Factors affecting the gold price in the global markets and forex market

Many factors affect the price of gold in the global markets and forex market, which are essential for those who intend to work professionally in the gold market to be aware of. In this article from the Trendo Broker educational team, we will discuss important factors such as changes in the US dollar value, interest rates, and geopolitical events. Stay tuned.

Contents

Gold in the international forex market

In the forex market, the XAUUSD symbol, which refers to the global ounce of gold, is one of the most popular trading symbols. This symbol shows the value of one gold ounce to the US dollar. Changes in the value of this symbol are affected by various factors, the most important of which are:

- Economic news

- Geopolitical and political events

- The US dollar value

- Interest rate

- Banks and investment funds

- Supply and Demand

- Inflation

We will review each of the cases in detail below.

Read More: Fundamental Analysis in Forex

Economic news

Significant changes occur in the price of gold at the time of important economic news releases, which is mainly news related to the US dollar. That is why we always recommend checking the economic calendar and considering important news in your trading strategy. One of the most popular websites for tracking important economic news is the Forex Factory website, and you can use the services of this website for free.

For example, as you can see in the image below, on the 13th of February 2024, after the CPI news release at 16:30, we saw an increase in the strength of the US dollar, which resulted in a significant drop in global gold. That is why, as a professional trader, you should monitor the economic calendar continuously and be fully aware of the effects of important news.

Geopolitical and political events

Gold was always known as a haven for investment during geopolitical and political events. For example, during the occurrence or threat of war, the gold price is immediately affected, because only in such a situation does the investment risk increase, but war also means excessive printing of money and increased government spending. As you can see in the image below, with the start of the Ukraine-Russia war, global gold experienced significant growth.

Read More: What is a commodity?

Gold price growth immediately after the war started between Ukraine and Russia

The US dollar value

The US dollar and global gold have an inverse affinity in the forex market. Whenever the US dollar increases, we face a decrease in the price of gold and vice versa. The reason for this relationship is that, for example, when the dollar's value decreases, investors invest in other financial markets, such as gold, to avoid the decrease in the value of their capital, and this causes an increase in the demand for gold (XAUUSD), which in turn leads to price growth. That is why professional traders constantly monitor the Federal Reserve and the US economic conditions to make correct and timely trading decisions if they see signals for changing the dollar's value.

Interest rate

Changes in interest rates have major effects on all financial markets and the gold market. For example, when the Federal Reserve in America lowers or increases the interest rate by 0.25%, the financial markets quickly react, and new trends form. That is why you must constantly monitor the American central banks' policies and be aware of all the news and events. Technical analysis is helpful, but knowledge of market conditions is also necessary for success in trading.

You can see the connection between the Federal Reserve interest rate changes and the global ounce in the picture below. Of course, you must note that only the US dollar interest rate does not affect the price of gold. Generally, we can say that if the global conditions are such that the general interest rate is high, capital will leave safe assets and go to currencies with high interest rates, and this will cause the global gold price to decrease.

Changes in the Federal Reserve interest rate and the global ounce

Banks and investment funds

Banks and investment funds are among the other factors that play a role in gold price fluctuations. When the big banks increase their gold inventory, we see an increase in the gold price. Banks collect all the orders, and this causes the price of gold to grow. By following news and analytical articles from reliable sources, you can grasp such events and increase your trading efficiency by making better decisions.

