How to Reduce Spread in Forex Trading? Ultimate Guide to Reduce Spread in Forex

As the difference between the bid and ask price, a lower spread means you’re stepping into the market closer to your desired price point, enhancing potential profitability.

Whether you’re a seasoned trader or just starting out, understanding how to minimize the spread is crucial for optimizing your trading strategy.

This ultimate guide will walk you through practical steps to reduce the spread in Forex trading, ensuring that you’re not leaving money on the table. From choosing the right broker to timing your trades for maximum efficiency, we’ll cover all the bases to help you trade smarter, not harder.

So, let’s dive into the world of pips and points, and tighten those spreads to give your trades the edge they deserve.

Contents

What is the Spread in Forex Trading?

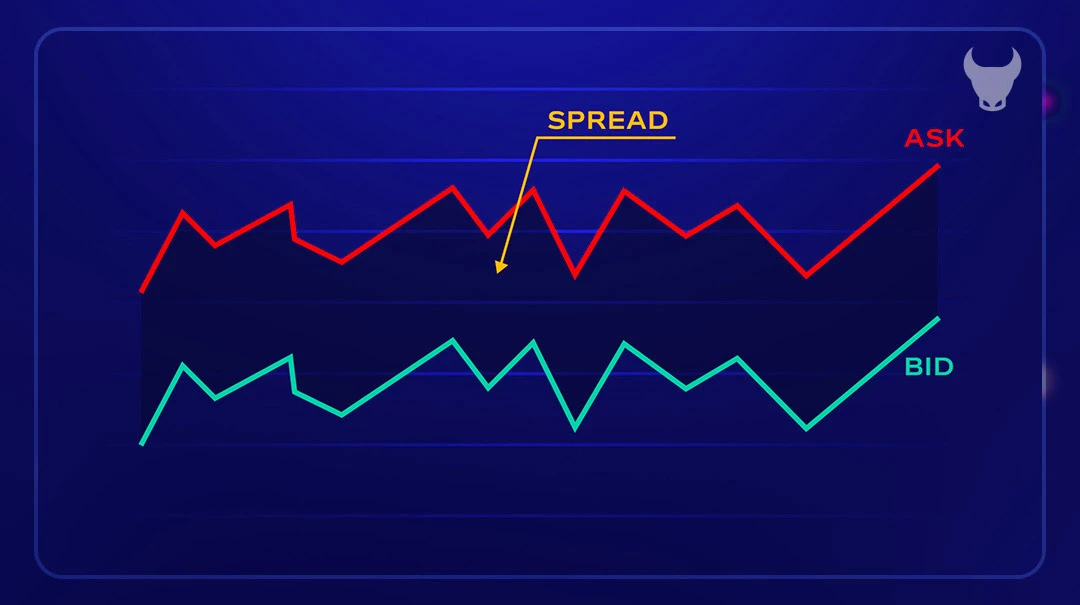

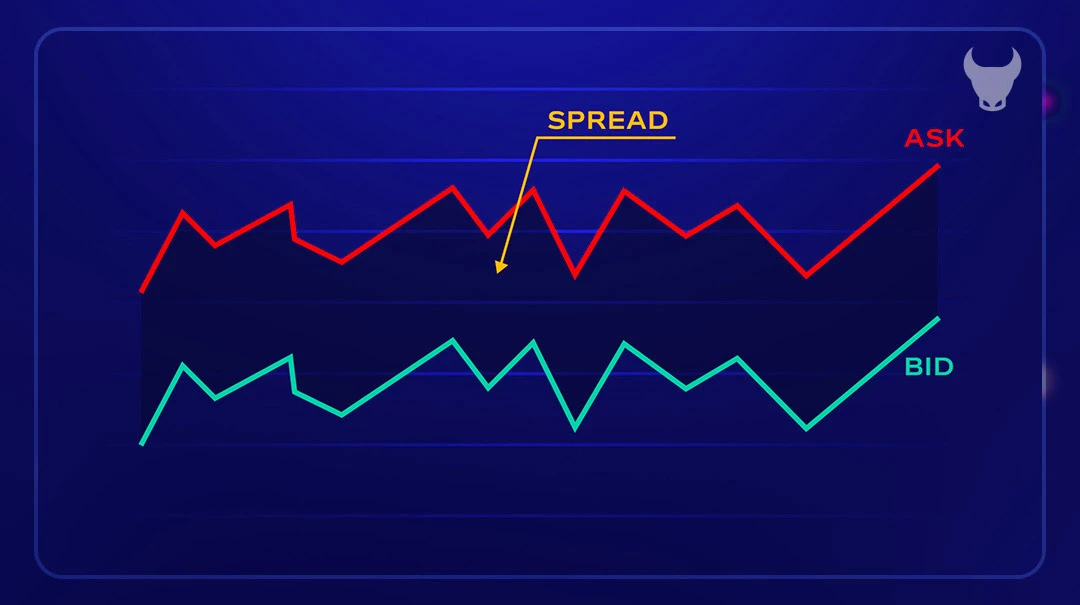

In the Forex trading, the term spread is frequently used. But what exactly does it mean? Simply put, the spread is the difference between the bid price and the ask price of a currency pair.

The bid price is the highest price that a buyer (the bidder) is willing to pay for a currency. On the other hand, the ask price is the lowest price that a seller (the asker) is ready to accept. When you’re buying a currency pair, you’ll do so at the ask price, and when you’re selling, you’ll do so at the bid price.

The spread is essentially the cost of trading that you pay to your broker. It’s how most brokers make their money. A lower spread means less cost for you and higher potential profits. Conversely, a higher spread means it could take longer for your trades to become profitable.

How to Calculate Spread?

Calculating the spread in Forex trading is a straightforward process. It involves subtracting the bid price from the ask price. Here’s a simple step-by-step guide on how to do it:

1. Identify the Bid and Ask Prices: The first step is to identify the bid and ask prices for the currency pair you’re interested in. These prices are usually provided by your Forex broker.

2. Subtract the Bid Price from the Ask Price: Once you have the bid and ask prices, subtract the bid price from the ask price. The result is the spread.

For example, let’s say the bid price for the EUR/USD currency pair is 1.1200, and the ask price is 1.1202. The spread would be calculated as follows:

Spread = Ask Price−Bid Price = 1.1202−1.1200 = 0.0002

This result, 0.0002, is also known as 2 pips. In Forex trading, a pip is the smallest price move that a given exchange rate can make based on market convention. Most currency pairs are priced to four decimal places and the smallest change is the last (fourth) decimal point.

