What Is the Meaning of Risk-Free Trading? A Complete Guide to Risk-Free Trading and Its Various Techniques

We’ll explore proven techniques, from stop-loss orders to hedging, and how they can be applied to trade with peace of mind. Whether you’re starting out or refining your approach, understanding risk-free trading is a step towards more secure investments.

Dive in to discover how to trade smartly, minimize risks, and potentially increase your returns.

Contents

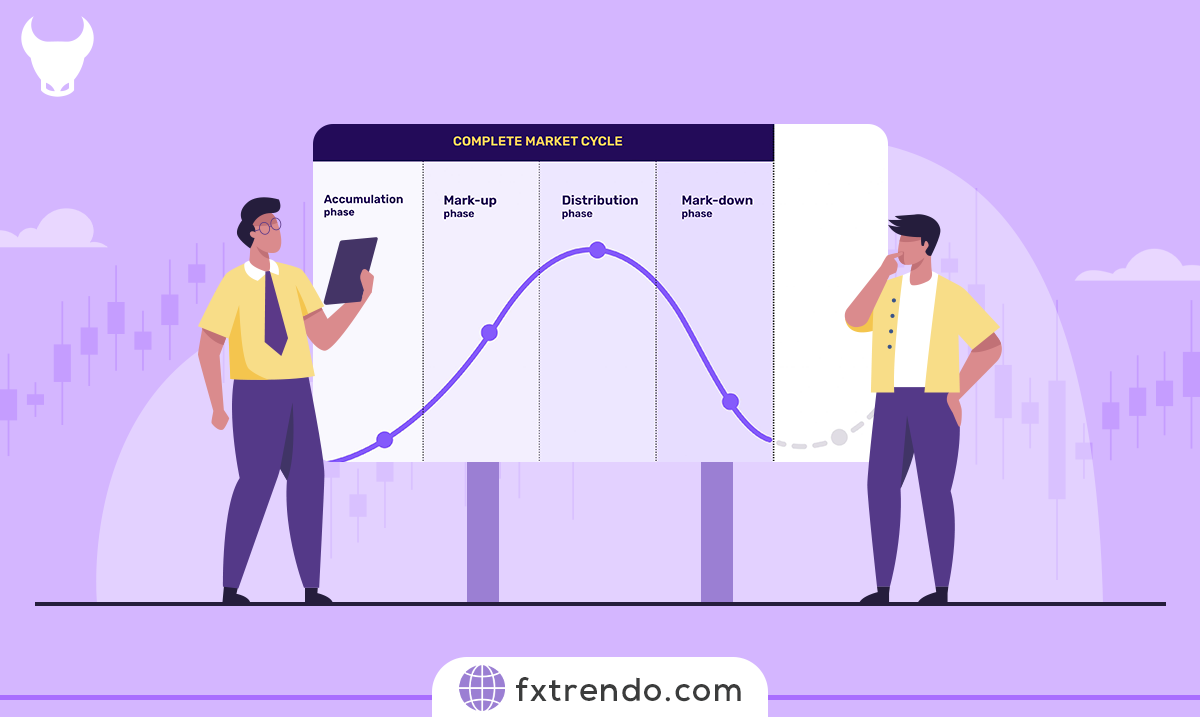

What is Risk in Trading?

When we talk about risk in trading, we’re referring to the possibility of an investment’s actual return differing from the expected return. This includes the potential of losing some, or even all, of the original investment. In simpler terms, it’s the chance that the outcomes of your trades will not unfold as you hope.

Risk is an inherent part of trading; it’s the shadow to the light of opportunity. Every trade carries with it a certain level of uncertainty, and this uncertainty is what we call risk. It’s like planting a seed without knowing what the weather will be like—it could flourish, or it could struggle.

Types of Trading Risks

Types of Trading Risks

Market Risk

Market risk, also known as systemic risk, is the unpredictable movement of prices in financial markets. It’s like navigating a roller coaster—the ups and downs can catch you off guard. Factors such as economic events, geopolitical tensions, and unexpected news can cause sudden price fluctuations. Traders face the risk that their positions may move against them, resulting in losses.

