Ultimate Guide to Zero Spread in Forex - The Best Broker with Zero Spread in Forex

Imagine trading currencies as if you were exchanging money at a no-fee booth, where what you see is what you get. This is the essence of zero spread trading in Forex—a scenario where the usual cost between the buy and sell price of a currency pair disappears, allowing for transparent and direct trades.

This guide is your beacon through the fog of Forex jargon, illuminating the path to understanding zero spreads. We’ll delve into their benefits, such as cost savings and enhanced trade execution, and provide a roadmap for selecting the best broker who can offer you this competitive edge.

Zero spread can be a game-changer. It means trading without the worry of the spread eating into potential profits. It’s especially beneficial for those who trade frequently or in large volumes, as every pip saved is a pip earned.

By the end of this guide, you’ll grasp why zero spread could be the key to unlocking a more profitable trading strategy.

Contents

What is Spreads in Forex?

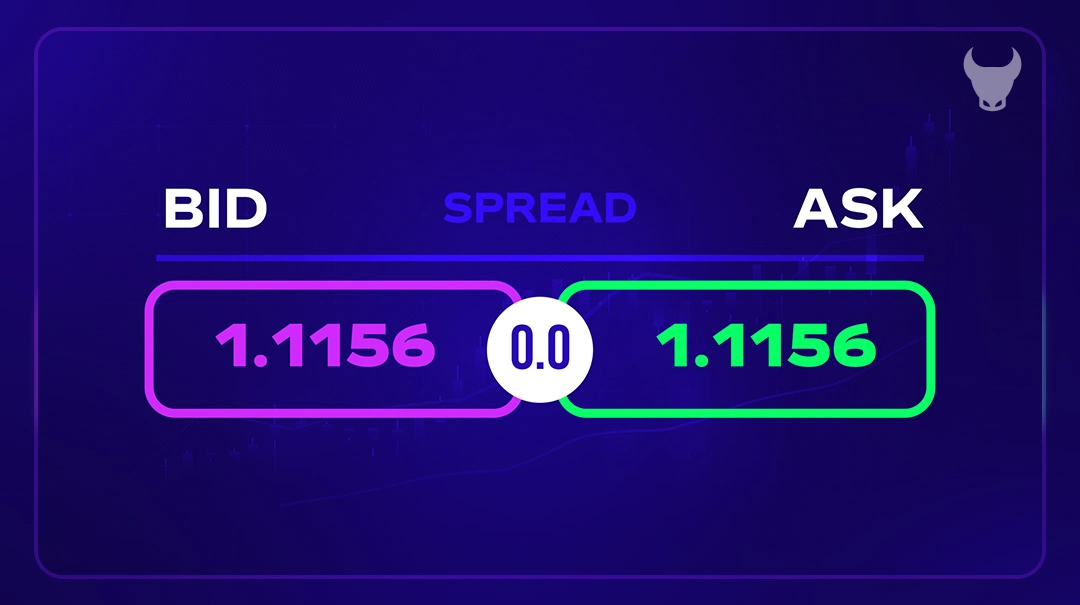

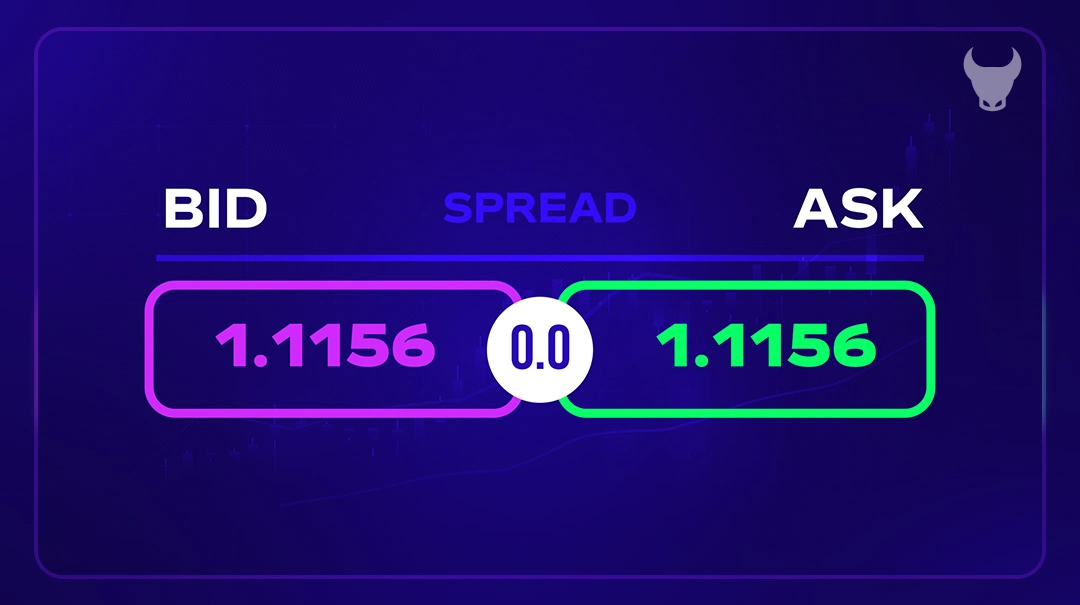

In the dynamic world of Forex trading, the term spread is a fundamental concept that every trader must understand. It represents the difference between the bid and ask prices of a currency pair. The bid price is what you can sell a currency for, while the ask price is what you can buy it for. This spread is essentially the cost of trading and is how brokers make their money.

For example, if you’re looking to trade EUR/USD, you might see a bid price of 1.1050 and an ask price of 1.1055. The spread here would be 5 pips, which is the smallest unit of price movement in Forex trading. It’s crucial for traders to be aware of the spread because it affects the profitability of their trades. A smaller spread means lower transaction costs and potentially higher profits.

There are two main types of spreads : fixed and variable. Fixed spreads remain constant regardless of market conditions, while variable spreads can fluctuate based on market volatility. Understanding these types can help traders choose the right broker and trading strategy to minimize costs and maximize gains.

Spreads have a direct impact on the profitability of your Forex trades. To make a profit, you must overcome the spread before you can start earning. For example, if the spread on a currency pair is 2 pips, you would need the trade to move at least 2 pips in your favor just to break even. The wider the spread, the more the market needs to move for you to achieve profitability. Therefore, choosing a broker with competitive spreads can significantly improve your chances of making a profit.

Read more: What is Gold Spread?

What is Zero Spread in Forex?

