How to use Take Profit and Stop Loss in Forex trading

The forex market, being the largest financial market globally, presents an enticing opportunity for millions across the world to generate income. However, navigating the forex market is no simple task. It demands a high degree of discipline and patience. A cornerstone of successful trading lies in effective risk and capital management. Take Profit and Stop Loss are two indispensable tools in this regard. The purpose of this article is to offer hands-on guidance on how to utilize these tools optimally, with the aim of mitigating trade risks and enhancing trading efficiency. So, let’s dive in.

Contents

What is Take Profit and Stop Loss?

Take Profit (TP) and Stop Loss (SL) are automated orders set at a predetermined price. The moment the market hits this price, the trade is automatically closed.

The beauty of TP and SL is that they remain active even if your trading platform is closed or you’re offline. This means you don’t need to constantly monitor your trades.

Stop Loss (SL) is an order designed to cap potential losses in a trade. For Buy trades, the loss limit is set below the entry point, while for Sell trades, it’s set above the entry point. On the other hand, Take Profit (TP) is an order set to capture potential profits on a trade. For Buy trades, the profit limit is set above the entry point, and for Sell trades, it’s set below the entry point.

When it comes to TP and SL, it’s important to note that these orders are triggered at the Bid price or the Ask price.

Most forex brokers, by default, display the price chart based on the Bid price.

There might be instances where, in a Sell trade, the chart price reaches your TP, but the TP doesn’t trigger, and the market reverses.

In such scenarios, beginners might think the broker has tampered with their trade. However, the reality is:

Take Profit and Stop Loss in Buy trades are activated with the Bid price.

Take Profit and Stop Loss in Sell trades are activated with the Ask price.

Read more: What is spread? The difference between Ask and Bid prices

Another important point regarding take profit and stop loss is that slippage may cause your take profit or stop loss to be activated a little further from the price you placed the order. Three of the most important factors that cause slippage are:

- News announcement time

- Market gaps

- Rapid price fluctuations

In these situations, beginners might suspect that their broker has interfered with their trade. However, the true culprit behind this slippage is the swift market fluctuations, a phenomenon that can occur with any broker at any given time.

To address this, Trendo Broker has been proactively working to reduce the likelihood of slippage in trades. They have achieved this by investing in their infrastructure and enhancing their central system. This way, they ensure a smoother trading experience for their clients.

Read more: What is Slippage?

Comparing how to trade with Take Profit and Stop Loss against exiting a trade manually.

Take Profit and Stop Loss orders offer an automated approach to trading. They close the trade instantly upon activation. Besides these automatic orders, there’s also the option to manually close the trade, whether it’s in profit or loss.

However, we strongly recommend the consistent use of Take Profit and Stop Loss orders. This is because they present a less risky alternative compared to manually exiting a trade. These automated orders provide a safety net, ensuring that your trading decisions are not swayed by emotions or sudden market changes.

Advantages of using take profit and stop loss

1. Efficient Time Management: As a swing trader, it’s not feasible to constantly monitor the market. By employing stop loss and take profit orders, you can free yourself from the need to constantly watch the charts. A periodic check, say every hour, should suffice.

2. Emotional Stability: Post-trade, it can be mentally challenging to remain patient when in profit or to accept a loss and exit the trade. Emotions can sway your decisions, leading to potential trade manipulation. This is why we advocate for the use of take-profit and stop-loss orders - they help keep emotions in check.

3. Mitigating News-Related Risks: Significant news releases, such as war-related updates or economic data, can trigger large and unpredictable market fluctuations. To shield your trades from such risks, it’s advisable to use take profit and stop loss orders.

4. Effective Risk and Capital Management: Employing specific take profit and stop loss orders allows you to allocate a defined portion of your capital to each trade. This prevents the possibility of losing your entire capital due to a single unsuccessful trade.

Read more: Advice about risk management that you never knew!

