سشنهای معاملاتی بازار فارکس از مباحث پایه و بسیار مهم در آموزش معاملهگری به شمار میآیند و هر تریدر حرفهای باید درک روشنی از آنها داشته باشد. شاید این سؤال برای بسیاری مطرح شود که سشن فارکس چیست و چرا تا این حد اهمیت دارد؟ با وجود ۲۴ساعته بودن بازار فارکس، میزان نوسان و نقدشوندگی در تمام ساعات شبانهروز یکسان نیست و همه زمانها برای معامله مناسب نیستند. اگرچه امکان ثبت سفارش در هر ساعتی وجود دارد، اما در برخی بازهها بازار در حالت کمنوسان قرار دارد و تغییرات قیمتی محدودی رخ میدهد. برای تشخیص زمانهای مناسب معامله و استفاده بهتر از فرصتهای بازار، آشنایی با سشنهای معاملاتی فارکس ضروری است. در ادامه، با بررسی این سشنها، بهترین زمانها برای انجام معاملات فارکس را مرور خواهیم کرد.

سشن فارکس چیست؟

زمانبندی درست، یکی از مهمترین عوامل موفقیت در بازار فارکس است و نقش تعیینکنندهای در سودآوری معاملات دارد. از لحاظ زمانی، یک روز کامل معاملاتی در بازار فارکس، به ۴ بخش اصلی تقسیم میشود، که عبارتاند از:

- نشست سیدنی (استرالیا)

- نشست توکیو (آسیا)

- نشست لندن (اروپا)

- نشست نیویورک (آمریکا)

در بازار فارکس، چرخه معاملات بهگونهای طراحی شده که ساعت کاری فارکس بهصورت پیوسته و ۲۴ساعته جریان دارد. یک روز معاملاتی با آغاز نشست سیدنی در استرالیا شروع میشود، سپس با فعال شدن نشست توکیو در آسیا و بعد از آن سشن لندن در اروپا ادامه مییابد و در نهایت با جلسه معاملاتی نیویورک در آمریکا به پایان میرسد. پس از اتمام سشن نیویورک، این روند دوباره با شروع نشست سیدنی تکرار میشود و روز معاملاتی جدید شکل میگیرد. این چرخه منظم در تمامی روزهای هفته بهجز شنبه و یکشنبه برقرار است و همین ساختار سبب شده بازار فارکس بهعنوان یک بازار ۲۴ساعته شناخته شود.

چهار سشن اصلی فارکس به این دلیل اهمیت بالایی دارند که همزمان با فعالیت بانکهای مرکزی بزرگ، حجم زیادی نقدینگی وارد بازار میشود و نوسانات افزایش مییابد. هر بازهای که یکی از این بانکها فعال باشد، یک سشن فارکس نام دارد. آشنایی با این سشنها و ویژگیهای هرکدام برای معاملهگران ضروری است، زیرا رفتار بانکها و بازیگران بزرگ تأثیر مستقیمی بر نوسانات بازار دارد.

۱) سشن معاملاتی سیدنی (استرالیا)

نشست معاملاتی سیدنی در قاره استرالیا، ساعت ۷ صبح بهوقت سیدنی شروع میشود و تا ساعت ۱۶ بهوقت سیدنی باز است، بهعبارتی این نشست، ساعت ۱:۳۰ بامداد بهوقت تهران آغاز میشود و تا ساعت ۱۰:۳۰ صبح بهوقت تهران ادامه دارد. توجه داشته باشید که زمانهای اعلامشده براساس ساعت تهران، در فصلهایی از سال بهدلیل تغییرات ساعت رسمی، دچار تغییر میشود و مطمئنترین روش برای بررسی نشست سیدنی، کنترل ساعت دقیق بهتایم شهر سیدنی است. در غیر این صورت، معمولاً افراد با سردرگمی مواجه میشوند.سشن معاملاتی سیدنی، نسبت به سایر نشستهای معاملاتی، دارای کمترین حجم معاملاتی است و معمولاً بازار در این بازه زمانی، نوسانات کمی را تجربه میکند، مگر آنکه خبر مهمی منتشر شده باشد و سنتیمنت بازار، هیجانی باشد. به همین دلیل، این سشن برای معاملهگرانی که به دنبال نوسانات شدید و فرصتهای معاملاتی پرریسک هستند، چندان جذاب نیست.

