The Forex market, with its unique characteristics, offers a dynamic environment for currency trading — one where the concepts of spread and commission are among the key factors determining trading costs and overall trader success. These two elements, as the core components of the cost structure in Forex, have a direct impact on trading strategies and financial performance. In this article, we take a comprehensive and professional look at the difference between spread and commission, how each is calculated, and their respective roles in trading performance — offering practical insights for all active market participants. Stay with us.

The Difference Between Spread and Commission in Forex

In the Forex market, trading costs play a major role in determining profitability. Two key components of these costs are spread and commission. Understanding these concepts and knowing the difference between them is essential for every trader, from beginner to professional. In the following sections, we will first define each term and then compare them across several dimensions.

What Is Spread in Forex?

The spread refers to the difference between the bid (buy) and ask (sell) prices of a currency pair in the Forex market. This difference — usually measured in pips — represents the fee paid by the trader to the broker for opening a position. For example, if the sell price of the EUR/USD pair is 1.1200 and the buy price is 1.1198, then the spread is 2 pips.

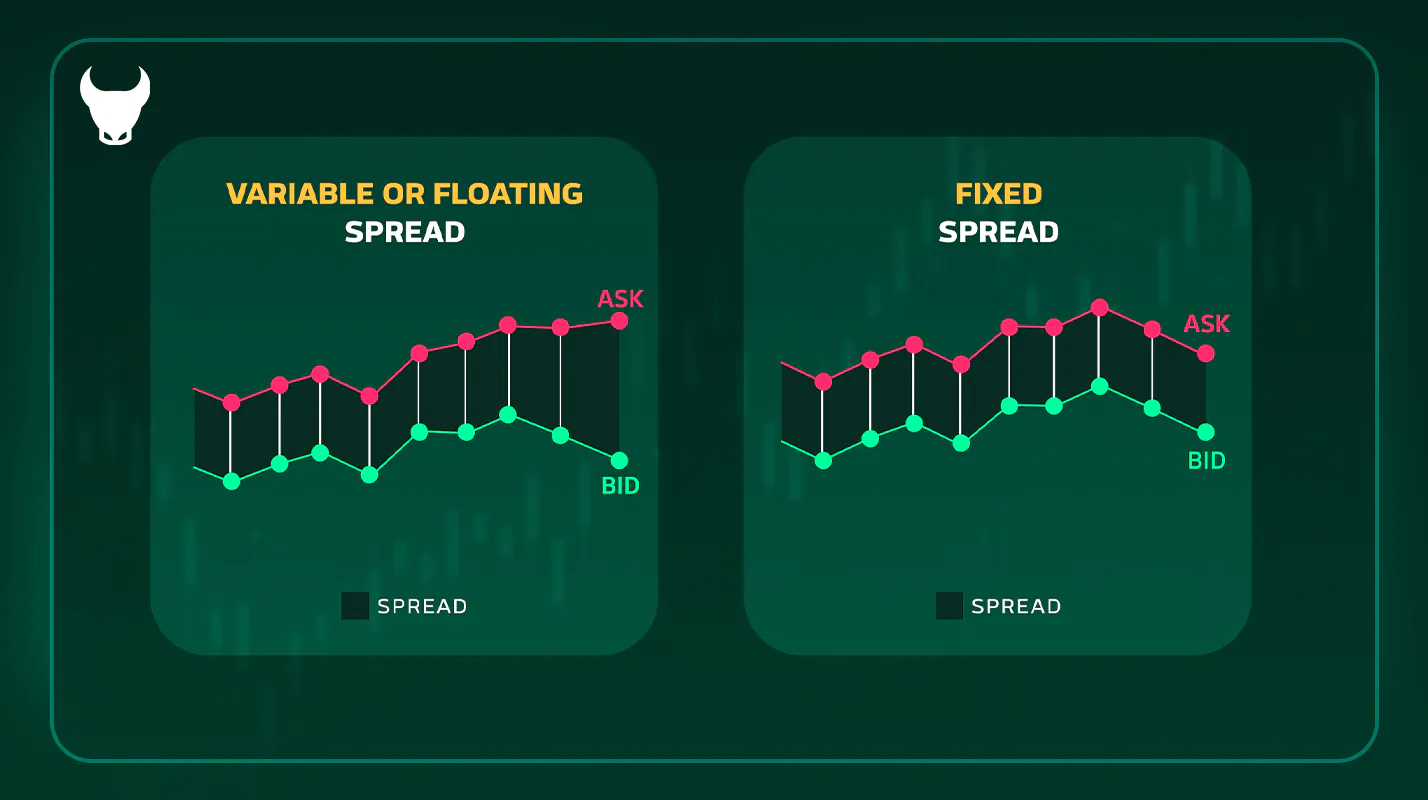

Spreads are generally divided into two main types:

-

Fixed Spread: The spread remains constant under normal market conditions and is suitable for traders who prefer cost predictability.

