How to Trade with the Harmonic Bat Pattern? The Ultimate Guide to Harmonic Bat Pattern Trading Strategy

Trading with the Harmonic Bat Pattern using Fibonacci ratios helps traders identify optimal entry and exit points.

We learned about the importance of harmonic patterns in the article “The Ultimate Guide to Harmonic Pattern Trading Strategy”. This advanced trading strategy, known for its accuracy and reliability, helps traders identify potential reversal points in the market.

In this ultimate guide, we’ll walk you through the essentials of the Harmonic Bat Pattern, from its unique structure to practical trading tips.

Whether you’re a seasoned trader or just starting out, this guide will equip you with the knowledge and confidence to harness the power of the Harmonic Bat Pattern.

Let’s dive in and discover how this pattern can transform your trading strategy!

Contents

What is the Harmonic Bat Pattern?

The Harmonic Bat Pattern is a technical analysis tool used by traders to predict potential price reversals in financial markets. Discovered by Scott Carney in 2001, this pattern is part of the harmonic trading family, which relies on precise Fibonacci ratios to identify key points in price movements.

The Bat Pattern consists of five points labeled X, A, B, C, and D. These points form specific Fibonacci retracement and extension levels, which help traders spot potential reversal zones.

Here’s a simple breakdown of the pattern:

1. XA Leg: The initial move from point X to point A.

2. AB Leg: A retracement from point A to point B, typically around 38.2% to 50% of the XA leg.

3. BC Leg: A move from point B to point C, retracing 38.2% to 88.6% of the AB leg.

4. CD Leg: The final move from point C to point D, extending 161.8% to 261.8% of the BC leg.

The most critical part of the Bat Pattern is the D point, which represents the potential reversal zone. This point is identified by a deep retracement of 88.6% of the XA leg. When the price reaches this area, traders look for signs of a reversal to enter or exit trades.

The Bat Pattern is valued for its accuracy and the relatively small stop-loss levels it requires. By using this pattern, traders can make more informed decisions and potentially increase their chances of success in the market.

In summary, the Harmonic Bat Pattern is a tool for identifying potential reversals in financial markets. Its unique structure and reliance on Fibonacci ratios make it a favorite among traders looking to enhance their trading strategies.

Types of the Bat Pattern

The Bat Pattern comes in two main types: the Bullish Bat and the Bearish Bat. Both patterns use the same Fibonacci ratios but are applied in different market conditions.

Bullish Bat Pattern

The Bullish Bat Pattern identifies potential buying opportunities in a downtrend.

A Bullish Bat Pattern

It resembles the letter “M” and indicates that the price may reverse upwards after reaching the D point. Here’s how it works:

1. XA Leg: The initial downward move from point X to point A.

2. AB Leg: A retracement upwards from point A to point B, typically around 38.2% to 50% of the XA leg.

3. BC Leg: A downward move from point B to point C, retracing 38.2% to 88.6% of the AB leg.

4. CD Leg: The final upward move from point C to point D, extending 161.8% to 261.8% of the BC leg.

When the price reaches the D point, which is a deep retracement of 88.6% of the XA leg, traders look for signs of a reversal to enter a long position.

Bearish Bat Pattern

The Bearish Bat Pattern identifies potential selling opportunities in an uptrend.

A Bearish Bat Pattern

It resembles the letter “W” and indicates that the price may reverse downwards after reaching the D point. Here’s the breakdown:

1. XA Leg: The initial upward move from point X to point A.

2. AB Leg: A retracement downwards from point A to point B, typically around 38.2% to 50% of the XA leg.

3. BC Leg: An upward move from point B to point C, retracing 38.2% to 88.6% of the AB leg.

4. CD Leg: The final downward move from point C to point D, extending 161.8% to 261.8% of the BC leg.

When the price reaches the D point, which is a deep retracement of 88.6% of the XA leg, traders look for signs of a reversal to enter a short position.

Both types of Bat Patterns are valued for their precision and the relatively small stop-loss levels they require. By understanding and applying these patterns, traders can better anticipate market reversals and make more informed trading decisions.

The Significance of Fibonacci Ratios in the Bat Pattern

Fibonacci ratios play a crucial role in the Bat Pattern, helping traders identify potential reversal points in the market. These ratios are derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones. The key Fibonacci ratios used in the Bat Pattern are 38.2%, 50%, 61.8%, 88.6%, 161.8%, and 261.8%.

