What Is EUR/USD? A Complete Review for the Euro-Dollar Symbol (EURUSD)

The EURUSD currency pair is the most important symbol in the forex market, providing many profitable opportunities for traders.

At the core of this bustling market is the EUR/USD pair. Representing the euro against the US dollar, it's the most traded currency pair globally. Its significance for traders and investors cannot be overstated; it’s a key barometer for the health of both the European and American economies.

Whether you're a novice or a seasoned trader, grasping the dynamics of EUR/USD will enhance your trading strategy and decision-making. From historical trends to market influences, this comprehensive review delves into everything you need to know about the Euro-Dollar symbol.

Contents

What is Forex?

The foreign exchange market, or Forex, is the largest and most liquid financial market in the world. It involves trading currencies between individuals, companies, and governments. Forex operates 24 hours a day, five days a week, and encompasses transactions totaling over $6 trillion each day. This vast market is decentralized, meaning there is no central exchange or clearinghouse.

In Forex, currencies are traded in pairs, such as EUR/USD, GBP/JPY, or AUD/CAD. The value of one currency is determined in relation to another, and traders aim to profit from fluctuations in these exchange rates. Major players in the Forex market include central banks, commercial banks, financial institutions, corporations, and individual traders.

Forex is crucial for international trade and investment, as it facilitates currency conversion for global businesses. For instance, a German company importing goods from Japan will need to exchange euros for yen.

What Is EUR/USD?

Every currency pair in the Forex market consists of two parts. In the EUR/USD pair, the base currency is the euro (EUR) and the quote currency is the US dollar (USD). The euro is the official currency of 19 countries that form the Eurozone, and they are key members of the 27 nations in the European Union. The euro is the second most-held reserve currency in the world, after the US dollar, and over 300 million people in Europe use it daily.

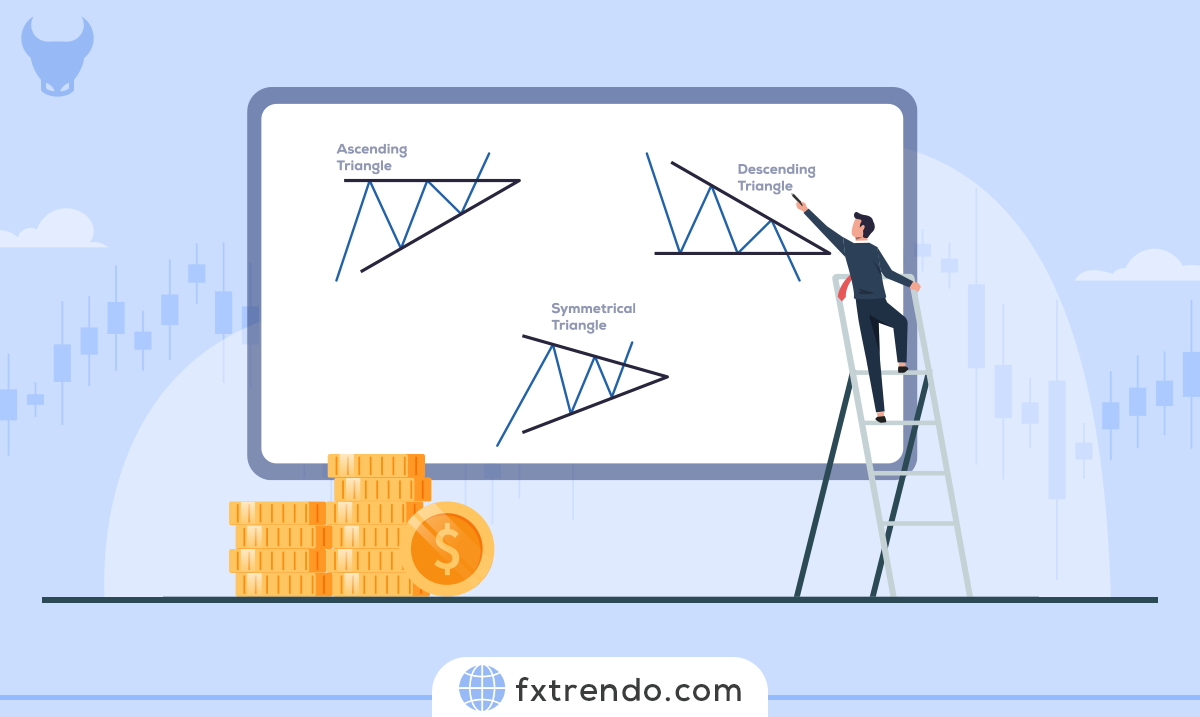

About 30% of the total daily trading volume in the Forex market involves this pair, making it essential to understand the characteristics and movements of EUR/USD. Successful trading in the EUR/USD pair requires combining technical analysis with fundamental analysis . Profitability is challenging with just one of these approaches, except for scalping trades.

It's worth noting that the EUR/USD pair typically has the lowest commission and trading spread among brokers. This makes EUR/USD the most attractive and best choice for scalpers. In Trendo brokers , the spread on EUR/USD is often zero, allowing you to trade this pair with minimal commission.

Economic Factors Affecting the EUR/USD Symbol

Success in the Forex market requires understanding key economic factors that influence currency movements. One of the critical questions for any trader is identifying the best currency pair to trade and predicting its trend. While predicting the future with certainty is impossible, several economic factors can help in making informed decisions. Some key factors impacting the EUR/USD pair include:

Economic Strength of the US and the EU: The relative economic strength of the US and the European Union plays a significant role in the movement of the EUR/USD pair.

