One of the trading strategies of Smart Money is Order Blocks, which play a significant role in the financial markets world, and learning them can improve your profit potential. Generally, order blocks are orders to buy or sell currencies or other assets in large volumes. In this article, we will discuss order blocks, review their types, and how to trade and manage the risk associated with them. Stay tuned.

What is an Order Block?

In the intricate tapestry of Forex trading, order blocks stand out as the bold patterns woven by the market’s most influential players. But what exactly is an order block? It’s a term that might sound complex, but its concept is rooted in the basic principles of supply and demand.

An order block is a cluster of orders, typically originating from major financial institutions or savvy traders, positioned at a certain price level. These are not random placements; they are strategic, calculated moves designed to enter or exit the market with significant volume without causing drastic price fluctuations. Imagine a game of chess where each piece is moved with precision and purpose; that’s how institutional traders place their order blocks.

Why are they so significant? Because they can act as magnets for price action. A well-placed order block can attract the price back to its level, as it represents a point of interest where big players have previously shown their hand. For the individual trader, spotting these blocks is akin to reading the market’s pulse, providing insights into where the price might head next.

Why are Order Blocks in Forex Important?

The importance of order blocks in Forex trading is akin to understanding the currents beneath the waves in the ocean. They are the invisible forces that can propel you forward or pull you under. Here’s why they are crucial:

1. Blueprints of Market Intentions:

Order blocks are like the blueprints that reveal the intentions of the market’s most influential players. They show where big money has been placed, providing clues to future market movements.

2. Price Movement Catalysts:

These blocks often act as catalysts for significant price movements. Identifying an order block can give traders a heads-up on potential surges or drops in price, allowing them to position themselves advantageously.

3. Risk Management Tools:

By understanding where order blocks are situated, traders can set more informed stop-loss orders and take-profit points, enhancing their risk management strategies.

4. Market Structure Markers:

Order blocks help define the market structure. They can indicate key support and resistance levels, which are essential for technical analysis and making educated trading decisions.

5. Psychological Indicators:

They also serve as psychological indicators. Knowing that an order block represents a concentration of trades by large institutions can influence trader sentiment and, consequently, the market’s direction.

6. Liquidity Pools:

Order blocks often represent liquidity pools. For traders looking to execute large orders, these blocks can provide the necessary liquidity to enter or exit positions without causing slippage.

Understanding the importance of order blocks is not just about recognizing patterns; it’s about gaining insight into the underlying mechanics of the market. It’s about seeing the forest for the trees, the ebb and flow of the market’s tides, and using this knowledge to navigate the Forex market with a keener eye and a steadier hand.

How Does Order Block Trading Work?

Order block trading is a strategy used by traders to identify key levels in the market where large institutional orders have been placed. These levels, known as order blocks, often act as strong support or resistance areas, making them ideal entry or exit points for trades.

Here’s a breakdown of how it works:

1. Identifying Order Blocks:

Traders look for price zones on charts where significant buying or selling activity has occurred. These zones are typically marked by a cluster of orders from large market participants like banks or hedge funds.

2. Waiting for Confirmation:

Once an order block is identified, traders wait for the price to return to this level. They look for confirmation signals, such as a strong reversal pattern or a significant price movement, to validate the order block.

3. Entering the Trade:

If the confirmation signals are in place, traders enter a trade in the direction of the expected price movement. For example, if the order block is acting as support, they might buy, expecting the price to rise.

4. Setting Stop Loss and Take Profit:

To manage risk, traders set stop-loss levels below the order block (for long positions) or above it (for short positions). They also set take-profit levels based on their analysis of potential price movements.

5. Monitoring the Trade:

Traders keep an eye on the trade, ready to adjust their stop-loss or take-profit levels if the market conditions change.

Order block trading can be a powerful tool, but it requires patience and skill to identify and confirm order blocks accurately. It’s also important to practice good risk management to protect your capital.

How to Identify Order Blocks?

Order blocks can be identified on any timeframe. In technical analysis, the choice of trading timeframe depends on your type of trading.

1. Study Historical Price Charts:

Begin by examining historical price charts. Look for areas where the price has made a strong move away from a certain level. These are potential order block zones.

2. Observe Consolidation Phases:

Pay attention to consolidation phases before a significant price movement. The consolidation phase often precedes the formation of an order block.

3. Identify Institutional Footprints:

Large institutions leave footprints in the form of price levels where substantial volumes have been traded. These levels can often be identified by looking at volume indicators or price level tools.

4. Look for Rejection Wicks:

Candlestick charts can reveal order blocks through rejection wicks. These are the tails or shadows of candlesticks where price has tested a level and then sharply reversed.