اگر قصد معامله در سشن سیدنی را دارید، توصیه میشود نمادهایی را انتخاب کنید که یک طرف آنها، ارز AUD یا NZD باشد؛ زیرا این نمادها در این نشست، نسبت به بقیه نمادها، نوسانات بیشتری دارند. برای مثال جفتارزهای AUDUSD و NZDUSD بهترین گزینهها برای معامله در جلسه استرالیا محسوب میشوند.

استراتژیهای معاملاتی مناسب در سشن سیدنی عمدتاً شامل معاملات با روش BLSH (فروش در سقف و خرید در کف) است، چرا که با توجه به نوسانات کم و حجم پایین معاملات، قیمتها معمولاً در یک محدوده خاص نوسان میکنند. معاملهگران میتوانند از سطوح حمایت و مقاومت مشخص برای ورود و خروج استفاده کنند.

۲) سشن معاملاتی توکیو (آسیا)

نشست معاملاتی توکیو در قاره آسیا، ساعت ۹ صبح بهوقت توکیو آغاز میشود و تا ساعت ۱۸ بهوقت توکیو ادامه دارد، بهعبارتی این نشست، ساعت ۴:۳۰ بامداد بهوقت تهران شروع میشود و تا ساعت ۱۳:۳۰ بهوقت تهران باز است. توجه داشته باشید که زمانهای اعلامشده براساس ساعت تهران، در فصلهایی از سال بهدلیل تغییرات ساعت رسمی، دچار تغییر میشود و مطمئنترین روش برای بررسی نشست توکیو، کنترل ساعت دقیق بهتایم شهر توکیو است.

سشن معاملاتی توکیو دارای حجم معاملاتی بیشتری نسبت به سشن سیدنی است و معمولاً در این بازه زمانی، بازار نوسانات قابل توجهتری نسبت به جلسه استرالیا تجربه میکند. در این نشست، علاوهبر بانک مرکزی ژاپن، بانکهای مرکزی و موسسات مالی بزرگی مانند بانکهای سنگاپور و هنگکنگ نیز فعالیت میکنند، که این امر موجب افزایش لیکوئیدیتی و حجم معاملات میشود.

اگر قصد معامله در سشن آسیا را دارید، توصیه میشود نمادهایی را انتخاب کنید که یک طرف آنها، ارز JPY باشد؛ زیرا این جفتارزها در این نشست، نسبت به سایر نمادها، نوسانات بیشتری دارند. برای مثال جفتارزهای EURJPY و USDJPY بهترین گزینهها برای معامله در جلسه توکیو محسوب میشوند.

استراتژیهای معاملاتی مناسب در سشن توکیو شامل استراتژیهای روندی (Trend Following) است، بهویژه در ساعات ابتدایی این نشست که معمولاً بازار جهت مشخصتری میگیرد. معاملهگران میتوانند از شکست سطوح کلیدی و ادامه روندهای شکلگرفته در پایان سشن قبلی بهره ببرند. همچنین، استراتژی معاملات خبری در زمان انتشار شاخصهای مهم اقتصادی ژاپن مانند تولید ناخالص داخلی (GDP)، شاخص قیمت مصرفکننده (CPI) و تصمیمات بانک مرکزی ژاپن، میتواند فرصتهای سودآور ایجاد کند.

۳) سشن معاملاتی لندن (اروپا)

نشست معاملاتی لندن در قاره اروپا، ساعت ۸ صبح بهوقت لندن آغاز میشود و تا ساعت ۱۷ بهوقت لندن ادامه دارد، بهعبارتی این نشست، ساعت ۱۱:۳۰ صبح بهوقت تهران شروع میشود و تا ساعت ۲۰:۳۰ بهوقت تهران باز است. توجه داشته باشید که زمانهای اعلامشده براساس ساعت تهران، در فصلهایی از سال بهدلیل تغییرات ساعت رسمی، دچار تغییر میشود و مطمئنترین روش برای بررسی نشست لندن، کنترل ساعت دقیق بهتایم شهر لندن است.

