What is the Relationship between Margin, Leverage, and Lot? Everything about Leverage and Its Connection to Margin and Lot Size

Margin refers to the amount of money required to open a position, while leverage allows traders to control a larger position with a smaller amount of capital. Lot size, on the other hand, determines the volume of the trade.

By mastering the balance between these components, traders can optimize their risk management and enhance their trading performance.

In this blog post, we’ll delve into the nuances of margin, leverage, and lot size, and explore how they work together to influence your trading outcomes.

Whether you’re a novice or an experienced trader, this comprehensive guide will provide valuable insights to help you navigate the complexities of the trading world with confidence.

Contents

What is Margin?

Margin is essentially the money you borrow from a broker to purchase an investment. Think of it as a loan that allows you to buy more than you could with just your own funds. When you trade on margin, you only need to put down a fraction of the total value of the trade, which is known as the margin requirement. This can amplify both your potential gains and losses.

Here’s a simple example: If you want to buy $10,000 worth of stocks but only have $5,000, you can use margin to borrow the remaining $5,000 from your broker. This means you only need to provide 50% of the total value, and the broker covers the rest. However, it’s important to remember that trading on margin comes with risks. If the value of your investment drops, you could end up owing more than your initial investment.

Margin trading can be a powerful tool for experienced traders who understand the risks and rewards. It allows you to leverage your investments, potentially increasing your returns. However, it’s crucial to use margin wisely and be aware of the potential for significant losses.

How Margin Works in Different Markets?

Margin works differently across various markets, such as forex, stocks, and futures, but the core concept remains the same: it allows traders to borrow funds to increase their buying power.

Forex Market: In the forex market, margin is used to open and maintain positions in currency pairs. When you trade forex on margin, you only need to deposit a small percentage of the total trade value, known as the margin requirement. This allows you to control a larger position with a smaller amount of capital. For example, with a 1% margin requirement, you can control $100,000 worth of currency with just $1,000. However, trading on margin in the forex market can amplify both gains and losses, so it’s essential to manage risk carefully.

Stocks Market: In the stock market, margin trading involves borrowing money from a broker to purchase stocks. You need to open a margin account and deposit a certain amount of money, which acts as collateral for the loan. The broker lends you the rest, allowing you to buy more shares than you could with your own funds. For instance, if you have $5,000 and the broker offers a 50% margin, you can buy $10,000 worth of stocks. While this can increase your potential returns, it also comes with the risk of margin calls if the value of your stocks drops significantly.

Futures Market: In the futures market, margin works a bit differently. Instead of borrowing money, you deposit an initial margin to open a futures contract. This initial margin is a small percentage of the contract’s total value. Additionally, you need to maintain a maintenance margin, which is the minimum amount required in your account to keep the position open. If your account balance falls below this level, you’ll receive a margin call and need to deposit more funds. Futures margin helps ensure that both parties in the contract have a financial stake in the trade, reducing the risk of default.

How to Calculate Margin for Trading?

Calculating the margin for trading is a straightforward process, but it’s crucial to understand the formula and its components. The margin is calculated based on the lot size, the leverage, and the currency pair you’re trading.

Here’s the basic formula for margin calculation:

Let’s break it down:

Lot Size: This is the number of units of the base currency in a Forex trade. For example, if you’re trading EUR/USD, the lot size could be 100,000 Euros if you’re trading a standard lot.

Leverage: Leverage is expressed as a ratio, such as 1:100. This means that for every dollar of your money, you can trade $100 in the Forex market.

So, if you’re trading 1 standard lot of EUR/USD (which is 100,000 Euros) with a leverage of 1:100, the margin required to open this position would be:

This means you need to have at least 1,000 Euros in your trading account to open this position.

Types of Margin in the Forex Market

In the forex market, understanding the different types of margin is crucial for effective trading. Here are the main types of margin you need to know:

1. Initial Margin: This is the amount of money required to open a new position. It’s a small percentage of the total trade value and acts as a security deposit. For example, if the initial margin requirement is 2% for a $100,000 trade, you need to deposit $2,000.

2. Maintenance Margin: Also known as the minimum margin, this is the minimum amount of equity you must maintain in your account to keep a position open. If your account balance falls below this level, you’ll receive a margin call, requiring you to deposit more funds to maintain the position.

