Elliott Wave Theory is one of the most popular strategies that traders use. This theory, if learned correctly, will perform well. In the early 1930s, a professional accountant named Ralph Nelson Elliott, a stock market expert, analyzed stock data over 75 years. He thought that the markets moved unorganized and randomly but later realized that there was a specific pattern.

Contents

- Understanding the Elliot waves theory

- Market forecasting with Elliott waves

- Types of waves in Elliott wave theory

What is the Elliot waves theory?

According to Elliott, the market moves in repetitive cycles. The cause of these cycles is retail traders’ mass emotions (masses), and psychological factors (fear and greed) are the main reasons. He observed that the upward and downward price fluctuations caused by the traders’ collective psychology always repeat. These fluctuations are called waves. Therefore, if traders clearly understand these recurring cycles, they can predict future price movements. Traders can identify the points where the market is going to reverse.

Practical Terms

There are many terms involved in Elliott wave theory. We have mentioned two basic terms in this article and will explain the other terms in the following articles. These terms are:

- Wave

- Fractals

Further, we explain these terms.

Wave: Elliott suggested that trends form as a result of traders’ psychology. He proved that the fluctuations formed by this mass psychology are a repeating pattern and called these fluctuations waves.

Fractals: In general, fractals are structures whose divided parts are like identical copies of the whole. These structures repeat themselves even on an infinite scale. Elliott discovered that this cycle can also be seen in all financial markets. In another article, we will explain the fractal structure of waves.

Read More: Fractal approach and key rules in Elliott wave theory

Market forecasting with Elliott waves

Elliott studied stocks in detail and concluded that we can make predictions using the characteristics of wave patterns. As you know, there is always a pullback or price correction in a trending market. That is, the price trend is divided into primary and corrective movements. Major movements indicate the market’s main direction, while corrections are against the trend.

Read More: What is a trending and ranging market?

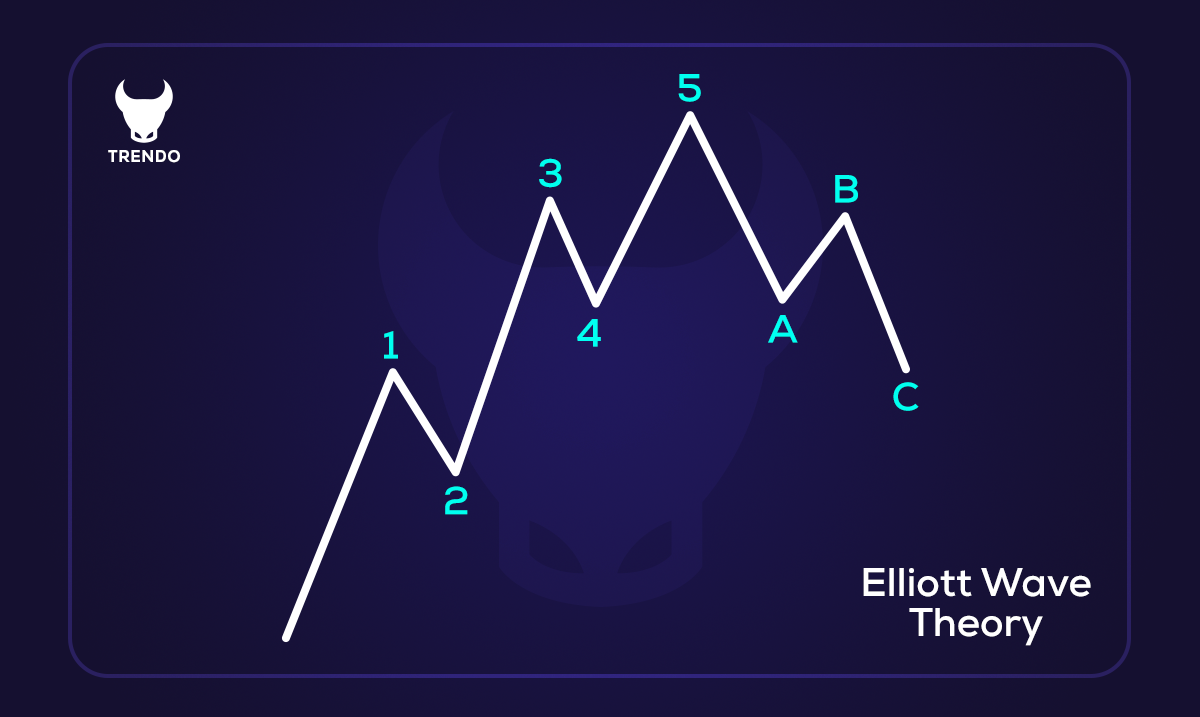

Elliott wave theory also uses a similar principle. The impulse wave moves in the same direction as the primary trend and shows five waves in its pattern. Then there is a corrective wave that moves in the opposite direction of the primary trend. On a smaller scale, for every impulse wave, we can find another five waves again. And such a pattern is repeated by going to smaller and smaller scales.