-

Variable (Floating) Spread: The spread fluctuates depending on market conditions and liquidity. During major economic news releases, it may widen significantly.

In accounts without commission, the spread represents the main source of revenue for brokers, which is why monitoring spreads is a key factor when choosing both a broker and a trading account type.

What Is Commission in Financial Markets?

Commission is a direct fee charged by the broker for executing trades. Unlike the spread — which is embedded in the difference between bid and ask prices — the commission is usually a fixed amount per lot or a percentage of the trade volume. For instance, a broker may charge $10 per standard lot traded on the EUR/USD pair. Commissions are typically applied to ECN accounts. Because these accounts offer direct access to interbank liquidity and extremely low spreads, the broker charges a separate commission for providing this service.

Sign Up with Trendo Broker and Get a $100 Free Bonus

Key Differences Between Spread and Commission

To better understand the distinction between spread and commission, let’s compare them across several aspects:

1) Calculation Method

-

Spread: Calculated as the difference between bid and ask prices and automatically applied when a position is opened.

-

Commission: Charged separately as a fixed fee or percentage of the trade volume and deducted directly from the trader’s account.

2) Account Type

-

Spread: Present in all trading accounts, but it plays the primary cost role in standard or no-commission accounts (such as micro or classic accounts).

-

Commission: Typically applies to ECN or professional accounts, which feature lower spreads but charge a direct fee per trade.

3) Cost Transparency

-

Spread: Can vary based on market volatility (especially with floating spreads), making cost forecasting more difficult.

-

Commission: Usually fixed and predictable, allowing traders to better manage their trading expenses.

4) Impact on Trading Strategy

-

Short-term traders (scalpers) and those who make multiple trades per day often prefer low-spread ECN accounts with commissions, as this setup minimizes total costs.

-

Long-term traders (swing traders) are generally less sensitive to spreads, as these costs are negligible compared to their potential profits.

5) Market Dependency

-

Spread: Highly affected by market volatility and liquidity — spreads often widen significantly during major news events.

-

Commission: Remains fixed and independent of market conditions.

In summary, choosing between high-spread, no-commission accounts and low-spread, commission-based accounts depends on a trader’s strategy and goals. For example:

-

Beginners or those trading small volumes may benefit more from fixed-spread, no-commission accounts.

-

Professional traders who require extremely tight spreads and fast execution often prefer ECN accounts with commissions.

Spread and Commission Across Different Account Types

Spread and commission structures vary among brokers and account types. For example:

-

STP or Standard accounts generally have no commission but higher spreads.

-

ECN or PRO accounts offer tight (even zero) spreads, but charge fixed or percentage-based commissions.

Both factors — spread and commission — are critical in determining total trading costs, especially for Forex traders.

Choosing a Broker with Low Spreads and Commissions

Choosing a broker with low spreads and commissions is crucial, especially for traders who execute multiple or high-volume trades. These costs can have a significant impact on net profit over time. For example, in scalping trades, where the profit from each transaction may only be a few pips, even a one-pip difference in spread can dramatically affect profitability.

In addition to spreads and commissions, traders should also pay attention to other factors such as the broker’s credibility and track record, order execution speed, customer support, and deposit and withdrawal methods to make an informed choice.

Trendo Broker is one of the reputable and experienced brokerage firms in the Forex market that has been able to attract the attention of many traders by providing high-quality services and competitive trading conditions. Trendo is registered in Armenia, the United Kingdom, and Saint Lucia, and operates under the financial regulations of these countries. The main features of Trendo Broker include the following:

-

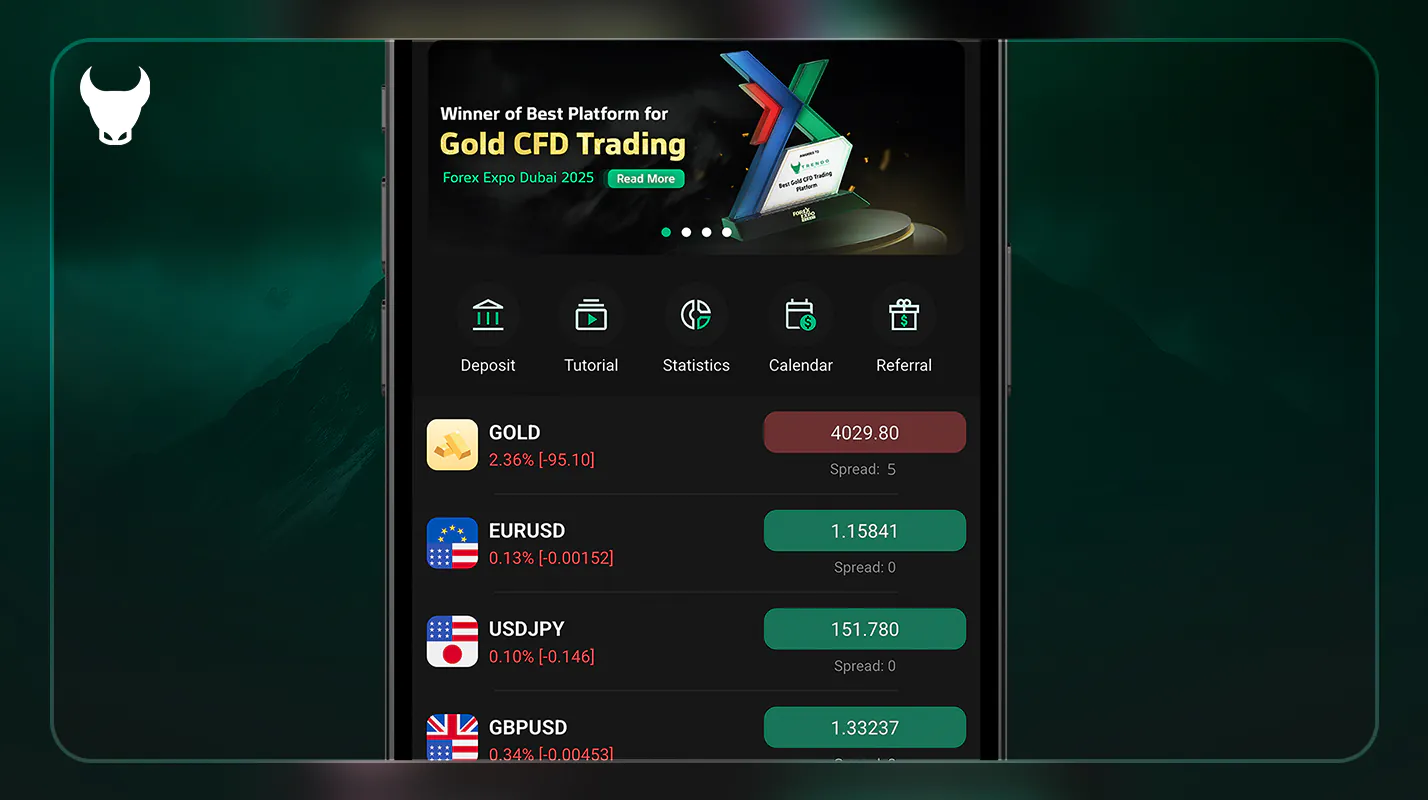

Lowest spread and commission:

Trendo Broker, due to offering ECN accounts, provides extremely low spreads that start from zero pips on some major currency pairs such as EURUSD. The commissions in this broker are also competitive, as it charges 3 dollars per lot per side of the trade.

You can view the spreads of various instruments online by visiting the Trendo trading platform.

-

Professional support:

Trendo Broker provides 24-hour support, even on holidays, which is highly valuable for traders who need quick solutions to their issues. The support team is available to users via online chat, email, and social media.

-

Variety in deposit and withdrawal methods:

Trendo Broker supports various deposit and withdrawal methods, including cryptocurrencies such as Tether and Bitcoin. It is also worth mentioning that deposits and withdrawals in Trendo are processed with no additional fees and at the highest possible speed.

-

Advanced trading platforms:

Trendo Broker offers its users a proprietary trading platform that, due to its simple user interface and powerful analytical tools, meets all traders’ needs and eliminates the necessity of any other platform.

-

Promotional plans and bonuses:

Trendo Broker offers various promotional programs, such as no-deposit bonuses, allowing traders to start their Forex activity without risk. Trendo’s promotional programs include:

Free $100 welcome bonus

10% cryptocurrency deposit bonus plan

Referral program

Cashback plan

Conclusion

A precise understanding of the difference between spread and commission, as two main pillars of trading costs in the Forex market, is of great importance. By being aware of the distinctions between these two concepts and their impact on trading performance, traders can make more informed decisions and optimize their strategies.

Download the Trendo trading platform and trade with zero spread.