Fixed vs. Variable Spreads: Which One Offers Better Value? | Trendo Broker

Fixed spreads, as the name suggests, remain constant regardless of market conditions. They offer predictability and are particularly beneficial for those who trade during volatile market times.

On the other hand, variable spreads fluctuate based on liquidity and volatility, often offering lower spreads during high liquidity periods. This can be advantageous for traders who operate in a high liquidity environment.

The choice between fixed and variable spreads ultimately boils down to your trading style, risk tolerance, and the market conditions you typically trade in.

In this blog post, we will delve deeper into the nuances of both types of spreads, aiming to provide you with the insights needed to make an informed decision.

Stay tuned as we unravel the mystery of fixed vs. variable spreads on Trendo Broker.

Contents

What are Spreads in Forex Trading?

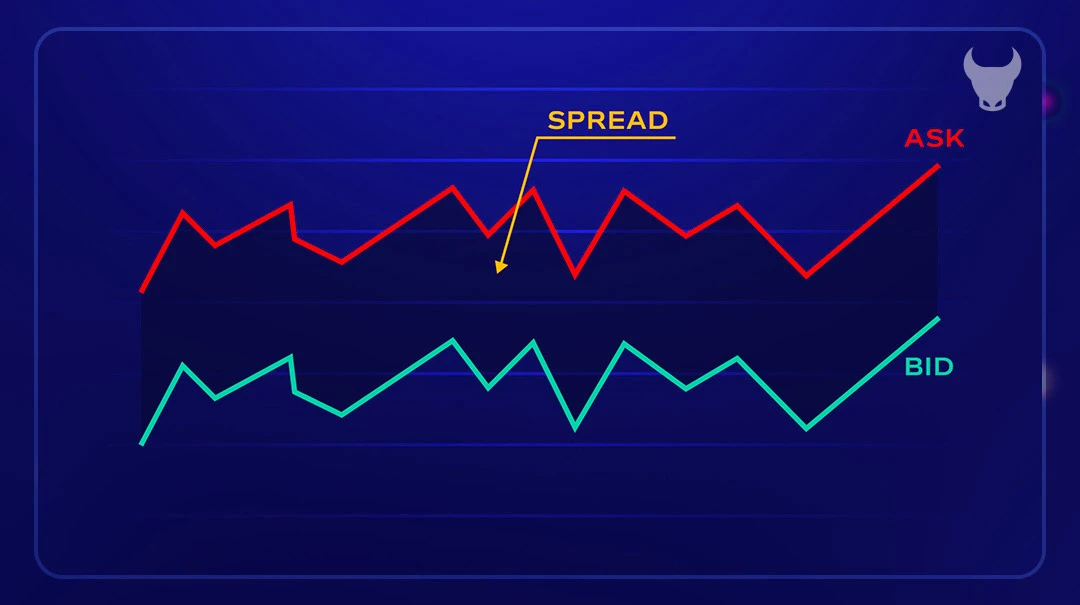

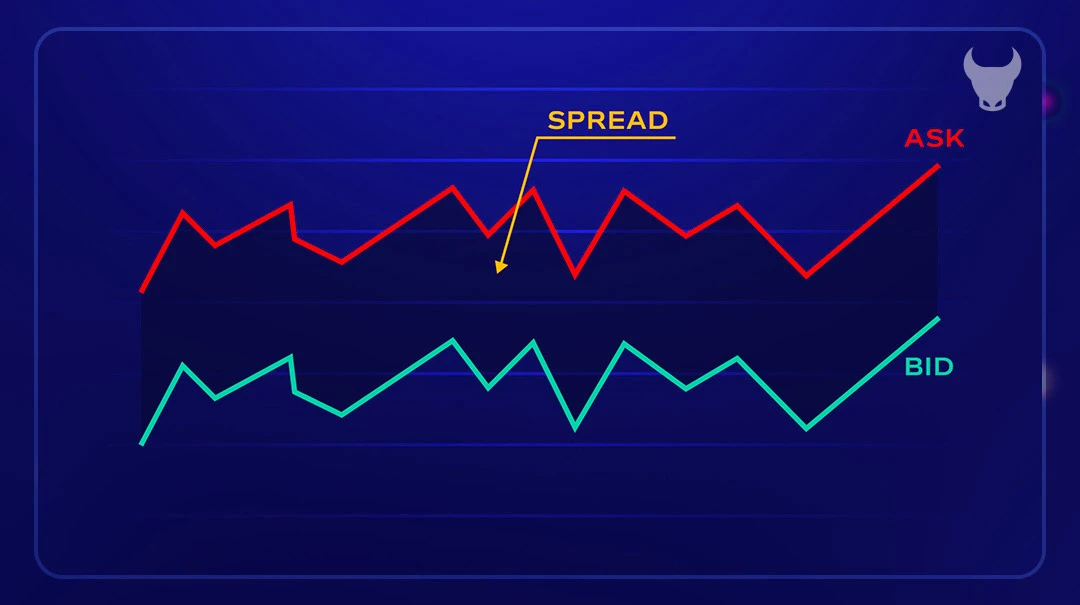

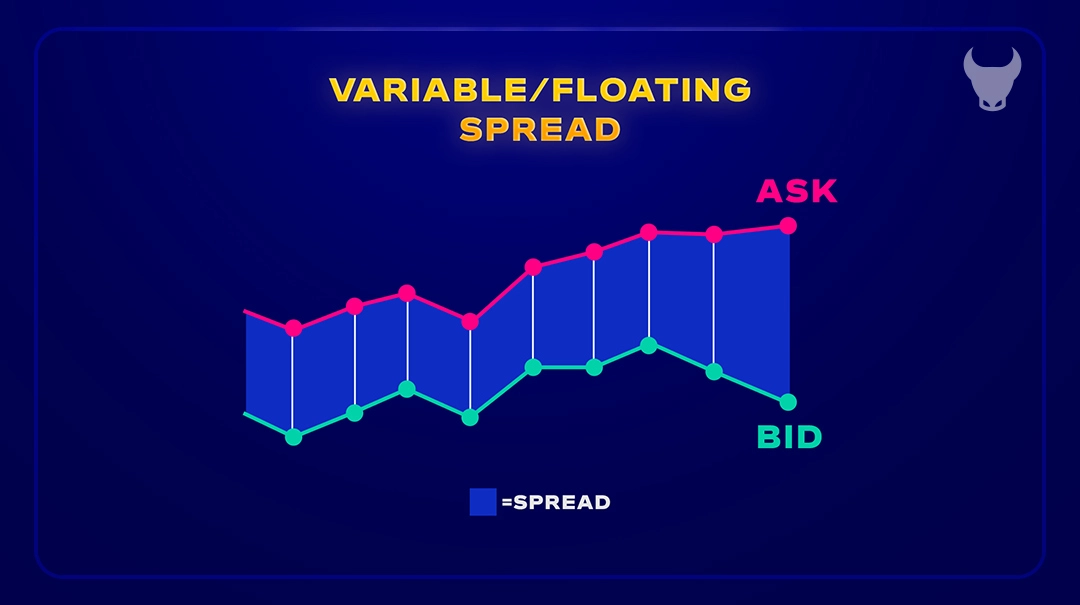

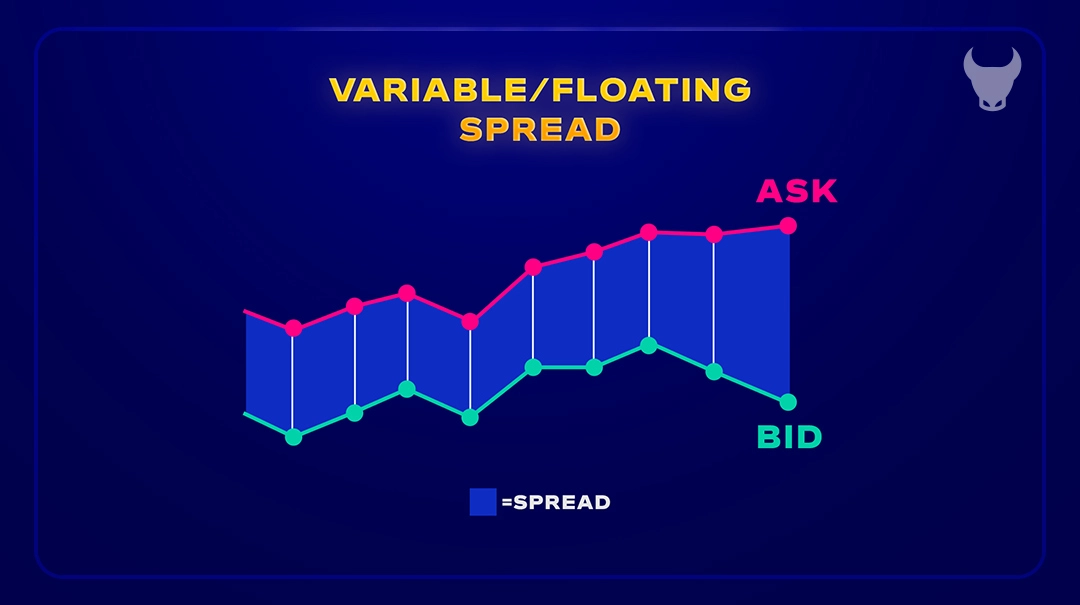

In the Forex trading, spreads are as fundamental as the air we breathe. They are the lifeblood of currency transactions, representing the cost of trading between two currencies. To put it simply, a spread is the difference between the bid and ask prices of a currency pair.

Let’s break it down. When you’re looking to trade a currency pair, the bid price is what the broker will buy the base currency from you for, and the ask price is what you’ll pay to buy that currency from the broker. The spread is this gap between the bid and ask, and it’s measured in pips, which is the smallest price move that a given exchange rate can make.