سشن معاملاتی لندن بزرگترین و مهمترین نشست معاملاتی در بازار فارکس محسوب میشود و حدود ۳۴ درصد از کل حجم معاملات روزانه جهانی، متعلق به سشن لندن و اروپاست. میزان نوسانات در این سشن بسیار بالا ارزیابی میشود و بازار در این بازه زمانی، پرحرکتترین و پرنوسانترین حالت خود را تجربه میکند. اگر شما نیز قصد معاملهگری روزانه در فارکس را دارید، نشست لندن یکی از بهترین و پرفرصتترین گزینهها برای شماست.

همچنین برای معامله در این نشست، توصیه میشود نمادهایی را انتخاب کنید که یک طرف آنها، ارزهای EUR، GBP یا CHF باشد؛ زیرا این جفتارزها در سشن لندن، نسبت به سایر نمادها، نوسانات بیشتری دارند. برای مثال جفتارزهای EURUSD و GBPUSD بهترین گزینهها برای معامله در این جلسه هستند. برای معامله در این سشن، حتماً زمان دقیق انتشار اخبار و گزارشهای اقتصادی اروپا و انگلیس را مدنظر داشته باشید، زیرا این اخبار، ممکن است نوسانهای چشمگیر و قدرتمندی در بازار ایجاد کنند.

استراتژیهای معاملاتی مناسب در سشن لندن بسیار متنوع هستند و به دلیل نوسانات بالا و حجم معاملات عظیم، اکثر سبکهای معاملاتی در این نشست کارایی خوبی دارند. استراتژی شکست محدوده یکی از مؤثرترین روشهاست، چراکه بازار معمولاً در ساعات ابتدایی سشن لندن، محدودههای شکلگرفته در سشنهای قبلی را میشکند و روندهای قوی ایجاد میکند. استراتژیهای روندی نیز در این سشن بسیار مناسب هستند، زیرا روندهای قیمتی واضح و قدرتمندی در این بازه زمانی شکل میگیرند. معاملهگران میتوانند از اندیکاتورهای روند مانند میانگینهای متحرک و MACD برای شناسایی و دنبالکردن این روندها استفاده کنند.

بیشتر بخوانید: نیوز تریدینگ یا معاملهگری با اخبار در فارکس

۴) سشن معاملاتی نیویورک (آمریکا)

نشست معاملاتی نیویورک در قاره آمریکا، ساعت ۸ صبح بهوقت نیویورک آغاز میشود و تا ساعت ۱۷ بهوقت نیویورک ادامه دارد، بهعبارتی این نشست، ساعت ۱۶:۳۰ بهوقت تهران شروع میشود و تا ساعت ۰۱:۳۰ بامداد روز بعد بهوقت تهران باز است.

میزان نوسانات در سشن نیویورک بسیار بالا ارزیابی میشود و این نشست پس از سشن لندن، دومین بازار پرحجم و پرنوسان در جهان محسوب میگردد. در سشن نیویورک، بهدلیل تأثیرگذاری بسیار بالای اقتصاد ایالات متحده در اقتصاد جهانی و اهمیت و نقش کلیدی دلار آمریکا در معاملات فارکس، تقریباً تمامی جفتارزها بیشترین نوسانات خود را تجربه میکنند. بازار در سشن معاملاتی آمریکا، حرکات قیمتی قدرتمند و نوسانات شدیدی دارد که فرصت معاملاتی بسیار عالی برای معاملهگران روزانه فارکس فراهم میکند. در این نشست، مهمترین دادهها و گزارشهای اقتصادی بازار فارکس یعنی اطلاعات مربوط به دلار آمریکا (USD) منتشر میشود، بههمین دلیل باید زمان دقیق انتشار این اخبار را بهدقت مدنظر داشت. برای دسترسی به زمان انتشار اخبار، میتوانید به تقویم اقتصادی فارکس ترندو مراجعه کنید.