The main factor that affects the direction of the EURUSD currency pair is the economic strength of the United States and the European Union.

If the US economy grows faster than the EU’s, the US dollar will likely strengthen against the euro. Conversely, if the EU's economy outpaces the US, the euro may gain strength relative to the dollar.

Interest Rates: Interest rates set by the Federal Reserve (Fed) in the US and the European Central Bank (ECB) in the EU are crucial. Generally, higher interest rates attract foreign capital, boosting the value of the currency. Comparing the interest rates of the US and the EU can indicate potential movements in the EUR/USD pair.

Employment Data: Employment figures in both regions significantly impact the EUR/USD pair. For example, the US Non-Farm Payroll (NFP) data, released on the first Friday of every month, is a critical economic indicator. Similarly, employment data from the Eurozone also affects the euro and, consequently, the EUR/USD pair.

Key Economic Indicators: Other essential economic indicators include the Consumer Price Index (CPI), Gross Domestic Product (GDP), trade balance, Producer Price Index (PPI), and retail sales. These indicators are periodically released for both the US and the Eurozone and can influence the EUR/USD value, especially if the reported figures deviate significantly from expectations.

Political Conditions: Political stability is another vital factor. Political instability in the Eurozone can lead to a stronger US dollar against the euro. Similarly, political turmoil in the US can weaken the dollar. Any factor that changes the economic outlook of a country is crucial for traders and has a visible impact on the market.

Being aware of these economic factors and regularly following economic calendars is essential for making informed trading decisions in the Forex market.

Advantages and Risks of Trading EUR/USD

Trading the EUR/USD pair comes with its own set of advantages and risks. Let's break them down simply and clearly:

Advantages

High Liquidity: The EUR/USD is the most traded currency pair in the Forex market. Its high liquidity means traders can easily enter and exit positions with minimal slippage, ensuring smoother transactions.

Tight Spreads: Due to its popularity, the EUR/USD pair often has the tightest spreads among brokers, reducing trading costs for investors.

Rich Information: There is an abundance of information and analysis available on the EUR/USD pair. This wealth of data helps traders make informed decisions.

Economic Stability: Both the euro and the US dollar are backed by strong and stable economies. This stability can provide some predictability in trading, making it a less volatile option compared to other currency pairs.

Risks

Economic Dependence: The EUR/USD pair is heavily influenced by economic events in the Eurozone and the US. Economic reports, central bank announcements, and political events can cause significant price swings.

Interest Rate Changes: Interest rate decisions by the Federal Reserve and the European Central Bank can sharply impact the EUR/USD pair. Sudden rate changes can lead to unexpected market movements.

Geopolitical Risks: Political instability in either the US or the Eurozone can affect the EUR/USD exchange rate. Unpredictable political events can lead to increased volatility.

Market Sentiment: The sentiment of traders and investors towards the Eurozone or the US economy can drive the EUR/USD pair. Market sentiment is often influenced by news and macroeconomic trends, making it sometimes difficult to predict.

When is the Best Time to Trade the EUR/USD Currency Pair?

The EUR/USD is the most active currency pair in the Forex market, boasting the highest trading volume. Trading volume surges when European markets open for business. Similarly, when U.S. markets are open, significant trades occur in the EUR/USD pair.

However, the peak liquidity happens during the overlap of these two markets. This overlap period offers the highest liquidity, making it the ideal time for day trading and scalping. During these hours, the market is bustling, providing ample opportunities for traders to execute their strategies efficiently.

Understanding the best times to trade EUR/USD can enhance your trading performance and help you capitalize on the market's dynamics.

Correlation of the Euro to Dollar Currency Pair with Other Symbols

When trading the EUR/USD pair, it's crucial to recognize its correlations with other currency pairs. For example, there is often a positive correlation between EUR/USD and pairs like GBP/USD and AUD/USD. This means that these pairs tend to move in the same direction. Understanding these correlations can help you make more informed trading decisions.

Paying attention to these correlations can prevent you from opening positions in multiple correlated pairs simultaneously, which would increase your trading risk. The similar movements of these pairs mean that if one trade goes against you, the others are likely to do the same, magnifying your losses.

By being aware of these relationships, you can manage your risks more effectively and make better trading choices.

Read more: What Is Correlation In Forex? The Role Of Correlation In Trading

Conclusion

In this article, we've examined the EUR/USD currency pair, which boasts the highest liquidity in the Forex market.

The EUR/USD is the most important currency pair due to its high volume and minimal commission and spreads offered by most brokers, making it highly attractive to traders.

Analyzing the economic factors of the US and the European Union is crucial in determining the direction of this pair. The relative economic strength, interest rates, employment data, and other economic indicators are key factors in analyzing and predicting EUR/USD movements.

For successful trading with the EUR/USD pair, combining technical and fundamental analysis is essential. Additionally, risk and money management are critical to executing trades effectively.

FAQ

1. Under what symbol is the EUR/USD currency pair offered on the Trendo broker?

2. When is the best time to trade EURUSD?

3. What is the EURUSD spread and commission in Forex?

4. Why is the Eurodollar symbol the most suitable option for scalping?

5. What are the news factors that affect the EURUSD symbol?

پست مرتبط

پربازدیدترین ها

0