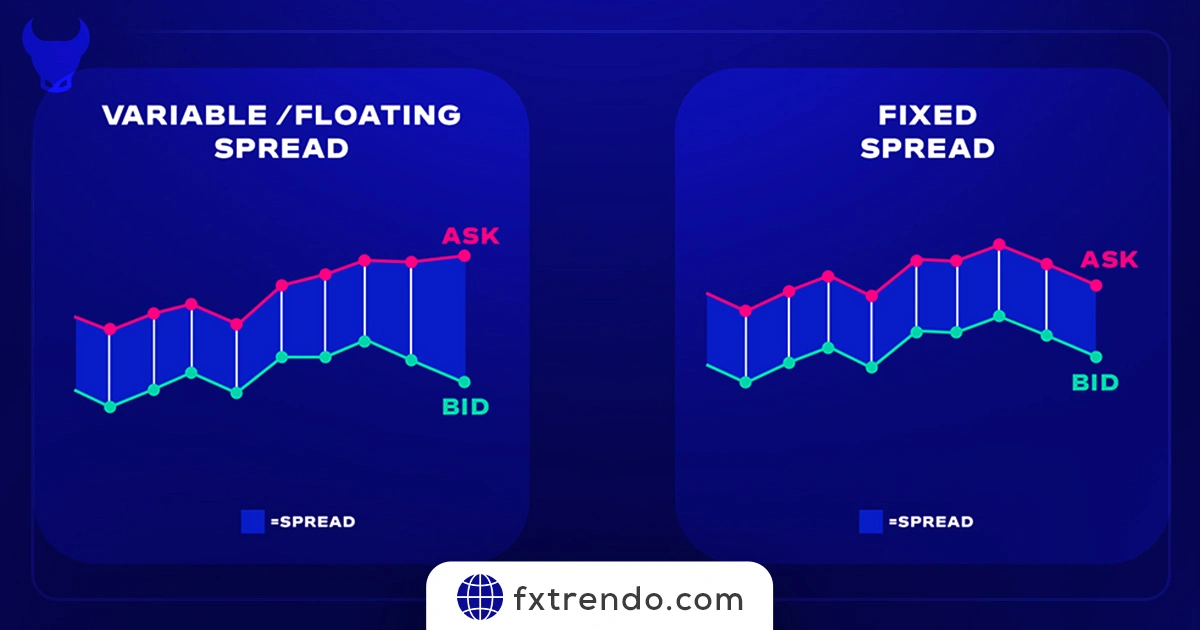

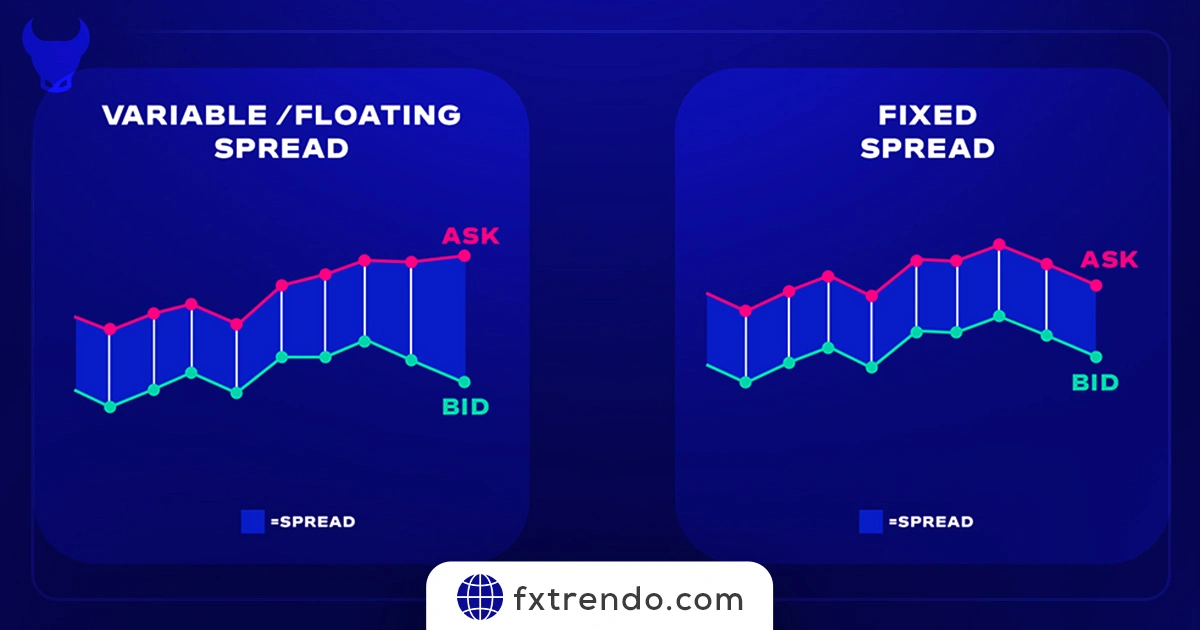

There are two main types of spreads in Forex: fixed and variable (also known as floating). Fixed spreads don’t change, giving you the stability of knowing your trading costs upfront, much like a fixed-rate mortgage. Variable spreads, however, can fluctuate with market conditions, offering lower costs during times of high liquidity but can widen significantly during volatility.

What are Fixed Spreads?

When you step into the Forex market, you’ll hear a lot about spreads. Fixed spreads are like the fixed price menu at a restaurant — they don’t change, no matter what’s happening in the market. They’re the difference between the buy and sell price of a currency pair, and they stay the same, whether the market is calm or in the middle of a storm.

Fixed spreads give you a sense of security. You know exactly what the trading cost will be, allowing you to plan your trades with precision. They’re especially helpful during major economic announcements or events when variable spreads can widen and become unpredictable. With fixed spreads, you’re immune to these sudden changes, which can be a relief, especially if you’re new to trading or prefer a more steady approach.

