The Best Gold Trading Strategy in Forex

This historical performance demonstrates gold’s enduring appeal as a safe-haven asset in times of crisis.

In this blog post, we will explore a highly effective gold trading strategy tailored for the Forex market. This strategy capitalizes on gold's unique characteristics, providing traders with a reliable method to navigate the often unpredictable forex landscape.

By leveraging historical trends and modern analytical tools, this approach aims to optimize your trading decisions and maximize your returns.

Let's dive in and uncover the secrets to mastering gold trading in the Forex market.

Contents

Gold in Forex

The symbol for gold in Forex refers to trading gold as a commodity against a specific currency. In Forex, gold is denoted by the symbol XAU, which represents its value against a base currency. For example, the gold symbol in Forex can be expressed as XAUUSD, where XAU represents gold and USD represents the US dollar.

Gold is highly valued as a safe-haven asset globally. This hard commodity has experienced significant growth in recent years. For instance, during the economic uncertainties caused by the COVID-19 pandemic, global gold prices reached their highest level in nine years. This rise in value during crises underscores gold's role as a stable and secure investment.

In the Forex market, gold trading is typically represented by the pair XAU/USD. This pair indicates the value of gold (XAU) in terms of US dollars (USD). When trading this pair, you are effectively trading gold as a commodity against the US dollar.

Read more: What is a commodity?

The price of XAU/USD fluctuates based on various factors, including global economic conditions, geopolitical events, and changes in supply and demand. Traders often turn to gold trading in Forex to hedge against market volatility and currency fluctuations, making it a strategic component of a diversified trading portfolio.

Popular Features of Gold (XAUUSD) Among Traders

One of the services offered by the Trendo broker is to provide continuous and up-to-date analysis of the gold symbol, which traders can benefit from in the form of educational videos by visiting Trendo's YouTube page.

Gold (XAUUSD) has become a favorite among traders for several key reasons:

High Pip Value

In Forex, the smallest unit of price change is called a pip (Percentage in Point). The pip value for gold in Forex is relatively high. For example, every 10 pips in gold are equivalent to one dollar. This high pip value makes gold an attractive asset for traders looking to capitalize on small price movements.

Read more: Pips in Forex

Safe-Haven Asset

Gold is considered a safe-haven asset, especially during times of economic uncertainty. In 2009, during the global financial crisis, a significant amount of investment flowed into gold, initiating a strong upward rally. This event demonstrated to many traders that gold is indeed a secure asset. During economic crises and wars, the price of gold tends to rise as investors seek stability.

