نقدینگی (Liquidity) مفهومی اساسی در بازارهای مالی است که نشاندهندۀ سهولت و سرعت خرید یا فروش یک دارایی است. این نیروی نامرئی که زیربنای بازارهای مالی است، بر ثبات بازار و تصمیمات سرمایهگذاری تأثیر میگذارد. در این مقاله به بررسی مفهوم نقدینگی، تأثیر آن و نحوۀ تشخیص نواحی نقدینگی، خواهیم پرداخت. درک نقدینگی که عامل اصلی حرکت در بازار است برای هر کسی که در دنیای پیچیدۀ بازارهای مالی فعالیت میکند، بسیار مهم و ضروری است. پس با ما همراه باشید.

فهرست مطالب

نقدینگی یا لیکویدیتی در فارکس چیست؟

نقدینگی یا لیکوئیدیتی (Liquidity)، در واقع مجموعهای از سفارشها و دستورات شامل اردر لیمیتها، سفارشهای حد ضرر و دستورات حد سود است؛ که در نزدیکی سطوح خاصی از عرضه یا تقاضا اجرا میشوند. بارها شاهد فعالشدن حد ضرر خود در مارکت بودهایم، دلیل اصلی این است که روشهای عمومی که اکثر معاملهگران خرد از آن استفاده میکنند، کارایی زیادی نداشته و طرف دیگر معاملات آنها، بازیگران بزرگ و معاملات الگوریتمی است و سفارشات بازیگران بزرگ نیز به گونهای تنظیم شدهاند که ضرر اکثر معاملهگران خرد، برابر با سود آنها باشد. بههمین دلیل برای بقا در مارکت نیاز به نگاه متفاوتتری به مارکت داریم. آشنایی با نقدینگی (Liquidity) که از آن به عنوان سوختی برای به حرکت درآوردن مارکت یاد میشود، میتواند روی سودآوری معاملات و مدیریت ریسک شمت، تأثیر مفیدی بگذارد.

تأثیر نقدینگی در بازارهای مالی

نقدینگی یکی از عوامل کلیدی در بازارهای مالی است و تأثیرات گستردهای روی رفتار و عملکرد بازارهای مالی و فارکس دارد. در ادامه، به تأثیرات نقدینگی در معاملات و سفارشات بازارهای مالی میپردازیم:

- نقدینگی بیشتر به افزایش حجم معاملات در بازارهای مالی منجر شده و سرمایهگذاران بزرگ میتوانند بهراحتی معاملات بزرگتری انجام دهند.

- نقدینگی بیشتر سبب کاهش انحراف قیمت میشود و با کاهش اسپرد، بازار پایدارتری خواهیم داشت.

- نقدینگی بیشتر به افزایش سرعت اجرای معاملات منتهی میشود. این امر برای سرمایهگذاران حرفهای بسیار مهم است.

- نقدینگی به تعادل بازار کمک میکند و نقدینگی بالا، سبب پویایی و تعادل مارکت خواهد بود.

انواع نقدینگی در سبکهای اسمارت مانی (پول هوشمند)

انواع مختلفی از نقدینگی وجود دارد و روشهای شناسایی آنها براساس هر سبک معاملات میتواند متفاوت باشد. یکی از مطلوبترین حالتها، طبقهبندی انواع نقدینگی به سه مورد زیر است:

- سطوح رنج نقدینگی (Range Liquidity Levels)

- نقدینگی خط روند (Trend Line Liquidity)

- نقدینگی در سقف یا کف برابر (Equal Highs and Lows)

در ادامه هر کدام از این موارد را کامل بررسی خواهیم کرد.

سطوح رنج نقدینگی (Range Liquidity Levels)