Why Fibonacci Ratios Matter in Bat Pattern?

1. Precision in Entry and Exit Points: The Bat Pattern relies on specific Fibonacci retracement and extension levels to pinpoint where price movements are likely to reverse. This precision helps traders set accurate entry and exit points, reducing the risk of false signals.

2. Identifying Reversal Zones: The pattern’s structure, defined by the XA, AB, BC, and CD legs, uses Fibonacci ratios to determine the potential reversal zones. For example, the D point, which is the most critical part of the pattern, is identified by an 88.6% retracement of the XA leg. This deep retracement level is where traders look for signs of a market reversal.

3. Risk Management: By using Fibonacci ratios, traders can set stop-loss levels more effectively. Knowing the exact points where the price is likely to reverse allows for tighter stop-loss placements, minimizing potential losses.

4. Market Psychology: Fibonacci ratios are widely used in trading because they reflect natural patterns found in nature and human behavior. This widespread acceptance means that many traders are looking at the same levels, which can reinforce the likelihood of price reactions at these points.

Application in the Bat Pattern

XA Leg: The initial move sets the stage for the pattern.

AB Leg: Retraces 38.2% to 50% of the XA leg.

BC Leg: Retraces 38.2% to 88.6% of the AB leg.

CD Leg: Extends 161.8% to 261.8% of the BC leg.

The D point, with its 88.6% retracement of the XA leg, is the key area where traders anticipate a reversal. This precise use of Fibonacci ratios makes the Bat Pattern a reliable tool for predicting market movements.

Briefly, Fibonacci ratios are integral to the Bat Pattern, providing the framework for identifying potential reversals, managing risk, and understanding market psychology. By mastering these ratios, traders can enhance their ability to make informed decisions and improve their trading strategies.

How to Apply Fibonacci Ratios to Identify Potential Bat Patterns?

Applying Fibonacci ratios to identify potential Bat patterns involves a series of steps that help traders pinpoint key reversal points in the market. Here’s a straightforward guide to help you understand the process:

Step-by-Step Guide

1. Identify the XA Leg: Start by spotting the initial move in the market, known as the XA leg. This can be either an upward or downward movement.

2. Measure the AB Leg: Once the XA leg is identified, look for a retracement from point A to point B. This retracement should be between 38.2% and 50% of the XA leg. Use Fibonacci retracement tools to measure this accurately.

3. Determine the BC Leg: Next, identify the move from point B to point C. This leg should retrace between 38.2% and 88.6% of the AB leg. Again, use Fibonacci retracement tools to find this range.

4. Project the CD Leg: The final leg, from point C to point D, is crucial. This leg should extend between 161.8% and 261.8% of the BC leg. Use Fibonacci extension tools to project this leg.

5. Confirm the D Point: The D point is the potential reversal zone. It should be a deep retracement of 88.6% of the XA leg. When the price reaches this area, look for signs of a reversal, such as candlestick patterns or other technical indicators.

By following these steps and using Fibonacci ratios, you can effectively identify potential Bat patterns and make more informed trading decisions.

How to Identify the Harmonic Bat Pattern on Charts?

Identifying the Harmonic Bat Pattern on charts might seem challenging at first, but with practice, it becomes easier. The Bat Pattern helps traders spot potential reversal points in the market. Here’s a step-by-step guide:

1. Look for the Initial Move (X to A): The pattern starts with a significant price movement from point X to point A.

2. Identify the Retracement (A to B): After the initial move, the price retraces to point B. This retracement should be between 38.2% and 50% of the XA move. Use Fibonacci retracement tools to measure this.

3. Spot the Extension (B to C): From point B, the price moves again to point C. This move should be an extension of 38.2% to 88.6% of the AB move.

4. Find the Final Leg (C to D): The last move is from point C to point D. Point D should be at the 88.6% retracement of the XA move. This is the potential reversal zone.

5. Confirm the Pattern: Once all the points are identified, draw the pattern on your chart. The Bat Pattern should resemble a bat with its wings spread out. Double-check the Fibonacci levels to ensure accuracy.

6. Look for Additional Confirmation: Before making any trading decisions, look for additional confirmation signals such as candlestick patterns, volume changes, or other technical indicators.

By following these steps, you’ll be able to identify the Harmonic Bat Pattern on charts with confidence.