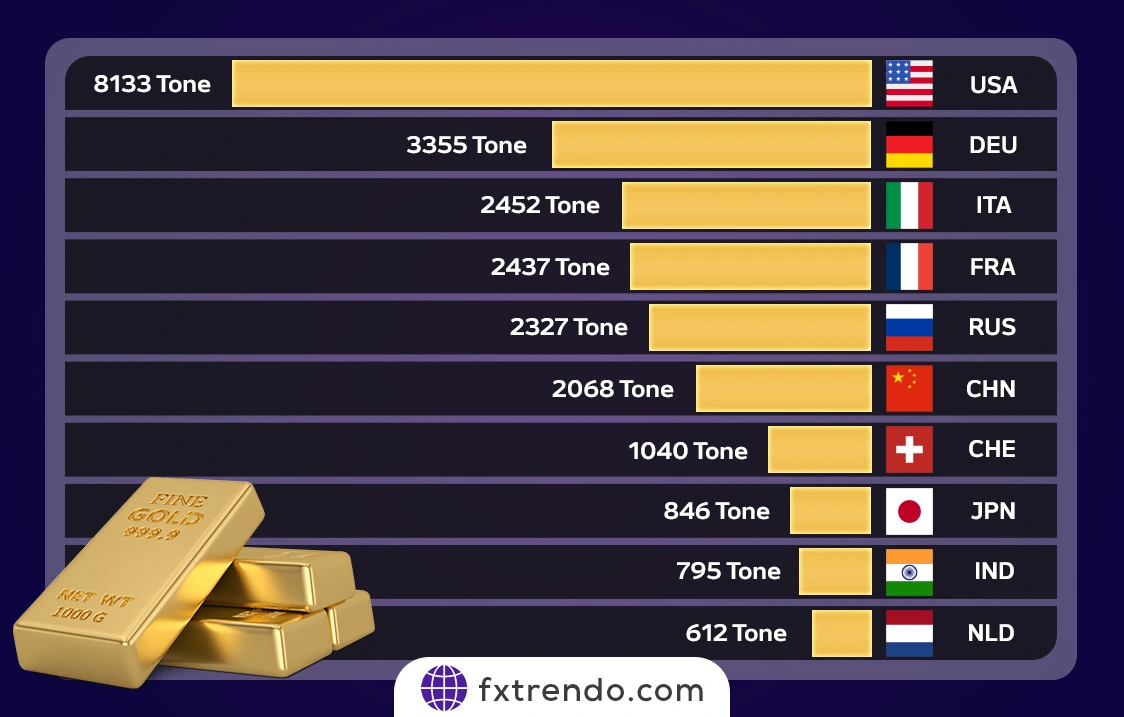

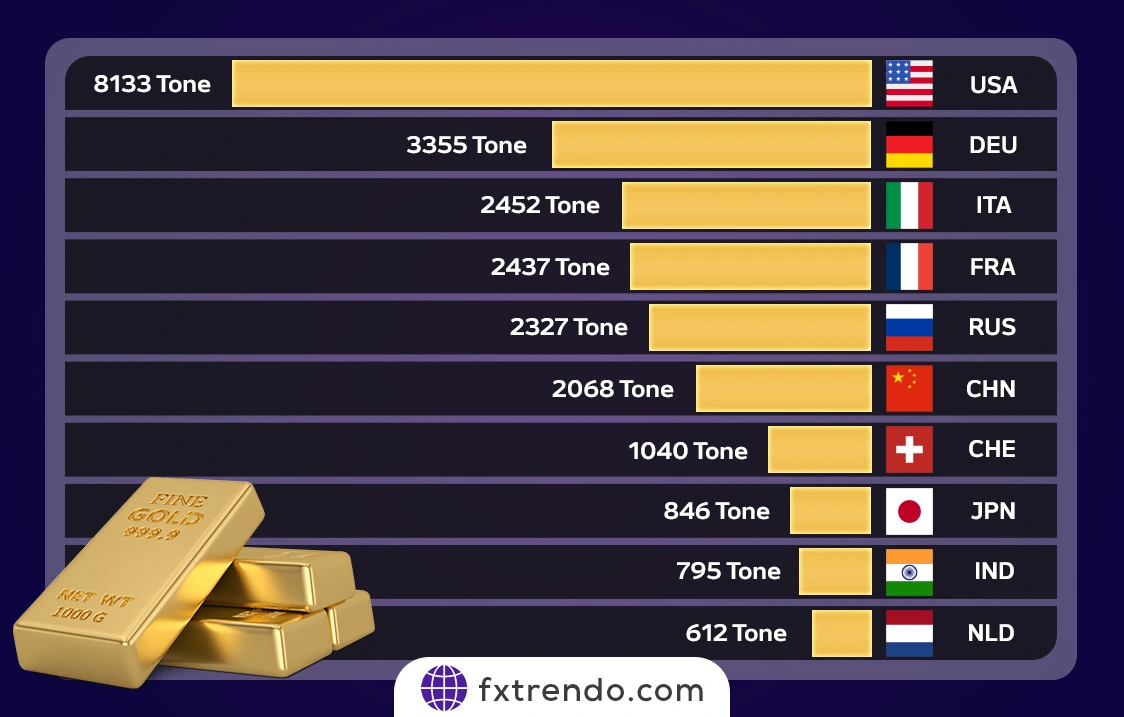

The image above shows the ranking of countries by gold reserves in 2023. With over 8,000 tons of gold in its treasury, the United States has almost as much gold as the Netherlands, India, and Japan combined.