Types of waves in Elliott waves theory

There are two types of waves in this theory:

- Impulse

- Corrective

In general, Elliott stated that trending markets move in 3-5 wave patterns. The 5-wave pattern is related to the impulse wave, and the 3-wave pattern is related to the corrective wave, and the combination of 5-wave and 3-wave patterns forms a trend. Further, we will describe the features of each wave type separately.

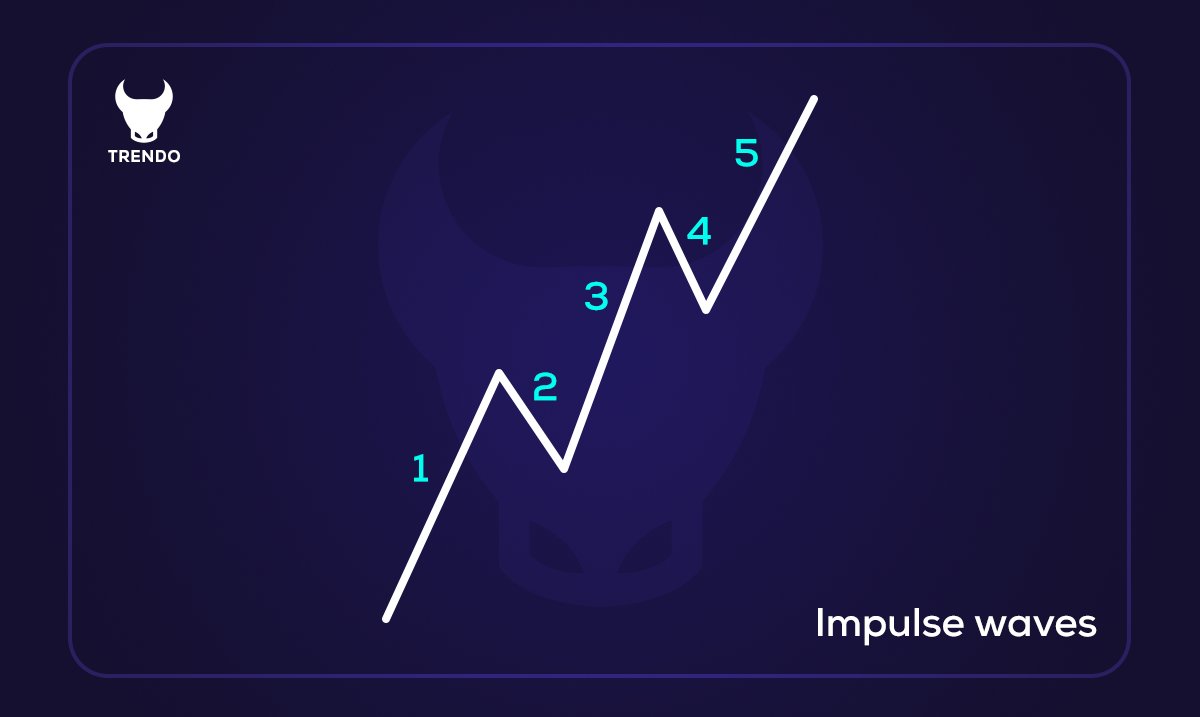

Impulse wave: Impulse waves form by five waves numbered 1 to 5. The figure below shows the 5-wave impulse pattern. 1, 3, and 5 are stimulus waves, meaning they move in the overall trend’s direction, while waves 2 and 4 are corrective waves moving against the general trend. The figure below shows the 5-wave impulse pattern.

Now, we will analyze each wave separately. To better understand the market trend, we consider it bullish.

Wave 1: This wave is the first upward movement in the market. Usually, a handful of people who think that the target currency is at a discount and that it is a good time to buy, create this wave.

