بازارهای مالی از جمله بازار فارکس به ندرت به صورت مستقل حرکت می کنند. یک روند در یک دارایی اغلب با چندین دارایی دیگر در ارتباط است، به این معنی که برخی از قیمت ها با کاهش برخی دیگر افزایش می یابند. این اثر همبستگی بازارهای مالی نامیده می شود و با اینکه می تواند برای شناسایی فرصت ها مفید باشد، اما اگر مراقب نباشید می تواند ریسک شما را افزایش دهد. با درک نحوه عملکرد همبستگی در فارکس ، می توانید گام مهمی در جهت کاهش ریسک کلی خود بردارید.

همبستگی یا کورولیشن در بازار های مالی چیست؟

همبستگی یا کورولیشن (correlations) در بازار های مالی از جمله فارکس اندازه گیری میزان حرکت دارایی ها در راستای یکدیگر است. دارايی ها و ارز ها در بازار مالی به دلايل مختلف همچون ارتباط دارايی ها با يكديگر ، ارتباط كشورها از نظر اقتصادی، صنعتی و سياسی از يكديگر تاثير مي پردازند. شما می توانید همبستگی کل دارایی ها و نمادها در فارکس را اندازه گیری کنید. ضریب همبستگی یک عدد بین بازه 1- تا 1+ است و معمولاً به صورت درصد نیز بیان می شود. اگر دو بازار 100% همبستگی داشته باشند، حرکت آنها همیشه مشابه خواهد بود و به آن همبستگی کامل می گویند. در عین حال، یک همبستگی 50 درصدی به این معنی است که این دو بازار تقریبا در یک جهت حرکت می کنند، اما ممکن است همیشه همدیگر را دنبال نکنند.

انواع همبستگی

سه نوع همبستگی وجود دارد:

- همبستگی مثبت، بازارهایی را توصیف می کند که حرکات یکدیگر را تقلید می کنند و در راستای هم حرکت میکنند.

- همبستگی منفی، بازارها را با حرکات معکوس توصیف می کند و در خلاف هم حرکت میکنند.

- همبستگی صفر، بازارهایی را بدون هیچ رابطه ای توصیف می کند.

همبستگی جفت ارزهای فارکس

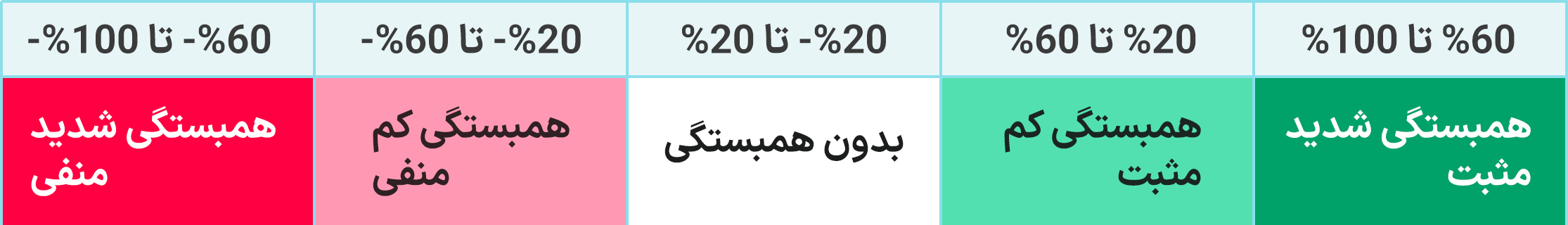

در اینجا یک جدول ضریب همبستگی برای جفت ارزهای اصلی فارکس وجود دارد که نشان می دهد میزان و نوع همبستگی این جفت ارزها با یکدیگر در یک دوره چگونه است.به طور مثال جفت ارز EUR/USD بيشترين همبستگی از نوع مثبت به ميزان 77%+ را با GBP/USD دارد اين بدان معناست در صورتی كه جفت ارز يورو دلار رشد كند به احتمال 77% جفت ارز پوند دلار نيز صعود میکنند و همسو با یکدیگر حركت ميكنند و EUR/USD با جفت ارز USDCAD همبستگی شديد منفی به ميزان 79%- دارد اين بدان معناست در صورتی كه جفت ارز يورو دلار رشد كند به احتمال 79% جفت ارز دلار كد نزول میکنند و و اين دو جفت ارز در خلاف هم حركت ميكنند.

همچنين در جدول بالا مشاهده ميكنيد جفت ارز GBP/USD با جفت ارز GBP/JPY همبستگی مثبت شديد به ميزان 88%+ دارد در هر دو نماد ارز اول پوند انگلستان است. ميتوان نتيجه گرفت اين همبستگی مثبت شديد به دليل حركات هم راستا دلار آمريكا و ين ژاپن است.