Zero spread in Forex trading is a concept where the bid and ask prices of a currency pair are identical, meaning there is no difference between the price at which you can buy and sell the currency. This results in no spread or commission charged by the broker for executing the trade.

There are generally two types of zero spread accounts: those that charge a fixed commission per trade and those that offer commission-free trading but may include other fees. The former is transparent about the costs associated with each trade, while the latter may incorporate costs in other ways, such as higher minimum balance requirements or inactivity fees.

In essence, zero spread allows traders to buy and sell currency pairs at the same price, without any additional costs. This can be particularly advantageous in highly liquid markets or during periods of low volatility, where such conditions are more likely to occur. Zero spread accounts are often seen as a way to reduce trading costs and improve profitability for Forex traders. However, it’s important to note that not all brokers offer zero spread accounts, and those that do may have other fees or conditions that could affect overall trading costs.

How Zero Spread Accounts Work?

Zero spread accounts are a unique type of trading account offered by some Forex brokers. Here’s a more detailed explanation:

In traditional Forex trading, the spread is the difference between the buy (ask) and sell (bid) price of a currency pair. This spread is how most brokers generate their revenue. However, in a zero spread account, this difference is eliminated.

When you trade with a zero spread account, you’re able to enter and exit trades at the exact market price displayed on your screen. This is possible because of the advanced trading platforms and deep liquidity pools that these accounts are connected to.

Advanced trading platforms are software applications that provide all the necessary tools for online trading. They offer real-time market data, technical analysis tools, and order execution capabilities. These platforms are designed to handle high volumes of trades quickly and efficiently, which is crucial for zero spread trading.

Deep liquidity pools refer to the availability of large volumes of orders in the market. In the context of Forex trading, a deep liquidity pool means that there’s a significant number of buyers and sellers at different price levels. This allows for immediate execution of trades, even large ones, without significant price changes.

So, in a zero spread account, when you place a trade, the order is sent through the trading platform to the liquidity pool. Because of the depth of the pool, the order can be matched with an opposite order (a sell order if you’re buying, or a buy order if you’re selling) at the exact same price, allowing the trade to be executed without a spread.