3. Used Margin: This is the portion of your account balance that is currently being used to maintain open positions. It represents the total amount of initial margin required for all your open trades.

4. Free Margin: This is the amount of money in your account that is available for opening new positions. It’s calculated as the difference between your account equity and the used margin. Free margin acts as a buffer to absorb potential losses.

5. Margin Level: This is a percentage value that indicates the health of your trading account. It’s calculated by dividing your equity by the used margin and multiplying by 100. A higher margin level indicates a healthier account, while a lower margin level may trigger a margin call.

What is Leverage?

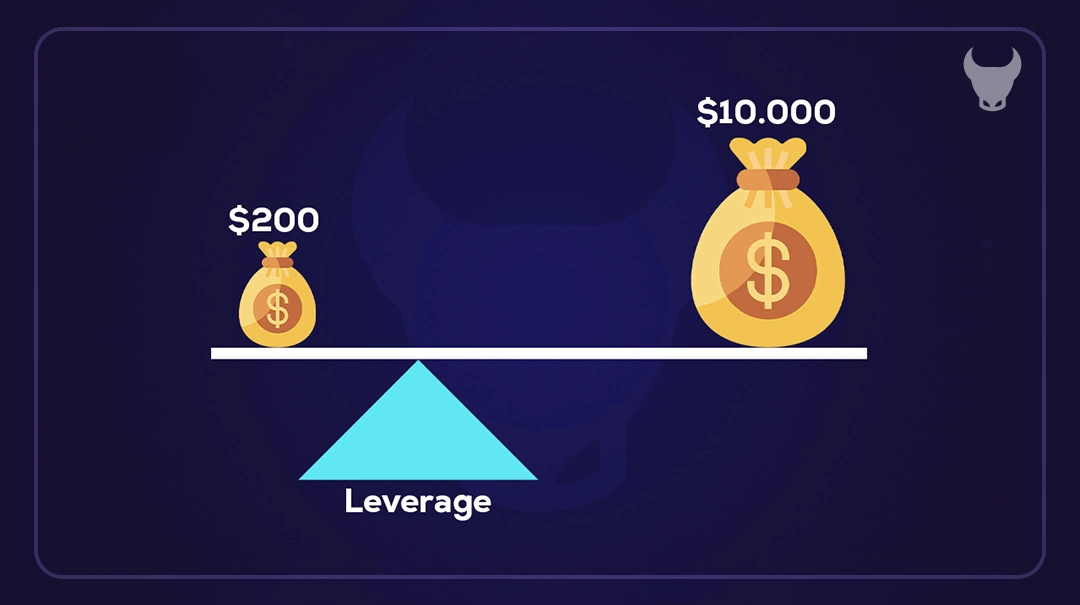

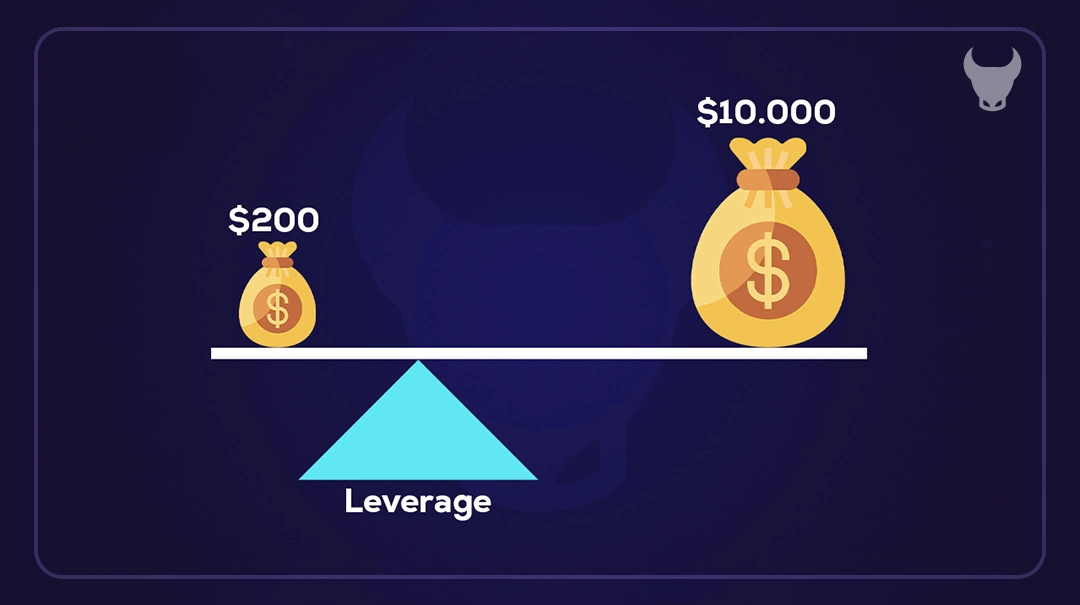

Leverage in trading is a powerful tool that allows you to control a larger position with a smaller amount of capital. Essentially, it’s like borrowing money from your broker to increase your buying power. This means you can potentially amplify your profits, but it also comes with increased risk.

Here’s a simple way to understand leverage: Imagine you have $1,000 in your trading account, and your broker offers you leverage of 10:1. This means you can trade with $10,000 instead of just your $1,000. If the trade goes in your favor, your profits are magnified. However, if the trade goes against you, your losses are also magnified.

Read more: What are The Differences between Leverage in Forex and Leverage in Crypto

Leverage is expressed as a ratio, such as 10:1, 20:1, or even higher. The higher the leverage, the greater the potential for both profit and loss. It’s important to use leverage wisely and understand the risks involved. While it can enhance your returns, it can also lead to significant losses if the market moves against you.

How Leverage Amplifies Trading Positions?

Leverage is a powerful tool in trading that allows you to control a larger position with a smaller amount of your own capital. This amplification can significantly increase both potential profits and potential losses.