However, this stability comes at a cost. Fixed spreads are typically wider than variable spreads. This is because the broker, who sets the fixed spread, takes on the risk of market fluctuations and includes that in the spread. So, while you enjoy the predictability, you might be paying a bit more for it.

Benefits (Advantages) of Fixed Spreads

When it comes to trading in the Forex market, fixed spreads are like a trusted companion that never lets you down. They offer a range of benefits that can make your trading experience smoother and more predictable. Here are some of the key advantages:

Predictability: With fixed spreads, you know the cost of trading upfront. There are no surprises, no sudden spikes—just the comfort of knowing exactly what you’re paying for each trade.

Stability in Volatile Markets: Even when the market is as unpredictable as the weather, fixed spreads remain unchanged. This means you can trade during economic announcements or market shocks without worrying about ballooning costs.

Simplicity: Fixed spreads make calculating trading costs straightforward. You don’t need to be a math whiz to figure out your expenses, which makes planning your trades and managing your budget a breeze.

No Requotes: Nothing is more frustrating than clicking ‘trade’ and getting a message that the price has changed. With fixed spreads, requotes are a thing of the past. You get the price you see, every time.

Ideal for Certain Strategies: If you’re a trader who uses strategies like scalping, where every pip counts, fixed spreads can be a game-changer. They allow you to execute your strategy with precision, without the variable spread eating into your profits.

Fixed spreads offer a level of control and transparency that can be very appealing, especially for those new to Forex trading or those who prefer a more measured approach to their trading strategy.

Disadvantages of Fixed Spreads

While fixed spreads offer the comfort of predictability, they come with their own set of disadvantages that traders should be aware of. Here’s a closer look at the potential downsides:

Higher Costs in Low Volatility: Fixed spreads are typically wider than variable spreads during times of low market volatility. This means that even when the market is calm and the trading could be cheaper, you’re still paying a premium for the stability of a fixed spread.

Lack of Flexibility: Fixed spreads don’t adjust to market conditions. So, when the market is quiet, you might miss out on the opportunity to benefit from tighter spreads that variable spreads offer.

Potential Conflict of Interest: Since fixed spreads are set by brokers, there’s a possibility of a conflict of interest. Brokers might set the fixed spread higher to ensure their profit, which could mean less favorable trading conditions for you.

Requotes: Although less common, some traders experience requotes with fixed spreads. This happens when the market is volatile, and the broker is unable to offer the fixed spread at the moment you want to trade.

Unsuitable for News Trading: Fixed spreads are not ideal for news trading, where traders capitalize on the volatility caused by news events. Since fixed spreads don’t reflect the immediate market changes, they can hinder the ability to make quick profits during these times.

While fixed spreads provide stability and predictability, they may not always offer the best value, especially in a calm market or when quick, flexible trading is required. Understanding these disadvantages is crucial for traders to make informed decisions that align with their trading strategies and goals.

What are Variable Spreads?

Variable spreads are the chameleons of the Forex market; they change colors, or in this case, values, adapting to the market’s rhythm and flow. Unlike their fixed counterparts, variable spreads fluctuate based on market conditions, reflecting the real-time supply and demand of currency pairs.

To understand variable spreads, think of them as the heartbeat of the market, quickening during times of high activity and slowing down when things are more tranquil. When there’s a surge in trading activity, say during the release of major economic news, spreads tighten as the volume of buy and sell orders increases. Conversely, in quieter times, the spread can widen, reflecting the decreased demand for currency trades.

Here’s how it works: let’s say you’re trading the EUR/USD pair. Under normal conditions, the spread might be just a few pips. But when a significant news event occurs, like an interest rate decision or employment report, the spread can widen significantly, sometimes up to 20 pips or more. This reflects the increased uncertainty and risk in the market at that moment.

Variable spreads offer the potential for lower costs during periods of high liquidity, which can be particularly attractive for traders who are active during these times. However, they also require a keen eye and a steady hand, as the spread’s variability can impact the cost of trades and potential profits.

