Definition of PIP and how to calculate trade's profit and loss in the forex market

A pip is a fundamental concept that traders utilize to measure price changes in forex trading symbols. Understanding pips is essential for accurately determining the extent of these price fluctuations. Moreover, a thorough grasp of pips is crucial for calculating the profit or loss of a trade.

Contents

What is a pip in forex?

The term “pip” is an acronym for “Price Interest Point” or “Point in Percentage,” signifying the smallest unit of price changes in the forex market.

Essentially, pips serve as the standard unit for expressing asset price movements and quantifying trading profits or losses. This metric is integral to forex trading, as it provides a uniform scale for traders to communicate price changes and evaluate their trading outcomes.

Pip in brokers

For enhanced precision in price calculations, certain brokers use a smaller unit known as a “pipette.” One pipette represents one-tenth of a pip, meaning that one pip is equal to 10 pipettes. This finer measurement allows for more detailed pricing.

Consequently, brokers can be categorized based on the number of digits they display in their quotes: those that use four digits are referred to as “four-digit brokers,” while those that include an additional digit for the pipette are known as “five-digit brokers.”

Four-digit brokers, often the more traditional ones, present these changes up to four decimal places. This level of precision is referred to as a “Pip.” For instance, if the exchange rate for the EUR/USD pair is listed as 1.2362, the fourth decimal place—represented by the digit ‘2’—is the Pip.

On the other hand, five-digit brokers offer a higher degree of accuracy by showing price changes up to five decimal places, known as a “Pipette.” Taking the same EUR/USD pair as an example, a rate of 1.23622 would mean that the fifth decimal place—indicated by the last ‘2’—is the Pipette. This additional decimal place allows for a more granular view of price movements, catering to traders who require more detailed information for their strategies.

Usually, the fourth decimal place in currency pairs is known as pip. This issue is valid for both 5-digit and 4-digit broker types. But in currency pairs where one side is the yen (JPY), two digits (in 4-digit brokers) or three digits (in 5-digit brokers) are displayed after the decimal point. In these currency pairs, the pip position is the second digit after the decimal point. For example, when the USDJPY currency pair is traded at 149.765, the second digit after the decimal point in the pip position is 6.

In the picture below, you can see the price of several currency pairs in Trendo Broker. Since Trendo broker is a 5-digit broker, in these symbols, the pip position is marked with purple, and the pipette position is marked with blue.

Pip's position in different symbols

Trendo Broker offers a diverse range of trading symbols beyond currency pairs, encompassing the metal market (like gold and silver), cryptocurrencies, the energy sector (including oil and gas), and key stock market indices. While the concept of a pip is used across these different markets to denote rate changes, its placement and value can vary depending on the type of symbol.

Read more: Types of financial markets and their trading hours

Pip's position in gold (XAUUSD)

Gold is one of the most popular trading symbols in the forex market. The price of gold is usually described in dollars and up to two decimal places. For example, if the price per ounce of gold is listed as $1930.50, the final digit—‘0’ in this case—represents the pip or point. The number after the decimal point in the pip position is the number 5.

Read more: Factors affecting the price of gold in the global markets and the forex market

Pip's position in Bitcoin

In the context of Bitcoin trading, the pip and pipette positions are uniquely defined. For Bitcoin, the last digit before the decimal point represents the pipette position, while the second-to-last digit signifies the pip position. Suppose the bitcoin price is 30251.70, meaning the number 1 is in the pipette position and the in the pip position is number 5.

Pip's position in oil

In the oil symbol (CRUDE OIL), the two digits after the decimal point are in the pip position. For example, if the oil price is $75.83, the number 3 is in the pip position.

Pip's position in the Dow Jones and Nasdaq indices

The pip position in Dow Jones and Nasdaq is the last digit (the number before the decimal), and the first digit after the decimal is in the pip position.

In the case of famous indices like the Dow Jones and Nasdaq, the pip and pipette positions are determined by the digits surrounding the decimal point. The last digit before the decimal point is considered the pip position, while the first digit following the decimal point occupies the pipette position.