This mechanism can significantly reduce trading costs, as you’re not paying the spread on each trade. It also enhances transparency, as you’re trading at the true market price. However, it’s important to note that brokers offering zero spread accounts often charge a commission on trades instead. This commission is usually a fixed amount per lot traded. So, while you’re not paying a spread, you’re still incurring a trading cost in the form of the commission.

Overall, zero spread accounts can be a great option for high-frequency traders, scalpers, and any trader who values cost-effectiveness and precision in their trading. However, as with any trading account, it’s important to understand the costs involved and to choose a reputable broker.

Who Should Consider a Zero Spread Account?

Zero spread accounts are ideal for day traders and scalpers who perform a high volume of trades over short periods. The absence of a spread can significantly lower trading costs for these active traders. Additionally, those who prefer to see and trade on raw prices directly from liquidity providers may find zero spread accounts more in line with their trading style. It’s important for traders to assess their trading frequency, strategy, and cost preferences when considering a zero spread account.

Benefits of Zero Spread in Forex Trading

Zero spread accounts have transformed Forex trading, offering a slew of advantages that cater to the needs of modern traders. Here’s why they’re gaining popularity:

Clarity and Precision

With zero spread, what you see is what you get. The prices displayed are the prices at which trades are executed, providing clarity and allowing for precision in trade execution.

Ideal for High-Frequency Traders

Traders who operate on tight margins, such as scalpers and day traders, find zero spread accounts particularly beneficial. The absence of a spread allows them to capitalize on small price movements without worrying about the overhead of a spread.

Accessibility

Zero spread accounts often come with lower barriers to entry, making Forex trading more accessible to a broader audience. This democratization of trading means that more people can try their hand at the Forex market.

Improved Scalping Opportunities

For scalpers, who aim to profit from small price movements, zero spread accounts are particularly beneficial. They can enter and exit trades without being affected by the spread, capturing more frequent and smaller profits.

Lower Entry Requirements

Zero spread accounts often have lower minimum deposit requirements compared to regular accounts. This accessibility allows traders with smaller capital to participate in Forex trading without being hindered by high spreads.

Effective for News Trading

News releases can cause spreads to widen, impacting trade entry and exit points. Zero spread accounts sidestep this issue, allowing traders to act on news without the added concern of fluctuating spreads.

In essence, zero spread accounts offer a streamlined trading experience, aligning with the needs of traders who value transparency, cost-effectiveness, and precision in their trading endeavors.

Potential Drawbacks of Zero Spread Trading

While zero spread trading offers many advantages, it’s important to be aware of the potential drawbacks that could impact your trading strategy:

Higher Commissions

One of the main considerations with zero spread accounts is the commission structure. Instead of a spread, brokers may charge a fixed commission per trade, which can be higher than the cost of a spread in traditional accounts. This means that for traders who execute a large number of trades, the overall cost could be greater.

Limited Currency Pairs

Zero spread accounts may not offer all currency pairs. Some brokers provide zero spreads only on major pairs, limiting the options for traders who wish to diversify their trading across various currencies.

Volatility Risk

Without a spread to act as a buffer, zero spread accounts can expose traders to increased volatility risk. During periods of high market volatility, prices can fluctuate significantly, potentially leading to larger losses.

Market Depth

Brokers offering zero spreads might have reduced market depth compared to those with wider spreads. This can affect the ability to execute large orders without impacting the market price.

Hidden Fees

Some zero spread brokers may have hidden fees or markups that can offset the benefits of lower spreads. It’s crucial to read the fine print and understand all associated costs before opening an account.

In summary, while zero spread trading can be cost-effective and transparent, it’s essential to consider these potential drawbacks and assess whether they align with your trading goals and risk tolerance.

How to Choose the Right Zero Spread Forex Broker?

Choosing the right zero spread Forex broker is a crucial decision for traders looking to minimize costs and maximize efficiency. Here’s a comprehensive guide to help you make an informed choice:

Regulation and Reputation

Start by ensuring the broker is regulated by a reputable financial authority. This provides a level of security and trustworthiness. Look for brokers with a strong reputation in the industry, as this can be indicative of their reliability and customer service quality.

Trading Platform

A user-friendly trading platform is essential for executing trades smoothly. Consider whether the broker offers platforms that are compatible with your preferred trading style, whether it’s scalping, day trading, or long-term investing.

Currency Pairs and Instruments

Check if the broker offers a wide range of currency pairs and other financial instruments. This will give you the flexibility to diversify your trades and manage risk effectively.