اگر قصد معامله در سشن نیویورک را دارید، توصیه میشود نمادهایی را انتخاب کنید که یک طرف آنها، ارز USD باشد؛ زیرا این جفتارزها در این نشست، نسبت به سایر نمادها، نوسانات بیشتری دارند. برای مثال جفتارزهای EURUSD و نماد XAUUSD (طلا در برابر دلار) بهترین گزینهها برای معامله در جلسه نیویورک به شمار میآیند.

استراتژی روندی یکی از محبوبترین روشها در این سشن است، چراکه روندهای قوی و پایدار معمولاً در ساعات ابتدایی این نشست شکل میگیرند، بهویژه در زمان همپوشانی با سشن لندن. استراتژی معاملات خبری در سشن نیویورک اهمیت فوقالعادهای دارد، زیرا مهمترین دادههای اقتصادی جهان از جمله گزارش اشتغال غیرکشاورزی (NFP)، نرخ بیکاری، تصمیمات فدرال رزرو و… در این سشن منتشر میشوند که میتوانند نوسانات شدید و حرکات قیمتی بزرگی ایجاد کنند. دیتریدینگ و اسکالپینگ نیز در سشن نیویورک به دلیل حجم بالای معاملات، اسپرد پایین و حرکات سریع قیمت، فرصتهای عالی برای کسب سود کوتاهمدت فراهم میکنند. با این حال، به دلیل سرعت و شدت بالای نوسانات در این نشست، رعایت اصول مدیریت ریسک و استفاده از حد ضرر مناسب، ضروری و حیاتی است تا معاملهگران بتوانند از فرصتها بهره ببرند و در عین حال از سرمایه خود محافظت کنند.