Portfolio Diversification

Most Forex trading focuses on currency pairs, but gold offers an alternative avenue for traders. Adding gold to a trading portfolio allows for greater diversification. Traders can benefit from the price movements of gold just as they would with other commodities like oil or silver.

Low Investment Requirement

One of the exciting features of trading gold in Forex is that it requires relatively low capital. Unlike physical gold, which demands a substantial investment, trading gold in the Forex market can be started with much less capital. This accessibility makes gold trading an attractive option for many traders.

At this stage, choosing a broker is also an important factor in gold trading, because gold has a significant spread due to its high volatility. Therefore, it makes sense to choose a broker that has the lowest trading spread for gold. It is worth noting that the Trendo broker has the lowest spread for gold trading. To check this issue, you can refer to the Trendo dedicated platform.

Read more: Features of the Best Broker for Trading Gold

Risk Aversion

Gold is known for its risk-averse nature. In economics, risk aversion refers to the preference for lower risk. For example, during the COVID-19 pandemic, gold prices soared as it became a haven for investors amid financial turmoil.

Read more: NFP on the Forex Economic Calendar

Additionally, major economic news, such as the release of the Non-Farm Payroll (NFP) report, often impacts gold prices. For instance, in 2019, a weaker-than-expected NFP report led to a rise in gold prices and a decline in the US dollar, highlighting gold's risk-averse qualities.

Choosing the Right Broker

Selecting the right broker is crucial for gold trading due to the significant spreads associated with gold's volatility. It's advisable to choose a broker that offers the lowest spreads for gold trading. For example, Trend Broker provides some of the lowest spreads for gold transactions. You can visit Trend Broker's exclusive platform for more information.

Key Elements of a Successful Gold Trading Strategy

A successful gold trading strategy requires a clear approach to analyzing the market, managing risk, and timing your trades. Gold can be volatile, so it's important to use a strategy that considers both technical and fundamental factors.

Here are the key elements of an effective gold trading strategy.

1. Technical Analysis

Technical analysis involves using price charts and indicators to predict gold’s price movements. Key tools include:

Moving Averages: These help identify trends in gold prices. A simple or exponential moving average can show if gold is in an uptrend or downtrend.

Support and Resistance: Support is the price at which gold tends to stop falling, while resistance is where gold tends to reverse upward. These levels help identify entry and exit points.

Relative Strength Index (RSI): The RSI measures whether gold is overbought or oversold, signaling potential reversal points.

By using these tools, traders can pinpoint optimal trade entries and exits.

2. Fundamental Analysis

Fundamental analysis looks at the broader economic factors affecting gold prices. Key factors include:

Economic Data: Reports like Non-Farm Payroll (NFP), inflation, and GDP growth can impact gold prices. Strong economic data often leads to a stronger U.S. dollar, which may reduce gold’s appeal.

Interest Rates: When central banks raise interest rates, the U.S. dollar tends to strengthen, which can negatively affect gold. Conversely, low interest rates make gold more attractive.

Geopolitical Events: Political instability, wars, and other global issues often drive gold prices higher as investors seek safety.

Understanding these factors helps traders predict longer-term price trends and adjust their strategies.

3. Risk Management

Effective risk management is vital for protecting your capital, especially when trading volatile assets like gold. Some essential practices include:

Position Sizing: Limit the amount of your total capital that you risk on each trade. A common rule is to risk no more than 1-2% of your account on a single trade.

Stop-Loss Orders: A stop-loss limits your loss by automatically closing your position if the price moves against you. Setting an appropriate stop-loss helps protect your account from large losses.

Take-Profit Orders: A take-profit order locks in your gains when the price reaches a certain level. This ensures you exit the market before the price reverses.

Using stop-loss and take-profit orders helps you manage risk and avoid emotional decisions.