How to Trade with the Harmonic Bat Pattern?

Trading with the Harmonic Bat Pattern involves a systematic approach to identify potential reversal points and make informed trading decisions. Here’s a step-by-step guide:

Step-by-Step Trading Guide

1. Identify the Bat Pattern: Use charting software to spot the Bat Pattern. Look for the five-point structure (X, A, B, C, D) with specific Fibonacci retracement and extension levels.

2. Wait for Pattern Completion: Ensure the pattern completes at the D point, which should be an 88.6% retracement of the XA leg. This is the potential reversal zone.

3. Look for Reversal Signals: At the D point, watch for signs of a reversal. These can include candlestick patterns like doji or engulfing patterns, or other technical indicators such as RSI or MACD showing divergence.

4. Enter the Trade:

Bullish Bat Pattern: If the pattern is bullish, enter a long position when you see confirmation of a reversal at the D point.

Bearish Bat Pattern: If the pattern is bearish, enter a short position when you see confirmation of a reversal at the D point.

5. Set Stop-Loss Orders: Place your stop-loss order just beyond the X point. This helps protect against significant losses if the trade goes against you.

6. Determine Profit Targets: Use multiple profit targets to manage your trade:

First Target: Set the first profit target at the 38.2% retracement of the AD leg.

Second Target: Set the second profit target at the 61.8% retracement of the AD leg.

Final Target: You can set additional targets or exit the trade entirely based on your risk tolerance and market conditions.

7. Monitor the Trade: Keep an eye on the trade and adjust your stop-loss and profit targets as needed. If the price moves in your favor, consider trailing your stop-loss to lock in profits.

By following these steps and using the Harmonic Bat Pattern, you can improve your ability to identify potential market reversals and make more informed trading decisions.

The Best Tips for Trading the Harmonic Bat Pattern

Trading the Harmonic Bat Pattern can be highly rewarding if done correctly. Here are some of the best tips to help you succeed:

1. Master the Basics: Ensure you have a solid understanding of the Harmonic Bat Pattern. Familiarize yourself with its structure, key points (X, A, B, C, D), and the Fibonacci levels involved.

2. Use Reliable Tools: Utilize reliable charting tools and software to identify the pattern accurately. Tools with built-in Fibonacci retracement and extension features can be particularly helpful.

3. Wait for Confirmation: Don’t rush into a trade as soon as you spot the pattern. Wait for additional confirmation signals such as candlestick patterns, volume changes, or other technical indicators to validate the pattern.