How to place a take profit and stop loss

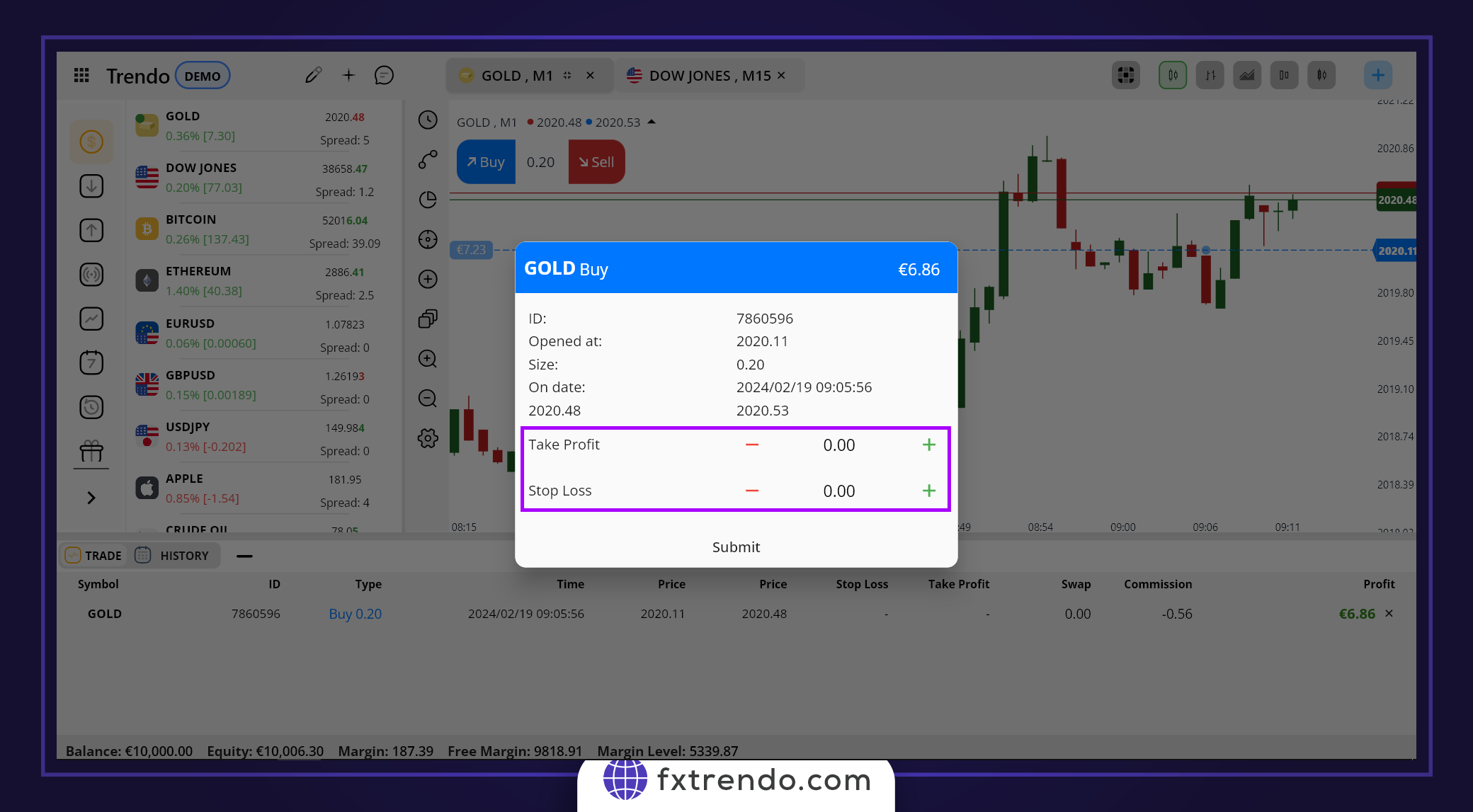

To set the take profit and stop loss, after opening the trade, place your mouse cursor in the purple area indicated in the image below and click.

After clicking in the specified area, similar to the image below, in a new window, set your take profit and stop loss in the specified box (purple) and click Submit.

Remember, you have the option to close your trade manually at any point. To do this, simply click on the ‘Close’ icon. This flexibility allows you to react to market changes as they happen.

Methods of placing Take Profit and Stop Loss

Determining the ideal levels for Take Profit (TP) and Stop Loss (SL) necessitates a thorough grasp of market conditions, technical analysis, and risk and capital management. Here are some practical considerations for setting these levels:

Risk-to-Reward Ratio (R/R): This ratio represents the amount of risk you’re prepared to take on to achieve a certain profit from the market. The most prevalent risk-to-reward ratio in forex trading is 1:2. This means that your potential profit is double your potential loss. For instance, if you aim to earn a $50 profit on a trade, you should be ready to risk $25 of your capital.

Technical Analysis: Another method to determine take profit and stop loss levels is by using technical analysis. This involves identifying support and resistance levels and price patterns. Place your orders slightly away from the price point where the market is likely to reverse. This strategy can help you navigate market volatility and protect your investments.

Read More: Financial markets and their trading hours.

Employing a Fixed Risk Amount Per Trade: One approach to setting the amount for take profit or stop loss involves using a fixed risk amount for each trade. For instance, if you decide to risk only $30 per trade, you would adjust your stop loss and trading volume such that $30 is deducted from your trading account when the stop loss is triggered.

Setting Stop Loss Based on Total Capital: This strategy involves risking a specific percentage of your total capital in each trade. Let’s say your total capital is $1,000, and you decide to risk only 2% of the total capital per trade. In this case, you would set your stop loss at a point equivalent to $20. The advantage of this method is that your risk decreases with consecutive losses, making the likelihood of depleting your entire account almost zero. This approach promotes sustainable and responsible trading.

Summary

In this comprehensive guide from the Trendo Broker educational team, we’ve delved into the concepts of take profit and stop loss in forex trading, underscoring the significance of these two indispensable tools.

Employing take profit and stop loss orders enhances a trader’s capacity to manage risk and devise effective strategies.

In the world of trading, it’s not the entry point that holds importance. Rather, what ultimately dictates your long-term success or failure is the exit point.

Therefore, prior to initiating any trade, set the exit point from the trade and always be ready to bear a loss, because accepting a small loss is better than losing the entire account.

Related Post

most visited