What is Funding Rate? A Comprehensive Guide to Crypto Funding Rates

So, what exactly is a funding rate? It’s a periodic payment made between traders to ensure that the price of perpetual futures contracts stays in line with the actual market price of the underlying asset. This mechanism helps maintain market balance and fairness.

In this guide, we’ll dive deep into the world of crypto funding rates. You’ll learn how they work, why they matter, and how you can use them to your advantage.

Whether you’re a seasoned trader or just starting out, this comprehensive guide will equip you with the knowledge you need to navigate the crypto market more effectively. Let’s get started!

Contents

What is a Funding Rate?

A funding rate is a periodic payment made between traders in the cryptocurrency market to ensure that the price of perpetual futures contracts stays in line with the actual market price of the underlying asset. This mechanism is crucial for maintaining balance and fairness in the market.

In simpler terms, think of the funding rate as a small fee that helps keep the market stable. If too many traders are betting on the price of a cryptocurrency going up (long positions), the funding rate might increase, making it more expensive to hold those positions. Conversely, if most traders are betting on the price going down (short positions), the funding rate might decrease, making it cheaper to hold short positions.

This system helps prevent any one group of traders from dominating the market, ensuring that prices remain fair and reflective of the actual market conditions. Understanding funding rates is essential for anyone involved in crypto trading, as it can impact your trading costs and overall strategy.

Why Funding Rates Matter in the Crypto Market?

Funding rates are crucial in the crypto market, especially for perpetual futures contracts. These rates are periodic payments between traders to balance the difference between the perpetual contract and the spot price. But why do they matter?

Firstly, funding rates help maintain price stability. By encouraging traders to take positions that align with the market trend, they prevent significant price deviations between the futures and spot markets. This stability is essential for traders who rely on accurate pricing to make informed decisions.