Benefits (Advantages) of Variable Spreads

Variable spreads, often seen as the pulse of the Forex market, offer a dynamic approach to trading. They reflect the real-time heartbeat of the market’s supply and demand, providing several advantages:

Market Transparency: Variable spreads mirror the true market conditions, giving traders a transparent view of the currency’s supply and demand dynamics. This transparency ensures that traders are getting a fair price based on actual market activity.

Cost Efficiency: In times of low volatility, variable spreads can be much narrower than fixed spreads, which translates into reduced trading costs. This efficiency is particularly beneficial for traders who operate during off-peak hours or when the market is less active.

Potential for Lower Costs: Traders can capitalize on tighter spreads during less active trading hours, which can significantly lower transaction costs. This is especially advantageous for those who trade frequently or with larger volumes.

Flexibility: Variable spreads offer the flexibility to benefit from market conditions. When the market is liquid, spreads tighten, allowing traders to enter and exit positions at better prices, potentially increasing profits.

Adaptability to Market Conditions: As variable spreads adjust to market liquidity, they can offer smoother trade execution during high liquidity periods, which is crucial for traders looking to capitalize on quick market movements.

Variable spreads can provide a cost-effective and flexible trading experience, adapting to market conditions and offering potential savings on trading costs. They are particularly suited for experienced traders who can navigate the ebb and flow of the Forex market.

Disadvantages of Variable Spreads

Variable spreads, while adaptable and reflective of real-time market conditions, come with their own set of challenges. Here are some of the disadvantages that traders should consider:

Unpredictability: The very nature of variable spreads means they can change at a moment’s notice, making it difficult to predict trading costs. This unpredictability can be a significant hurdle, especially for those who rely on precise cost calculations for their trading strategies.

Widening During Volatility: During times of high volatility, such as major news releases or economic events, variable spreads can widen considerably. This can increase the cost of entry and exit, potentially eating into profits or increasing losses.

Complexity for New Traders: For newcomers to Forex trading, the fluctuating nature of variable spreads can add an extra layer of complexity to the learning curve. It requires a deeper understanding of market dynamics and the factors that influence spread changes.

Potential for Higher Costs: In certain market conditions, particularly when liquidity is low, variable spreads can be higher than fixed spreads. This can make trading more expensive, particularly for those who trade during off-peak hours or in less popular currency pairs.

Difficulty in Scalping: Scalpers, who make numerous trades for small profits, may find variable spreads challenging. The unpredictability and potential widening of spreads can quickly erode the thin margins on which scalping strategies rely.

While variable spreads can offer benefits during times of high liquidity, they also present a set of disadvantages that require careful consideration. Traders need to weigh these against their trading style, risk tolerance, and the market conditions they typically operate in.

Comparing Fixed and Variable Spreads (What are the differences between fixed and variable spreads?)

When navigating the Forex market, traders must make a crucial choice between fixed and variable spreads. This decision is influenced by several key factors, including market conditions, trading style, and risk tolerance. Understanding these differences is essential for aligning your trading approach with the spread type that best suits your needs.

Key Factors to Consider

Market Conditions: Fixed spreads remain constant regardless of market changes, offering cost stability. Variable spreads, however, fluctuate with market liquidity and volatility, potentially providing lower costs during normal conditions but can widen during market upheavals.

Trading Style: If you prefer predictability and a structured approach, fixed spreads might be your ally. For those who thrive on market dynamics and are adept at responding to real-time changes, variable spreads could offer more opportunities.