Liquidity Risk

Liquidity risk is akin to being stuck in a traffic jam during an emergency. It refers to the difficulty of entering or exiting trades due to insufficient market liquidity. When a market lacks enough buyers or sellers, executing orders becomes challenging. Traders may struggle to buy or sell assets at desired prices, leading to potential losses.

Operational Risk

Think of operational risk as the gremlins in the machinery. It encompasses errors, technical glitches, and human blunders. From accidental keystrokes to server crashes, operational risks can disrupt trading activities. Traders need robust systems, backup plans, and vigilance to mitigate these risks.

What is Risk-Free Trading?

Risk-free trading is a concept that sounds almost too good to be true: the ability to trade without any fear of losing money. But let’s set the record straight—it’s not about completely eliminating risk (because that’s impossible), but rather about minimizing risk to the greatest extent possible.

First, let’s dispel the myth that risk-free trading means zero risk. In reality, every investment involves some level of risk. Even the safest options—like government bonds—carry a small degree of risk. Risk-free trading acknowledges this truth but aims to manage and control the risks effectively.

The Mechanics of Risk-Free Trading

Risk-free trading might sound like a dream come true for many traders. But how does it work in reality? Let’s break it down.

At its core, risk-free trading is about implementing strategies that minimize the potential for loss. These strategies often involve a combination of careful market analysis, diversification, and the use of specific financial instruments.

One common technique is hedging. This involves taking an offsetting position in a related security, such as options or futures. For example, if you own shares in a company, you might buy a put option for the same stock. This means if the stock price falls, the gain from the option will offset the loss from the stock.

Another technique is diversification. This involves spreading your investments across a variety of assets or markets. The idea is that if one investment performs poorly, others may perform well and offset the loss.

Lastly, many traders use stop-loss orders. These are instructions to sell a security when it reaches a certain price. This can limit the potential loss from any single trade.

Remember, while these techniques can reduce risk, they can’t eliminate it entirely. Even the most sophisticated strategies can’t predict market movements with 100% accuracy. Therefore, it’s essential to approach risk-free trading with a clear understanding of its mechanics and a healthy dose of realism.

Advantages of Risk-Free Trading

Risk-free trading, while a bit of a misnomer, offers a plethora of benefits that can make the trading experience less stressful and more rewarding. Here’s why many traders strive for a risk-averse approach:

Stress Reduction

Trading can be a high-stress activity, with constant market fluctuations and the potential for loss. Risk-free trading strategies aim to reduce stress by minimizing the potential for large losses. It’s like having a map in a maze; you might not know exactly where you’re going, but you have a guide to help you find your way.

Increased Confidence

With a risk-managed approach, traders can operate with increased confidence. Knowing that you have measures in place to protect your investments allows you to make decisions without the paralyzing fear of significant losses.

Better Decision Making

When traders are less stressed and more confident, they tend to make better decisions. Risk-free trading removes the emotional rollercoaster that can lead to rash decisions, allowing for a more analytical and calculated approach to trading.

Longevity in Trading

By employing risk-free trading techniques, traders can ensure longevity in the markets. Just like a well-maintained car is more likely to go the distance, a well-managed trading account is more likely to survive the ups and downs of market volatility.

Disadvantages and Risks of Risk-Free Trading

The term “risk-free trading” might conjure images of a perfect financial world where profits are guaranteed and losses are non-existent. However, the reality is more nuanced. While risk-free trading strategies aim to minimize risks, they come with their own set of disadvantages and potential pitfalls.

The Illusion of Safety

Overconfidence: One of the biggest risks of risk-free trading is the false sense of security it can create. Traders might become overconfident, believing their strategies are foolproof, which can lead to complacency and underestimating the market’s unpredictability.

Opportunity Cost

Missed Gains: In the pursuit of minimizing risks, traders might miss out on lucrative opportunities. High-reward trades often come with higher risks, and a strictly risk-averse approach could mean foregoing significant profits.

Cost and Complexity

Increased Expenses: Some risk-free trading techniques, like hedging, require additional transactions, which can increase costs in terms of fees and spreads.