Minimum Deposit and Leverage

Assess the minimum deposit requirements and leverage options. While zero spread accounts can be cost-effective, they may come with higher leverage, which can increase risk. Ensure that the leverage offered aligns with your trading strategy and risk tolerance.

Customer Support

Reliable customer support is crucial, especially when dealing with Forex trading. Look for brokers that offer 24/7 support through multiple channels such as phone, email, and live chat.

Fees and Commissions

While zero spread accounts eliminate the spread cost, they may charge commissions or other fees. Carefully review all associated costs to ensure they are transparent and reasonable.

Execution Policy

Understand the broker’s execution policy, including how quickly they can execute trades. This is particularly important in fast-moving markets where delays can impact trade outcomes.

Withdrawal Options

Consider the withdrawal options available to you. Look for brokers that offer multiple withdrawal methods and have a good track record of processing withdrawals promptly.

By considering these factors, you can choose a zero spread Forex broker that best suits your trading needs and goals. Remember to do thorough research and consider all aspects before making your decision.

Introducing the Best Brokers Offering Zero Spread in Forex

Welcome to the world of zero spread Forex trading, where the cost of trading is minimized, and the potential for profit is maximized. In this section, we’ll introduce you to some of the top brokers that offer zero spread accounts, providing you with a transparent and cost-effective trading experience.