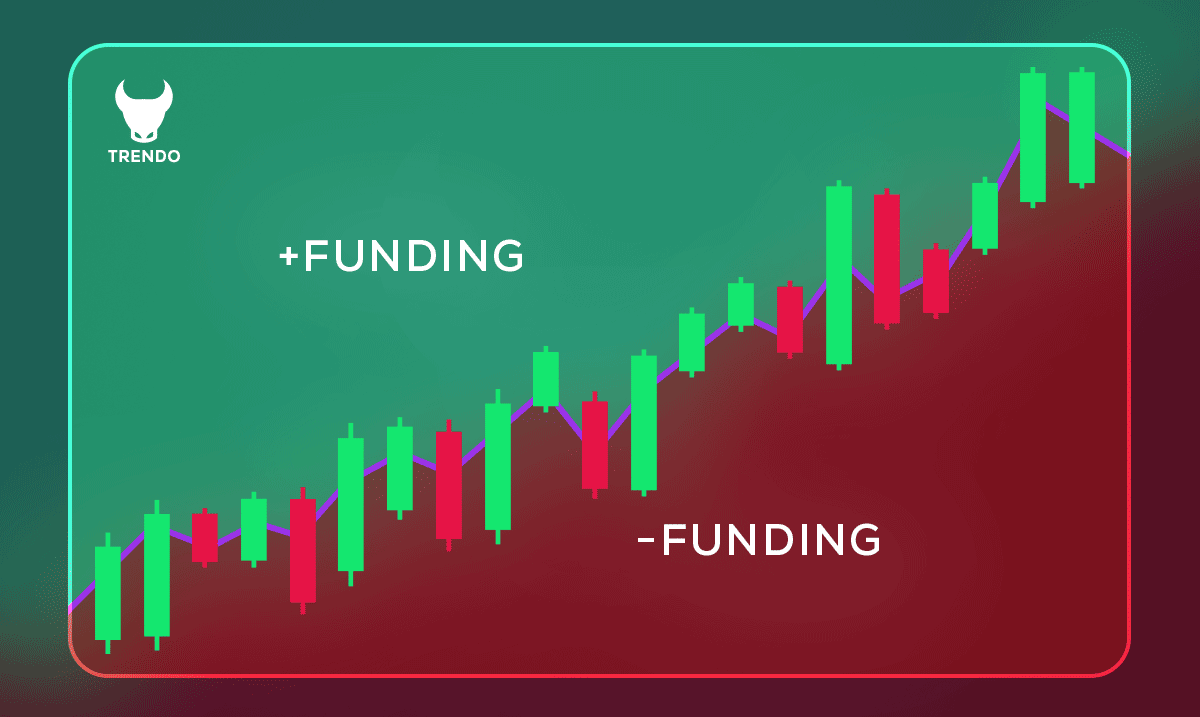

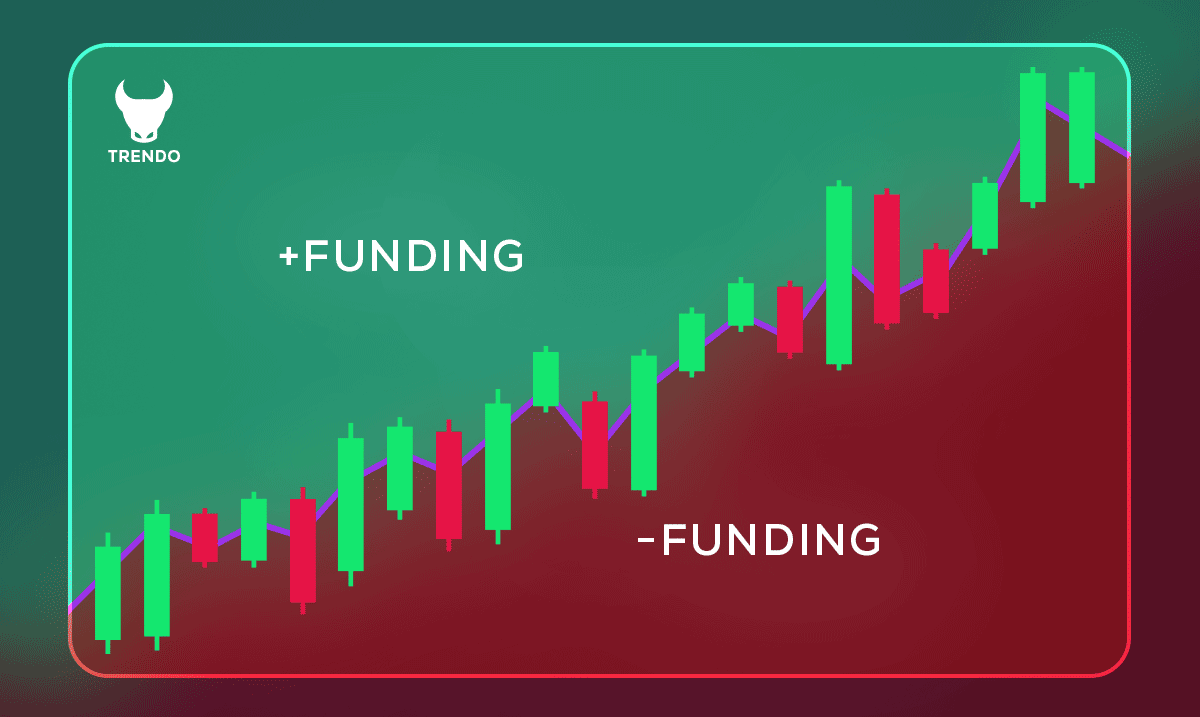

Secondly, funding rates provide insights into market sentiment. Positive funding rates indicate that long positions are dominant, suggesting bullish sentiment. Conversely, negative rates imply a bearish outlook with more short positions. Understanding these trends can help traders anticipate market movements and adjust their strategies accordingly.

Lastly, funding rates impact trading costs. Traders need to account for these rates when calculating potential profits and losses. Ignoring them can lead to unexpected costs, affecting overall profitability. By keeping an eye on funding rates, traders can better manage their positions and optimize their trading strategies.

Briefly, funding rates are vital for maintaining market stability, gauging sentiment, and managing trading costs. Whether you’re a seasoned trader or just starting, understanding and monitoring funding rates can significantly enhance your trading experience.

Read more: Sentiment Analysis in Forex

How Funding Rates Are Calculated?

Each exchange calculates funding rates based on its specific rules and policies, updating them every 8 hours. Traders must regularly monitor their exchange platforms to stay informed about these rates. However, by oopening an account with the Trendo broker, you not only avoid paying funding rates on cryptocurrency transactions but also gain access to margin trading. This allows you to leverage credit provided by Trendo, opening the door to exceptional profit opportunities on their exclusive platform.

Funding rates are calculated to keep the price of perpetual futures contracts close to the spot price of the underlying asset. This involves a few key components:

1. Interest Rate: The base rate reflecting the cost of holding a position, varying by platform and market conditions.

2. Premium or Discount: The difference between the perpetual contract price and the spot price. If the contract price is higher, the funding rate is positive, and long position holders pay short position holders. If lower, the rate is negative, and short position holders pay long position holders.

3. Market Demand: The demand for long or short positions influences the funding rate. High demand for long positions can increase the rate, while high demand for short positions can decrease it.

The funding rate is usually calculated and settled at regular intervals, such as every 8 hours, to ensure market balance and prevent significant deviations from the spot price

Types of Funding Rates

Funding rates in the crypto market can vary based on different factors and mechanisms. Here are the main types:

Funding rates are generally divided into two categories: positive and negative.

1. Fixed Funding Rates: These rates remain constant over a specified period. They provide predictability for traders, allowing them to calculate costs and profits more accurately. However, they might not always reflect current market conditions.

2. Variable Funding Rates: Unlike fixed rates, variable funding rates fluctuate based on market conditions. They are recalculated at regular intervals, such as every 8 hours. This type of rate can be more reflective of current market sentiment but can also introduce uncertainty in trading costs.

3. Positive Funding Rates: When the funding rate is positive, traders with long positions (betting on the price going up) pay those with short positions (betting on the price going down). This usually happens when the perpetual contract price is higher than the spot price, indicating a bullish market sentiment.