Complex Strategies: Risk-free trading often involves complex financial instruments and strategies that can be difficult to understand and execute, potentially leading to errors.

Market Dynamics

Changing Conditions: The market is dynamic, and conditions can change rapidly. A strategy that seems risk-free in a stable market may not hold up in a volatile one.

Psychological Impact

Stress and Anxiety: Ironically, the focus on risk-free trading can lead to stress and anxiety, as traders might constantly worry about the possibility of incurring a loss, despite their precautions.

Risk-free trading is not a panacea. It requires a careful balance between protecting investments and seizing growth opportunities. Traders must be aware of the disadvantages and remain vigilant, adapting their strategies as market conditions evolve. It’s important to remember that in trading, as in life, there are no guarantees—only strategies to manage risk and maximize potential rewards.

Tips to Avoid Common Pitfalls

Stay Informed: Keep abreast of market trends and economic news. An informed trader is better equipped to adjust strategies in response to market movements.

Diversify Wisely: Diversification is key, but it must be done wisely. Spread your investments across different asset classes, sectors, and geographies to mitigate risk without diluting potential returns.

Regular Reviews: Regularly review and adjust your trading strategies. What works today may not work tomorrow. Stay flexible and ready to adapt.

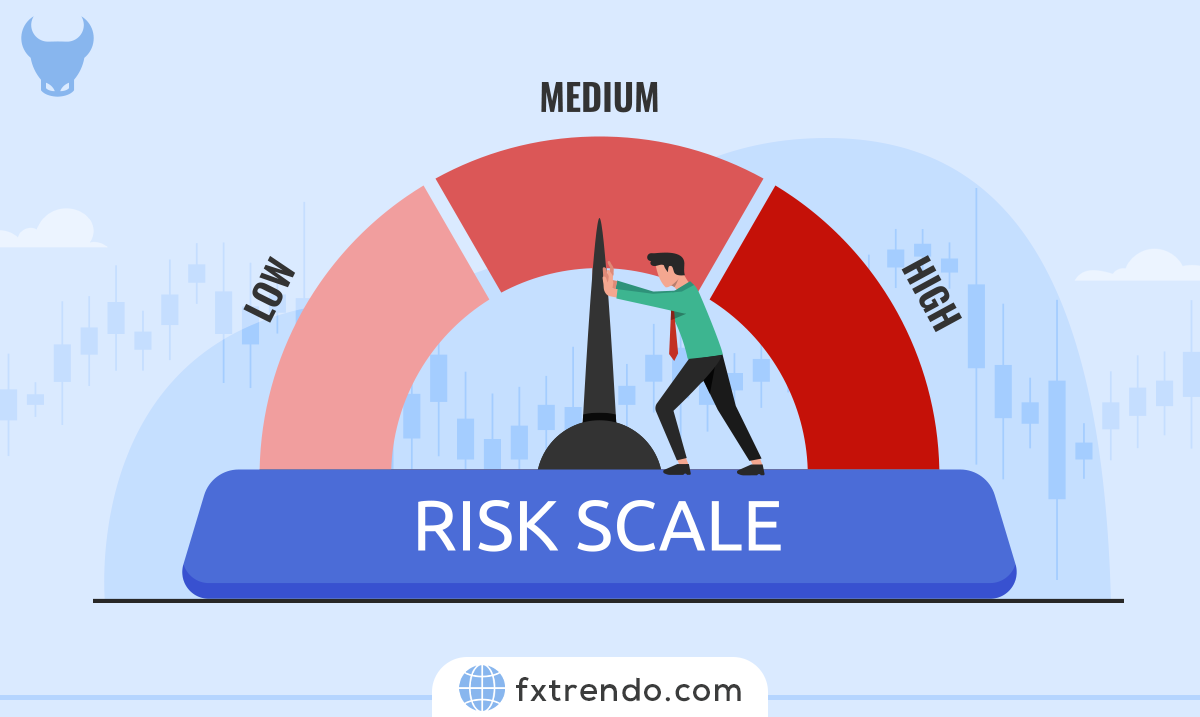

Risk Assessment: Continuously assess the level of risk you’re comfortable with and ensure your trading strategies align with your risk tolerance.

