در دنیای اقتصاد، شاخصهای مهمی به منظور اندازهگیری عملکرد بازارهای مالی وجود دارند. در واقع آن ها معیاری برای بررسی شرایط کلی اقتصاد یک کشور هستند. یکی از مهمترین این شاخصها، شاخص وزنی نزدک است که در این مقاله قصد داریم به بررسی آن بپردازیم.

شاخص وزنی نزدک(NASDAQ) چیست؟

شاخص وزنی نزدک (NASDAQ) به عنوان یکی از انواع شاخصهای بازار سرمایه، عملکرد شرکتها را بر اساس ارزش بازاری آنها ارزیابی میکند. این شاخص نمایانگر ترکیبی از ارزش بازاری شرکتها در بازار سرمایه است و شرکتهای با ارزشِ بازاری بزرگتر، وزن بیشتری در محاسبات این شاخص دارند. به عبارت سادهتر، این شاخص بیانگر اهمیت نسبی هر شرکت در مارکت است و شرکتهای بزرگتر تأثیرات بیشتری بر عملکرد آن دارند. شاخص وزنی نزدک معمولا در تحلیلها و پیشبینیهای مرتبط با عملکرد بازارها و سرمایهگذاریها استفاده میشود و به عنوان یکی از شاخصهای کلان مورد توجه قرار دارد.

تاریخچه و تکامل شاخص وزنی نزدک

در ادامه به بررسی تاریخچه ی این شاخص خواهیم پرداخت که یکی از شناخته شدهترین شاخصهای بازار سرمایه در دنیاست.

