What is the Spread in Crypto Trading? Ultimate Guide about Crypto Spread

Cryptocurrencies are more than just digital money; they're the frontier of a decentralized financial system. Unlike traditional currencies, they aren't tied to any single entity or government, giving you a level of freedom and control over your assets that was previously unimaginable. This new form of currency is transparent, secure, and, most importantly, global.

As a trader, you'll engage in a dance with supply and demand, buying low and selling high, always aiming to capitalize on the market's ever-changing tides. Whether you're a beginner or a seasoned pro, understanding the intricacies of the market, from order books to trading pairs and beyond, is essential.

Contents

What is a Spread in the Trading World?

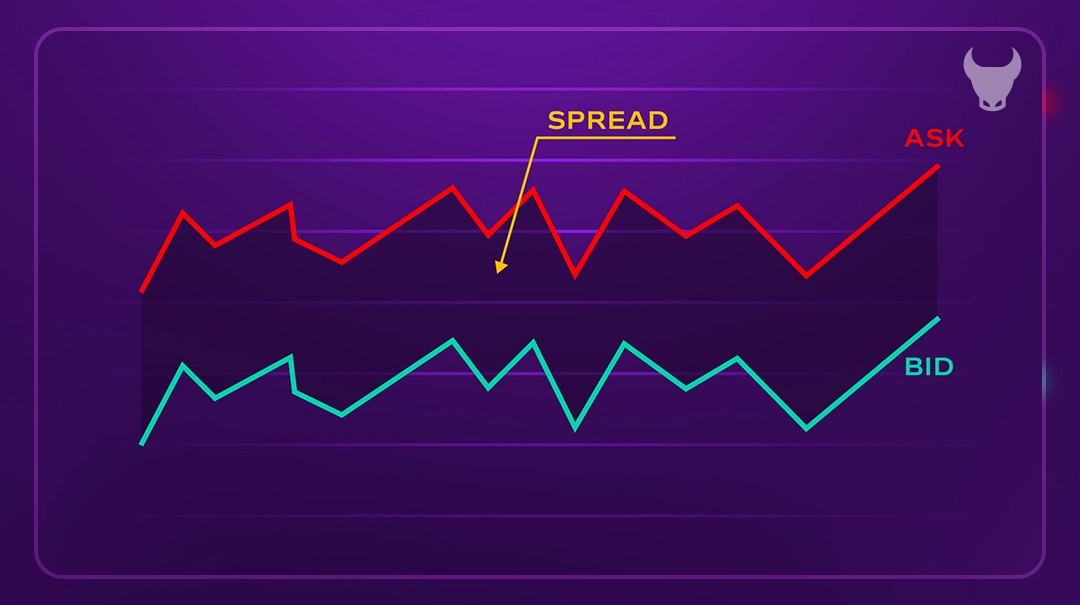

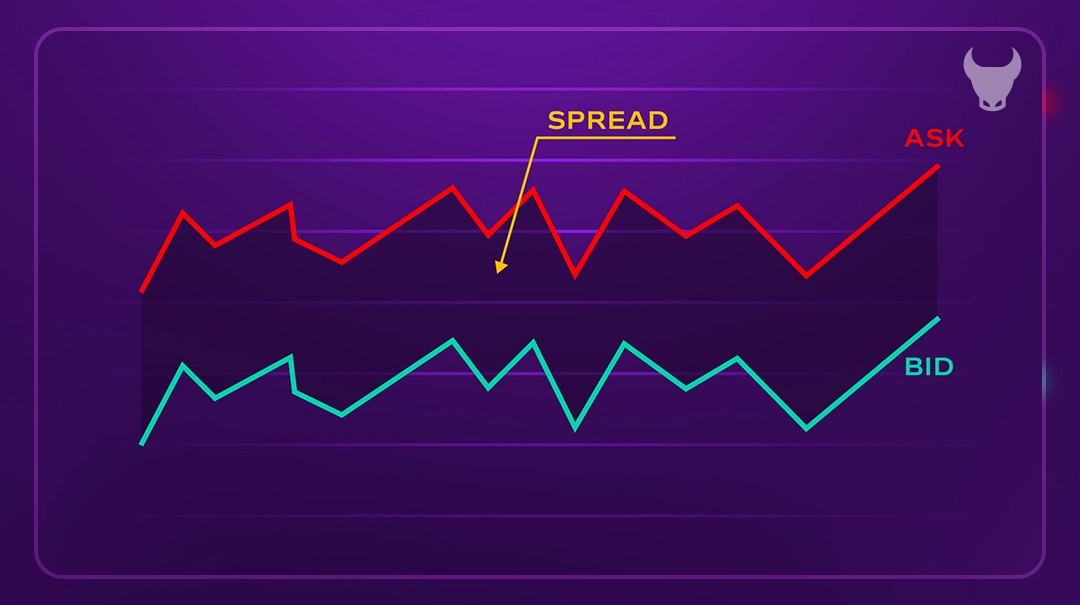

In the bustling trading world, the term spread is akin to the compass that navigates the seas of financial markets. Simply put, a spread is the difference between the bid and ask price of a financial asset. It’s the bridge between what buyers are willing to pay and what sellers are asking for.

Imagine you’re at a marketplace. One vendor is shouting, “I’ll buy apples for $1 each!” while another yells, “I’ll sell apples for $1.20 each!” The 20 cents difference between buying and selling price is the market’s spread for apples. In trading, this concept is universal, whether you’re dealing with stocks, forex, commodities, or cryptocurrencies.

The spread is more than just a number; it’s a reflection of an asset’s liquidity and market activity. A narrow spread indicates a high liquidity with lots of buyers and sellers making deals. A wider spread can signal less activity, or perhaps, a more volatile market.

For traders, the spread is a key factor in strategy. It represents the cost of entry and exit from the market. A lower spread means less cost to trade, which is why traders favor assets with tighter spreads. It’s the silent partner in every transaction, the unseen hand that guides the flow of trades.

Why is Spread Important?

The importance of spread in trading cannot be overstated. It’s the silent gatekeeper of the financial markets, influencing every trade you make. Here’s why spread matters:

1. Cost of Trading: Spread is essentially the cost you pay to enter and exit a trade. It’s the toll fee on the highway of trading. A lower spread means lower costs, which is why traders often seek out assets with tight spreads.

