What is Forex's Function & a Trader's Job?

Trade and exchange of goods existed since ancient times, and traders were engaged in trading in the form of goods for goods and then money for goods, which later emerged due to the many problems that traditional markets had and technological advancement. With smartphones and social media activity increasing and the Internet development, new financial markets emerged with a more professional and up-to-date mechanism. The forex market is one of the world's most up-to-date, largest, and most popular financial markets.

Forex, short for Foreign Exchange Market, is one of the largest decentralized financial and investment markets where different countries' currencies are traded. The forex market is an international market where all interested people worldwide can trade currency pairs, cryptocurrencies (Bitcoin, Ethereum, etc.), famous indices, and shares of large companies such as Apple, Google, Microsoft, etc. Forex market players include countries' central banks, the world's big banks, financial institutions, commercial companies, traders and investors, and ordinary people. Banks and financial companies cover a large part of the market, but traders and people make up only 5% of the forex market with their capital.

The forex market has become one of the most profitable financial markets due to its high trading value, which attracted many enthusiasts. But acquiring knowledge and skills is necessary to be present and active in the forex market and earn profit. Every interested person should first get acquainted with the basic concepts of the forex market, then take their knowledge and skills to a more professional level. One of the questions that arise for people who have not yet entered the forex market is what is Forex's function, and what is a trader's job? If such a question arises for you, stay with us in this article by Trendo that mentions some helpful points.

Contents

What is Forex's Function?

The main purposes of trading in Forex are practical and commercial, but many enthusiasts enter this global market to make a profit. Today, millions of people from all over the world are engaged in trading in the market. Because Forex trading is a second source of earning more money, which of course, will become your only job and source of income if you become a professional in this market. You can take your first step with Trendo's help, start with Trendo, and accelerate your success if you are also looking for a new way to invest, work and earn money in the forex market!

The Forex market is a 24-hour market where you have no time and place limit to work in this market and can work with a reliable Forex Broker at any time with any job and income via a laptop and the internet. Another advantage of Forex is the market being two-way. It means that you can profit from both price growth and price reduction. Trading in Forex is based on knowledge, so the more you increase your knowledge, awareness, and skills, the clearer your path will be in your trading. On the other hand, information and news related to the market are equally available to all activists & traders, also there is no information rent, and trades are made based on the trader's knowledge and in a fair manner.

What is Traded in Forex?

In the forex market, currencies of different countries are bought and sold in pairs. The national currency of each country is also displayed as a three-letter code, for example, USD, US dollar, EUR, European euro, GBP, British pound, CHF, Swiss franc, etc., where the first two letters indicate the country or region and the third is the first letter of that country's currency.

Currency pairs divide into Major, Minor, and Regional currency pairs. Major currency pairs are currency pairs that have the US dollar on one side, including EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, and AUD/USD. According to the activists' and professionals' advice, it is best to buy and sell the major currency pairs because they have the highest market trading volume and high liquidity. The currency pair USD/EUR has the highest trading volume of 84%.

The following are also tradeable in addition to currency pairs:

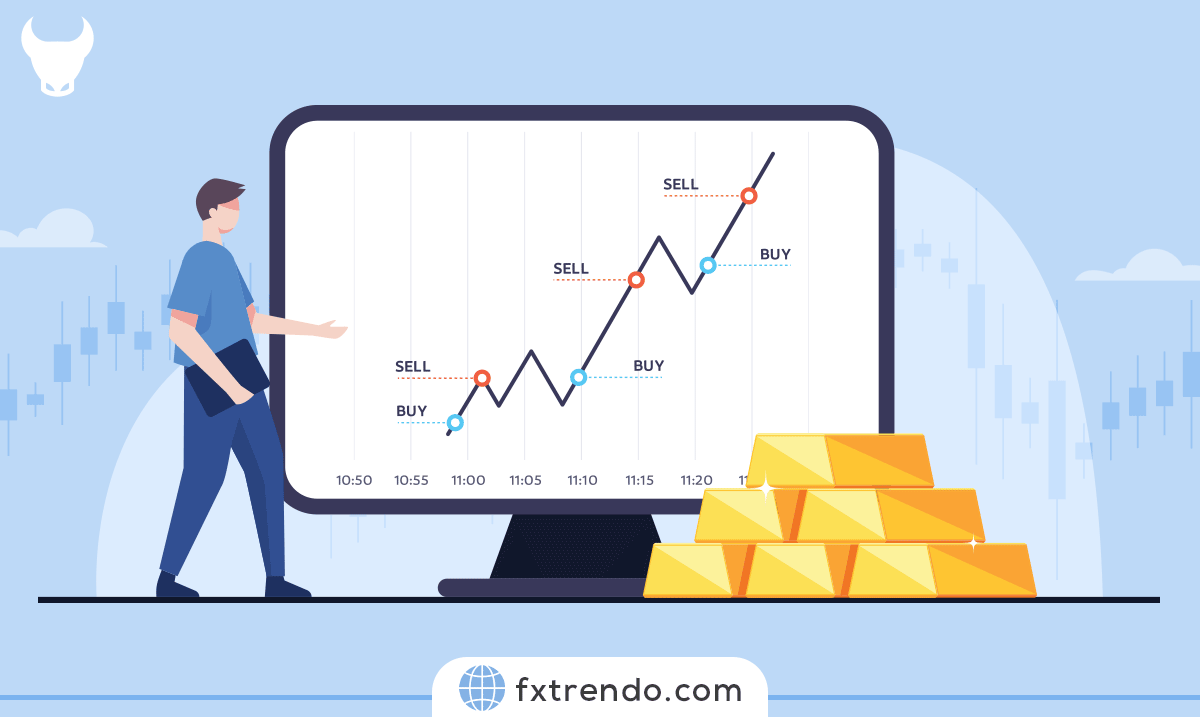

- Metals including gold with the XAU code, silver, palladium, platinum, and copper

- Energy sources like oil and gas

- Shares of famous companies such as Apple, Google, and Amazon shares

- Indices like Dow Jones and the S&P500 index, Nasdaq, the US dollar index with the DXY symbol, the Dax30 index (Shares of 30 major and large German companies traded on the Frankfurt Stock Exchange combined), etc.

- Cryptocurrencies such as Bitcoin with the BTC symbol, Ethereum as ETH, Cardano as ADA, Litecoin as LTC, etc.

- Exchange-Traded Funds or ETFs

Read More: What is a Currency Pair? (What is traded in Forex?)

What is a Trader's job?

Trade is the exchange of goods, and the person trading is called a Trader. In financial markets such as the stock market, cryptocurrency market, and Forex, assets such as securities, commodities, currency pairs, etc., are traded by individual traders. Traders carry out trades for personal gain or another person, institutions, banks, etc. If done for individuals or institutions, they receive a fee for each trade.

Types of Traders

- Forex Trader

- Stock Trader

- Crypto Trader

A forex trader: is a person who profits from the change in the currency pair's price relative to each other. At first, he predicts the currency pair's price, then enters the trade with a sell or buy position in the trend's direction and earns a profit. We have a variety of traders in the market, which include the following

Scalper Trader: Trade in a few minutes to a few seconds time frames and with a small trading volume. A scalper trader may make 100 trades in a day.

Day Trader: This category of trader opens a buy or sell trade and closes it before the end of the market time.

Swing Trader: A swing trader trades in a market with high volatility, and in the neutral trend of the market, the risk of trading increases for this category of trader.

Long-term Trader: This category of traders trades based on the most important economic factors. Their trades are open for a few days to a year, and they look for long-term returns.

A trader must have extensive and specialized knowledge relevant to the target financial market, constantly follow the news and significant macro-level economic decisions, and have high analytical skills. Trading is challenging, exciting, and time-consuming, so the trader must be diligent, motivated, have a risk-taking spirit, and control his emotions well.

Read More: Financial markets and their trading hours

The Currency pair's price is influenced by various factors, including the following:

1- Economic Factors: these include the unemployment rate, economic growth, inflation, interest rate, and rate of changes in the goods and services prices.

2- Political Factors: includes government policies, international relations, and economic sanctions.

3- Geographical Factors: Countries' geographical and regional situation, international trade, and trade agreements.

4- Technical Factors: These include technical and fundamental analysis, price trends, trading volume, and market fluctuations.