5. Use Technical Indicators:

Incorporate technical indicators such as Fibonacci retracement levels, pivot points, and moving averages to pinpoint potential order block areas.

6. Check Timeframes:

Analyze multiple timeframes. Order blocks may be more evident on higher timeframes such as the 4-hour or daily charts.

7. Confirm with Price Action:

Once you’ve identified a potential order block, watch for price action to confirm it. If the price respects the level by bouncing off or breaking through with significant volume, it’s likely an active order block.

8. Refine with Support and Resistance:

Refine your identification by correlating order blocks with known support and resistance levels. They often align, reinforcing the significance of the block.

Read More:

What is a trending or ranging market?

Pros and Cons of Using Order Blocks in Forex Trading

Order blocks are powerful tools in Forex trading, offering both advantages and potential drawbacks. Understanding these can help traders make informed decisions.

Pros

1. High Accuracy:

Order blocks often represent areas where large institutional traders have placed their orders. This means they can provide highly accurate entry and exit points for trades.

2. Clear Market Structure:

They help in identifying the market structure, making it easier for traders to understand the current market conditions and potential future movements.

3. Enhanced Risk Management:

Using order blocks can improve risk management by allowing traders to set precise stop-loss and take-profit levels based on key market levels.

4. Trend Identification:

Order blocks can signal potential trend reversals or continuations, giving traders insights into the direction of the market.

5. Scalability:

The strategy can be applied across various timeframes, making it suitable for different trading styles, from scalping to swing trading.

Cons

1. Complexity:

Identifying order blocks accurately requires a deep understanding of price action and market dynamics. It can be challenging for novice traders.

2. False Signals:

Not all order blocks are reliable. Sometimes, the market may break through these levels, leading to false signals and potential losses.

3. Requires Patience:

The strategy often involves waiting for the price to return to the identified order block, which can require patience and discipline.

4. Dependence on Institutional Activity:

Since order blocks are created by large institutional traders, changes in their trading behavior can affect the reliability of these levels.

5. Risk of Overfitting:

Traders may over-rely on historical data to identify order blocks, leading to overfitting and poor performance in live trading conditions.

Understanding these pros and cons is crucial for effectively incorporating order blocks into a trading strategy.

Types of Order Blocks

There are different units of order blocks, but the most important ones are:

- Bullish order block

- Bearish order block

- Breaker Block

- Rejection Block

- Vacuum Block

Further, we will discuss all these topics.

Bullish Order Block:

A bullish order block is formed near support and is known as the last bearish candle before the price makes a significant and aggressive ascent move. At this key level, big traders have placed buy orders. As you can see in the picture below, the order block range has been determined, and the price has returned with good momentum after hitting that range.

Bearish Order Block:

A bearish order block is formed near resistances and is known as the last bullish candle before the price makes a significant and aggressive descent move. At this key level, big traders have placed significant sell orders. You can see an example of a bearish order block in the image below, which has good validity due to the strong initial movement.

Breaker Block:

When we reach strong support in a downtrend, and the price rises and breaks its last ceiling (W pattern), in this case, the area of the breaker block is the ceiling and floor of the candle that caused the last ceiling to break. The color of this candle is in line with the new trend.

All of the above applies to the M pattern and the uptrend too. In a way, when we reach a strong resistance in an uptrend and the price returns and breaks its last floor, in this case, the breaker block area is the ceiling and the floor of the candle that caused the last floor to break. The color of this candle is in line with the new trend. In the image below, you can see an example of a breaker block.

Rejection Block:

when we have one or more candles with a long shadow on important ceilings or floors, the price tends to skip the body of these candles and reach the shadows. Usually, this encounter with shadows is accompanied by good momentum. These boundaries created by shadows are called Rejection blocks. Note that the direction of rejection candles is not crucial, and these candles can be ascending or descending.

Vacuum Block:

If a piece of news causes a gap, it means in the gap range, which is known as a vacuum block, no trade has been made, and when the price returns to this range, we will probably see a strong reverse reaction.

Features of Profitable Order Blocks

Profitable order blocks have distinct characteristics that make them valuable for traders. Here are some key features:

1. Clear Support and Resistance Levels:

Profitable order blocks often act as strong support or resistance levels. When the price approaches these levels, it tends to reverse direction, providing traders with potential entry or exit points.

2. Volume Spikes:

High trading volumes are a hallmark of profitable order blocks. These spikes indicate significant buying or selling activity, often from institutional traders, which can lead to substantial price movements.