2. Market Liquidity: The size of the spread is a direct indicator of a market’s liquidity. A narrow spread signifies a healthy, active market with plenty of buyers and sellers. In contrast, a wide spread can indicate a sluggish market or one that’s not as frequently traded.

3. Trade Execution: Spread affects how quickly and at what price your trade is executed. In a market with a tight spread, orders are more likely to be filled at desirable prices. A wider spread can mean more slippage, where there’s a difference between the expected price of a trade and the price at which the trade is executed.

4. Price Transparency: The spread offers a transparent view of the market’s current pricing situation. It allows traders to gauge the best available prices for buying or selling, ensuring they make informed decisions.

5. Profit Potential: For traders, especially those who engage in short-term strategies like day trading, the spread can significantly impact profit margins. The smaller the spread, the less the price needs to move in your favor to break even or make a profit.

In essence, the spread is a vital component of trading that reflects the health of the market and influences your trading experience. It’s a key metric that traders monitor closely, as it can make the difference between a successful trade and one that falls short.

What is Spread in Crypto?

In the world of cryptocurrency trading, ‘spread’ is a term that often pops up, but what does it really mean? Spread, in simple terms, is the difference between the buy (bid) and sell (ask) price of a cryptocurrency. It’s a direct reflection of the market’s liquidity – a narrow spread suggests a high demand and supply, making it easier to trade without affecting the price too much.

Let’s break it down with an example. Imagine you’re eyeing Bitcoin, and you see two prices: one is the price at which people are ready to buy (bid), and the other is the price at which people are ready to sell (ask). The gap between these two is the spread. If the bid price is $39,000 and the ask price is $39,500, the spread is $500.

This spread is crucial because it represents the transaction cost for the trader – it’s the price you pay for the immediacy of the trade. In a market with a tight spread, you can execute trades quickly without a significant loss between the buy and sell prices. However, in markets with wider spreads, there’s a larger gap to bridge, which can affect both the entry and exit points of your trade.

How to Calculate Crypto Spread?