Education: Invest in your education. The more you understand about the markets and trading strategies, the better equipped you’ll be to navigate the risks.

While risk-free trading can minimize potential losses, it’s crucial to remain vigilant and proactive. By understanding the disadvantages and maintaining a disciplined approach, traders can work towards achieving a balance between safety and performance in their investment journey.

Various Techniques of Risk-Free Trading

Risk-free trading doesn’t mean avoiding risks altogether; it’s about managing them intelligently. Let’s explore some techniques that traders use to create a safety net for their investments:

1. Diversification

What is it? Diversification involves spreading your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce the impact of a single loss. It’s like having multiple backup plans.

How does it work? By diversifying, you avoid putting all your eggs in one basket. If one investment performs poorly, others may compensate. Imagine having both stocks and bonds in your portfolio—the ups and downs of each won’t hit you as hard.

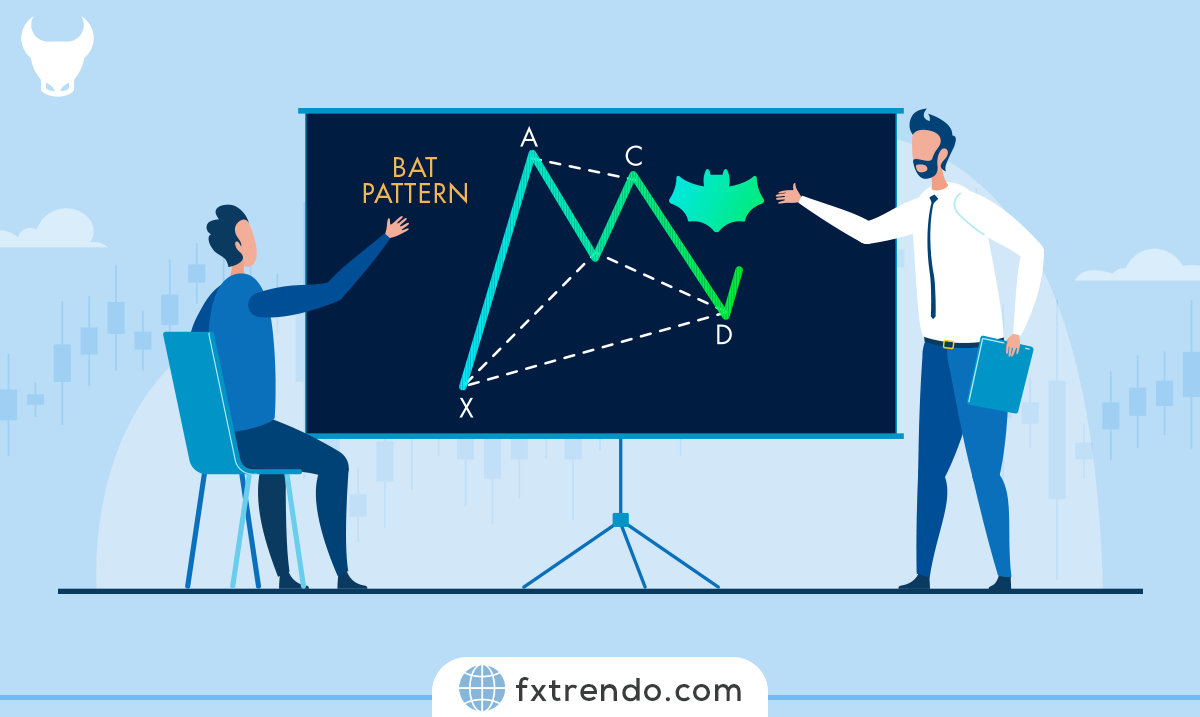

2. Hedging

What is it? Hedging is like buying insurance for your investments. It’s a way to protect against potential losses.

How does it work? Traders use financial instruments (like options or futures) to offset potential losses. For example, if you own stocks, you might buy put options (which gain value when stock prices fall) to hedge against a market downturn.