Risk Tolerance: Fixed spreads provide a safeguard against volatile market conditions, which can be appealing if you have a lower risk tolerance. Variable spreads might suit you if you’re willing to embrace the risks for potentially lower costs.

| Factor | Fixed Spreads | Variable Spreads |

|---|---|---|

| Cost Stability | High | Low |

| Spread Width During Volatility | More significant for frequent, small trades (scalping). | More significant for larger volume trades. |

| Predictability | Variable spreads can fluctuate; fixed spreads are predictable. | Usually a fixed cost, offering predictability. |

| Transparency | Cost is less transparent as it’s built into the trade. | Fees are clear and separate from the trade. |

| Suitability | Better for traders who prefer simplicity and integrated costs. | Better for traders who value transparency and fixed costs. |

Cost Stability

Fixed spreads offer the advantage of cost stability, ensuring that traders are not caught off-guard by sudden spread changes. This can be particularly beneficial during economic news releases or other high-impact events.

Spread Width during Volatility

Variable spreads reflect the market’s heartbeat, tightening during periods of high liquidity and widening in response to volatility. This can affect the cost of trades, with potential implications for profit and loss.

Suitability for Different Trading Strategies

Fixed spreads are well-suited for strategies that rely on cost certainty, such as scalping or automated trading systems. Variable spreads, conversely, may benefit strategies that take advantage of market movements, such as swing trading or news trading.

Both fixed and variable spreads have their place in Forex trading. By considering your individual trading style, risk tolerance, and the market conditions you typically face, you can choose the spread type that offers you the best value and aligns with your trading objectives.

Which One Offers Better Value? Which Spread is Better for You?

The quest to determine which spread offers better value in Forex trading is akin to choosing the right tool for a job—it largely depends on the task at hand and the user’s expertise. Both fixed and variable spreads have their unique advantages and are tailored to different trading scenarios and styles.

Fixed Spreads: These are often favored by traders who value consistency and predictability. Fixed spreads can be particularly advantageous for those new to trading or those who employ automated trading systems. They provide a stable cost structure, which is beneficial during times of high market volatility, as they do not widen like variable spreads.

Variable Spreads: More experienced traders who can navigate the market’s fluctuations tend to prefer variable spreads. These spreads can offer better value during periods of high liquidity, as they are generally lower than fixed spreads under normal market conditions, making them more cost-effective. However, they require a good understanding of market dynamics, as they can widen significantly during times of volatility.

Read more: How to Reduce Spread in Forex Trading ?

Analysis Based on Different Scenarios:

Long-term Trading: For traders with a long-term horizon, fixed spreads provide the benefit of a known cost structure, which aids in strategic planning and financial management.

Short-term Trading: Traders looking to capitalize on short-term market movements might find variable spreads more beneficial, as they allow for taking advantage of tighter spreads during periods of high liquidity.

High-frequency Trading vs. Casual Trading:

High-frequency Trading: Traders executing a large volume of trades may lean towards fixed spreads to ensure that each trade has a predictable cost.

Casual Trading: Those who trade less frequently might prefer variable spreads to potentially reduce their trading costs during times when the market is more liquid.

Impact of Market Volatility:

Market volatility: can cause variable spreads to widen, which can increase trading costs and affect profitability. Fixed spreads remain unchanged, offering a shield against the unpredictable swings of the market.

How to Choose the Right Spread Type for You?

Choosing the right spread type in Forex trading is a decision that can significantly impact your trading success. It’s like picking the right pair of shoes for a marathon; the right choice can enhance your performance, while the wrong one can hinder it. Here’s a guide to help you select the spread type that fits your trading style like a glove.

Understand Your Trading Style: Are you a sprinter or a long-distance runner? Similarly, determine if you’re a day trader, scalper, or long-term investor. Your trading frequency and the time you hold positions will influence whether fixed or variable spreads are more suitable for you.

Consider Market Conditions: Just as weather conditions can affect a marathon, market conditions can influence spread types. Fixed spreads offer consistency regardless of market changes, while variable spreads can fluctuate with market liquidity and volatility.

Assess Your Risk Tolerance: Your comfort level with risk is like your stamina in a race. If you prefer a predictable cost structure and less exposure to market volatility, fixed spreads may be your ally. If you’re comfortable with risk and can handle the variable nature of spreads, then variable spreads might offer you better opportunities.

