global economic and political events.

5. Technical Analysis Tools: Tools like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) help traders analyze market trends and make informed decisions.

6. Risk Management Tools: Effective risk management is crucial. Tools like stop-loss and take-profit orders help traders manage their risk and protect their capital.

7. Trading Journals: Keeping a trading journal helps traders track their trades, analyze their performance, and identify areas for improvement. Tools like Edgewonk and TraderSync offer digital trading journals with advanced analytics.

1. Educational Resources: Continuous learning is vital for success. Websites like BabyPips and Investopedia offer educational content, tutorials, and courses on forex trading and technical analysis.

By utilizing these tools and resources, swing traders can enhance their strategies, stay informed about market developments, and improve their overall performance.

Conclusion

Identifying the best Forex pairs for swing trading is crucial for maximizing your trading success.

The EUR/USD, GBP/USD, USD/JPY, AUD/USD, and USD/CAD pairs each offer unique opportunities and challenges.

By understanding their characteristics, market behaviors, and the economic factors that influence them, you can develop effective trading strategies tailored to each pair.

Successful swing trading requires a combination of technical and fundamental analysis, as well as staying informed about global economic events.

By focusing on these top Forex pairs and applying the insights shared in this guide, you’ll be well-equipped to navigate the Forex market and achieve your trading goals.

FAQs

Which currency pairs are best for swing trading?

Which currency pair moves the most?

Which currency pair is the most profitable?

Which currency pairs are most predictable?

What are the best forex pairs to trade?

What are the best forex pairs to swing trade?

What is the best swing trading forex?

How many pairs to watch for swing trading?

Which pattern is best for swing trading?

Which Forex Pairs is the best for Day Trading?

پست مرتبط

پربازدیدترین ها

0