Here’s how it works: When you use leverage, you’re essentially borrowing money from your broker to increase your buying power. For example, if you have $1,000 and your broker offers you leverage of 10:1, you can control a position worth $10,000. This means that even small market movements can have a big impact on your trading results.

Let’s break it down with a simple example. Suppose you invest $1,000 in a trade without leverage, and the market moves in your favor by 1%. Your profit would be $10. However, if you use 10:1 leverage, that same 1% market movement would result in a $100 profit, because you’re controlling a $10,000 position. This is how leverage amplifies your trading positions.

Risks and Benefits of Using Leverage

Leverage can be a powerful tool in trading, offering both significant benefits and notable risks. Understanding these can help you make informed decisions and manage your trading strategy effectively.

Benefits of Using Leverage:

1. Increased Potential for Gains: Leverage allows you to control a larger position with a smaller amount of capital. This means that even small market movements can result in substantial profits.

2. Access to Larger Positions: With leverage, you can take larger positions than you could with just your own funds. This can help you capitalize on market opportunities that would otherwise be out of reach.

3. Enhanced Flexibility: Leverage provides the flexibility to diversify your trading portfolio without needing a large amount of capital. This can help spread risk across different assets.

Risks of Using Leverage:

1. Magnified Losses: Just as leverage can amplify gains, it can also amplify losses. If the market moves against your position, you could lose more than your initial investment.

2. Margin Calls: If your account balance falls below the required margin level, your broker may issue a margin call, requiring you to deposit additional funds. Failure to meet a margin call can result in the liquidation of your positions.

3. Increased Volatility: Leverage can increase the volatility of your trading account. This means that your account balance can fluctuate more dramatically, making it harder to manage risk.

4. Higher Costs: Using leverage often comes with additional costs, such as interest on borrowed funds and higher trading fees. These costs can eat into your profits and increase your overall risk.