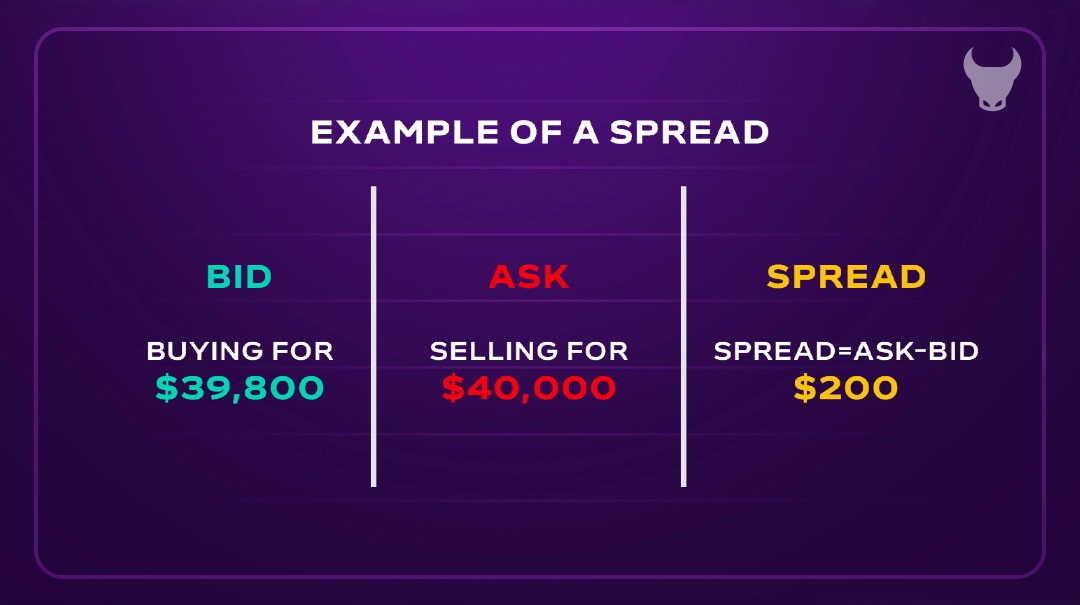

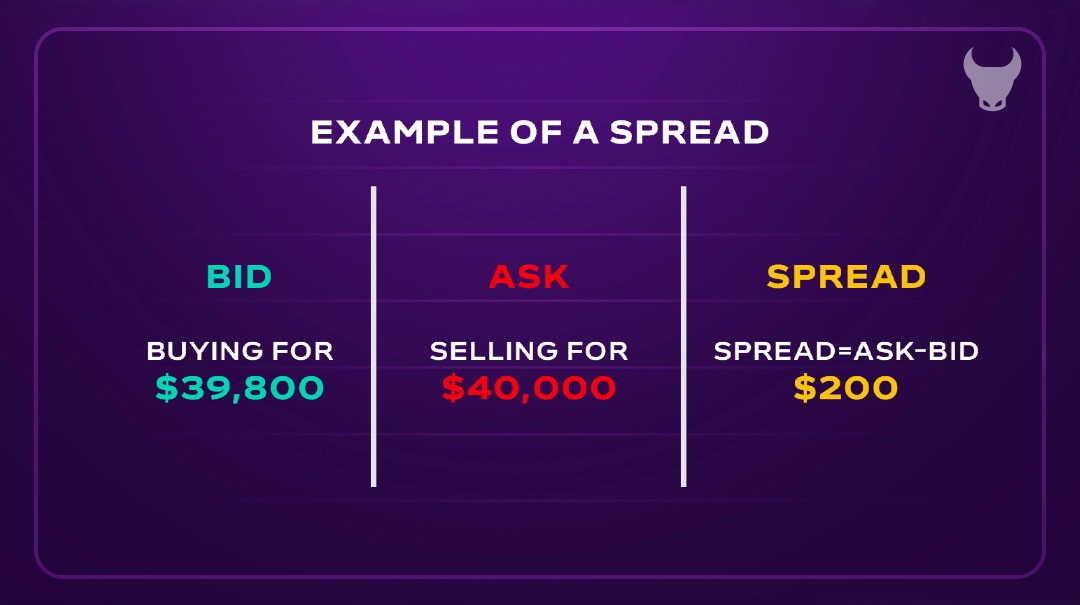

Calculating the spread in crypto trading is a straightforward process, but it’s an essential skill for any trader. The spread is the difference between the bid price (what buyers are willing to pay) and the ask price (what sellers are willing to accept). To calculate the spread, you simply subtract the bid price from the ask price.