Read more: The Difference between Spread & Commission

Forex Spread Types

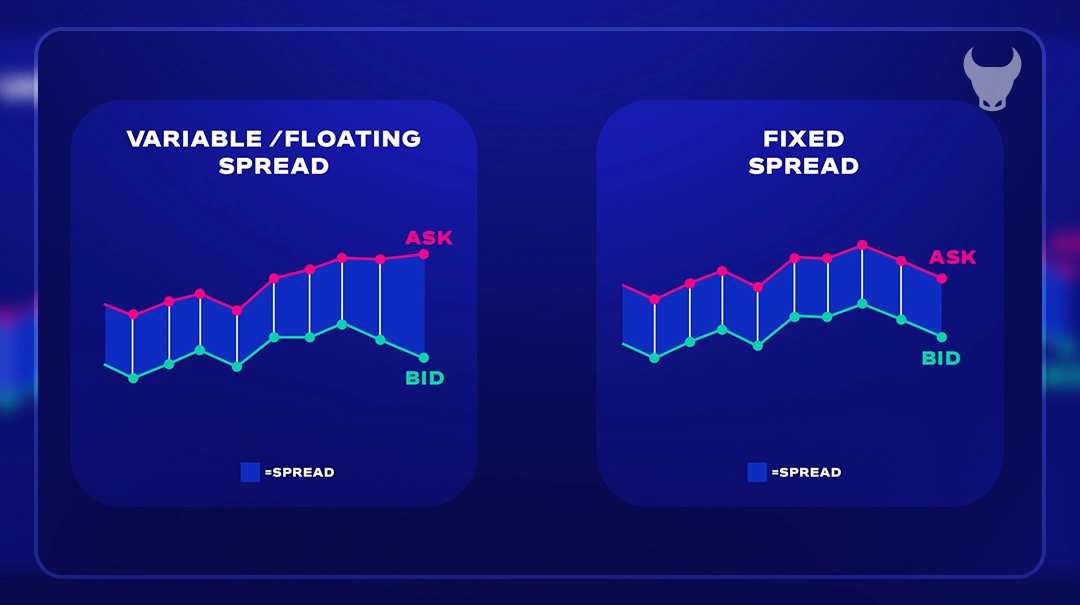

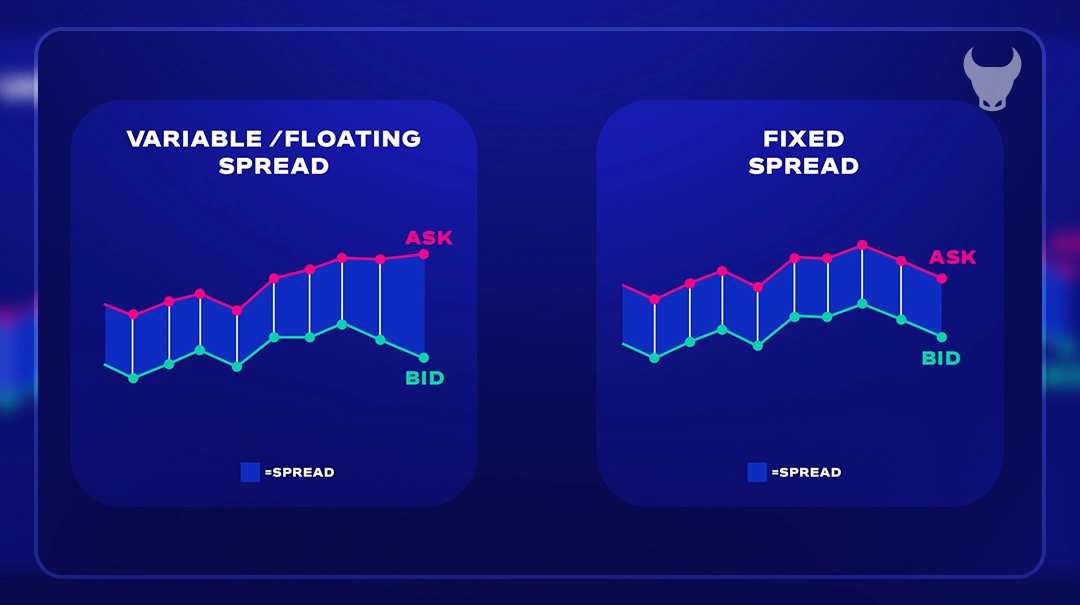

When you’re navigating the Forex market, understanding the different types of spreads can be as important as knowing the layout of a new city. There are mainly two types of spreads in Forex: fixed and variable.

Fixed spreads remain constant, regardless of market conditions. They’re like a flat fee, providing a sense of stability and predictability. This can be particularly appealing if you’re trading during news events or volatile market hours when spreads can widen. However, fixed spreads are typically wider than the average variable spreads, as brokers need to cover the risk of market fluctuations.

On the other hand, variable spreads fluctuate with market conditions. They can be as narrow as 0 pips and widen significantly when there’s major economic news or events causing volatility. Variable spreads reflect the true market conditions and can be lower than fixed spreads during times of liquidity and normal market conditions.

Some brokers also offer a hybrid spread model, which combines elements of both fixed and variable spreads. This model can adapt to different trading styles and strategies, offering flexibility and potentially lower costs under certain conditions.

How Spread Impacts Forex Trading?

