Many traders are confused about choosing take-profit and stop-loss points and use old techniques that weaken their trading strategy. We explained the history, calculating method, and drawing Fibonacci levels before. Here, we teach you how to determine the exact stop-loss and take-profit orders with the Fibonacci tool’s help.

Using the Fibonacci extension to place accurate take-profit orders

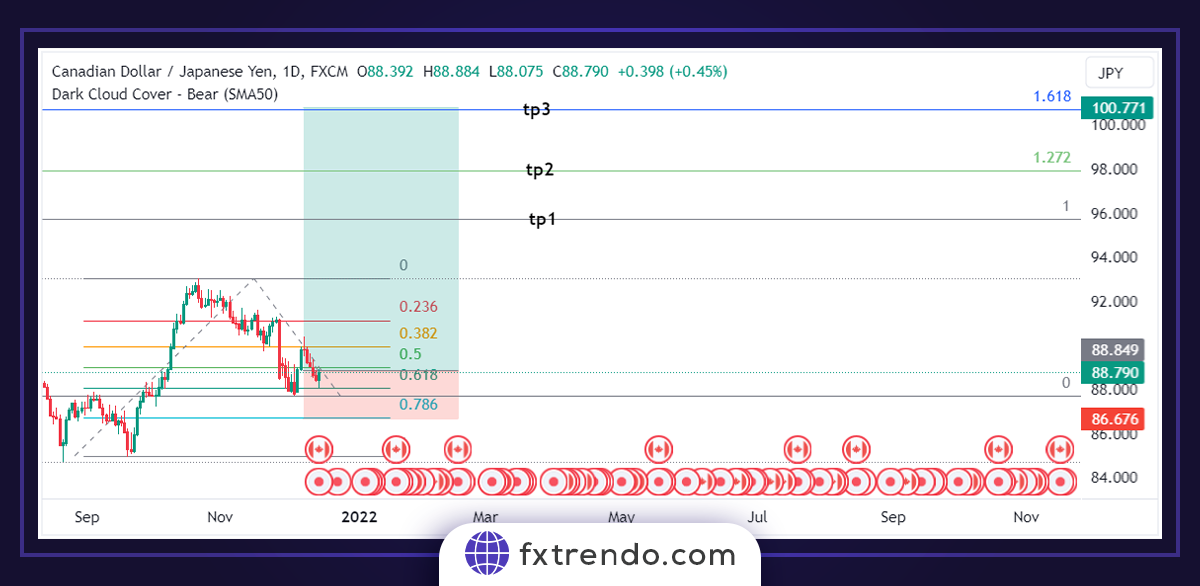

There are many ways to determine “take profit” points, but Fibonacci levels are more accurate. Here, we discuss the Fibonacci indicator’s accuracy in determining “take profit” areas. To find a trading position, we must first find a price trend. A major trend can be a previous trend’s continuation or the start of a new trend after a market reversal. In the chart below, we can see the uptrend’s reversal. In this case, we have to wait for a price correction. If the correction follows all the rules of the Fibonacci strategy explained above, we can enter the trade.

In the image below, we can see the price correction, which originates from the swing ceiling. We will evaluate this swing high using retracement Fibonacci levels. Of course, the Fibonacci levels used to determine the exact location of “take-profit” are different from the retracement Fibonacci levels we used in all previous sections.

In this step, first, we find the suitable entry area using retracement Fibonacci levels. We can see that the price correction reacts at exactly the 8.61% Fibonacci level in the chart, which can be a trend continuation sign. But to be sure, having a confirmation candle in this situation is essential. We get a bullish confirmation candle in the main trend’s direction, after which we can enter a buy trade.

Read More: Trading strategy with trend line and candlestick patterns with Fibonacci levels confirmation

Then, we use “Fibonacci extension or three points” instead of retracement Fibonacci to determine take-profit or target points. To draw a Fibonacci extension on the chart, click on the previous low first, then drag and click on the recent high. Finally, drag the cursor to the last floor. The chart below shows how Fibonacci extensions are drawn using swing lows and swing highs.

The strategy is to save some profit at 100% and then 127% and the remaining profit at 161%. The take-profit points are shown in the chart below. It is possible to maximize profit by earning profit at any level using this method.

Using Fibonacci retracement to place a suitable stop-loss order

As a trader, you should always use a “Stop-Loss” order since it is crucial to avoid incurring huge losses. In some unfavorable circumstances, it will lead to trading capital loss (margin call) if you don’t use this order. Placing a suitable stop-loss order ensures we do not expose our capital to unbearable risk. However, accidentally setting a stop-loss order may expose us to the risk of exiting the trade early. Thus, the correct placement of this order is vital. Therefore, the Fibonacci tool can be a great help for us in deciding the exact stop-loss points.

Read More: How to avoid margin calls in Forex

Below, we see a major move up where Fibonacci levels are drawn using the Swing low and Swing high. We can notice a price correction that has reacted well from near the 8.61% Fibonacci level using the “Fibonacci Strategy”, and if we have a candlestick confirmation now, it can be a confirmation to enter a buy trade.

With the Engulf candle confirmation, we can execute the “buy” trade by placing suitable “stop-loss” and “take profit” orders. The classic way to use a stop loss order is to set it 50 pips away from the entry point. Most novice traders use this method, but when we use such methods, there is a high chance that we exit the trade before the trade moves in our analysis direction. The chart below shows that placing a 50 pip stop loss can be dangerous, and the candles hit the stop loss point after entry.

Now, the stop loss strategy based on Fibonacci levels is to place the stop loss at the Fibonacci level, which is below the Fibonacci level and was the reason for entering the trade. Considering the above example, since the price correction hit the 8.61% Fibonacci level and showed a confirmation candle, the stop loss is placed at the 6.78% Fibonacci level. Although this technique is quite simple, most traders do not know it.

We can see how the price is moving upwards from near the stop loss at the 6.78 level and moving toward the targets in the chart above. This example shows the importance of a stop-loss order position created using Fibonacci levels.

Summary

We explained how to use the Fibonacci tool to determine stop-loss and take-profit orders accurately in this article. Fibonacci levels are a powerful tool that helps traders make more profits, reduce losses, and identify suitable entry and exit points. However, it is essential to note that Fibonacci levels aren’t perfect tools and cannot always provide accurate results. In addition to following fundamental news, try to use other technical analysis tools such as candlesticks and indicators.