Here’s the formula in a clear, step-by-step format:

1. Identify the Bid and Ask Prices: Look at the current trading pair, say BTC/USD. You’ll see two prices. The higher one is usually the ask price, and the lower one is the bid price.

2. Subtract the Bid Price from the Ask Price: This will give you the spread value.

For example, if the ask price for BTC is $40,000 and the bid price is $39,800, the spread would be:

3. Express the Spread as a Percentage (Optional): To understand the spread relative to the price, you can calculate the spread percentage. Divide the spread by the ask price and multiply by 100.

Using the same numbers:

This percentage gives you an idea of the cost relative to the asset’s price, which is particularly useful when comparing the spreads across different cryptocurrencies or trading platforms.

Remember, the spread can change rapidly due to market volatility, so it’s important to calculate it in real-time for the most accurate trading decisions.

How Spreads Apply to Crypto Trading?

When you step into the world of crypto trading, spreads become a fundamental aspect of your trading experience. They are the thin line that separates the bid and ask prices, and understanding them can be your key to successful trading.

In crypto trading, spreads are affected by various factors such as market volatility, liquidity, and trading volume. The spread can tell you a lot about the state of the market for a particular cryptocurrency. A tight spread in a highly liquid market means that the cryptocurrency is in high demand, allowing for quick trades that are close to the market price.

On the other hand, a wide spread could indicate a less liquid market or a period of higher volatility, where the difference between what buyers are willing to pay and what sellers are asking for is greater.

For traders, spreads are important because they represent the immediate cost of trading. A wider spread means that a trade has to move more in your favor to become profitable. This is especially crucial for short-term traders, like day traders, who rely on small price movements for gains. They typically prefer cryptocurrencies with tighter spreads to maximize their potential profits on each trade.

Moreover, spreads also reflect the efficiency of a cryptocurrency exchange. An exchange with narrow spreads and high liquidity is often a sign of a healthy trading environment. Traders should always be aware of the spreads when placing trades, as they directly impact the entry and exit points, and therefore, the potential profitability of the trades.

Types of Crypto Spreads

Navigating the crypto markets requires an understanding of the different types of spreads that can affect your trading decisions. Spreads in crypto can vary based on market conditions, and recognizing these variations is key to a trader’s arsenal.

1. Fixed Spread: This type of spread remains constant, regardless of the market’s ups and downs. It offers traders predictability in transaction costs, making it easier to calculate potential profits or losses.

2. Variable Spread: As the name suggests, variable spreads fluctuate with market conditions. During times of high volatility, the spread can widen significantly, affecting trade execution and costs.

3. Inter-exchange Spread: This spread is the difference in the price of the same cryptocurrency across different exchanges. It’s particularly relevant for traders who engage in arbitrage, seeking to profit from price discrepancies between markets.

4. Intra-exchange Spread: Within the same exchange, this spread refers to the price differences between related or deeply correlated assets. It’s a factor to consider when trading pairs of cryptocurrencies.

5. Calendar Spread: Found in the futures market, the calendar spread involves the difference in pricing between contracts with different expiration dates. It’s a strategy used by traders to take advantage of the varying time value of different contracts.

Factors Influencing Crypto Spread

When it comes to crypto trading, the spread is influenced by a variety of factors that can either tighten or widen the gap between the bid and ask prices. Understanding these factors is crucial for traders who want to maximize their potential profits and minimize costs. Here are the key elements that affect crypto spread:

1. Market Volatility: The more volatile the market, the wider the spread tends to be. This is because higher volatility increases the risk for market makers, leading them to compensate by setting a larger spread.

2. Liquidity: Liquidity is about how easily a cryptocurrency can be bought or sold in the market without affecting its price. Highly liquid cryptocurrencies usually have tighter spreads, as there’s a steady flow of buy and sell orders.