The spread in Forex trading is like the ripples caused by a stone thrown into a pond; its impact can be far-reaching. A trader must understand that the spread is not just a cost, but it also affects how and when you trade.

Immediate Impact: The most direct impact of the spread is on your trading costs. Every time you enter a trade, the spread is the first hurdle you face. A higher spread means a higher initial cost, and you’ll need the market to move more in your favor just to break even.

Influence on Strategy: Your trading strategy might need to be adjusted based on the spread. For scalpers and day traders, who make a large number of trades for small profits, a lower spread is crucial. For longer-term traders, while still important, the spread’s impact is less pronounced.

Market Entry and Exit: The spread can influence when you decide to enter or exit the market. A wider spread might discourage you from taking a quick trade, while a narrower spread could make short-term trades more viable.

Profitability: Ultimately, the spread affects your bottom line. A lower spread can lead to higher profitability, as less of your profit is eaten up by trading costs. Conversely, a high spread can significantly cut into your profits, especially if you’re making frequent trades.

What Factors Influence the Spread?

Several factors can influence the spread in Forex trading. Understanding these can help you anticipate changes in the spread and adjust your trading strategy accordingly. Here are some key factors:

1. Market Liquidity: Liquidity refers to the ability to buy or sell a currency without causing a significant price movement. Currency pairs with high liquidity (like EUR/USD or USD/JPY) typically have narrower spreads than less liquid pairs.

2. Volatility: During periods of high market volatility, spreads often widen. This is because brokers face higher risk and increase the spread to compensate.

3. Economic Events: Major economic events, such as interest rate decisions or employment reports, can cause spreads to widen due to increased volatility and uncertainty in the market.

4. Trading Sessions: The Forex market operates 24/5, and the spread can vary depending on the time of day. When major markets like London or New York are open, spreads tend to be tighter due to higher trading volume.

5. Broker’s Policies: Each Forex broker has its own policies and methods for calculating the spread. Some brokers offer fixed spreads, while others offer variable spreads.

6. Political Events: Political instability or changes in government policies can lead to increased market volatility, which can result in wider spreads.

7. Currency Pairs: Not all currency pairs are created equal. Major pairs like EUR/USD typically have tighter spreads compared to exotic pairs, which can have much wider spreads due to lower liquidity.

By understanding these factors, you can better anticipate changes in the spread and make more informed trading decisions

How to Reduce Spread in Forex Trading? Strategies to Reduce Spread in Forex Trading

Reducing the spread in Forex trading is akin to finding the best deals when shopping; it requires a bit of research, timing, and strategy. Here are some strategies that can help you reduce the spread and keep more of your profits:

1.Choose the Right Broker : Not all brokers are created equal. Some offer tighter spreads than others. It’s essential to shop around and compare the spreads offered by different brokers, especially during the times you plan to trade.

2. Trade during Peak Hours: The Forex market sees the highest liquidity when major markets overlap, such as the London and New York sessions. Trading during these times can result in tighter spreads due to the high volume of transactions.

3. Focus on Major Currency Pairs: Major pairs like EUR/USD, GBP/USD, and USD/JPY tend to have tighter spreads compared to exotic pairs. This is because they are traded more frequently, which increases liquidity and decreases the spread.

4. Use Limit Orders: A limit order allows you to enter the market at a specific price. By using limit orders instead of market orders, you can avoid trading at prices with wider spreads that can occur during volatile market movements.

5. Avoid Significant News Releases: Economic announcements can cause volatility, which can lead to wider spreads. By timing your trades to avoid these periods, you can benefit from more stable spreads.

6. Consider a Fixed Spread Account: If you prefer predictability and stability in your trading costs, a fixed spread account might be suitable for you. While fixed spreads are generally wider, they don’t widen during news events or volatile market conditions.

7. Consider Using a Spread Indicator: A spread indicator can help you monitor the spread in real-time and make more informed trading decisions.