کدام جفت ارزها همبستگی بیشتری دارند؟

همانطور که در جدول بالا مشاهده می شود، جفت ارزهای کلیدی که بیشترین همبستگی را دارند شامل EUR/USD و GBP/USD هستند. آنها اغلب به دلیل روابط اقتصادی بین کشورهای اروپایی حرکات مشابهی دارند.در این مورد، GBP و EUR بر اساس نزدیکی جغرافیایی مشترک منطقه یورو و بریتانیا و همچنین وضعیت ارز ذخیره پشتیبان، روابط نزدیکی دارند. همچنین، این واقعیت که هر دوی این جفت ارزها دلار را به عنوان یک ارز متقابل به اشتراک می گذارند به این معنی است که هر تغییری در دلار به طور همزمان در هر دو جفت ارز منعکس می شود.

جفت ارزهای دیگری که تمایل به نشان دادن همبستگی قوی دارند جفت ارزهای AUD/USD و NZD/USD هستند استرالیا و نیوزلند نیز از نظر جغرافیایی و اقتصادی و صنعتی به یکدیگر بسیار نزدیک هستند.

ارزهایی که به طور کلی به عنوان “دارایی کم ریسک” شناخته می شوند (فرانک سوئیس و ین ژاپن) نیز همبستگی خوبی میتوانند با یکدیگر نشان دهند.

ارزهایی که به طور کلی به عنوان “ارزهای کالایی” شناخته می شوند (دلار کانادا و استرالیا و نیوزلند) نیز همبستگی خوبی با یکدیگر نشان می دهند را نشان می دهند.

چرا همبستگی ها مهم هستند؟

همبستگیها میتوانند تأثیر قابلتوجهی بر سطح ریسک کلی و سود نهایی شما داشته باشند و حرکت یک بازار مخالف تحلیل شما بر کل پرتفوی شما تأثیر میگذارد. به عنوان مثال، اگر در دو نماد با همبستگی مثبت 75 درصد پوزیشن های فروش باز داشته باشید، احتمالاً روند نزولی در یکی منجر به حرکت مشابه در دیگری می شود. در این صورت، اگر یک پوزیشن خلاف تحلیل شما حرکت کند، ریسک از دست دادن سرمایه اختصاص داده شده به هر دو موقعیت را دارید. بنابراین، کل ریسک شما از معامله می تواند بالاتر از آنچه در ابتدا برنامه ریزی کرده بودید باشد.

اگر چندین موقعیت همبسته دارید، ریسک کلی شما در مدیریت حساب می تواند بسیار بیشتر از آن چیزی باشد که فکر می کنید. بنابراین همیشه ارزش این را دارد که بررسی کنید کدام بازارها به هم مرتبط هستند و کدامیک می تواند به تنوع پرتفوی شما بیفزاید.