Wave 2: This move is the opposite of the previous move. A bearish market occurs as early buyers save their profits and think the target currency is overvalued. However, the price will not fall to the previous low as many traders still consider the price discounted.

Wave 3: Wave 3 is similar to wave 1. This wave is usually the longest and strongest wave regarding movement power. Because as the prices go up, the general public starts buying along with the institutional actors. Therefore, it is usually stronger than wave 1.

Wave 4: After a strong up move (Wave 3), some traders start taking profits, assuming that the target currency has become expensive. However, this bearish move is not very strong as some traders still believe in bullishness and view the currency as discounted.

Wave 5: Wave 5 is when most people buy the desired currency. This wave is created due to the fear of missing out (FOMO) and is considered a trap to create liquidity. Wave 5 is when the target currency has become fully media, and all high-profile analysts on news channels advise people to buy. However, in reality, this wave is when the target currency becomes too expensive, so large investors and institutions start selling and closing their long positions, and the general public provides liquidity.

Read More: Forex Trading Psychology (The importance of psychology in trading)

All these waves together form a 5-wave impulse pattern, and the same rules and features apply to the downtrend for sell trades.

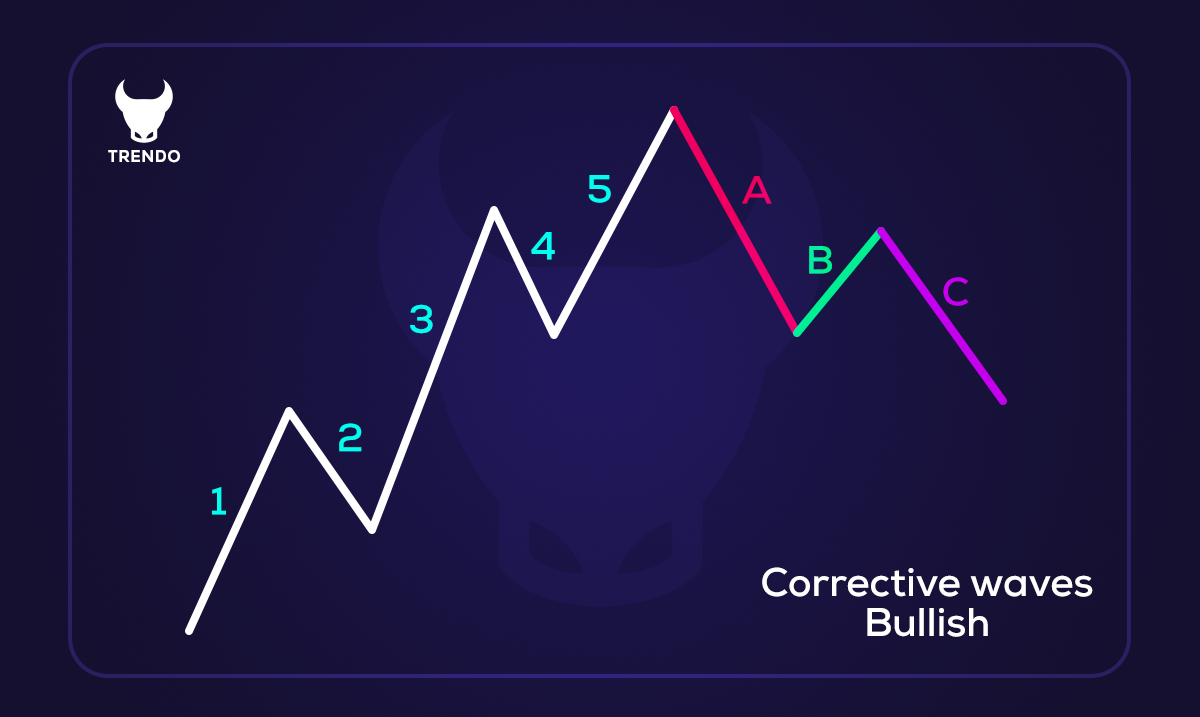

Corrective wave: A trend consists of a combination of a 5-wave pattern and a 3-wave pattern. A 5-wave impulse pattern moves in the primary trend’s direction, while a 3-wave corrective pattern moves against the trend. If the trend is upward, impulse waves are upward, and corrective waves are downward. In the above example’s continuance, corrective waves are shown in the figure below.