3. Consolidation Zones:

Order blocks frequently form in areas where the price has consolidated or moved sideways for a period. This consolidation allows large orders to be placed without causing drastic price changes.

4. Engulfing Candlesticks:

The presence of engulfing candlesticks around the order block area is a strong signal. These candles indicate a shift in market sentiment and can confirm the presence of an order block.

5. Trend Reversals:

Profitable order blocks often signal potential trend reversals. When the price breaks through these levels, it can indicate a change in the market direction, providing traders with opportunities to enter or exit trades.

6. Institutional Involvement:

Order blocks are typically created by large institutional traders, such as banks or hedge funds. Their involvement ensures that these levels are respected by the market, making them reliable indicators.

7. Timeframe Visibility:

Order blocks are more visible on longer timeframes, where the consolidation and volume spikes are more apparent. Traders often use multiple timeframes to confirm the presence of an order block.

8. Price Action Confirmation:

The confirmation of an order block comes from the price action itself. When the price reacts strongly at the identified level, it validates the order block and signals a potential trade opportunity.

Best Order Blocks Indicators

Order blocks are crucial for understanding market structure. They represent price levels where institutional traders place significant orders, often leading to large price movements. Identifying these levels can help predict market reversals or continuations. Several indicators are available to help traders spot order blocks more easily. Here are some of the best ones.

1. Market Structure Break (MSB) Indicator

The Market Structure Break (MSB) Indicator helps traders spot when price breaks through a key structure level, signaling the start of a new trend or the formation of an order block. This indicator automatically marks these breakpoints, making it easier to track potential order blocks.

The MSB indicator is effective because it identifies shifts in market direction. When a structure break occurs, it often signals that an institutional order has been placed, forming an order block. By recognizing these zones, traders can enter positions with a higher probability of success.

2. Smart Money Concepts (SMC) Indicator

The Smart Money Concepts (SMC) Indicator focuses on identifying areas where institutional traders, or “smart money,” are likely placing orders. It highlights order blocks, liquidity zones, and structure breaks using a combination of price action, market structure, and volume.

By following the actions of institutional traders, this indicator helps traders align their positions with larger market trends. It’s especially useful for traders focusing on long-term trends and institutional activity.

