یکی از استراتژیهای معاملاتی اسمارت مانی، اردر بلاکها (Order Blocks) هستند که در دنیای بازارهای مالی نقش مهمی ایفا میکنند و آشنایی با آنها میتواند پتانسیل سودآوریِ شما را بهبود ببخشد. به طور کلی، اردر بلاکها عبارتاند از دستورهای خرید یا فروش ارزها یا دیگر داراییها در حجمهای بزرگ. در این مقاله قصد داریم به انواع اردر بلاکها بپردازیم و انواع آنها، چگونگی معامله و مدیریت ریسک مرتبط با آنها را بررسی کنیم. با ترندو همراه باشید.

اردر بلاک چیست؟

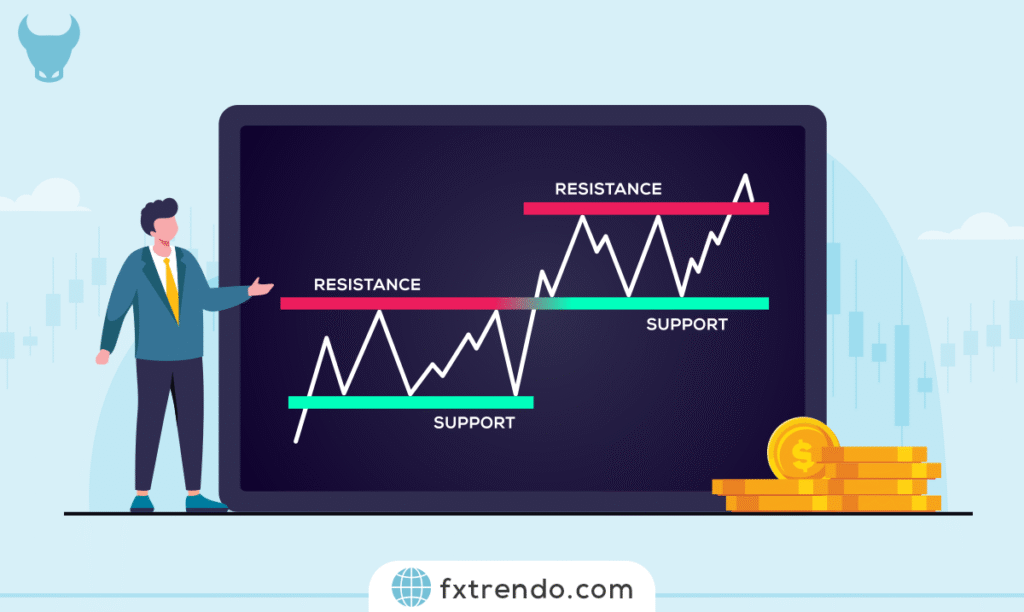

اردر بلاکها در واقع، مناطق قیمتی خاصی هستند که در آن شرکتکنندگان بزرگ بازار، قبلاً سفارشهای خرید یا فروش قابلتوجهی را قرار دادهاند و وجود مقادیر زیاد سفارش در یک محدوده، روی حرکت قیمت به یک جهت خاص تأثیرگذار خواهد بود. بهطور کلی اردر بلاکها نوع خاص و پیشرفتهای از سطوح حمایت و مقاومت هستند که بهعنوان نقطۀ ورود یا خروج برای معاملات استفاده میشوند. بنابراین اردر بلاکها (Order Blocks) میتوانند بینش مفیدی در مورد رفتار معاملهگران بزرگ و سطوح کلیدی مارکت ارائه دهند.