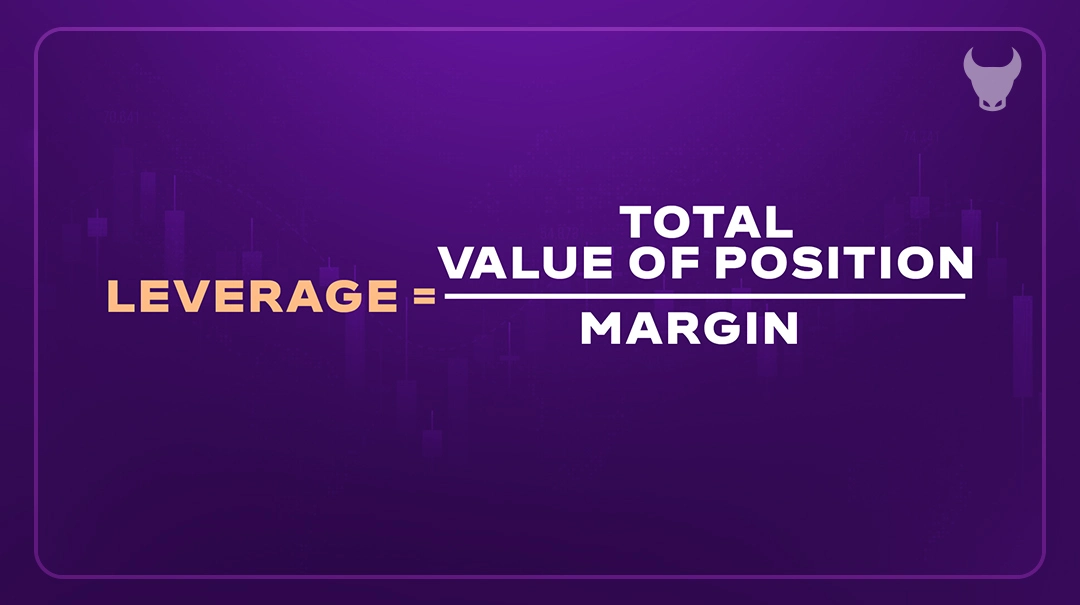

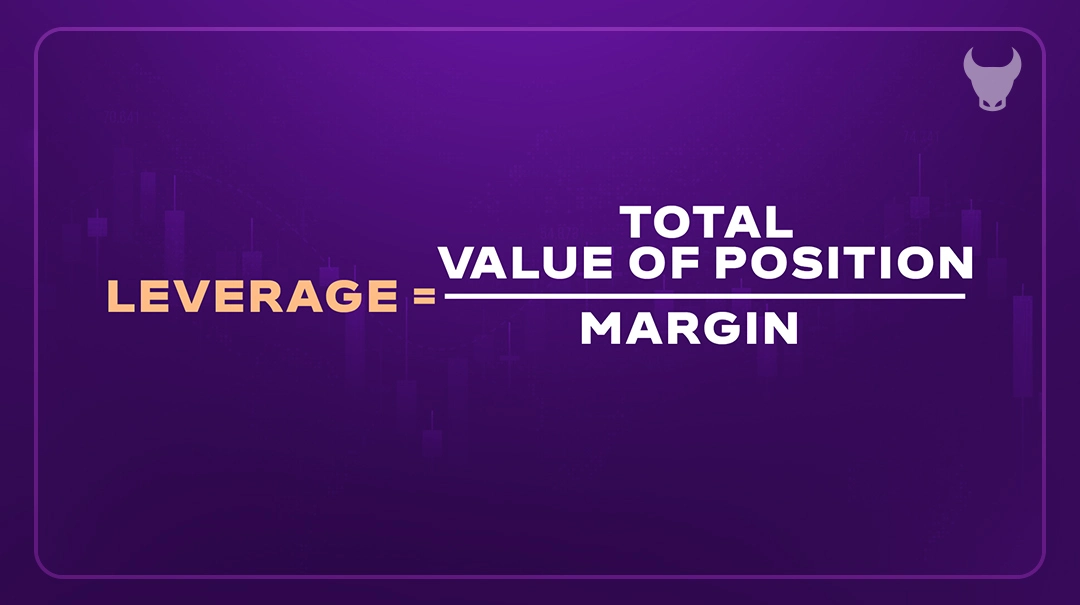

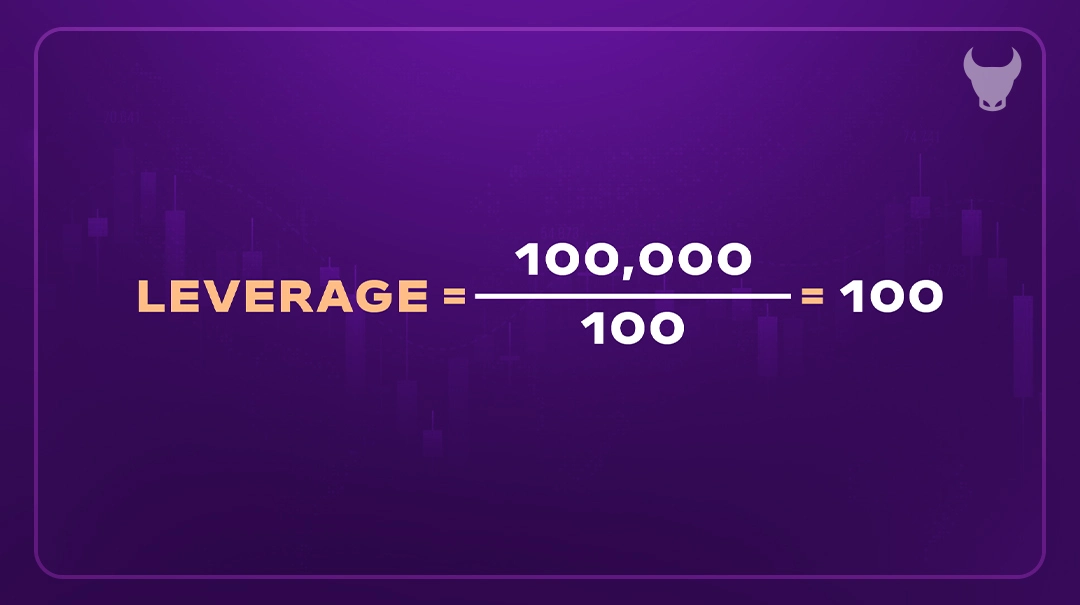

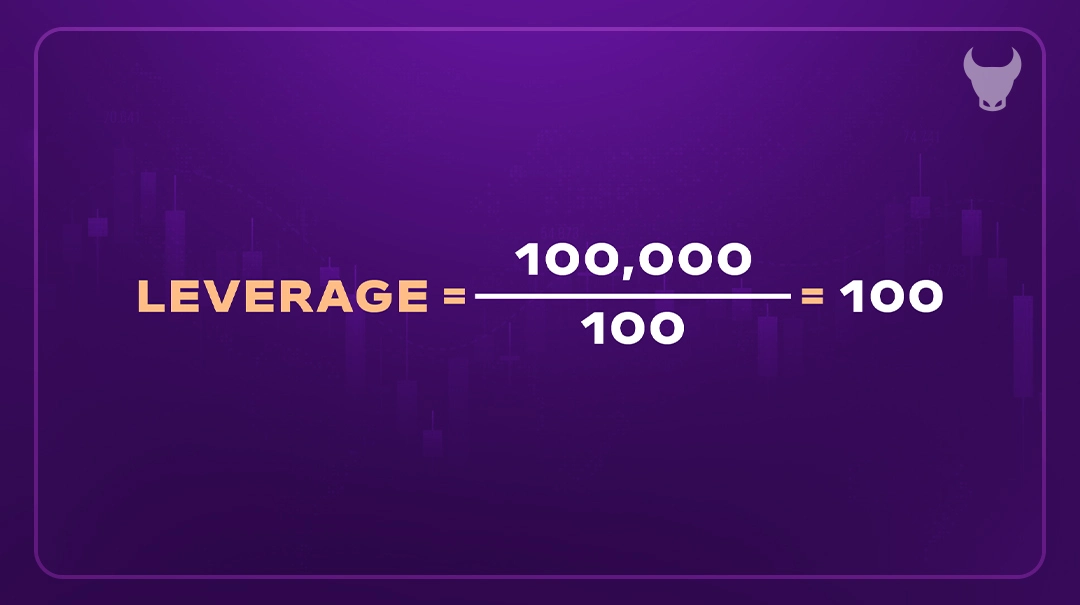

How to Calculate Leverage?

Calculating leverage in Forex trading is a straightforward process. It’s typically expressed as a ratio, such as 1:100, which means that for every $1 of your own money, you can trade $100 on the Forex market.

But how do you calculate this ratio? The formula for calculating leverage is:

Let’s break it down:

Total Value of Position: This is the total amount of currency you’re controlling in a trade. For example, if you’re trading 1 standard lot of EUR/USD (which is 100,000 Euros), the total value of the position is 100,000 Euros.

