One of the most frequently asked questions by traders in financial markets, particularly in the forex market, is: “How can spread be reduced?” or “What is the best method for reducing spread?” Spread refers to the difference between the bid and ask price of a currency pair or symbol in the forex market, and it can have a significant impact on the profit and loss of trades. In this article, the Trendo broker educational team will answer this important question. Stay with us.

What Is Spread?

Before examining the question of how to reduce spread or what is the best method for reducing spread, it is better to first review the concept of spread in the forex market.

Spread in the forex market refers to the difference between the bid price and the ask price of a currency pair or symbol. This difference, which is typically displayed in pips (pipettes), is considered the cost of trading and directly affects the trader’s final profit. In other words, the lower the spread, the lower the trading cost, and consequently, the trader’s final profit will increase.

In the forex market, spread is generally divided into two types:

- Fixed Spread: This type of spread has a constant value under all market conditions and is determined by the broker.

- Floating Spread: This type of spread changes based on liquidity levels and real-time market conditions. Floating spread is usually lower than fixed spread.

The Best Method for Reducing Spread

Now we come to the question: how can spread be reduced? Or what is the best method for trading in conditions of low spread?

As explained in the definition of spread, traders alone have no role in determining the spread level and cannot directly influence it. But there is no need to worry! Although traders cannot directly reduce spread, through smart choices, they can trade under conditions where spread is at its lowest possible level. For this purpose, consider the following points:

1) Choosing a Broker with the Lowest Spread

Brokers play a key role in determining spread. They may offer fixed or variable spreads, which depends on their internal policies and the types of trading accounts they provide. When choosing a broker, consider the following criteria:

- Spread and Commission Levels: Choose a broker that offers the lowest level of spread and commission.

- Reputation and Regulatory Licenses: Select a broker that is supervised by reputable international regulatory bodies and has a trustworthy track record.

- Trading Platform: The trading platform should be user-friendly, fast, and equipped with professional analytical tools.

- Customer Support: The broker should provide strong support services with 24-hour responsiveness.

Based on the criteria mentioned, one of the best choices for traders seeking the lowest spread and commission is Trendo broker, as Trendo broker, in addition to offering the lowest spreads (zero spread on major currency pairs) and the lowest commission, also provides one of the best trading platforms. Trendo has its own proprietary platform and, moreover, has features including 24-hour support even on holidays, offering diverse and attractive promotional schemes, providing instant deposit and withdrawal methods, offering weekly analysis, and more.

Download the Trendo trading platform and receive a free $100 bonus

2) Choosing the Right Trading Time

Another effective method for trading with minimum spread is choosing the right time to trade. At certain hours of the day, financial markets have higher liquidity, which leads to reduced spread. For example, during the London and New York trading sessions, the spread on major currency pairs at Trendo broker is zero, or the spread on the gold symbol (XAUUSD) during these hours at Trendo is less than one pip, which is unparalleled compared to other brokers (approximately 2 pips). It can roughly be said that the spread at other brokers is usually twice as much as the spread on trading symbols at Trendo broker. To view Trendo broker’s real spreads, you can take action through one of the following methods on days when the market is open:

- Visit the live prices page

- Visit the Trendo trading platform

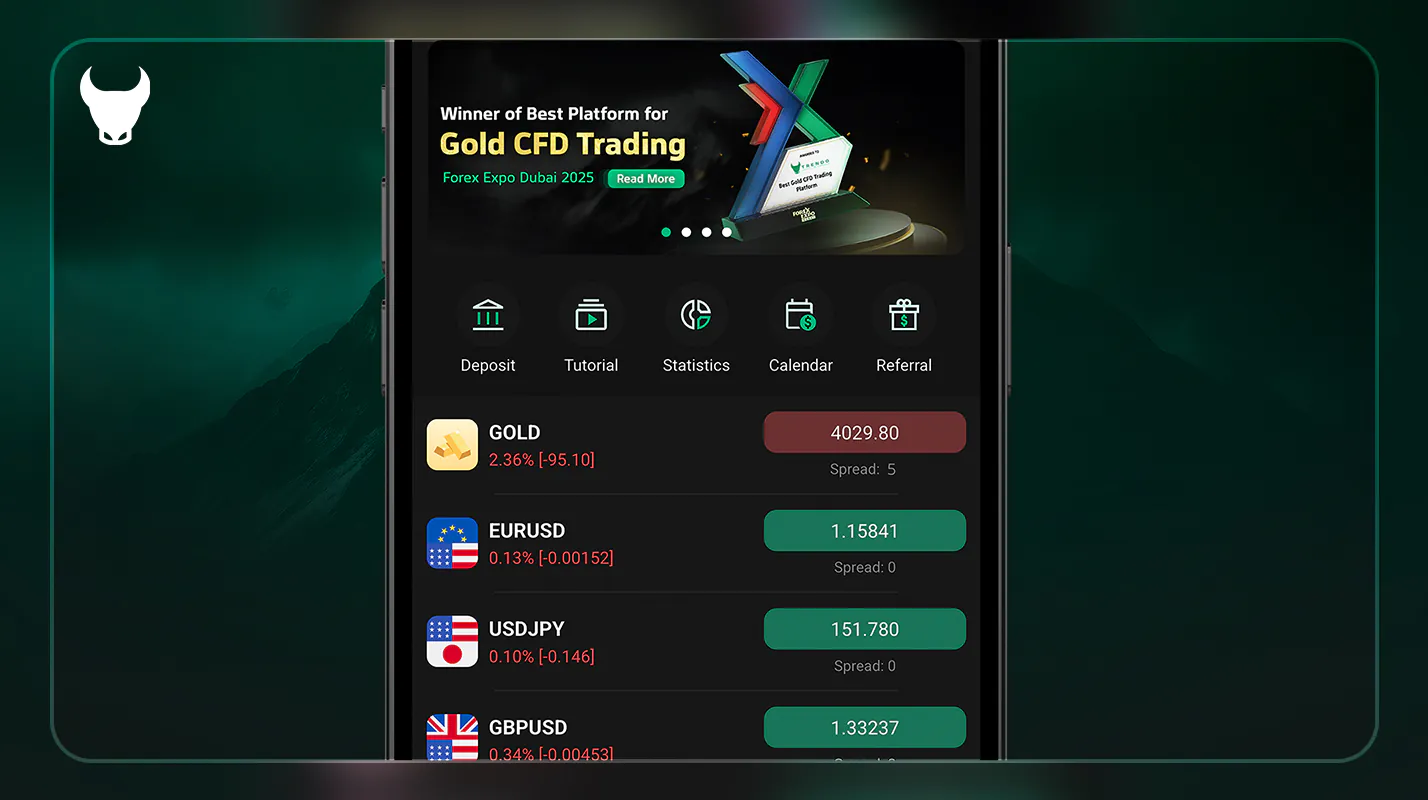

In the image below, you can also view the spread of some trading symbols at Trendo broker:

3) Avoiding Trades During Extreme Market Volatility

One of the key principles in trade risk management is avoiding entering new trades at times when the market is experiencing extreme volatility. This volatility typically occurs in response to major economic events or the release of impactful news and can have significant effects on price behavior. Under such conditions, spread increases dramatically, which can raise trading costs and increase the risk of loss for traders.

One of the essential tools that professional traders use to stay informed about market events is the forex economic calendar. The economic calendar provides accurate information about the timing of the release of reports and important economic news, such as interest rates, Gross Domestic Product (GDP), Consumer Price Index (CPI), and other key data. By regularly reviewing this calendar, traders can anticipate when the market might experience extreme volatility and adjust their trading strategy accordingly.

Conclusion

Ultimately, you should note that your role in reducing spread is limited to choosing the right time to trade and selecting the appropriate broker. By following these points, you can reduce your trading costs and earn more profit from your trades. By trading during the London and New York sessions and choosing Trendo broker, you can experience the lowest possible spread and get closer to your financial goals.

Register with Trendo broker and trade with the lowest spread