چگونگی تشخیص اردر بلاکها

اردر بلاکها را در هر تایمفریمی میتوان شناسایی کرد. در تحلیل تکنیکال، انتخاب تایمفریم معاملاتی به نوع معاملهگری شما بستگی دارد. اگر قصد معاملۀ کوتاهمدت یا روزانه دارید، از تایمفریمهای کوچک مثل پنج یا پانزدهدقیقه استفاده کنید. در غیر این صورت، برای معاملات بلندمدت از تایمفریمهای بزرگتر مثل چهارساعته (H4) یا روزانه (D1) استفاده کنید. بعد از انتخاب تایمفریم مناسب، باید روند مارکت را بررسی و شناسایی کنید. این کار مهمترین بخش از معاملهگری شماست. در این مرحله، مناطقی را که قیمت در آنها واکنشهای مهمی نشان دادهاست را پیدا کنید، مانند:

- واکنشهای برگشتی شدید

- تثبیتهای طولانی

- شکستهای قوی

برای علامتگذاری سطوح اردر بلاک (Order Block)، بیشترین و کمترین قیمتِ آخرین کندلی که خلاف جهت حرکت شارپ قیمت بستهشده است را مشخص میکنیم. این سطوح، مناطقی را نشان میدهند که معاملهگران سازمانی ممکن است سفارشهای بزرگی را در آن ثبت کردهباشند.

ممکن است در ابتدای کار، شناسایی اردر بلاکهای صحیح برای شما کمی چالشبرانگیز باشد. یک روش دیگر برای یافتن اردر بلاکها استفاده از اندیکاتور است. برای این کار، ابتدا وارد پلتفرم TradingView شوید. در بخش اندیکاتورها، عبارت Order Block Finder را سرچ کنید. اندیکاتورهای متعددی وجود دارند که شما میتوانید از آنها استفاده کنید، روی گزینۀ مدنظر کلیک کنید تا اندیکاتور مورد نظر به چارت شما اضافه میشود. این اندیکاتورها در تایمفریمهای مختلف اردر بلاکها را شناسایی میکنند و شما میتوانید از آنها برای رسم نواحی مهم استفاده کنید.

حتما بخوانید: بازار روند دار و رنج یا خنثی چیست؟

انواع اردر بلاک

تقسیمبندیهای متفاوتی از اردر بلاکها ارائه شدهاست، اما مهمترین آنها عبارتاند از:

- اردر بلاک صعودی

- اردر بلاک نزولی

- بریکر بلاک (Breaker Block)

- ریجکشن بلاک (Rejection Block)

- وکیوم بلاک (Vacuum Block)

در ادامه تمام این موارد را بررسی خواهیم کرد.

اردر بلاک صعودی:

یک اردر بلاک صعودی در نزدیکی حمایتها تشکیل میشود و قبل از اینکه قیمت یک حرکت صعودی قابلتوجه و تهاجمی را شکلدهد، به عنوان آخرین کندل نزولی شناخته میشود. در این سطح کلیدی، معاملهگران بزرگ سفارشات خرید ثبت کردهاند. همانطور که در تصویر زیر مشاهده میکنید، محدودۀ اردر بلاک مشخص شدهاست و قیمت پس از برخورد به آن محدوده، با مومنتوم خوبی، برگشت داده شدهاست.

اردر بلاک نزولی:

یک اردر بلاک نزولی در نزدیکی مقاومتها تشکیل شده و قبل از اینکه قیمت یک حرکت نزولی قابلتوجه و تهاجمی را شکل دهد به عنوان آخرین کندل صعودی شناخته میشود. در این سطح کلیدی معاملهگران بزرگ سفارشات فروش قابلتوجهی را ثبت کردهاند. در تصویر زیر یک مثال از اردر بلاک نزولی را مشاهده میکنید که به دلیل حرکت قوی اولیه، از اعتبار خوبی برخوردار است.

بریکر بلاک (Breaker Block):

هرگاه در یک روند نزولی به یک حمایت قوی برسیم و قیمت صعود کند و آخرین سقف خود را بشکند (الگوی W)، در این حالت، محدوۀ بریکر بلاک، سقف و کف کندلی است که سبب شکستهشدن آخرین سقف شدهاست. رنگ این کندل همجهت با روند جدید است.