بیشتر بخوانید: بررسی کامل یورودلار (EURUSD)، مهمترین جفتارز بازار فارکس

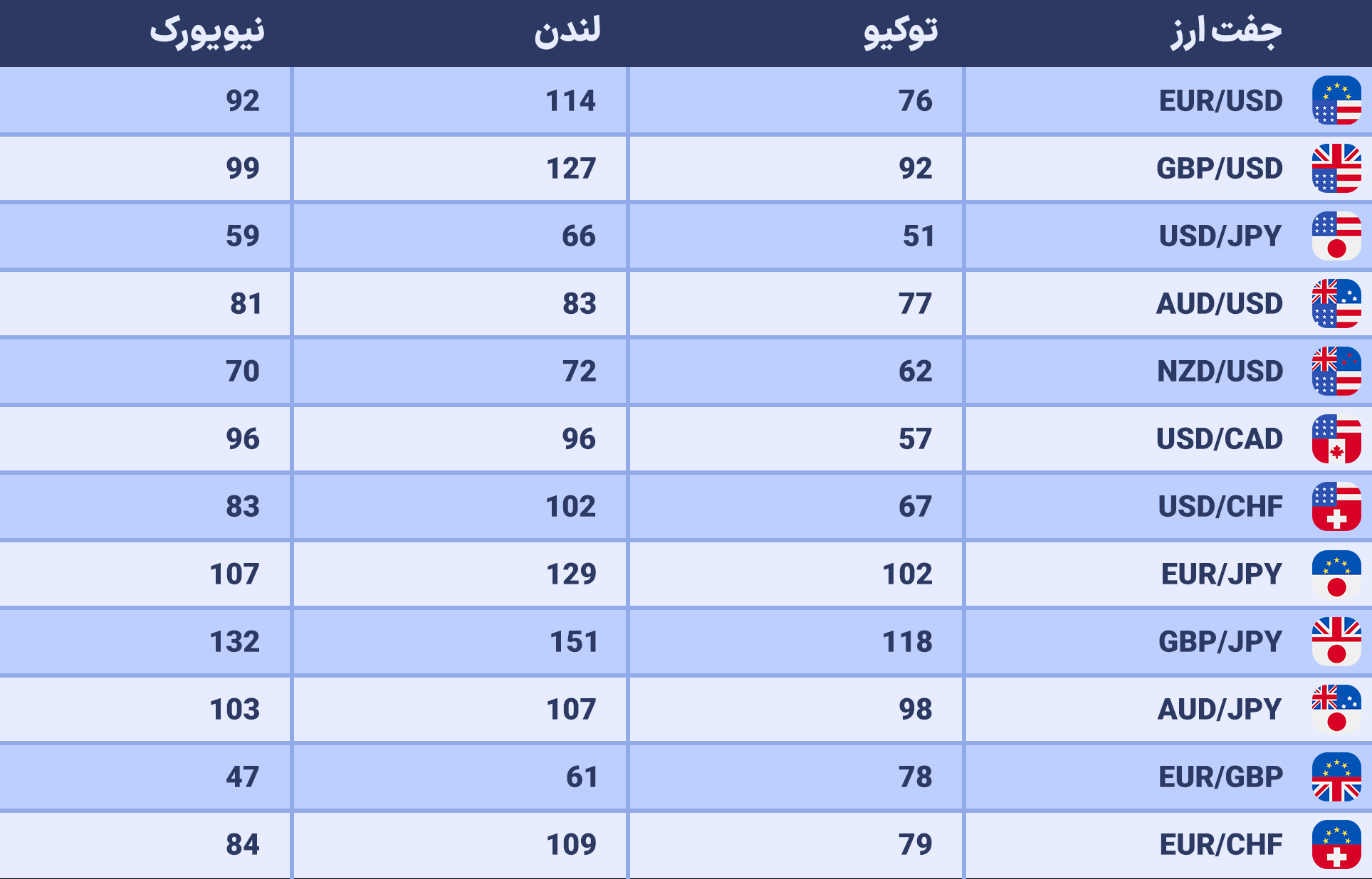

در جدول زیر، ساعت سشنهای معاملاتی مهم فارکس را مشاهده میکنید:

ساعت مهمترین سشنهای فارکس (نشستهای معاملاتی)

جدول مقایسهای سشنهای معاملاتی فارکس

برای درک بهتر تفاوتهای کلیدی بین چهار سشن اصلی فارکس و انتخاب مناسبترین زمان برای معامله، جدول زیر یک جدول سشن های فارکس است و مقایسه جامع و خلاصه از ویژگیهای هر نشست را ارائه میدهد. با مطالعه این جدول، میتوانید نشست معاملاتی که با سبک معاملاتی و بازه زمانی شما هماهنگی دارد، شناسایی کنید و تصمیمات معاملاتی بهتری بگیرید.

جدول سشن های فارکس

| نام سشن | ساعت فعالیت | ساعت (بهوقت تهران) | میزان نوسان | ارزهای مناسب | سبکهای مناسب ترید |

| سیدنی (استرالیا) | ۷:۰۰ – ۱۶:۰۰ | ۱:۳۰ – ۱۰:۳۰ | کم | AUD، NZD (مانند AUDUSD، NZDUSD) | معاملات BLSH (تریدینگ رنج)، اسکالپینگ |

| توکیو (آسیا) | ۹:۰۰ – ۱۸:۰۰ | ۴:۳۰ – ۱۳:۳۰ | متوسط | JPY (مانند EURJPY، USDJPY) | استراتژیهای روندی (Trend Following)، شکست محدوده (Breakout Trading) |

| لندن (اروپا) | ۸:۰۰ – ۱۷:۰۰ | ۱۱:۳۰ – ۲۰:۳۰ | بسیار بالا | EUR، GBP، CHF (مانند EURUSD، GBPUSD) | شکست محدوده (Breakout Trading)، استراتژیهای روندی |

| نیویورک (آمریکا) | ۸:۰۰ – ۱۷:۰۰ | ۱۶:۳۰ – ۱:۳۰ | بسیار بالا | USD (مانند EURUSD، XAUUSD) | استراتژیهای روندی، معاملات خبری (News Trading)، شکست سطوح کلیدی |

هر یک از سشنهای معاملاتی فارکس خصوصیات خاص خود را دارند و بر اساس سبک معاملهگری، میتوانند برای گروههای مختلفی از تریدرها مناسب باشند. آگاهی از زمان باز شدن بازار فارکس و شروع هر سشن نقش مهمی در انتخاب بهترین بازه زمانی برای معامله دارد. سشن نیویورک نیز به دلیل همپوشانی با سشن لندن، فرصتهای معاملاتی فراوانی ایجاد میکند و برای تریدرهایی که به دنبال نقدشوندگی بالا و نوسانات قابل توجه هستند، بسیار ایدهآل است.