Evaluate Costs and Benefits: Weigh the costs of fixed spreads against the potential benefits of variable spreads during high liquidity times. Consider how each type aligns with your financial goals and trading strategy.

Test with a Demo Account: Before running the marathon, you’d train. Similarly, use a demo account to experience how fixed and variable spreads work with your trading approach. This hands-on experience can be invaluable in making your decision.

Seek Guidance: Just as a coach can guide a runner, don’t hesitate to seek advice from more experienced traders or financial advisors. They can provide insights into how different spreads can affect trades based on various strategies.

Choosing the right spread type is a personal decision that should be made based on a thorough understanding of your trading style, risk tolerance, and the market conditions you’ll be operating in. Whether you choose fixed or variable spreads, ensure it’s a decision that will support your trading strategy and help you cross the finish line with success.

Why Choose Trendo Broker?

When it comes to navigating the vast ocean of Forex trading, having the right broker is like having a reliable compass. Trendo Broker stands out as a beacon for traders, guiding them through the currents of the financial markets with its robust offerings and trader-centric benefits.

Trendo Broker is not just a platform; it’s a gateway to global trading opportunities. It offers a seamless trading experience with access to a wide range of instruments, including Forex pairs, CFDs on indices, commodities, stocks, ETFs, and various digital currencies. With platforms available for Windows, Mac, iOS, Android, and Web, Trendo Broker ensures that you can trade anytime, anywhere, with ease and efficiency.

Benefits of Trading with Trendo Broker

Trading with Trendo Broker comes with a plethora of advantages designed to elevate your trading journey:

Zero Spread and Lowest Commission: Enjoy trading with some of the most competitive spreads and lowest commissions in the market, ensuring that your trades are cost-effective.

High Leverage and Low Margin: Maximize your trading potential with high leverage options while maintaining low margin requirements.

Speed and Security: Benefit from high-speed trade execution coupled with the security you need to trade with confidence.

Powerful Tools and Live Charts: Utilize powerful trading tools and live charts to make informed decisions and stay ahead of market movements.

24/7 Support: Receive round-the-clock support from a team of experts, ensuring that help is always at hand whenever you need it.

Diverse Deposit and Withdrawal Methods: Experience the convenience of multiple deposit and withdrawal methods, catering to your preferences.

Up-to-date Market News and Analysis: Stay informed with the latest market news and analysis, helping you to make timely and educated trading decisions.

Conclusion

As we draw the curtains on our exploration of fixed and variable spreads, it’s clear that both have their rightful place in the Forex trading landscape. Like two sides of the same coin, they offer distinct advantages tailored to different trading styles and market conditions.

Summary of Key Points Discussed:

Fixed Spreads provide a stable and predictable cost structure, ideal for traders who value consistency and simplicity in their trading costs.

Variable Spreads offer flexibility and the potential for lower costs during periods of high liquidity, suited for traders who can adeptly navigate the market’s ebb and flow.

The choice between fixed and variable spreads isn’t about right or wrong; it’s about what aligns best with your trading approach, risk tolerance, and financial goals. Fixed spreads might be the beacon of stability for the cautious sailor, while variable spreads could be the wind in the sails for the adventurous trader.

Now, it’s your turn to chart the course. Evaluate your trading needs, consider your approach, and decide which spread type will lead you to your desired destination.

With Trendo Broker, you have a partner that offers both fixed and variable spreads, empowering you to trade on your terms. Embrace the journey, make informed decisions, and let Trendo Broker be the compass that guides you to trading success.

Frequently Asked Questions

What are Fixed Spreads in Forex Trading?

What are Variable Spreads in Forex Trading?

What are the Advantages of Fixed Spreads?

What are the Disadvantages of Fixed Spreads?

What are the Advantages of Variable Spreads?

What are the Disadvantages of Variable Spreads?

Which is Better: Fixed or Variable Spreads?

How Does Trendo Broker Handle Spreads?

Article similaire

Le plus visité

0