تمام موارد بالا برای الگوی M و روند صعودی نیز حاکم است. بهطوری که وقتی در یک روند صعودی به یک مقاومت قوی برسیم و قیمت برگردد و آخرین کف خود را بشکند، در این حالت محدوۀ بریکر بلاک، سقف و کف کندلی است که سبب شکستهشدن آخرین کف شده است. رنگ این کندل هم جهت با روند جدید است. در عکس زیر، یک نمونه از بریکر بلاک را مشاهده میکنید.

ریجکشن بلاک (Rejection Block):

زمانی که در سقفها یا کفهای مهم، یک یا چند کندل با سایۀ بلند داشته باشیم. قیمت تمایل دارد بدنۀ این کندلها را رد کرده و به سایهها برسد. این برخورد با سایهها، معمولاً با مومنتوم خوبی همراه است. به این محدودهها که توسط سایهها ایجاد شدهاند، ریجکشن بلاک میگویند. لازم بهذکر است که جهت کندلهای ریجکشن اهمیتی نداشته و این کندلها میتوانند صعودی یا نزولی باشند.

وکیوم بلاک (Vacuum Block):

اگر یک خبر، سبب ایجاد یک گپ شود، یعنی در محدودۀ گپ که به وکیوم بلاک معروف است، هیچ معاملهای انجام نشدهاست و قیمت زمانی که مجدداً به این محدوده برگردد، احتمالاً شاهد یک واکنش برگشتی قوی خواهیم بود.

اعتبار اردر بلاکها

زمانی که قیمت شروع به حرکت و جهش اولیه از محدودۀ اردر بلاک کرد، این حرکت باید با مومنتوم خوبی همراه باشد و باید ۲ یا ۳ برابرِ اندازۀ کندل اردر بلاک باشد؛

نکات کلیدی و کاربردی در نحوۀ استفاده از اردر بلاکها عبارتاند از:

- اردر بلاکها به عنوان سطوح حمایت و مقاومت عمل میکنند.

- هرچه تعداد دفعات بازگشت قیمت به یک سطح بیشتر باشد، اردر بلاک ضعیفتر میشود. توصیه میشود از هر اردر بلاک، تنها یک بار استفاده کنید.

- هنگامی که قیمت از سطح اردر بلاک عبور کند، نقش حمایت یا مقاومت آن معکوس میشود. در چنین مواردی، معاملهگران قبل از ورود به معاملات در جهت شکست، منتظر آزمایش مجدد سطح شکستهشده باقی میمانند.

- برخی از معاملهگران برای ورود بهینه، از تحلیل مولتیتایمفریم استفاده میکنند یا سفارشهای معاملاتی خود را در وسط محدودۀ اردر بلاک قرار میدهند.

- برای موفقیت بیشتر در معاملات با اردر بلاکها، بهتر است از تحلیل فاندامنتال هم استفاده کنید.

نحوۀ معامله با اردر بلاکها

در اینجا یک راهنمای گامبهگام برای معامله با اردر بلاکها ذکر شدهاست:

۱. روند را تعیین کنید.