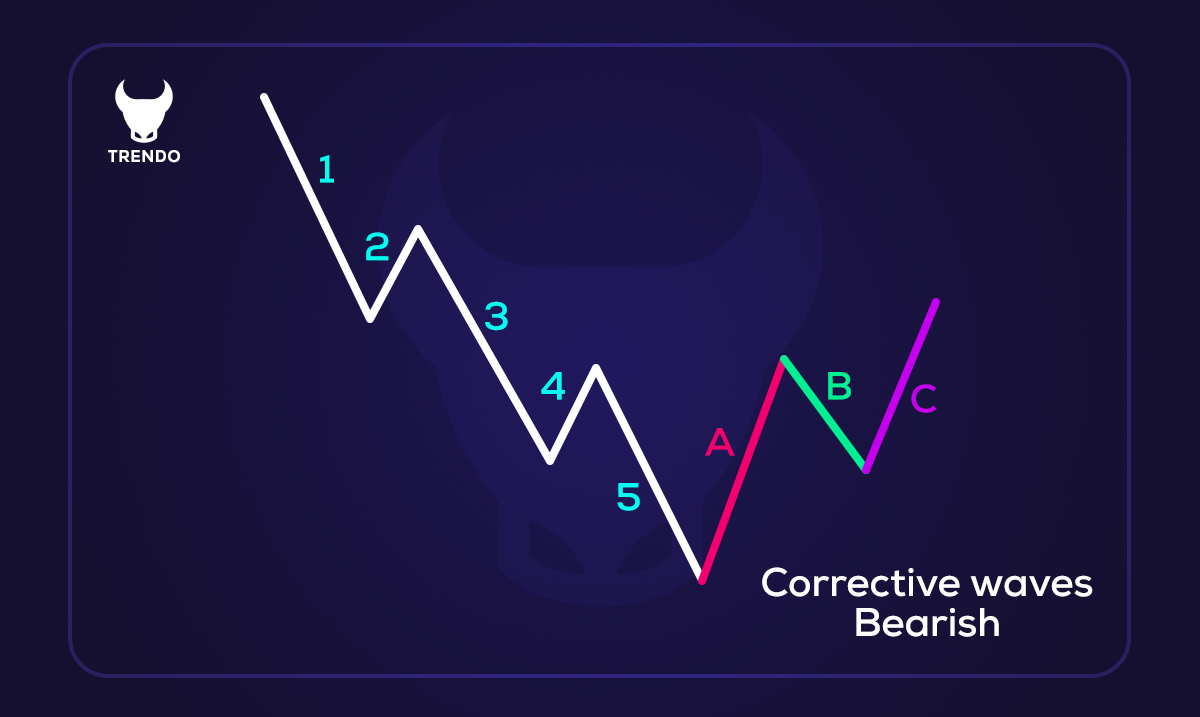

In the figure above, waves c, b, and a represent corrective waves. The general trend of the market is upward, but the corrective waves are against it. In other words, we can consider the 3-wave corrective wave (ABC corrective wave) as a pullback for the uptrend. We can use the Elliott wave theory for both bullish and bearish trends. Therefore, for a downtrend, the impulse wave follows the overall downtrend, while the corrective wave follows the uptrend. The figure below shows a 3-5 wave pattern for a downtrend.

The corrective wave shown above is not the only type occurring in financial markets. According to Elliott, there are twenty-one 3-wave corrective wave patterns, some simple and some complex. However, a trader does not have to keep them all. Below are the three most commonly applied corrective waves in the market:

- Zigzag pattern

- Flat pattern

- Triangle pattern

Further, we explain these patterns in detail.