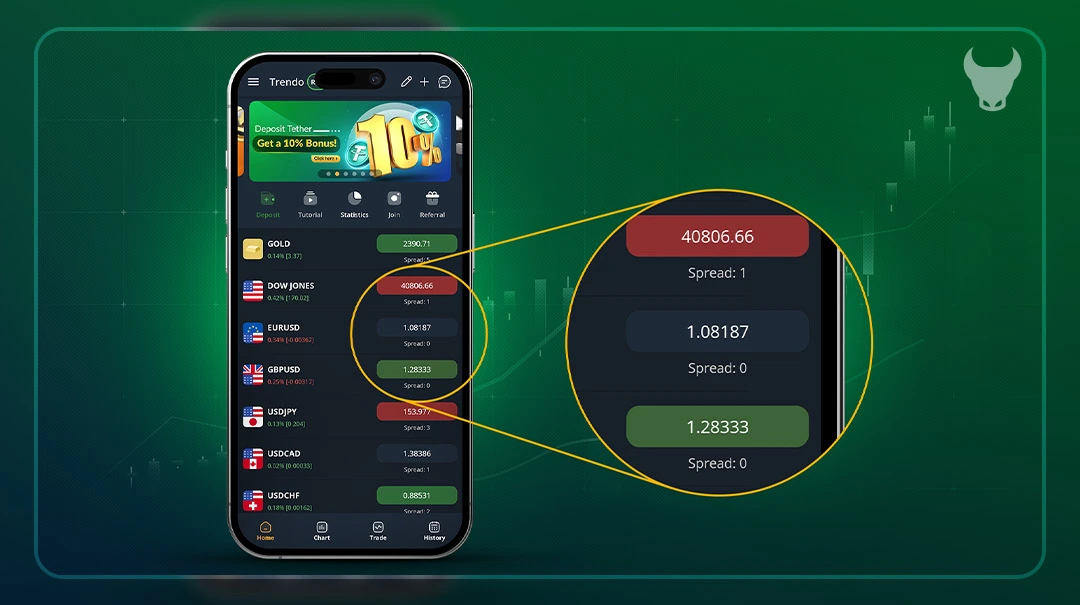

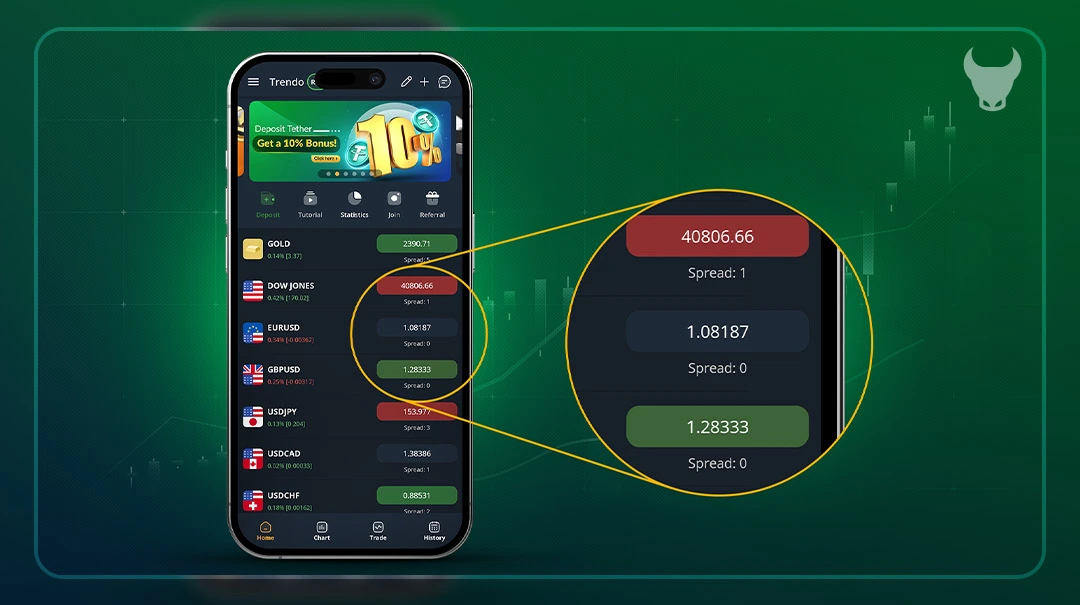

Trendo International Broker : Trendo is known for its accurate trading signals and offers a comprehensive suite of tools for forex trading. It supports multiple forex brokers and provides a free demo trading account for practice.

Tickmill Broker: Tickmill has evolved into a multi-asset broker with competitive spreads and a range of platforms. It’s recognized for its MetaTrader suite and offers features like copy trading and automated trading.

CMC Markets: CMC Markets is a well-established broker with a wide range of offerings, including CFDs and spread betting. It’s praised for its Next Generation platform and has been awarded as the Best Overall Forex Broker.

Interactive Brokers: Interactive Brokers is favored by professional investors and day traders for its low commissions, extensive investment offerings, and robust trading platform. It’s also known for its educational materials and research.

Capital.com: Capital.com offers a user-friendly interface, competitive fees, and a wide range of assets. It’s suitable for both beginners and experienced traders looking for a straightforward trading experience.

IC Markets: IC Markets is an Australian-based broker specializing in CFDs over Forex, Indices, Commodities, Bonds, and equity markets. It’s recognized for its competitive pricing and scalable execution, making it ideal for algorithmic traders.

FP Markets: FP Markets is noted for its robust trading environment with competitive fees. It provides access to over 10,000 financial markets and has been rated as the best CFD broker overall.

Each broker has its own set of features and benefits, so it’s important to consider your specific trading needs when choosing one.

How to Get Started with a Zero Spread Broker

Embarking on the journey of zero spread Forex trading can be both exciting and rewarding. Here’s a simple, step-by-step guide to help you get started with a zero spread broker:

Step 1: Choose Your Broker Select a broker that offers zero spread accounts. Look for one that aligns with your trading needs, is user-friendly, and has a strong reputation for customer service.

Step 2: Gather Your Documents Prepare the necessary documentation for account verification. This typically includes a government-issued ID (like a passport or driver’s license) and a proof of residence (such as a utility bill or bank statement).

Step 3: Complete the Application Fill out the broker’s online application form. Provide personal details, financial information, and trading experience as accurately as possible.

Step 4: Verify Your Identity Submit the required documents for verification. The broker will review them to ensure they meet regulatory requirements. This process can take from a few hours to several days.

Step 5: Make Your Initial Deposit Once verified, you’ll need to deposit funds into your account. Check the broker’s minimum deposit requirement and consider starting with an amount you’re comfortable with.

Step 6: Set Up Your Trading Platform Download and set up the trading platform provided by your broker. Familiarize yourself with its features and tools, which are crucial for effective trading.

Step 7: Start with a Demo Account If available, practice with a demo account to get a feel for trading without any financial risk. It’s a valuable step for testing strategies and understanding market movements.

Step 8: Go Live Transition to a live trading account when you feel ready. Begin with small trades to manage risk as you gain more experience.

Remember, while zero spread accounts can save on trading costs, they may come with other fees, such as commissions. Always consider the full cost structure and how it fits into your trading plan. Additionally, be mindful of leverage, as it can amplify both profits and losses.