4. Time Frame Selection

Your chosen trading time frame should align with your trading style. There are three main approaches:

Scalping: Traders make many small trades, aiming for small price movements. This requires quick decision-making and high market activity.

Day Trading: Day traders open and close positions within a single day. They rely on short-term price movements and often use technical analysis.

Swing Trading: Swing traders hold positions for several days or weeks, capitalizing on medium-term trends.

Select the time frame that suits your trading style and the amount of time you can dedicate to the market.

5. Market Sentiment

Market sentiment refers to the general mood of investors, which can heavily influence gold prices. Sentiment can be affected by news, economic reports, and geopolitical events.

Key tools for assessing sentiment include the Commitment of Traders (COT) report, which shows how major market players are positioning themselves.

During periods of risk aversion, like economic crises or geopolitical tension, gold tends to rise as investors move toward safer assets. Understanding sentiment helps you anticipate gold’s direction, especially during uncertain times.

6. Continuous Learning and Adaptation

The gold market is constantly evolving, so it’s important to adapt. Successful traders stay informed about economic developments, market trends, and new trading strategies. Reviewing past trades—both successful and unsuccessful—can also help refine your strategy over time.

By following these key elements, traders can improve their chances of success and navigate the volatility of the gold market.

Top Gold Trading Strategy

When it comes to investing in gold, many technical strategies are available, but most are not profitable long-term. A simple search for “best gold trading strategy” will show numerous suggestions, but many of them will only waste your time and money.

Gold has historically followed an upward trend due to global inflation, making a long-term investment strategy the most effective approach. Aiming for a 10-year horizon allows you to ride out short-term fluctuations and benefit from gold’s long-term growth.

The Best Strategy: Long-Term Investment

A solid strategy is to invest a fixed percentage of your income each month in gold. For example, setting aside 10% of your monthly income to buy gold provides a steady, low-risk way to build wealth. Over time, this approach can result in substantial holdings, without the need to time the market or worry about price swings.

Why Does This Strategy Work?

Gold’s value tends to increase over time, especially in response to inflation and economic uncertainty. Regular, monthly purchases help you average out the cost of gold, reducing the risk of buying at a market peak. This long-term strategy removes the stress of trying to predict short-term price movements and allows you to focus on building wealth steadily.

This strategy is one of the lowest-risk ways to invest in gold. Many short-term strategies are based on technical indicators that can lead to large losses if the market moves against you.

In contrast, consistently investing in gold each month provides stable exposure, helping to minimize the risk of big losses while positioning you for steady growth.

Over time, your regular investments will compound, and as gold prices rise, your portfolio will grow accordingly.

Best Time to Trade Gold in Forex

Determining the best time to trade gold in Forex depends on the type of trading you intend to do. If you are focused on long-term investments and holding gold over a longer period, the specific time of day for trading isn't as crucial. The key is to enter trades based on your long-term strategy.

However, for short-term trading or day trading, timing becomes much more important. The best times to trade gold in Forex are during the London and New York trading sessions. These sessions overlap and offer the highest liquidity and volatility, making it easier to capitalize on short-term price movements.

During these peak trading hours, market activity is at its highest, which leads to increased opportunities for profitable trades. The London session runs from 8:00 AM to 4:00 PM GMT, while the New York session runs from 1:00 PM to 9:00 PM GMT. The overlap between these sessions, from 1:00 PM to 4:00 PM GMT, is particularly optimal for trading gold due to the higher trading volume and market movements.

Briefly, the best time to trade gold in Forex depends on your trading goals. Long-term investors can enter trades at any time, while short-term traders should focus on the London and New York sessions for the best results.

Top Factors That Affect Gold Prices

Gold prices in the Forex market are influenced by a combination of economic, political, and social factors. Understanding these factors is crucial for investors and traders, as it can aid in making better trading decisions. Here are some of the most significant factors affecting gold prices:

Federal Reserve Monetary Policies

The monetary policies of the United States Federal Reserve are among the most influential factors on gold prices. For instance, the interest rates set by the Fed play a critical role. When interest rates rise, the demand for gold typically decreases, leading to lower prices. Conversely, when interest rates fall, the demand for gold increases, pushing prices higher. This is why professional traders closely monitor Fed announcements.