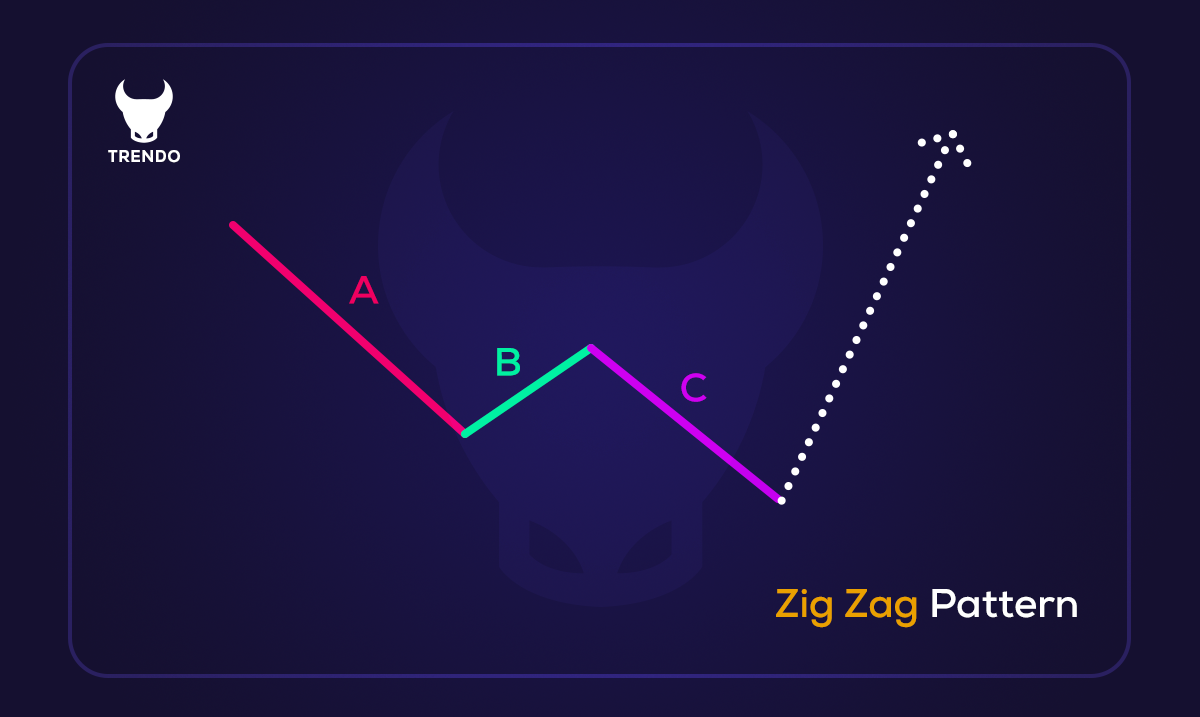

Zigzag pattern: Zigzag patterns are very steep compared to the common pattern and are against the general trend. It consists of three waves, and wave B is usually the shortest compared to wave A and wave C. Note that the zigzag pattern can occur two or three times. Also, zigzag patterns can break down into 5-wave patterns on a smaller scale.