3. Trading Volume: A high trading volume indicates a lot of trading activity, which typically results in a narrower spread. More activity means more buyers and sellers, which often leads to a more competitive and tighter spread.

4. Market Demand and Supply: The basic economic principles of demand and supply also play a role. If a cryptocurrency is in high demand, the spread might narrow as more traders are willing to buy and sell at prices closer to each other.

5. Time of Day: The spread can also vary depending on the time of day. During peak trading hours when more traders are active, the spread is likely to be tighter due to increased liquidity.

6. News and Events: Significant news or events can cause sudden shifts in market sentiment, leading to changes in the spread. Positive news might narrow the spread due to increased buying pressure, while negative news could widen it.

How Crypto Spreads Affect Trading?

Crypto spreads are more than just numbers on a screen; they’re a vital part of the trading equation. The spread affects every aspect of a trade, from the initial decision to enter the market to the final tally of profits and losses. Here’s how:

1. Starting Behind: When you enter a trade, you’re immediately faced with the spread as a hurdle. It’s the initial gap between your buying price and the selling price, and you need the market to move in your favor just to break even.

2. Cost of Quick Entry or Exit: The spread is essentially the price you pay for the immediacy of a trade. In a fast-moving market, a tight spread allows you to jump in and out without a significant impact on your returns. A wider spread, however, can eat into your profits or deepen your losses.

3. Market Sentiment Indicator: The size of the spread can also serve as a barometer for market sentiment. A narrow spread often indicates a healthy, active market, while a wider spread may suggest uncertainty or lower liquidity.

4. Profit Margin Impact: For those looking to make a profit, the spread is a critical factor. The larger the spread, the more the market needs to move in your favor to achieve profitability. This is especially true for day traders and those using high-frequency trading strategies.

5. Strategy Shaper: Your trading strategy must account for the spread. Some strategies work best with tight spreads, while others can accommodate a wider spread. It’s a balancing act that requires careful consideration and constant adjustment.

In essence, the spread is a fundamental component of crypto trading that shapes your trading experience and potential success. It’s a constant companion, whispering the state of the market and influencing every click you make.

How to Minimize the Impact of Spread in Crypto Market?

Minimizing the impact of spread in the crypto market is a strategic move that can enhance your trading efficiency and profitability. Here are some practical steps to reduce the spread’s influence on your trades:

1. Trade in High Volume: Engaging in high-volume trading can often lead to more favorable spreads. This is because large volume orders attract more attention and can narrow the spread due to increased competition among market makers.

2. Choose Liquid Markets: Opt for cryptocurrencies and exchanges known for their liquidity. High liquidity means more buyers and sellers, which typically results in tighter spreads.

3. Trade during Peak Hours: Execute your trades during peak market hours when trading activity is at its highest. This can lead to a more competitive environment and potentially smaller spreads.

4. Use Limit Orders: Instead of market orders, use limit orders to specify the maximum price you’re willing to pay or the minimum price you’re willing to accept. This gives you control over the spread you’re willing to incur.

5. Choose Exchanges with Tight Spreads: Not all exchanges are created equal, and the spread can vary significantly from one platform to another. Do your homework and compare the spreads offered by different exchanges. Look for platforms that are known for competitive spreads, as this can make a substantial difference in your trading costs.

6. Stay Informed: Keep abreast of market news and trends. Being informed can help you anticipate periods of volatility when spreads might widen, allowing you to adjust your strategy accordingly.

By implementing these strategies, you can take proactive steps to minimize the impact of spreads on your crypto trading endeavors, leading to more precise control over your trade executions and the potential for improved financial outcomes.

Comparing Crypto Spread with Other Market Spreads

When we talk about spreads in the financial world, we’re looking at the heartbeat of the markets. Whether it’s cryptocurrencies, stocks, or forex, the spread is a universal indicator of market health and liquidity. However, each market has its own characteristics when it comes to spreads.

Cryptocurrency Spreads: In the crypto market, spreads can be quite volatile, reflecting the nascent and fast-paced nature of this space. Crypto spreads are influenced by market liquidity, trading volume, and the overall volatility of the market. Due to the 24/7 nature of the crypto markets, spreads can also fluctuate significantly outside of the traditional trading hours of other markets.