USD Value

Gold is usually traded in US dollars on the global market. There is an inverse relationship between the value of the US dollar and the price of gold. When the dollar strengthens, gold prices tend to fall, and when the dollar weakens, gold prices generally rise.

Inflation

Gold is often seen as a hedge against inflation. When inflation rates are high, investors turn to gold to preserve the value of their assets. As a result, rising inflation typically leads to higher gold prices.

Geopolitical Events

Global political and economic events can also have a direct impact on gold prices. During times of political crises or wars, investors seek safe-haven assets like gold, increasing demand and driving up prices.

Read more: The best time to trade forex market currency pairs

By keeping a close eye on these key factors, traders and investors can better anticipate gold price movements and make more informed trading decisions.

Tips for Optimizing Gold Trading Performance

To excel in gold trading, consider these practical tips that can help enhance your performance and profitability:

1. Stay Informed

Keep up-to-date with global economic news and events that can impact gold prices. Key reports, such as non-farm payrolls, inflation data, and central bank announcements, often influence market movements. Subscribing to reliable financial news sources and setting up alerts can keep you informed.

2. Use Technical Analysis

Incorporate technical analysis tools to understand market trends and price movements. Indicators like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands can help identify entry and exit points. Regularly analyzing charts and patterns will improve your ability to predict market behavior.

3. Practice Risk Management

Implement strong risk management strategies to protect your investments. Use stop-loss orders to minimize potential losses and take-profit orders to secure profits. Diversify your portfolio to spread risk across different assets and avoid overexposing yourself to a single trade.

4. Follow a Trading Plan

Develop and stick to a well-defined trading plan. This plan should include your trading goals, risk tolerance, and strategies. A disciplined approach helps prevent emotional decisions and maintains consistency in your trading activities.

5. Analyze Market Sentiment

Understanding market sentiment can provide insights into potential price movements. Tools like the Commitment of Traders (COT) report can reveal the positions of large traders, offering clues about market direction. Social media, forums, and news analysis can also help gauge sentiment.

6. Monitor Gold Correlations

Be aware of gold's correlations with other assets, such as the US dollar, crude oil, and stock markets. For example, gold often has an inverse relationship with the US dollar. Understanding these correlations can help anticipate price movements and make more informed trading decisions.

7. Keep a Trading Journal

Maintain a detailed trading journal to track your trades, strategies, and outcomes. Reviewing past trades can provide valuable insights into what works and what doesn't, helping you refine your approach over time.

8. Stay Patient and Disciplined

Patience and discipline are crucial in gold trading. Avoid chasing quick profits or reacting impulsively to market fluctuations. Stick to your trading plan and make decisions based on thorough analysis.

By implementing these tips, you can optimize your gold trading performance and improve your chances of achieving consistent success in the Forex market. Continuous learning and adaptation to market conditions are key to becoming a proficient gold trader.

Conclusion

Gold holds a significant position in the Forex market. Understanding the dynamics, impacts, and trading strategies for gold in Forex enables traders to make informed decisions and potentially capitalize on the unique opportunities presented by this precious metal.

However, it is essential to remember that gold trading in Forex is highly volatile and requires substantial technical and fundamental knowledge. Therefore, refrain from trading gold (XAUUSD) without adequate experience and expertise.

With the right strategy and continuous learning, you can navigate the complexities of gold trading and optimize your investment outcomes.

FAQ

What is the symbol for gold at Trendo Broker?

What is the gold spread at Trendo Broker?

What is the best strategy in gold forex?

What is the best forex session to trade gold?

What is the best indicator for gold in forex?

How much is 1 lot in forex gold?

پست مرتبط

پربازدیدترین ها

1