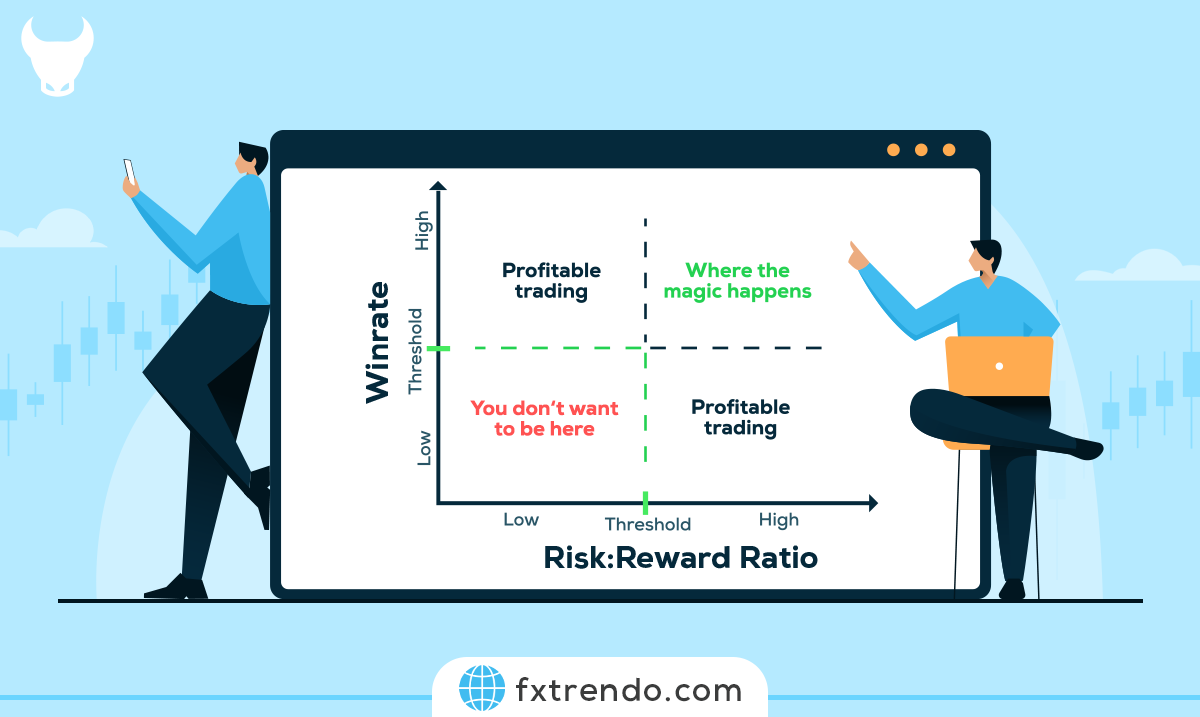

4. Set Clear Entry and Exit Points: Define your entry and exit points before entering a trade. This includes setting stop-loss levels to manage risk and identifying profit targets based on Fibonacci retracement levels or previous support and resistance levels.

5. Manage Your Risk: Always use stop-loss orders to protect your capital. Position sizing is also crucial; never risk more than a small percentage of your trading account on a single trade.

6. Stay Updated: Keep an eye on market news and events that could impact the price movement. Economic reports, geopolitical events, and other factors can influence the market and affect your trades.

7. Practice Patience: Trading requires patience and discipline. Stick to your trading plan and avoid making impulsive decisions based on emotions.

8. Review and Learn: After each trade, review your performance. Analyze what went well and what could be improved. Continuous learning and adaptation are key to long-term success in trading.

By following these tips, you can enhance your trading strategy and increase your chances of success with the Harmonic Bat Pattern.

Trading Strategy with the Harmonic Bat Pattern

Developing a trading strategy with the Harmonic Bat Pattern can help you make more informed decisions and potentially increase your profitability. Here’s a simple and understandable guide to creating an effective trading strategy:

How to Enter a Trade?

Identifying the Potential Reversal Zone (PRZ): The PRZ is where the price is likely to reverse. In the Bat Pattern, this is the D point, which is an 88.6% retracement of the XA leg. Use Fibonacci retracement tools to identify this zone accurately.

Waiting for Confirmation Signals: Before entering a trade, wait for confirmation signals at the PRZ. These signals can include candlestick patterns like doji, hammer, or engulfing patterns, or technical indicators such as RSI or MACD showing divergence. These signals increase the likelihood that a reversal is imminent.

Stop-Loss Placement

Where to Set Stop-Loss Orders in Bat Pattern Trades: Place your stop-loss order just beyond the X point. This placement helps protect against significant losses if the trade goes against you. For a bullish Bat Pattern, set the stop-loss below the X point. For a bearish Bat Pattern, set it above the X point.

Take-Profit Strategies

How to Set Profit Targets Using Fibonacci Extensions or Other Methods: Use multiple profit targets to manage your trade effectively:

1. First Target: Set the first profit target at the 38.2% retracement of the AD leg. This is a conservative target that allows you to secure some profits early.

2. Second Target: Set the second profit target at the 61.8% retracement of the AD leg. This target aims to capture more of the potential price movement.

3. Final Target: You can set additional targets or exit the trade entirely based on your risk tolerance and market conditions. Some traders use the 100% retracement of the AD leg or other Fibonacci extension levels for final targets.

By following these steps and using the Harmonic Bat Pattern, you can improve your ability to identify potential market reversals and make more informed trading decisions.

Conclusion

The Bat pattern is one of the most popular trading patterns in financial markets. You can increase the effectiveness of the Bat pattern by combining it with other technical analysis methods.

In conclusion, always remember to adhere to capital management rules, as failure to do so will inevitably lead to failure in financial markets.

FAQs

What is a bat harmonic pattern?

What is the most accurate harmonic pattern?

How to draw a bat harmonic pattern?

Is the bat pattern bullish or bearish?

What is the success rate of the Harmonic Bat Pattern?

Can the Bat Pattern be used in all markets?

How long does it take to master this trading strategy?

What is the success rate of the bat pattern?

Related Post

most visited