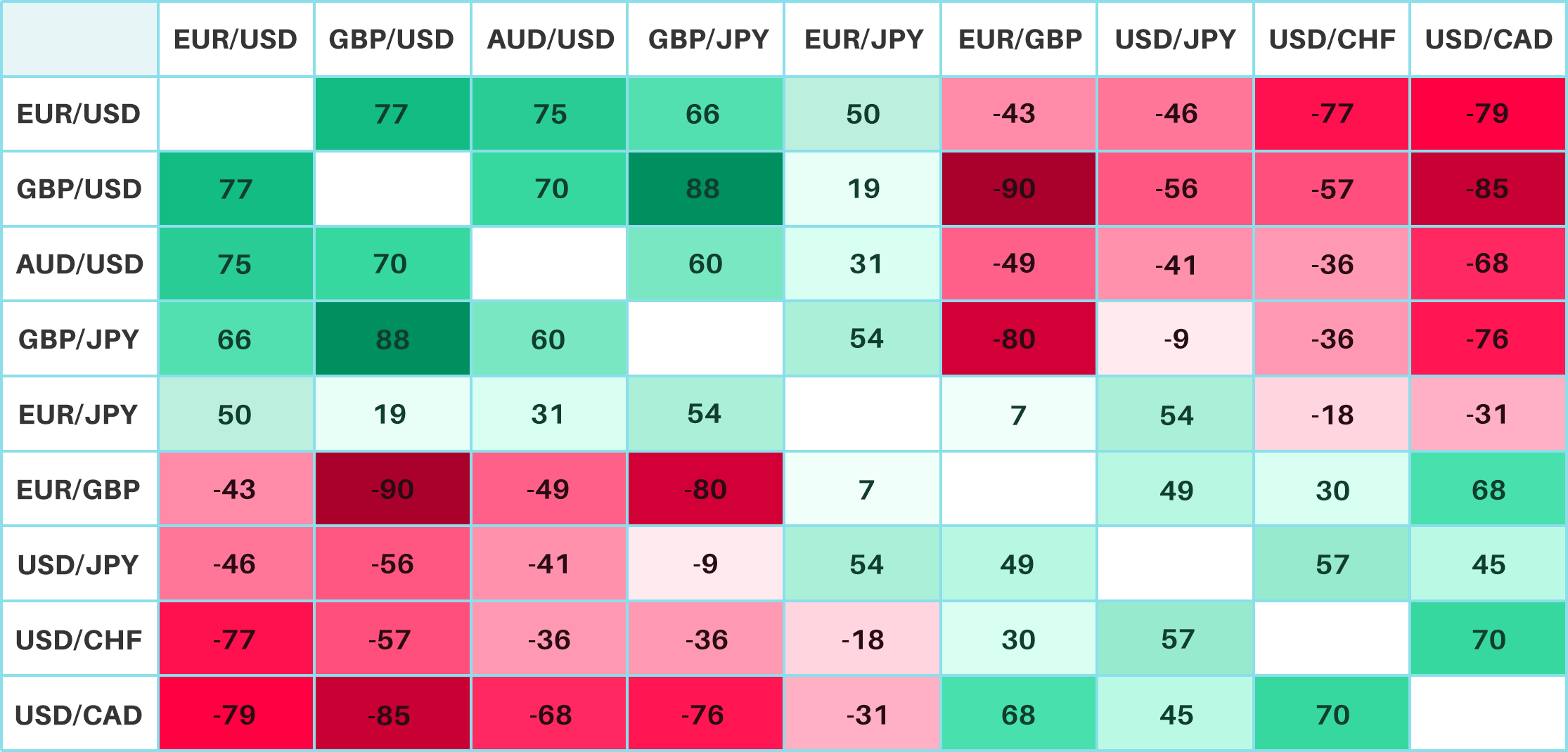

همچنين در همبستگی نمادها ميتوان برای تحليل تكنيكال كمک گرفت به طور مثال جفت ارز EUR/USD در تحليل تكنيكال از مقاومت اصلی خود عبور ميكند اما جفت ارز GBP/USD هنوز با مقاومت خود درگير است به دليل اينكه اين دو جفت ارز باهم همبستگی مثبت شديد دارند ميتوانند در تحليل تكنيكال نيز در یک راستا عمل كنند و اين جفت ارز نيز از مقاومت خود عبور كند .بنابراين از همبستگيی ها علاوه بر پوشش ريسک معاملات ميتوان در تحليل تكنيكال نيز استفاده كرد.

سود بردن از همبستگی ها

همچنین می توانید از همبستگی ها برای کسب سود استفاده کنید. به عنوان مثال، یک استراتژی معاملات سهام، یافتن سهام شرکت های مرتبط و نظارت بر عملکرد قیمت آنها است . اگر یکی از سهم های این شرکت ها نسبت به بقیه سهام ها حرکت مستقلی داشت، می توانید فیک بودن این حرکت احتمال و در مورد بازگشت نهایی آن به حالت عادی پوزیشن بگیرید. همین کار را می توان در معاملات فارکس نیز انجام داد.

همبستگی های کالایی

برخی از همبستگی ها فقط موقتی هستند، در حالی که برخی دیگر برای سال ها ادامه داشته اند و احتمالا ادامه خواهند داشت. در اینجا چند مثال رایج وجود دارد که باید در معاملات خود از آنها آگاه باشید.

همبستگی دلار با طلا:

شاید شناخته شده ترین همبستگی بازارهای مالی بین دلار آمریکا و طلا باشد. طلا به دلار آمریکا قیمت گذاری می شود، بنابراین قیمت آن به شدت به قدرت ارز وابسته است و یک همبستگی منفی قوی بین این دو وجود دارد. وقتی ارزش دلار افزایش می یابد، قیمت طلا اغلب کاهش می یابد. در نتیجه در معاملات طلا باید به داده های مربوط به دلار امریکا در تقویم اقتصادی مانند نرخ تورم، نرخ بهره و … توجه کرد.

همبستگی AUD/USD با مس و طلا:

بسیاری از جفت ارزها با کالاها مرتبط هستند. این اتفاق معمولا زمانی رخ می دهد که اقتصاد یک کشور برای رشد به کالاها وابسته است. به عنوان مثال، استرالیا بخش بزرگی از ثروت خود را از استخراج فلزات به دست می آورد. بنابراین قیمت AUD/USD می تواند با حرکت قیمت مس و طلا همبستگی مثبت داشته باشد.