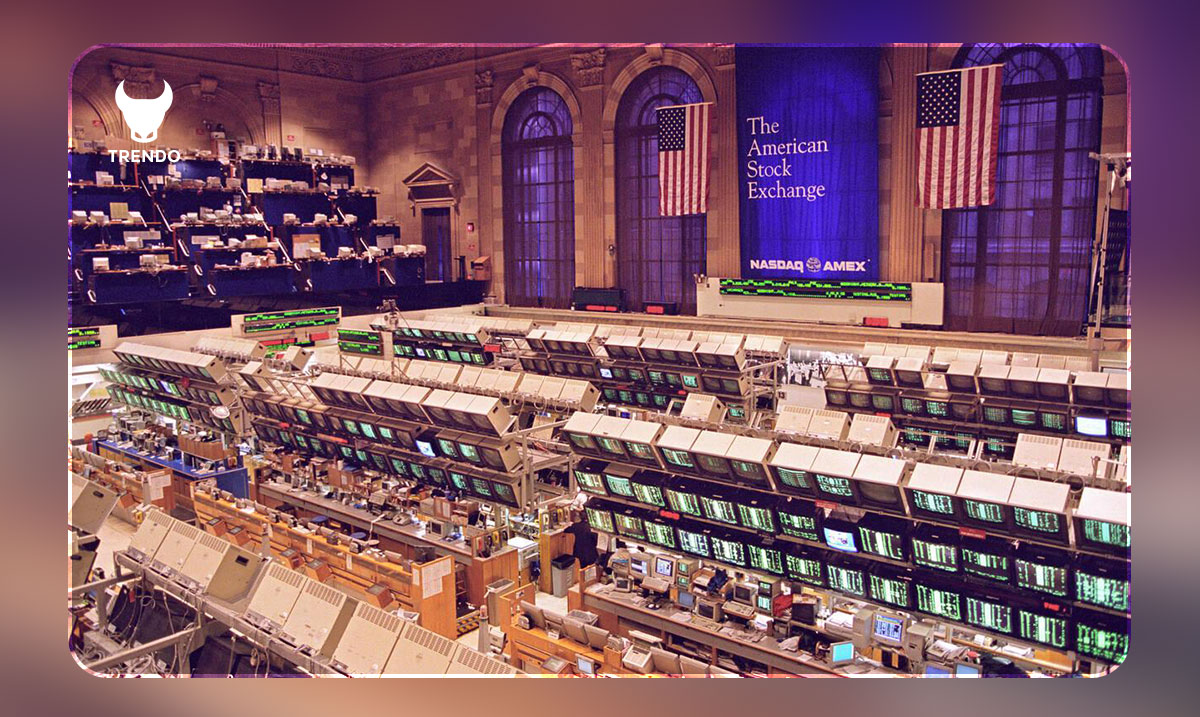

نزدک، در سال ۱۹۷۱ به عنوان یک بازار اوراق بهادار الکترونیکی در شهر نیویورک تاسیس شد. این بازار با هدف ایجاد یک سیستم معاملات بر اساس فناوری الکترونیکی و ارتباطات در بازار سرمایه تشکیل شد. از آن زمان به بعد نزدک به عنوان یکی از مراکز اصلی معاملات با اوراق بهادار مختلف به ویژه شرکتهای فناوری شناخته شده است. به مرور زمان، نزدک تخصص خود را در حوزههای مختلف توسعه داد. در حال حاضر این شاخص نه تنها شرکتهای فناوری، بلکه شرکتهای مرتبط با ارتباطات، بهداشت، انرژی و سایر صنایع را نیز شامل میشود. این تنوع باعث شده که از نزدک به عنوان یک معیار کلی از عملکرد بازار سرمایه استفاده شود.

عوامل مؤثر بر تغییرات شاخص NASDAQ

تغییرات در شاخص وزنی نزدک تحت تأثیر عوامل متعددی است که برخی از مهمترین آنها عبارت اند از:

- عملکرد شرکتهای مشمول

- تغییرات در بخشهای مختلف اقتصاد

- رویدادهای اقتصادی و سیاسی

- تغییرات در شرایط جهانی

- سیاستهای پولی و مالی بانک مرکزی

- تغییرات در فصلها و دورههای مختلف سال

عملکرد شرکتهای مشمول: بدیهی است که عملکرد شرکتهایی که در شاخص نزدک گنجانده شدهاند، تأثیر مستقیم بر تغییرات این شاخص دارند و افت و خیزهای ارزش این شرکتها، مستقیما شاخص را تحت تأثیر قرار میدهد.

تغییرات در بخشهای مختلف اقتصاد: عملکرد بخشهای مختلف اقتصادی مانند فناوری، ارتباطات، بهداشت، انرژی و … تاثیر زیادی بر تغییرات شاخص NASDAQ دارد. مثلا، در برخی مواقع بخش فناوری به علت عملکرد برتر، ممکن است تاثیر بیشتری بر شاخص داشته باشد.

رویدادهای اقتصادی و سیاسی: رویدادهای اقتصادی مانند رشد اقتصادی، نرخ بیکاری، تغییرات نرخ ارز و … میتوانند تاثیر مستقیمی بر تغییرات شاخص داشته باشند. همچنین، تصمیمات سیاسی و اقتصادی نیز ممکن است تغییرات شاخص را در آینده تحت تاثیر قرار دهند.

تغییرات در شرایط جهانی: وقوع رویدادهای جهانی مانند بحرانهای اقتصادی، تغییرات در تجارت بینالمللی و تنشهای سیاسی در دنیا نیز از عواملی هستند که شاخص نزدک از آن ها تاثیر می گیرد.

سیاستهای پولی و مالی: تصمیمات بانکهای مرکزی در زمینه نرخ بهره و سیاستهای پولی و مالی نیز میتوانند تاثیر بزرگی بر این شاخص داشته باشند.

تغییرات در فصلها و دورههای مختلف سال: برخی صنایع و شرکتها در فصلهای مختلف سال عملکرد متفاوتی دارند که میتواند تأثیرات موقت بر شاخص داشته باشد.

ترکیبی از این عوامل مؤثر بر تغییرات؛ سبب نوسان در این شاخص شده و تحلیل صحیح این عوامل به منظور پیشبینی و تفسیر تغییرات بازار سرمایه امری ضروری است.