Margin: This is the amount of your own money that is used to open the position. It’s essentially a good faith deposit, a collateral that you need to provide to ensure that you can cover the potential losses of the trade.

So, if you’re controlling a position worth 100,000 Euros and the margin required to open this position is 1,000 Euros, the leverage would be:

This means you’re trading with a leverage of 1:100.

What is the Relationship between Margin and Leverage?

Margin and leverage are two sides of the same coin in the world of Forex trading. They are interconnected and play a crucial role in determining your trading capacity.

Leverage is a tool that allows you to control large positions with a small amount of capital. It’s like a multiplier, increasing your buying power in the market. On the other hand, Margin is the amount of your own money that is used to open and maintain a position. It’s essentially a good faith deposit, a collateral that you need to provide to ensure that you can cover the potential losses of the trade.

The relationship between margin and leverage is inverse. The higher the leverage, the lower the margin required to open a position, and vice versa. This is because leverage magnifies your trading capacity, allowing you to control larger positions with a smaller amount of your own money. Therefore, less margin (or collateral) is required.

So, if you’re trading with a leverage of 1:100, the margin required to open a position would be 1% of the total value of the position.

What is Lot Size?

Lot size refers to the number of units of a financial instrument, such as currencies, stocks, or commodities, involved in a transaction. In trading, lot size is a crucial factor as it determines the volume of the trade and, consequently, the potential profit or loss.

In the forex market, lot sizes are standardized to ensure consistency and ease of trading. There are four main types of lot sizes:

1. Standard Lot: This is the largest lot size and equals 100,000 units of the base currency. For example, if you’re trading EUR/USD, a standard lot would be 100,000 euros.

2. Mini Lot: A mini lot is one-tenth the size of a standard lot, equaling 10,000 units of the base currency. This smaller size allows traders to take smaller positions and manage risk more effectively.

3. Micro Lot: A micro lot is one-tenth the size of a mini lot, equaling 1,000 units of the base currency. This is ideal for beginners or those with smaller trading accounts.

4. Nano Lot: The smallest lot size, a nano lot equals 100 units of the base currency. This allows for very small trades and is often used for testing strategies with minimal risk.

How Lot Size Affects Trading Volume and Risk?

Lot size plays a crucial role in determining both the trading volume and the level of risk in your trades. Here’s how it works:

Trading Volume: The lot size directly impacts the volume of your trade. A larger lot size means you’re trading a higher volume of the financial instrument. For example, in the forex market, a standard lot is 100,000 units of the base currency, while a mini lot is 10,000 units, and a micro lot is 1,000 units. The larger the lot size, the greater the volume of the trade, which can lead to higher potential profits.

Risk: Along with the potential for higher profits, larger lot sizes also come with increased risk. Each pip movement in the market has a more significant impact on your trade when you’re dealing with larger lot sizes. For instance, if you’re trading a standard lot, a one-pip movement could result in a $10 change in your account balance. In contrast, the same one-pip movement with a micro lot would only result in a $0.10 change. This means that while larger lot sizes can amplify your gains, they can also amplify your losses.

Briefly, the lot size you choose has a significant impact on your trading volume and risk. It’s essential to understand how lot size affects your trades and to select a lot size that aligns with your trading strategy and risk tolerance.

Calculating Lot Size in Different Markets

In the world of trading, Lot Size refers to the number of units of an asset being traded. It’s a standardized quantity of the instrument that is set by the exchange on which it’s traded. The calculation of lot size varies depending on the market you’re trading in. Let’s explore how to calculate lot size in different markets:

1. Forex Market: In the Forex market, a standard lot size is typically 100,000 units of the base currency. However, there are also mini lots (10,000 units), micro lots (1,000 units), and nano lots (100 units). The lot size you choose depends on the amount of capital you have and your risk tolerance.

2. Stock Market: In the stock market, a lot size refers to the number of shares in one trading unit. In the U.S., the standard lot size is 100 shares. However, there are also odd lots (less than 100 shares), and round lots (multiples of 100 shares).

3. Commodities Market: In the commodities market, lot size refers to the quantity of the commodity contract. For example, in gold futures trading, one lot size is 100 ounces of gold.