همبستگی دلار کانادا با نفت :

كانادا به عنوان يكی از بزرگترين كشورهای صادركننده نفت دنيا شناخته ميشود بنابراين اقتصاد كانادا بسيار به قيمت نفت وابسته است و در صورتی كه قيمت نفت صعود كند دلار كانادا نيز ارزشمند تر ميشود. همچنين به دليل همسايگی جغرافيايي كانادا و شرايط خوب كه با آمريكا دارد اين كشور بيشتر صادرات خود را به آمريكا دارد.در نتيجه USD/CAD با قيمت نفت همبستگی منفی دارد بنابراين با صعود نفت قيمت اين جفت ارز نزول ميكند.

جفت ارز CDD/JPY بيشترين همبستگی از نوع مثبت با قيمت نفت دارد.كشور ژاپن به دليل نداشتن منابع نفتی بايد تمام انرژی و نفت خود را وارد كند.در صورتی كه قيمت نفت افزايش يابد دلار كانادا به عنوان صادركننده قويتر ميشود و ین ژاپن به عنوان وارد كننده ضعيف تر ميشود.

همبستگی طلا و ارزهای امن:

در بازار فارکس ارز کشورهای ژاپن و سوییس به دلیل اقتصاد پایدار و و نرخ بهره پایین به عنوان ارز امن شناخته می شود. در مواقع بحرانی مانند جنگ و بیماری هایی مثل کرونا و بحران های اقتصادی، سرمایه گذاران به دارایی های امن مانند طلا و ارزهایی مانند ین ژاپن(JPY) و فرانک سوییس(CHF) علاقه مند می شوند. بنابراین طلا با این ارزها همبستگی مثبت و با جفت ارز USDJPY و USDCHF همبستگی منفی دارد.

همبستگی شاخص های بورسی امریکا

مهمترین شاخص های بورسی امریکا در قارکس سه نماد DOWJONES، NAZDAQ و S&P500 هستند. این سه نماد با یکدیگر همبستگی مثبت قوی دارند و همچنین این سه نماد با سایر بازارها مانند طلا، دلار امریکا و بیتکوین همبستگی دارند که در ادامه مورد بررسی قرار خواهند گرفت.

همبستگی شاخص های بورسی با دلار و طلا:

در حالت کلی زمانی که وضعیت اقتصادی امریکا خوب باشد و داده های اقتصادی، نشانه های رونق اقتصاد این کشور را نشان دهد، دلار امریکا قوی خواهد شد. در نتیجه به علت وضعیت مطلوب اقتصاد، سهام و شاخص های بورسی رشد خواهند کرد و طلا که به عنوان دارایی امن شناخته می شود نزول خواهد کرد. بنابراین در حالت کلی شاخص بورسی با دلار همبستگی مثبت و با طلا همبستگی منفی دارد.اما این موضوع در شرایط بحران میتواند صدق نکند و همبستگی منفی داشته باشند.

همبستگی بیتکوین و شاخص بورسی:

به تازگی بسیاری از تحلیل گران به همبستگی مثبت بیتکوین با شاخص های بورسی امریکا علی الخصوص NAZDAQ و S&P500 توجه زیادی دارند. بنابراین اگر معامله گر رمز ارز هستید برای معامله بهتر است به این دو شاخص بورسی امریکا توجه ویژه ای داشته باشید. به این نکته توجه کنید که بیتکوین با سایر رمزارزها هم همبستگی مثبت دارد.

سخن آخر

مانند شناگران موزون، برخی از جفت ارزها با یکدیگر و مانند قطب های یکسان آهنربا، برخی جفت ارزها در جهت مخالف یکدیگر حرکت می کنند. هنگامی که همزمان چندین جفت ارز را در حساب معاملاتی خود معامله می کنید، مهم ترین چیز این است که مطمئن شوید از میزان ریسک خود آگاه هستید. ممکن است باور داشته باشید که با معامله در جفت ارزهای مختلف ریسک خود را پخش یا متنوع می کنید، اما باید بدانید که بسیاری از آنها تمایل دارند در یک جهت حرکت کنند و با معامله جفت هایی که همبستگی بالایی دارند، شما فقط ریسک خود را بزرگ می کنید!

همبستگی بین جفت ارزها می تواند قوی یا ضعیف باشد و هفته ها، ماه ها یا حتی سال ها طول بکشد. اما همیشه بدانید که آنها می توانند در یک آن تغییر کنند. بهروز ماندن در مورد همبستگی جفت ارزها میتواند به شما در تصمیمگیری بهتر کمک کند اگر میخواهید اهرم، درصد ریسک و تنوع معاملات خود را مد نظر قرار دهید.