Suppose the Dow Jones price is 33,124.56 and the Nasdaq price is at 13,724.56, so number 5 is in the pipette position, and number 4 is in the pip position.

Pip changes calculation in currency pairs

In the forex market, price changes are described based on pips. It is enough to identify only the pip position in the desired symbol and determine the price difference based on it to calculate the pip changes. For instance, consider the USDCAD currency pair with an initial rate of 1.38021. Here, ‘2’ denotes the pip position, and ‘1’ indicates the pipette position. After some time, this symbol's price will increase to 1.38521. In this case, it is said that the USDCAD currency pair's price increased by fifty pips or 500 pipettes.

In another example, let's assume that USDJPY is at the price of 149.857, and after some time, this currency pair's price will reach 148.436. In this case, it is said that this currency pair's price has decreased by 142.1 pips or 1421 pipettes.

Profit and loss calculation in a trade

To calculate the profit or loss of a trade, you must multiply the following three parameters:

- Trading volume (Lot)

- Price movement rate based on pip

- Pip value

In our previous discussions, we’ve covered the first two parameters. The computation for the third parameter, however, is a bit more complex. If you prefer not to delve into these calculations, you can skip ahead to the “Forex Calculator” section. This tool will allow you to easily compute your potential profits or losses.

The pip value depends on the symbol type, trading volume, and rate. To calculate the pip value, you must consider the following situations:

1. The counter currency in the currency pair you intend to trade should be the base currency of your trading account. For example, let's say our account is based on USD, and we want to trade the EURUSD currency pair. In this case, the value of each pip will be $10.

2. The base currency in the currency pair you intend to trade should be the base currency of your trading account. For example, let's say our account is based on USD, and we want to trade the USDCAD currency pair. In this case, the value of each pip will be $10, which you need to divide by the current rate of the currency pair. In this case, the USDJPY currency pair is an exception, and the value of each pip in this symbol is $1000, which you must divide by the current rate of the currency pair.

3. If the currency pairs you intend to trade do not include the base currency of your account, the calculation process becomes slightly different. Similar to the first case, after performing the necessary computations, you’ll need to convert your profit or loss into dollars. This conversion should be done using the current exchange rate.

An example of how to calculate profit or loss

For instance, suppose you’ve initiated a buy trade on the USDCAD currency pair with a volume of 0.1 lot at a rate of 1.35075. Now, let’s say this currency pair has increased by 80 pips. To calculate the profit from this trade, you would follow these steps:

1. Multiply the volume of the trade (0.1 lot) by the increase in pips (80).

2. Multiply the result by $10, which represents the value of each pip.

3. Finally, divide the total by the current price (1.35100).

Following these steps, the profit from this trade would amount to $59.21.

Read More: What is the Lot or trading volume in the forex market?