Advanced Techniques for Reducing Forex Spread

As a Forex trader looking to trim the spread, you can adopt some advanced techniques that go beyond the basics. These strategies require a deeper understanding of market mechanics but can lead to significant savings on your trades.

1. Arbitrage: This involves buying and selling the same currency pair from different brokers to take advantage of the discrepancies in spreads. It’s a sophisticated strategy that requires fast execution and access to multiple trading platforms.

2. Scalping: A strategy that involves making numerous trades to profit from small price changes. Scalpers benefit from low spreads and must have the ability to make quick decisions and execute trades rapidly.

3. Trading with ECN Brokers: ECN (Electronic Communication Network) brokers provide traders direct access to other market participants. Trading with an ECN broker can offer lower spreads because they match trades between market participants directly.

4. Automated Trading Systems: Using algorithms and bots can help you trade at the best possible spreads. These systems can monitor multiple currency pairs and execute trades when the spread narrows to your desired level.

5. Price Action Trading: This technique involves analyzing the historical price movements to make trading decisions. By understanding price action, you can predict when the spread might be lower and plan your trades accordingly.

6. Market Depth Monitoring: Some platforms offer market depth information which shows the volume of orders at different price levels. By analyzing this data, you can gauge liquidity and potentially predict spread fluctuations.

7. Hedging: This involves opening multiple positions to protect against market fluctuations. While it doesn’t reduce the spread per se, it can minimize its impact on your overall trading costs.

8. Using Spread Alerts: Some trading platforms offer the option to set up alerts when the spread reaches a certain level. This can help you avoid trading when the spread is too high.

Practical Tips for Reducing Spread

Navigating the Forex market efficiently means being savvy about reducing the spread. Here are some practical tips that can help you tighten those spreads and keep your trading costs down:

1. Monitor the Economic Calendar: Stay ahead of the game by keeping an eye on the economic calendar. By planning your trades around major economic announcements, you can avoid the spread-widening effects of market volatility.

2. Use a Demo Account: Practice makes perfect. Use a demo account to test out different strategies for reducing the spread without any financial risk. This hands-on experience is invaluable.

3. Keep It Simple with Major Pairs: Stick to trading major currency pairs. They tend to have the most liquidity, which usually translates into lower spreads.

4. Be a Night Owl or an Early Bird: Consider trading during off-peak hours when spreads can be lower. This requires understanding the global Forex market hours and finding the sweet spot for your specific currency pairs.

5. Leverage Technology: Use trading platforms that offer real-time spread information. This way, you can monitor spreads as they fluctuate and execute trades when they narrow.

6. Negotiate with Your Broker: Don’t be afraid to negotiate better spread rates with your broker, especially if you’re trading large volumes.

7. Stay Informed: Keep up with market news and trends. The more informed you are, the better you can predict spread behavior and make smart trading decisions.

By incorporating these tips into your trading routine, you can work towards minimizing the spread’s impact on your trades. Remember, even small reductions in the spread can lead to significant savings over time, enhancing your overall trading performance.

Conclusion

As we wrap up our exploration of Forex trading, it’s clear that the spread is more than just a number—it’s a critical element that can shape the outcome of your trades. We’ve delved into various strategies to reduce the spread, from choosing the right broker and trading during peak hours to focusing on major currency pairs and employing advanced techniques.

Reducing the spread is not a one-time task but an ongoing process of learning and adaptation. The Forex market is ever-changing, and so should your strategies be. Continuous learning is key; staying updated with market trends, economic news, and technological advancements will empower you to make informed decisions.

Embrace the journey of Forex trading with an open mind and a commitment to improvement. Each trade is an opportunity to refine your approach and enhance your financial acumen. With diligence and adaptability, you can navigate the Forex waters, keeping spreads tight and your prospects for profitability robust.

Frequently Asked Questions

What is a spread?

What are the most common methods of reducing Spread?

What is the best way to reduce spread?

How to get low spread in forex?

How do you change spreads in forex?

Why my forex are spreads so high?

What is a good spread for forex?

پست مرتبط

پربازدیدترین ها

0