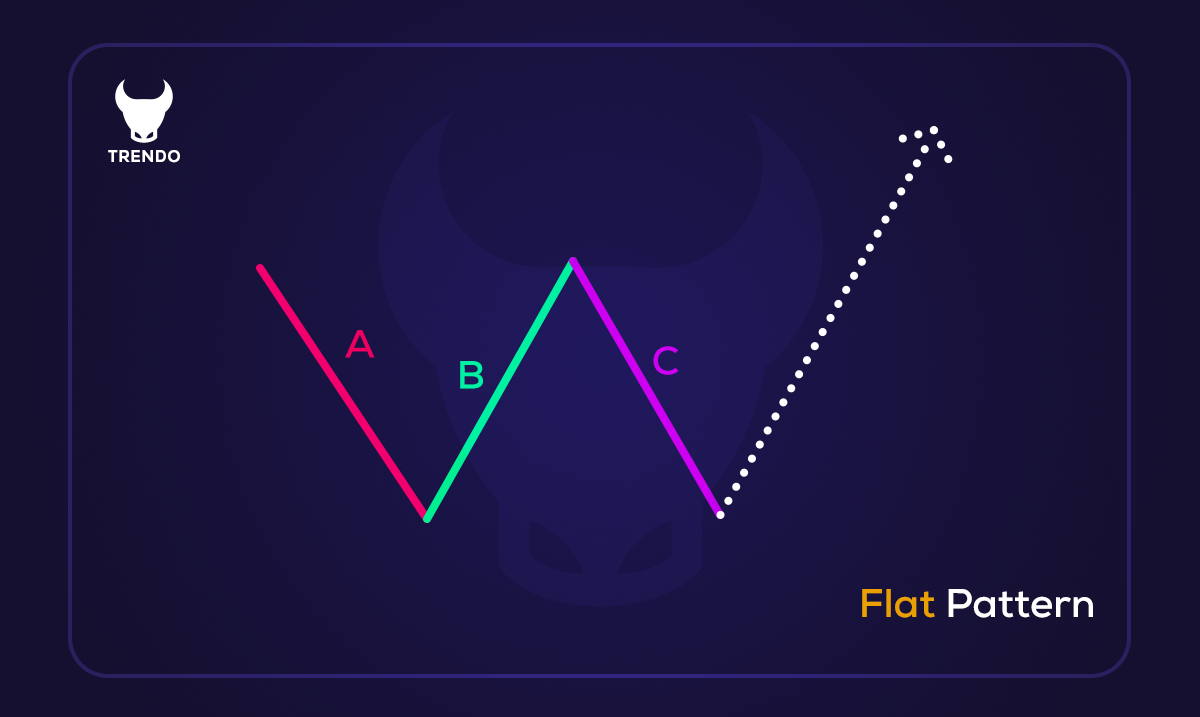

Flat pattern: As the name suggests, in flat corrective wave patterns, the 3-wave pattern is in the direction of the ranging or neutral trend. That is, wave C does not go below wave B, and wave B rises as much as wave A. Sometimes, wave B goes higher than wave A, which is acceptable.

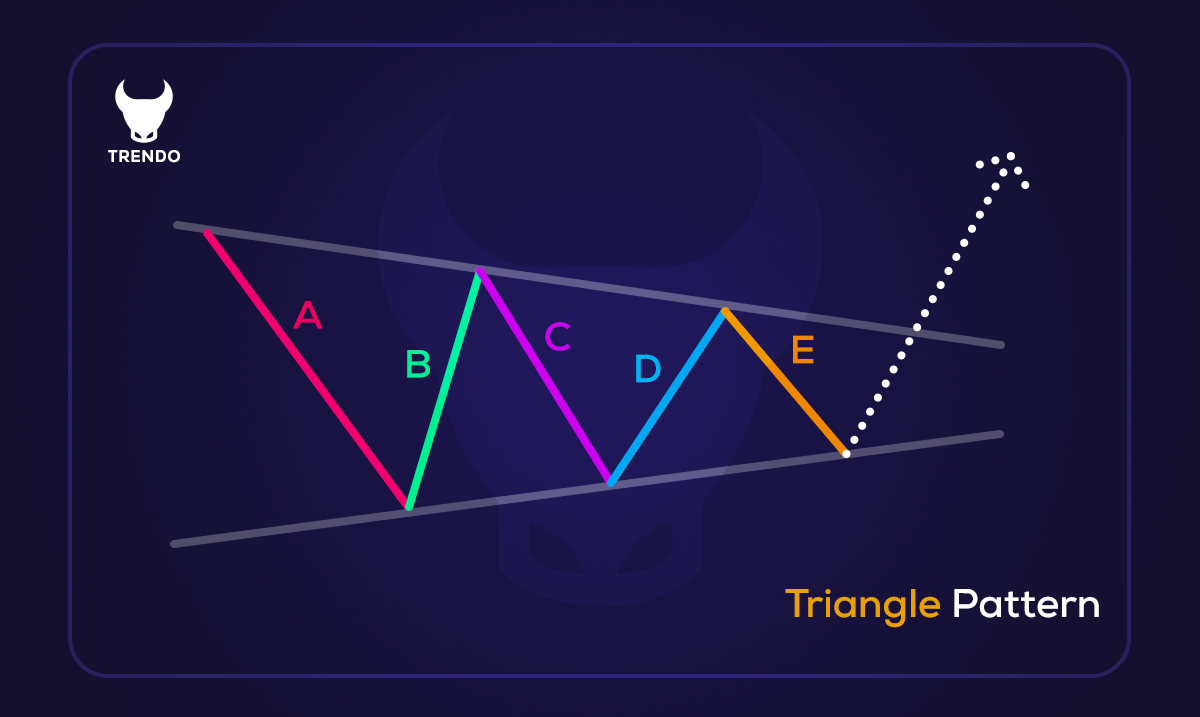

Triangle pattern: The triangle pattern is slightly different from other corrective patterns. The difference is that these patterns consist of 5 waves that move against the general trend. These corrective waves can be symmetrical, ascending, descending, or expanding.

Now that you have learned the basics of Elliott wave theory and types of impulse and corrective movements, we will teach you how to trade with Elliott waves in another article.

Read More: Teaching practical trading strategy with Elliott waves

Summary

Elliott wave trading and analysis and forecasting using this theory may seem a bit complicated. However, the Elliott wave principle is part of nature, and we can use it as a socio-economic phenomenon in financial markets, including Forex. Before entering the real world of trading, we advise traders to test their strategy in demo accounts for at least three months after learning and training, and if they continue to be profitable, they should enter real trading.