By following these steps, you can smoothly start your trading journey with a zero spread broker, setting the stage for a potentially successful Forex trading experience. Remember to trade responsibly and never invest more than you can afford to lose.

Strategies for Trading with Zero Spread

Trading with zero spread can be a unique experience that requires a tailored approach to maximize its benefits. Here are some strategies to consider:

1. High-Frequency Trading: Zero spread is particularly advantageous for high-frequency traders, including scalpers, who make numerous trades for small profits. Without the spread, each trade has a better chance of being profitable, even with minimal price movements.

2. News Trading: Economic news can cause significant volatility in the Forex market. With zero spread, traders can enter and exit positions more effectively during these times, as they don’t have to account for a widening spread.

3. Automated Trading Systems: Automated trading systems can be more efficient with zero spread accounts. These systems often operate on thin margins, and eliminating the spread can improve their performance.

4. Cost Management: Even though the spread is zero, other costs such as commissions may apply. Effective cost management involves understanding all associated fees and incorporating them into your trading plan.

5. Risk Management: With zero spread, it’s easy to overlook the importance of risk management. Set stop-loss orders and take-profit levels to manage your risk on each trade, just as you would with a standard spread account.

6. Leverage: Zero spread accounts often come with higher leverage, which can increase both potential profits and losses. Use leverage cautiously and always within your risk tolerance levels.

7. Diversification: Diversify your trading across different currency pairs and timeframes. This can help spread risk and take advantage of various market conditions.

8. Continuous Learning: Stay informed about market trends and continuously refine your trading strategies. The Forex market is dynamic, and what works today may not work tomorrow.

By employing these strategies, traders can effectively navigate the zero spread environment and potentially improve their trading outcomes. Remember, no strategy is foolproof, and consistent profitability in Forex trading requires discipline, patience, and ongoing education.

Tips for Successful Zero Spread Trading

Zero spread trading can be a highly effective way to trade Forex, but it requires a strategic approach. Here are some tips to help you succeed:

Understand the Costs Involved: Even with zero spread, there may be commissions or other fees. Make sure you understand all the costs associated with your trades to accurately calculate your potential profits and losses.

Use a Demo Account: Before diving into live trading, practice with a demo account. This will help you get used to the zero spread environment without risking real money.

Develop a Solid Trading Plan: A well-thought-out trading plan is essential. It should include your trading goals, risk tolerance, strategies, and criteria for entering and exiting trades.

Stay Informed: Keep up with financial news and market trends. Economic events can have a significant impact on currency prices, and being informed can help you make better trading decisions.

Manage Your Risk: Use risk management tools like stop-loss orders to protect your capital. Determine the maximum amount you are willing to risk on each trade and stick to it.

Keep Emotions in Check: Emotional trading can lead to impulsive decisions and increased risk. Maintain discipline and follow your trading plan, regardless of short-term market movements.

Regularly Review Your Trades: Analyze your trading activity regularly to identify what’s working and what’s not. Use this information to refine your strategies and improve your performance.

Be Patient: Success in Forex trading doesn’t happen overnight. Be patient, and don’t expect to make large profits from every trade. Consistency is key to long-term success.

By following these tips, you can enhance your chances of success when trading with a zero spread broker. Remember, continuous learning and adaptation are crucial in the ever-changing Forex market.

Conclusion

This guide explored zero spread in Forex trading, a cost-effective option for traders. Zero spread accounts allow trading at market price, reducing costs and increasing profitability.

We discussed the workings of zero spread accounts, effective strategies, and tips for success. The right broker, offering zero spread and valuing transparency and customer service, is crucial.

Zero spread trading is a sustainable method for traders seeking precision and cost-effectiveness. It suits high-frequency traders and scalpers.

Finding the best zero spread Forex broker requires research but promises rewarding outcomes. It allows pure engagement with the Forex market, free from traditional spreads.

Armed with this guide’s knowledge, explore zero spread brokers and start a clear, efficient trading journey with potential for financial rewards. The world of zero spread Forex trading awaits.

FAQ for Zero Spread in Forex

What is zero spread in Forex trading?

How does a zero spread account work?

What strategies can be employed in zero spread trading?

Why is choosing the right broker important in zero spread trading?

Is zero spread trading just a trend?

What is the journey to finding the best broker with zero spread in Forex like?

What are the potential rewards of zero spread trading?

Article similaire

Le plus visité

0