Stock Market Spreads: The stock market typically experiences less volatility in spreads compared to the crypto market. This is because stocks are traded on regulated exchanges with set trading hours, contributing to more stability. Moreover, the presence of market makers in stock exchanges often ensures tighter spreads during trading hours.

Forex Spreads: The forex market is renowned for having some of the tightest spreads among all financial markets. This is attributed to its high liquidity and the massive volume of trades that occur daily. Forex spreads are often less than a hundredth of a percent, making it a favorite for traders looking for minimal transaction costs.

How Crypto Spreads Differ and Why?

Crypto spreads differ from those in traditional financial markets, and understanding these differences is key to mastering the art of cryptocurrency trading. Here’s a closer look at how and why crypto spreads are unique:

24/7 Trading: Unlike traditional markets, which have set trading hours, the crypto market never sleeps. This constant activity can lead to more dynamic spread changes, influenced by global events at any hour of the day or night.

Market Maturity: The cryptocurrency market is relatively young compared to the stock and forex markets. This youthfulness can result in less stability and wider spreads as the market is still finding its equilibrium.

Liquidity Variations: Liquidity in the crypto market can vary greatly between different coins and exchanges. Popular cryptocurrencies like Bitcoin and Ethereum typically have tighter spreads due to higher liquidity, while lesser-known coins may have wider spreads.

Decentralization: The decentralized nature of cryptocurrencies means that there’s no single price for a coin across all platforms. This can lead to significant inter-exchange spread differences, offering arbitrage opportunities but also adding complexity to trading.

Volatility: Cryptocurrencies are known for their volatility, which can cause rapid and significant spread fluctuations. This volatility reflects the market’s reaction to news, trends, and investor sentiment.

Briefly, crypto spreads are shaped by the unique characteristics of the cryptocurrency market. They reflect the market’s nascent stage, its round-the-clock trading, and the varying liquidity and volatility of different coins.

Traders who understand these factors can navigate the crypto market more effectively, making informed decisions that take into account the impact of spreads on their trading strategies.

The Spread’s Impact on Trading Profits

When it comes to trading, whether you’re dealing with cryptocurrencies or any other financial instrument, the spread is a critical factor that directly influences your bottom line. Here’s how the spread can impact your trading profits:

Immediate Cost: As soon as you enter a trade, the spread is the first cost you encounter. It’s the difference you pay from the market price, and it represents the premium for instant market entry. For instance, if the spread for a cryptocurrency is $50, you’re starting $50 behind, needing the market to move in your favor by at least that much to break even.

Profit Threshold: The spread essentially sets the threshold for your trade to become profitable. A wider spread means you need a larger price movement in your favor to start making a profit. Conversely, a tighter spread means the market doesn’t have to move as much for you to see gains.

Profit Threshold: The spread essentially sets the threshold for your trade to become profitable. A wider spread means you need a larger price movement in your favor to start making a profit. Conversely, a tighter spread means the market doesn’t have to move as much for you to see gains.

Market Liquidity: The spread also reflects the liquidity of the market. In a highly liquid market, spreads are typically tighter, which can lead to more favorable trading conditions and potentially higher profits.

Conclusion

As we wrap up our exploration of spreads in the crypto trading world, it’s clear that they play a pivotal role in shaping the trading experience. From the immediate cost of entering a trade to the subtle nuances that influence profitability, spreads are a constant companion for every trader.

The importance of understanding crypto spreads cannot be overstated. It’s the cornerstone of making informed decisions that can lead to successful trades. A keen grasp of spreads empowers you to navigate the complexities of the market, manage risks, and capitalize on opportunities.

Continue your journey of learning and exploration. Dive deeper into the nuances of crypto trading, experiment with different strategies, and stay abreast of market trends. The more you engage with the market, the more adept you’ll become at leveraging spreads to your advantage.

FAQs

What is a typical spread in crypto trading?

Can spreads change during high volatility?

How do spreads impact long-term investments in crypto?

How do you calculate the spread in crypto?

What is the difference between slippage and spread?

How do you spread a bet on crypto?

How Do You Reduce the Spread of Crypto?

Why is the spread so high on crypto?

Does Binance have spread?

Is a spread bullish or bearish?

Which crypto has the lowest spread?

Article similaire

Le plus visité

0