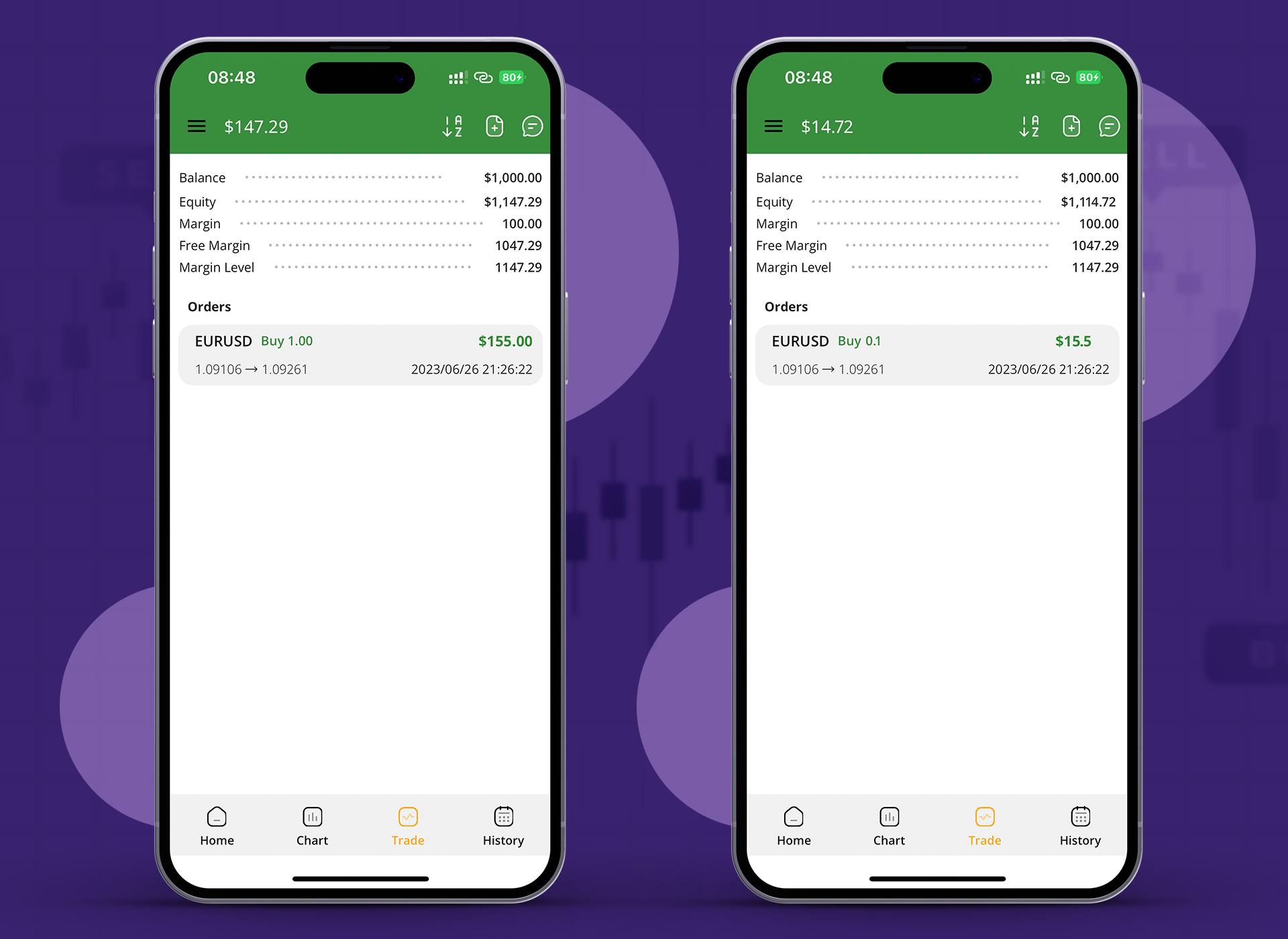

In a second example, imagine two traders who simultaneously enter a trade on the EURUSD symbol at Trendo Broker, with an entry price of 0.09106. Now, the price of this currency pair has risen to 0.09261, indicating an increase of 15.5 pips or 155 pipettes.

The first trader, who entered a buy trade with a volume of 1 lot, would now see a profit of $155 on his trade. The second trader, who also entered a buy trade but with a smaller volume of 0.1 lot, would be looking at a profit of $15.5.