4. Options Market: In the options market, lot size refers to the number of shares each contract controls. In the U.S., the standard lot size is 100 shares per contract.

Choosing the right lot size is crucial for managing your risk effectively. It’s important to choose a lot size that aligns with your risk tolerance and trading strategy.

The Relationship between Margin, Leverage, and Lot Size

In Forex trading, Margin, Leverage, and Lot Size are three crucial elements that are deeply interconnected. Understanding their relationship is key to managing your trades effectively and optimizing your trading potential.

Margin is the amount of your own money that is used to open and maintain a position. Leverage, on the other hand, is a tool that allows you to control large positions with a small amount of capital. It’s essentially a loan provided by the broker to the trader. Lot Size determines the quantity of the asset being traded.

The relationship between these three elements is quite straightforward. The higher the leverage, the lower the margin required to open a position. This is because leverage magnifies your trading capacity, allowing you to control larger positions with a smaller amount of your own money. Therefore, less margin (or collateral) is required. The lot size you choose will also affect the margin required and the leverage you can utilize.

Impact of Leverage on Margin Requirements

Leverage has a direct impact on margin requirements. The higher the leverage, the lower the margin required to open a position, and vice versa. This is because leverage increases your buying power in the market, allowing you to control larger positions with a smaller amount of your own money.

For example, if you’re trading with a leverage of 1:100, the margin required to open a position would be 1% of the total value of the position. If you increase the leverage to 1:200, the margin requirement would decrease to 0.5%.

Role of Lot Size in Determining Leverage and Margin

The lot size you choose plays a crucial role in determining the leverage you can utilize and the margin required to open a position. The larger the lot size, the larger the trading volume, and the higher the margin required. Conversely, a smaller lot size means a smaller trading volume and a lower margin requirement.

For example, if you’re trading 1 standard lot (100,000 units) with a leverage of 1:100, the margin required would be $1,000. If you reduce the lot size to a mini lot (10,000 units), the margin required would be $100.

Practical Tips for Traders

Navigating the world of Forex trading can be a complex journey. Here are some practical tips to help you manage your trading effectively and optimize your potential returns:

1. Understand the Basics: Before you start trading, make sure you have a solid understanding of the basic concepts such as margin, leverage, and lot size. These elements play a crucial role in determining your trading capacity and risk level.

2. Choose the Right Leverage: While leverage can amplify your profits, it can also amplify your losses. Choose a leverage level that aligns with your risk tolerance and trading strategy.

3. Manage Your Margin Effectively: Margin is the amount of your own money that is used to open and maintain a position. Make sure you have enough margin to cover potential losses and avoid margin calls.

4. Select the Appropriate Lot Size: The lot size you choose determines the volume of your trade and the level of risk you’re exposed to. Choose a lot size that aligns with your risk tolerance and trading capital.

5. Use Stop Loss and Take Profit Orders: These are tools that can help you manage your risk effectively. A stop loss order automatically closes your position if the price reaches a certain level, limiting your potential loss. A take profit order automatically closes your position when the price reaches a certain level, securing your profit.

6. Stay Informed: Keep up-to-date with market news and economic events. These can have a significant impact on currency prices.

7. Practice Risk Management: Never risk more than you can afford to lose. A common rule of thumb is to never risk more than 1-2% of your trading capital on a single trade.

8. Keep Learning: The Forex market is dynamic and constantly changing. Continuous learning and adaptation are key to successful trading.

Conclusion

In summary, understanding the relationship between margin, leverage, and lot size is crucial for successful trading. These three elements are interconnected and play a significant role in shaping your trading strategy and risk management.

Margin is the amount of money required to open a position, leverage allows you to control a larger position with a smaller amount of capital, and lot size determines the volume of the trade.

By mastering these concepts, traders can optimize their strategies, manage risks effectively, and make informed decisions.

Whether you’re a beginner or an experienced trader, a solid grasp of margin, leverage, and lot size will empower you to navigate the complexities of the trading world with confidence.

FAQs

What is the relationship between margin and leverage?

What is the relationship between lot size and leverage?

How do you convert leverage to lot size?

Does higher leverage mean lower margin?

What is the relationship between leverage and profitability?

Does increasing leverage increase profit?

How do you calculate leverage and profit?

Article similaire

Le plus visité

0