4. Negative Funding Rates: Conversely, negative funding rates occur when traders with short positions pay those with long positions. This happens when the perpetual contract price is lower than the spot price, indicating a bearish market sentiment.

5. Neutral Funding Rates: In some cases, the funding rate can be neutral, meaning there is no payment between long and short positions. This typically occurs when the perpetual contract price is very close to the spot price, indicating a balanced market.

How Funding Rates Affect Traders?

Funding rates have a significant impact on traders in the crypto market. Here’s how:

1. Profitability: Funding rates can directly affect a trader’s profitability. High funding rates reduce the profits of long positions, as traders need to pay more to hold their positions. Conversely, negative funding rates impact short positions, as traders with short positions may need to pay those with long positions.

2. Market Sentiment: Funding rates provide insights into market sentiment. High funding rates indicate a bullish market, with more traders taking long positions. Low or negative funding rates suggest a bearish market, with more traders taking short positions. Understanding these trends helps traders anticipate market movements and adjust their strategies.

3. Risk Management: Monitoring funding rates is crucial for effective risk management. By keeping an eye on these rates, traders can better manage their positions and avoid unexpected costs. This is especially important in volatile markets, where funding rates can change rapidly.

4. Trading Strategies: Funding rates influence trading strategies. Traders may choose to enter or exit positions based on the current funding rate. For example, if the funding rate is high, a trader might decide to close a long position to avoid high costs. Conversely, a negative funding rate might encourage a trader to hold a short position longer.

In summary, funding rates are vital for traders. They affect profitability, provide insights into market sentiment, aid in risk management, and influence trading strategies.

How to Use Funding Rate in Trading?

Using funding rates effectively can enhance your trading strategy in the cryptocurrency market.

- Market Sentiment

- Divergence or Trend Following

- Funding Rate Trading

- Trading Against the Funding Rate

Understanding Market Sentiment: The funding rate acts as a market sentiment indicator. It shows the behavior of the market and indicates which direction buyers or sellers currently prefer. This insight can improve your trading strategy when combined with other styles and help you make more informed decisions.

Divergence or Trend Following: Use the funding rate in relation the market trend. If the price trend and the funding rate diverge; for example, if the price increases but the funding rate remains negative, it can indicate market pressure against the trend. Conversely, alignment between the two can provide more confidence in trend analysis.

Funding Rate Trading: This strategy involves only receiving funding rate fees. To implement this method, you simultaneously enter a buy trade in the spot market and a sell trade in the futures market. While these positions neutralize each other in terms of trade direction, the sell position in the futures market allows you to earn funding rate fees.

Trading Against the Funding Rate: This trading strategy is high-risk and involves entering a trade against the market trend in small time frames, such as 1 or 3-minute charts. Just before the funding rate updates for the next period, you open a trade on the opposite side (the side that receives the funding rate fee). This way, you can receive the fee as a reward.

How to Track Funding Rates?

Tracking funding rates is essential for making informed trading decisions in the cryptocurrency market. Here are some simple steps to help you keep an eye on these rates:

1. Use Exchange Platforms: Most major cryptocurrency exchanges, like Binance and Bybit, provide real-time funding rate information for their perpetual futures contracts. You can find this data in the futures trading section of the platform.

2. Funding Rate Trackers: Websites like CoinGlass offer tools to track funding rates across multiple exchanges. These platforms provide historical data and real-time updates, helping you analyze trends and make better trading decisions.

3. Set Alerts: Some platforms allow you to set alerts for funding rate changes. For example, Cryptocurrency Alerting lets you set thresholds and receive notifications via email, SMS, or other methods when funding rates hit your specified levels.

4. Heatmaps: Funding rate heatmaps visually represent funding rates over time. They use color coding to show periods of high and low rates, making it easier to spot trends and potential trading opportunities.

5. API Access: For more advanced users, some exchanges and tracking platforms offer API access. This allows you to integrate funding rate data into your own trading tools and algorithms for automated analysis.

By using these methods, you can stay updated on funding rates and incorporate this information into your trading strategy, helping you manage costs and optimize your trades.

Conclusion

The funding rate is a fundamental concept in cryptocurrency trading, especially in futures trading. Its main role is to keep the contract price close to the asset price in the spot market. This mechanism helps maintain market balance and fairness, preventing price deviations.

The funding rate not only affects your costs but also helps you better understand market sentiment and make better trading decisions.

For those who intend to engage professionally in cryptocurrency markets, understanding and interpreting the funding rate is essential. By accurately understanding this concept, you can manage your trading costs and develop better strategies for your trades.

Ultimately, by using the funding rate as an analytical tool, you can improve your performance in cryptocurrency markets and increase your profitability.

FAQ

What is a funding rate?

How do you take advantage of funding rates?

How do funding fees work?

How often are funding rates updated?

Why do funding rates vary between exchanges?

Can funding rates be negative?

What is a negative funding rate in crypto?

What is a high funding rate for crypto?

How do funding rates affect my trading strategy?

Where can I find the current funding rates?

Related Post

most visited