3. Arbitrage

What is it? Arbitrage involves exploiting price differences in different markets. It’s like finding a pricing loophole and profiting from it.

How does it work? Let’s say a stock is trading at $100 on one exchange and $105 on another. You buy it on the cheaper exchange and sell it on the pricier one, pocketing the difference.

4. Paper Trading

What is it? Paper trading is like rehearsal for traders. It’s practicing trades without real money.

How does it work? Traders simulate trades, track their performance, and learn from mistakes—all without risking actual capital. It’s a safe way to test strategies and gain experience.

5. Stop-Loss Orders

What are they? Stop-loss orders automatically exit a trade when the price reaches a predetermined level.

How do they work? Imagine you buy a stock at $50. You set a stop-loss order at $45. If the stock price drops to $45, the order triggers, limiting your loss. It’s like having a safety net—you fall, but not too far.

6. Take-Profit Orders

What are they? Take-profit orders lock in gains when a trade reaches a specific profit level.

How do they work? Suppose you bought a currency pair at $1.10. You set a take-profit order at $1.15. When the pair reaches that price, the order executes, securing your profit. It’s like saying, “I’ve had my fill; time to cash in.”

Remember, risk-free trading isn’t about avoiding risks—it’s about navigating them wisely. By using these techniques, traders can sail through the markets with more confidence and fewer sleepless nights.

How to Implement Risk-Free Strategy Techniques

Implementing risk-free strategy techniques is about creating a blueprint for trading that prioritizes safety while still allowing for growth. Here’s a step-by-step guide to help you put these techniques into practice:

Step 1: Educate Yourself

Before diving into the markets, arm yourself with knowledge. Understand the basics of trading, the instruments you’ll be using, and the markets you’ll be entering. Knowledge is power, and in trading, it’s your first line of defense.

Step 2: Set Clear Goals

Define what you want to achieve with your trading. Are you looking for steady income, long-term growth, or capital preservation? Your goals will shape the strategies you implement.

Step 3: Assess Your Risk Tolerance

Everyone has a different comfort level with risk. Assess yours honestly. It will determine how aggressively you trade and which risk-free techniques you’ll use.

Step 4: Start with a Plan

Develop a trading plan that outlines your strategies, entry and exit points, and how you’ll implement risk management techniques. A plan acts as a roadmap, helping you navigate through your trading journey.

Step 5: Diversify Your Portfolio

Don’t concentrate all your funds in one type of investment. Spread them out across different assets to mitigate risk. Diversification is one of the simplest yet most effective risk-free strategies.

Step 6: Use Hedging Techniques

Learn how to use financial instruments like options and futures to hedge your positions. Hedging can protect your investments from adverse price movements.

Step 7: Practice with Paper Trading

Before committing real money, practice with paper trading. It’s a risk-free way to test your strategies and refine your approach without any financial consequences.

Step 8: Implement Stop-Loss and Take-Profit Orders

Make use of stop-loss and take-profit orders to automatically close your positions at predetermined levels. This helps you lock in profits and prevent large losses.

Step 9: Monitor and Adjust

The market is always changing, and so should your strategies. Regularly review your trades and adjust your plan as needed. Stay flexible and ready to pivot.

Step 10: Keep Emotions in Check

Trading can be emotional, but decisions based on fear or greed can lead to mistakes. Stick to your plan and make decisions based on logic, not emotion.

By following these steps, you can implement risk-free strategy techniques that align with your trading objectives and risk tolerance.

Risk-Free Trading Tools and Platforms

In the quest for risk-free trading, the tools and platforms you choose are your allies. They provide the technology and resources needed to apply the strategies we’ve discussed. Here’s a rundown of the types of tools and platforms that can support your risk-free trading journey:

Analytical Tools

Charting Software: Visuals can clarify complex data. Charting software offers a graphical representation of market trends, helping you spot patterns and make informed decisions.

Risk Management Calculators: Numbers don’t lie. Risk management calculators help you determine the right amount to invest and the level at which to set stop-loss orders.

Back testing Software: History often repeats itself. Back testing software allows you to test your strategies against historical data to see how they might perform in the future.