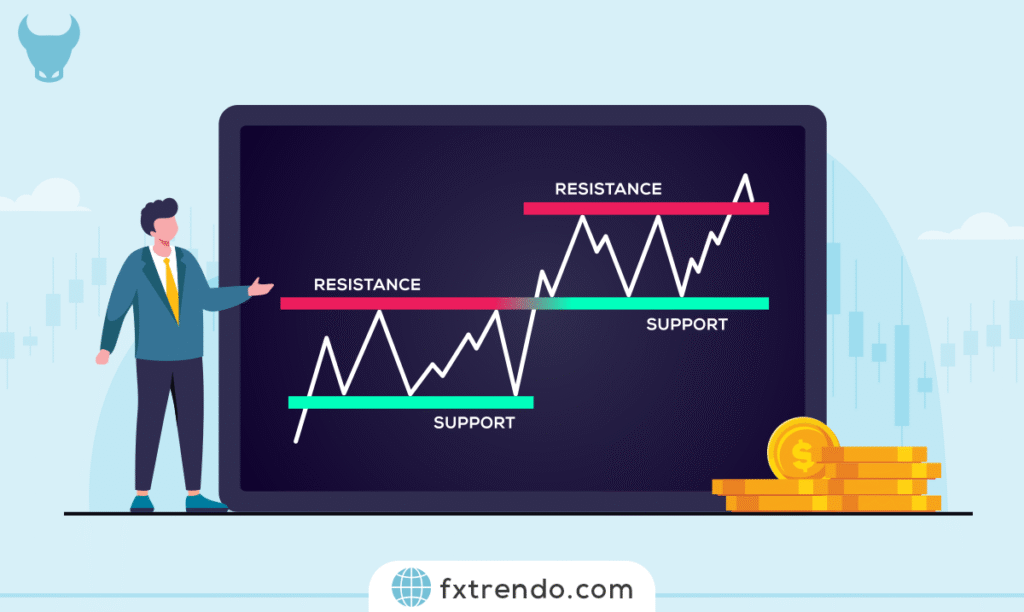

به این نوع نقدینگی، نقدینگی استاتیک نیز گفته میشود. زمانی که قیمت در یک محدودۀ رنج، شروع به ایجاد سقفها و کفهای برابر میکند، اکثر معاملهگران شروع به معامله کرده و حد ضررها را بالاتر یا پایینتر از این سقفها و کفها قرار میدهند و این ایجاد نقدینگی، سبب تمایل مارکت به عبور از آن ناحیه میشود. در ادامه بهدلیل حرکت سریع مارکت به سمت سفارشات حد ضرر، افراد دیگری فکر میکنند که محدودۀ رنج (Range) شکسته شده و در جهت شکست، وارد معامله میشوند که در واقع دومین گروهی هستند که استاپ آنها فعال میشود. در تصویر زیر یک نمونه از این نوع نقدینگی را مشاهده میکنید:

نقدینگی خط روند (Trend Line Liquidity)