Read More: Features of the best broker for gold trading

Supply and Demand

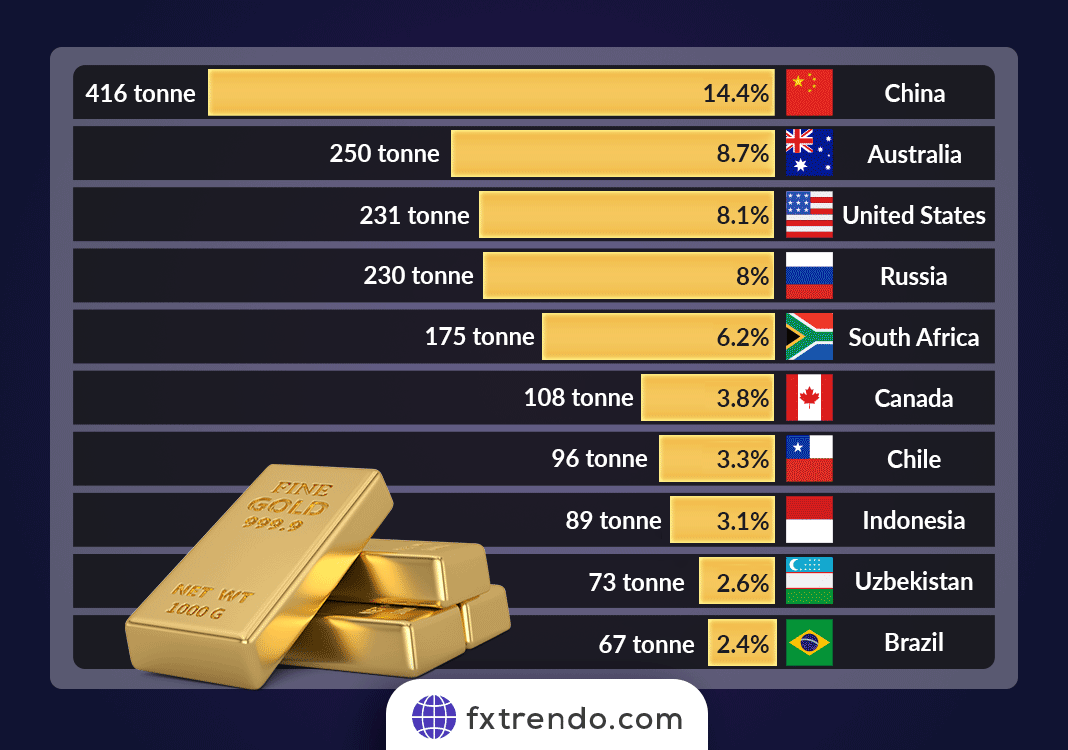

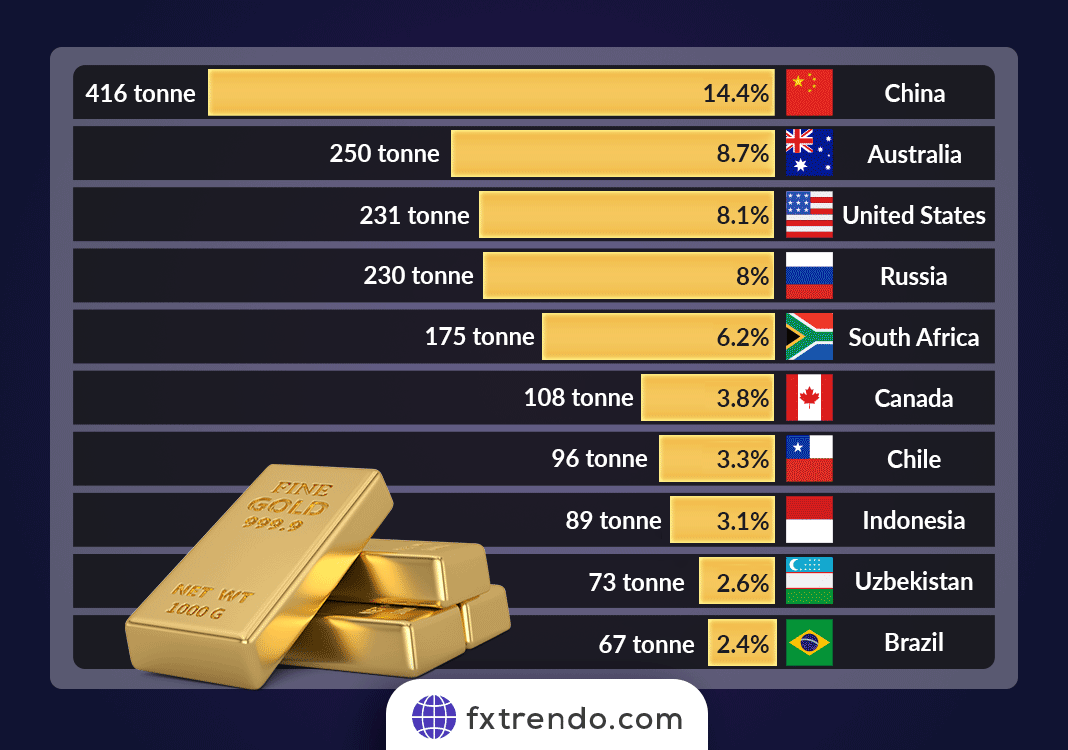

Generally, any factor that disturbs the balance of gold supply and demand in the long and short term, will cause changes in the global gold price. If the gold supply increases, we will face a price decrease. For example, when the price of gold decreases in the global market, there is no economic justification for many large mines to continue operating, and the end of their operation will be the reason for the gold price growth. On the other hand, if the gold price increases, many gold mines that were out of production due to unprofitability will resume mining, and this will increase the gold supply. In this regard, analyzing the world's major mines in countries such as the United States and Russia can be helpful, because increasing or decreasing the amount of gold extraction can impact market fluctuations.

The image above shows the amount of gold production in different countries in 2022

On the other hand, if the demand for gold increases, we will face an increase in the gold price. Gold is used in various fields, such as medicine, jewelry production, electronic equipment, space technologies, etc. If there is a significant increase in the demand for gold in these areas, we will see the growth of gold prices. Therefore, always observing the important news of the day and being aware of the market's general conditions is necessary.

Inflation

Inflation means a decrease in the value of a country's currency. When inflation increases, central banks try to control inflation with monetary policies. Changing the interest rate is one of the central banks' primary solutions in dealing with inflation. The increase in global inflation, especially in the United States, causes the price of gold to rise. As a safe asset, gold experiences good growth in the long term when the dollar's value and other currencies are decreasing.

CPI is an index to measure inflation. Inflation and interest rates are closely related. In times of inflation, central banks tend to increase interest rates to reduce demand for goods and services, which can lead to lower prices. Conversely, central banks tend to lower interest rates to stimulate demand and increase prices when inflation is low.

Read More: The Consumer Price Index or Inflation (CPI)

Is gold trading the same as holding it for the long term?

Long-term investing in gold is different from short-term trading in the forex market. Gold trading in these markets is done hourly and daily. Since gold trading in forex usually takes place in a short period, professional traders can make good profits from trading in the short term. But this requires a lot of training and experience.

Summary

Gold has been the focus of humans since ancient times. Trading gold in the forex market is also a good opportunity to profit, and many people worldwide trade gold in the forex market, which is why knowing the factors affecting the global gold price is particularly important. Investing in gold has different ways, including trading in the forex market, buying ornamental gold, investing in gold financial funds, etc., all of which require a lot of knowledge and experience that one can only obtain through continuous study and activity in the financial markets.

Связанный пост

Самый посещаемый