Trading Platforms

Brokerage Platforms: Your gateway to the markets. Brokerage platforms provide access to buy and sell assets. They often come with built-in tools for analysis and risk management.

Demo Accounts: The training wheels of trading. Many platforms offer demo accounts where you can practice trading with virtual money, honing your skills without financial risk.

Mobile Apps: Trade on the go. Mobile trading apps allow you to monitor the markets and manage your trades from anywhere, ensuring you never miss an opportunity.

Automated Trading Systems

Robo-Advisors: Let the algorithms do the work. Robo-advisors can manage your investments based on your risk tolerance and goals, often using ETFs to diversify.

Trading Bots: Consistency is key. Trading bots can execute trades based on predefined criteria, removing emotion from the equation.

Educational Resources

Webinars and Tutorials: Knowledge is power. Many platforms offer educational resources to help you understand trading and risk management better.

Community Forums: Learn from peers. Trading communities can be a goldmine of information, offering insights and advice from fellow traders.

By leveraging these tools and platforms, you can apply risk-free trading techniques more effectively. Remember, the goal is not to eliminate risk but to manage it. With the right resources at your disposal, you can approach trading with confidence and a greater sense of control.

Limitations of Risk-Free Trading Techniques

Embarking on a risk-free trading journey might seem like the ultimate goal for any trader, but it’s important to recognize that even the most cautious strategies have their limitations. Here’s a look at some of the constraints you might encounter:

The Myth of “Risk-Free”

No Guarantee of Profits: The term “risk-free” can be misleading. While certain strategies aim to minimize risks, they cannot guarantee profits. The markets are unpredictable, and even the best-laid plans can go awry.

Unforeseen Market Events: No matter how much you hedge or diversify, global events like economic crises or natural disasters can impact the markets in ways that no strategy can fully anticipate.

Practical Challenges

Costs: Some risk-free strategies involve costs that can eat into your profits. For example, buying options for hedging requires paying premiums, which can add up over time.

Complexity: Implementing risk-free strategies often requires a deep understanding of financial instruments and market dynamics. For the average trader, the complexity of these strategies can be daunting.

Time-Consuming: Setting up and maintaining a risk-free trading approach can be time-consuming. Constant monitoring and adjusting of positions to align with market changes require a significant time investment.

Psychological Factors

Overconfidence: A false sense of security can lead to overconfidence. Traders might take on more risk than they can handle, believing their strategies are infallible.

Underestimating Risks: It’s easy to underestimate risks when you believe you’re trading risk-free. This can lead to poor decision-making and potential losses.

Performance Limitations

Lower Returns: Typically, the lower the risk, the lower the potential returns. Risk-free trading strategies might protect your capital, but they can also limit your earning potential.

Opportunity Costs: By focusing on minimizing risks, you might miss out on high-reward opportunities that could have significantly boosted your portfolio.

Market Limitations

Liquidity Issues: Some risk-free strategies rely on the ability to enter and exit positions quickly. However, in a fast-moving market, liquidity can dry up, leaving you unable to execute your strategy as planned.

Slippage: Market conditions can change rapidly, leading to slippage, where the price at which a trade is executed does not match the expected price. This can undermine risk-free strategies.

In conclusion, while risk-free trading techniques can provide a sense of security and help manage potential losses, they are not foolproof. Traders must remain aware of these limitations and be prepared to adapt their strategies as market conditions evolve.

Conclusion

Risk-free trading is a strategic approach that aims to minimize potential losses in the unpredictable world of trading. While it doesn’t eliminate risk entirely, it equips traders with tools and techniques to manage it effectively. From hedging and diversification to stop-loss orders, these strategies can provide a safety net in volatile markets.

However, it’s crucial to remember that successful trading also requires continuous learning, market analysis, and a realistic understanding of risk.

Frequently Asked Questions

What is Risk-Free Trading?

Can Trading be Completely Risk-Free?

What is Hedging in Trading?

How Does Diversification Help in Trading?

What is a Stop-Loss Order?

What’s the best risk-free strategy for beginners?

Can risk-free trading guarantee profits?

پست مرتبط

پربازدیدترین ها

0