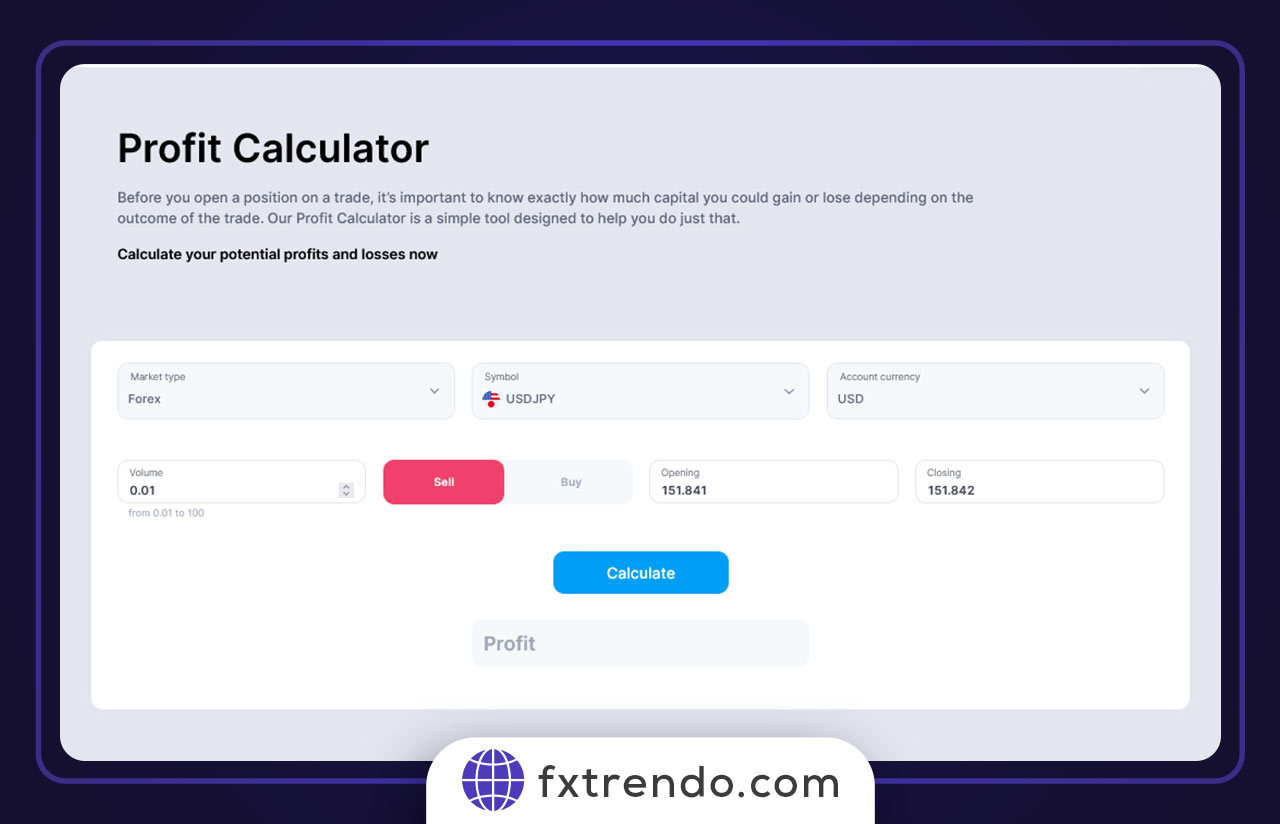

What is a forex calculator?

If you’d prefer not to manually calculate your profit or loss, Trendo’s Forex calculator is a great tool to consider. It’s designed to simplify the process for you. All you need to do is input the specifics of your trade, such as the trading volume, entry price, and exit price. Once you’ve entered these details, simply click on the ‘calculate’ option. The calculator will then display your potential profit or loss.

To use Trendo's Forex calculator, click on the following link:

As shown in the image below, let's say we entered a buy trade in the gold symbol (XAUUSD) at the 2111.53 price with a volume of 0.18 lots, and now gold is trading at the 2118.68 price.

Therefore, by inputting these parameters into the calculator - the trading volume, entry price, and current price - the profit from this trade can be accurately computed. In this case, the calculated profit for this particular transaction would be $128.70.

Summary

In this article, we’ve taken a deep dive into the concept of a pip, its role in various symbols, and how it’s calculated. We’ve also introduced the Trendo Forex calculator, a handy tool for quickly determining your potential profits or losses.

Understanding the pip is crucial for any professional trader. It’s not just about knowing what it is, but also understanding how it’s calculated. This knowledge is key to implementing effective risk management strategies in your trading activities.

If you have any further questions or uncertainties, remember that Trendo Broker offers 24/7 support through your trading platform. Don’t hesitate to reach out to them for assistance.

پست مرتبط

پربازدیدترین ها

0