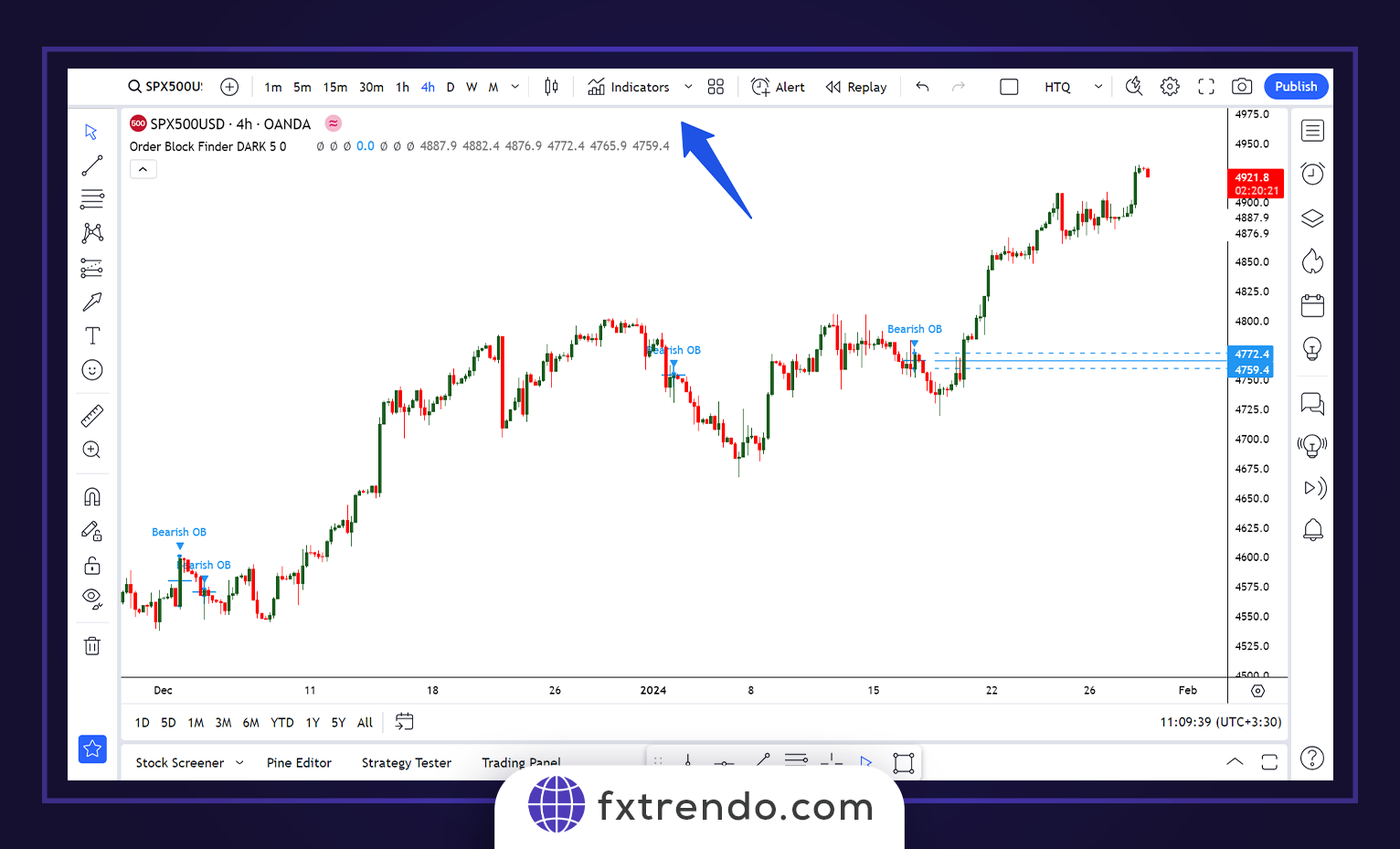

3. Order Block Finder Indicator

The Order Block Finder Indicator is designed to detect order blocks on the chart. It scans historical price action for areas where large buying or selling took place, indicating potential order blocks. These levels are then marked on the chart, making it easy for traders to spot them.

Once an order block is identified, traders can watch for price to retrace to that level, offering an entry point. This indicator works well for both trend-following and counter-trend strategies.

4. ICT Order Block Indicator

The ICT Order Block Indicator, based on the teachings of trader Michael J. Huddleston (ICT), is a tool for spotting order blocks using price patterns, market structure, and time-based analysis. It helps identify reversal points, trend continuation zones, and liquidity areas.

This indicator aligns with the concept of following institutional traders’ moves. Using this tool allows traders to enter positions in line with the market’s larger players, improving the odds of successful trades.

5. Price Action Order Block Indicator

The Price Action Order Block Indicator uses price action patterns to identify where large price movements indicate the presence of an order block. It’s based on the idea that institutional orders cause noticeable shifts in price, creating identifiable patterns.

This indicator is a good choice for traders who prefer a straightforward, manual approach to spotting order blocks. It tracks price action closely to determine when an order block is forming.

6. Auto Order Block Indicator

The Auto Order Block Indicator automatically detects and marks order blocks on the chart, eliminating the need for manual analysis. This tool saves time and reduces errors, making it helpful for both beginners and experienced traders.

The Auto Order Block Indicator scans for key levels where price has reversed sharply, highlighting areas where institutional orders are likely placed. It’s especially useful in fast-moving markets where spotting order blocks manually can be difficult.

7. Order Block All-in-One Indicator

The Order Block All-in-One Indicator is a versatile tool for MT4/MT5 platforms. It highlights unmitigated, mitigated, and breaker order blocks, providing a clear view of market structure. The indicator displays these blocks as colored rectangular areas with labels, making it easy for traders to identify potential reversal and continuation zones. This feature helps traders quickly recognize significant price levels where institutional orders may be placed, making it easier to spot trade opportunities in real-time.

These indicators help you spot high-probability trade opportunities and trade with more precision. Whether you use the Market Structure Break indicator, the ICT Order Block tool, or another option, these tools make it easier to analyze the market and improve your trading strategy.

How to Trade with Order Blocks?

Trading with order blocks is like harnessing the gravitational pull of the market’s most massive bodies—the institutional traders. To effectively trade with these blocks, one must understand their influence on price action and how to make strategic decisions based on their presence. Here’s a comprehensive guide to trading with order blocks:

1. Identify Potential Order Blocks:

The first and most important step in trading is to determine the trend and market structure. Use the methods discussed earlier to locate potential order blocks on your charts. Remember, these are areas where significant market moves have originated.

2. Wait for Price Action Confirmation:

Once you’ve identified an order block, wait for price action to confirm its influence. Look for signs like a bounce off the block or a breakthrough with increased volume.

There are two methods used to enter a trade. In the first method, after the price hits the desired area, we wait for a reversal candle such as a Hammer or Pin Bar to form and enter the position in the direction of the trend. In the second method, which is a little more aggressive, we open the position by placing a