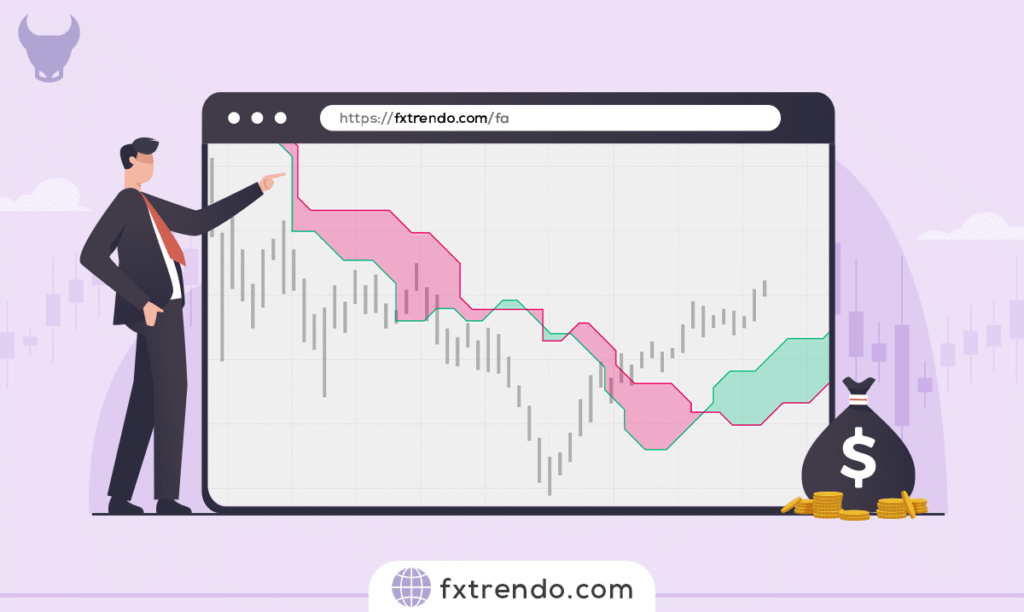

این نوع نقدینگی که به نقدینگی داینامیک نیز معروف است، همان سفارشهایی است که در پشت یک خط روند وجود دارند. خطوط روند نشاندهندۀ یک حرکت منظم از سقفهای بالاتر و یا کفهای پایینتر هستند که در امتداد یک خط راست ایجاد شدهاند. نکتۀ اصلی این است که هرچه خط روند واضحتر باشد، نقدینگی بیشتر خواهد بود. در مثال زیر، نقدینگی خط روند (Trend Line Liquidity) را میتوانید مشاهده کنید:

نقدینگی در سقف یا کف برابر (Equal Highs and Lows)

این نوع از نقدینگی در واقع به یک سطح از حمایت یا مقاومت واضح اشاره دارد که معاملهگران سفارشات حد ضرر خود را پشت آن قرار داده و پیشبینی میکنند که قیمت از آن برگردد. اما در اغلب موارد، قیمت این سطح را میشکند و معاملهگران با ضرر از معامله خارج میشوند، که در واقع یک جذب نقدینگی رخ داده است. در ادامه با یک مثال از این نوع نقدینگی با ما همراه باشید.

حتماً بخوانید: آموزش کاربردی اعمال حد سود و حد ضرر در معاملات فارکس

نحوۀ تشخیص نواحی نقدینگی و معامله با آنها

بر اساس انواع نقدینگی که در قسمت قبل بیان شد، شروع به مطالعه و بررسی نمودارهای قیمت بکنید. شما با تمرین کافی خواهید توانست، نواحی مهم نقدینگی را به خوبی شناسایی کنید.

نکات مهم در استفاده از نقدینگیها عبارتاند از:

- مناطقی که در گذشته به عنوان اردر بلاک عمل کردهاند، در مواردی در آینده بهعنوان یک ناحیه نقدینگی عمل میکنند و قیمت تمایل به حرکت به سمت آنها دارد.

- نقدینگی در هر تایمفریم، منحصر به همان تایمفریم است و نباید از آن برای سایر دورهها استفاده کرد.

- نقدینگیهای قابلمشاهده در تایمفریمهای بزرگتر، اعتبار بیشتری نسبت به بقیه دارند.

- قیمت برای رسیدن به اردر بلاکها، نباید به صورت شارپ از سطوح نقدینگی عبور کند.

برای معامله با نواحی نقدینگی (Liquidity) و استفادۀ کاربردی از آنها، پس از شناسایی روند و اردر بلاکهای مهم در جهت روند، سعی کنید از آن نواحی نقدینگی استفاده کنید که در مسیر رسیدن قیمت به اردر بلاک هستند، بهطوری که قیمت با برخورد به اردر بلاک، همزمان یک نقدینگی را هم جذب کرده باشد. این تلاقی نقدینگی و اردر بلاک، احتمال موفقیت شما در معامله را بیشتر خواهد کرد. همچنین برای شروع معاملهگری و تجربه معاملات واقعی میتوانید از بونوس خوشآمدگویی بروکر ترندو استفاده کنید. بدینترتیب شما شروعی بدون ریسک را در مارکت تجربه خواهید کرد.

حتماً بخوانید: فعالسازی بونوس خوشآمدگویی فارکس

سخن پایانی

در مقالهای که برای شما ارائه دادیم، به مفهوم نقدینگی در بازارهای مالی پرداخته و تأثیرات آن بر رفتار بازار و سرمایهگذاران را مورد بررسی قرار دادیم و از نقدینگی به عنوان یکی از عوامل کلیدی در مارکت یاد کردیم. نشان دادیم که چگونه نقدینگی میتواند به افزایش حجم معاملات، کاهش انحراف قیمت، افزایش سرعت اجرا و تعادل بازار کمک کند. در پایان همواره به یاد داشته باشید که بازارهای مالی با ریسکهای مختلفی هستند و بهعنوان یک معاملهگر باید مدیریت ریسک و سرمایه را مد نظر قرار دهید. آموزش مداوم یکی از مواردی است که در بلندمدت، به موفقیت شما در این حرفه کمک خواهد کرد.