What are the necessary Skills for a Trader?

The most important necessary skills that a trader must acquire are as follows:

Technical Analysis: Technical analysis is a method for predicting prices on graphs and charts. In technical analysis, the price is predicted using tools such as trend line, Fibonacci, indicators, price patterns, candlesticks, determination of support and resistance levels, trading volume, trend detection, etc., then the trader enters into buy or sells trades based on the analysis. The trader must specify Take Profit and Stop Loss in each buy or sell position.

Fundamental Analysis: Fundamental analysis examines the currency or stocks fundamentally and focuses on the financial and economic events of the company, news, and government's economic decisions. Federal Reserve interest rate, inflation, unemployment rate, economic growth, etc., are among the things that a trader must consider in trading from a fundamental point of view.

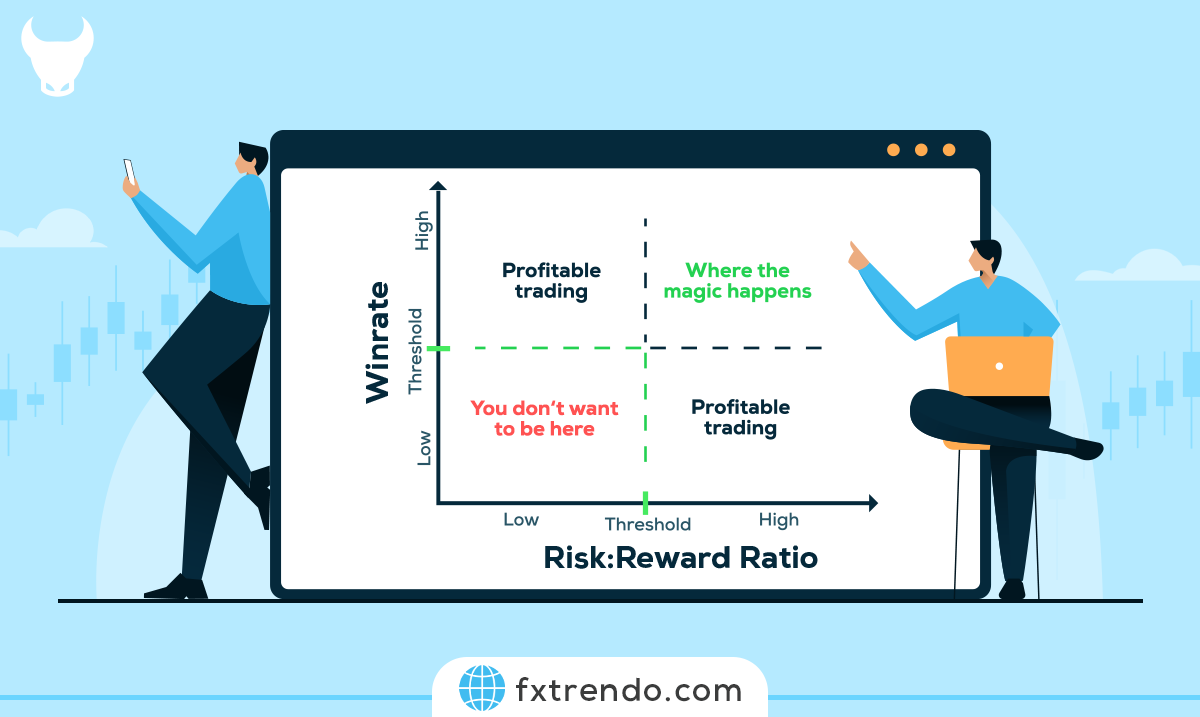

Capital Management: Capital management in financial markets is crucial because if you do not have capital management, it is not far off to lose the entire capital at the start. Therefore, you must have a proper strategy for capital management and involve only a part of your capital in each trade.

Summary

Thus, we learned that the trader in the forex market (or foreign exchange market) buys and sells currency professionally and uses technical and fundamental analysis to make a profit. The trader's job is to monitor the market, analyze economic and financial data, predict price changes, determine the amount of risk and desired profit, and execute buy and sell orders to exploit more efficiency. In addition to having sufficient knowledge and experience, the trader must also be able to manage capital and control risks.

Related Post

most visited