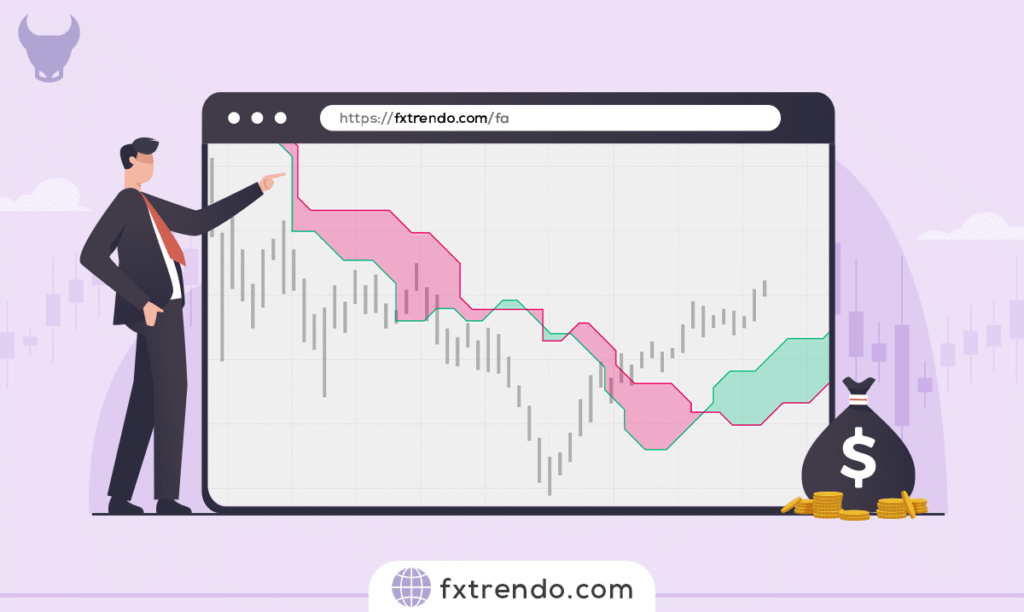

اولین و مهمترین مرحله در معاملهگری، تعیین روند و ساختار مارکت است. ابتدا مشخص کنید که مارکت چه روندی دارد؟ صعودی، نزولی یا رنج! شما باید فقط در جهت روند معامله کنید، به عنوان مثال اگر در یک روند صعودی هستید، تنها از اردر بلاکهایی استفاده کنید که نقش حمایتی دارند. بهعنوان مثال، در تصویر زیر، شاهد یک روند نزولی در تایمفریم روزانه از جفتارز USDCAD هستیم. قیمت در حال ثبت کفها و سقفهای پایینتر است.

۲. شناسایی اردر بلاکها

در این مرحله باید اردربلاکها را شناسایی کنید. براساس نکاتی که ذکر شد، نواحی مهم را علامتگذاری کنید. در این مثال، تنها باید اردربلاکهایی را پیدا کنیم که نقش مقاومتی دارد، همانطور که مشاهده میکنید، در ادامه، ناحیۀ مهم را علامتگذاری کردهایم.

۳. ورود به پوزیشن

از دو روش جهت ورود به معامله استفاده میشود. در روش اول پس از برخورد قیمت به ناحیۀ مورد نظر، منتظر ایجاد یک کندل برگشتی مانند چکش (Hammer) یا پینبار (Pin Bar) میمانیم و در جهت روند وارد پوزیشن میشویم. در روش دوم که کمی تهاجمیتر است، با قرار دادن پندینگ اردر ، پوزیشن را باز میکنیم. مزیت روش دوم این است که در قیمت بهتری وارد معامله شده و احتمال جاماندن از معامله به حداقل میرسد، اما بدیهی است که ریسک بیشتری نیز دارد. در این مثال، براساس روش اول، وارد معامله شدهایم.

۴. حد سود و حد ضرر را تعیین کنید.

یک دستور توقف ضرر را کمی دورتر از اردر بلاک قرار دهید تا خطر ضرر ناشی از تغییرات ناگهانی قیمت را کنترل کنید. برای تعیین حد سود نیز از سطوح حمایت و مقاومت بعدی استفاده کنید یا براساس نسبت ریسکبهریوارد سیستم معاملاتی خود، قیمت مناسب را تعیین کنید.

۵. ریسک را مدیریت کنید.

اردر بلاکها ممکن است همیشه درست عمل نکنند. همواره با حجم مناسب و رعایت مدیریت ریسک وارد معامله شوید و در هر معامله هرگز روی بیش از دو درصد از کل سرمایۀ خود ریسک نکنید.

سخن پایانی

مانند هر استراتژی معاملاتی، اردر بلاکها نیز یک روش معاملاتی قطعی و صد درصد سودآور نیستند. قبل از معامله با این روش، باید تمرین کرده و آن را در یک حساب آزمایشی (Demo)، مورد بررسی دقیق قرار دهید. توصیه میشود هرگز با پولی که از دست دادن آن میتواند روی روال کلی زندگی شما تاثیر بگذارد، وارد بازارهای مالی نشوید.