تغییر ساعت تابستانی بازار فارکس

اگر قصد دارید معاملات روزانه در فارکس را دارید، به این نکته توجه داشته باشید که ساعت باز و بستهشدن سشنهای معاملاتی در ماههای اکتبر و نوامبر و ماههای مارس و آوریل متفاوت است؛ زیرا برخی از کشورها (مانند ایالات متحده، بریتانیا و استرالیا) ساعت رسمی خود را تغییر میدهند. همچنین تنها نشستی که تغییر ساعت تابستانی ندارد، نشست توکیو (ژاپن) میباشد. اگر دوست ندارید درگیر این ساعتها و محاسبات مربوط بهآن شوید، توصیه میشود تایم هر سشن را تنها از روی ساعت معاملاتی همان شهر، بررسی کنید؛ ساده و راحت!

همپوشانی سشنهای معاملاتی در فارکس

همپوشانی سشنهای معاملاتی در فارکس، به ساعاتی از روز گفته میشود که دو سشن معاملاتی بهصورت همزمان باز هستند. برای مثال، از ساعت ۱۱:۳۰صبح تا ۱۳:۳۰ بهوقت تهران، سشن توکیو و سشن لندن، همپوشانی دارند و از ساعت ۱۶:۳۰ تا ۲۰:۳۰ بهوقت تهران، سشن لندن و سشن نیویورک، همپوشانی دارند. همپوشانی سشنهای معاملاتی، شلوغترین زمانها در طول روز معاملاتی هستند، زیرا زمانی که دو بازار همزمان باز هستند، حجم بیشتری از معاملات وجود دارد، نمادها نوسانات بیشتری انجام میدهند و بدیهی است که فرصتهای معاملاتی سودآوری در این ساعات، به وجود میآید. همانطور که در جدول زیر هم مشاهده میکنید، سشن لندن و نیویورک معمولاً بیشترین نوسانات را دارند، بنابراین در همپوشانی این دو سشن، برای معاملهگرانی که قصد معاملات اسکالپ و کوتاهمدت دارند، فرصتهای مناسبی وجود خواهد داشت.

همپوشانی سشنهای معاملاتی در فارکس

زمان مناسب معاملات در فارکس

زمان مناسب برای معاملهگری در فارکس برای هر تریدر میتواند متفاوت باشد و بازه زمانی یکسانی برای تمام معاملهگران توصیه نمیشود. شما باید براساس استراتژی خود، نمادهای معاملاتی و همچنین زمان رسمی کشور خود، بهترین تایم را برای ترید انتخاب کنید. برای مثال اگر قصد ترید روی ارز JPY را دارید، بهترین زمان برای شما، سشن معاملاتی آسیا میباشد، یا اگر قصد انجام معاملات کوتاهمدت و روزانه در نماد طلا (XAUUSD) را دارید، توصیه میشود، در سشن نیویورک یا لندن وارد بازار شوید. در تصویر زیر، ساعات معاملاتی سشنهای اصلی بازار فارکس را برای منطقه زمانی گرینویچ (GMT) مشاهده میکنید و از ساعات همپوشانی سشنها که در جدول نیز مشخص است، میتوانید برای معاملات اسکالپ استفاده کنید:

همپوشانی سشن های فارکس

بیشتر بخوانید: انواع بازار مالی جهان و ساعت معاملات آنها

سخن پایانی

سشنهای معاملاتی یکی از مفاهیم پایه در بازار فارکس است که باید بهصورت کامل با آن آشنا شوید و با دانستن ویژگی هر سشن فارکس، اقدام به ترید در آنها کنید. در این مقاله، ساعت سشنهای سیدنی، توکیو، لندن و نیویورک را همراه با نماد معاملاتی ویژه هر سشن بیان کردیم. لازمبهذکر است که توجه به سشنهای معاملاتی بیشتر برای معاملات روزانه کاربرد دارد و برای معاملات بلندمدت، تنها کافی است اخبار مهم را بررسی کرده و براساس استراتژی معاملاتی خود، مارکت را دنبال کنید.