تاثیرات شاخص وزنی NASDAQ بر اقتصاد جهانی

برخی از تاثیرات مهم این شاخص بر اقتصاد جهانی شرح زیر میباشد:

- تاثیر بر بازار سرمایه

- تاثیر روی رفتار سرمایهگذاران

- اثرگذاری بر نوسانات نرخ برابری ارزها

- تاثیر بر اشتغال و رشد اقتصادی

در ادامه به بررسی هر یک از این موارد خواهیم پرداخت.

تاثیر بر بازار سرمایه: تغییرات در شاخص وزنی NASDAQ میتواند تأثیرات مستقیمی بر سایر بازارهای سرمایه داشته باشد. به عنوان مثال، افزایش شاخص نزدک ممکن است تحرک مثبتی در بازارهای دیگری مانند SPX500 را ایجاد کند. شباهت نمودار های NASDAQ و SPX500 نشان دهنده ی تاثیر پذیری این دو شاخص از یکدیگر میباشد که در عکس زیر مشاهده می کنید:

حتما بخوانید: همبستگی یا کورولیشن در فارکس چیست؟ نقش همبستگی در معاملات

تاثیر بر رفتار سرمایهگذاران: افزایش یا کاهش شاخص نزدک ممکن است تاثیر بزرگی بر روی رفتار و تصمیمات سرمایهگذاران داشته باشد و سرمایهگذاران در پاسخ به تغییرات بزرگ این شاخص، تصمیمات مالی خود را تغییر می دهند.

تاثیر بر نوسانات نرخ برابری ارزها: هم چنین در مواقعی تغییرات در این شاخص نوسانات ارزها نیز اثرگذار است. به عنوان مثال، افزایش ارزش شاخص ممکن است منجر به افزایش ارزش دلار آمریکا نسبت به سایر ارزها شود.

تاثیر بر اشتغال و رشد اقتصادی: عملکرد شرکتها و صنایع کلان مشمول در شاخص نزدک میتواند تاثیر بزرگی بر اشتغال و رشد اقتصادی کشورهایی که بر شرکتهای تکنولوژی و فناوری تمرکز دارند، داشته باشد.

به طور کلی، این شاخص به عنوان یک نماینده مهم از بازار سرمایه جهانی، تاثیرات گستردهای بر اقتصاد جهان دارد و در تصمیمگیریها و اقدامات اقتصادی مختلف، تاثیرگذار است.

اجزای شاخص وزنی نزدک

شاخص وزنی شامل دو بخش اصلی است که هرکدام ویژگیها و موارد خاص خود را دارند. این دو بخش اصلی عبارت اند از:

- NASDAQ-100

- NASDAQ Composite

بخش اول (NASDAQ-100): این بخش از شاخص وزنی نزدک شامل ۱۰۰ شرکت بزرگ است که به طور عمده از حوزههای فناوری، ارتباطات، بهداشت و انرژی هستند. انتخاب این ۱۰۰ شرکت به دقت انجام میشود تا بهترین نمایندگان از صنایع مختلف باشند.

بخش دوم (NASDAQ Composite): این بخش از شاخص وزنی نزدک شامل بیش ۲۵۰۰ شرکت موجود در بازار NASDAQ است. به عبارت دیگر، تمامی شرکتها، چه بزرگ و چه کوچک، در این بخش گنجانده میشوند. این شاخص به عنوان یک نمای کلی از عملکرد کل بازار مورد استفاده قرار میگیرد. مهمترین ویژگی این بخش این است که تمامی شرکتها در آن لحاظ میشوند و تغییرات در هر یک از این شرکتها تأثیری بر روی ارزش کلی این بخش خواهد داشت.

بخشهای مختلف شاخص دارای ویژگیها و اهمیتهای متفاوتی هستند. به عبارتی هر بخش، یک دیدگاه خاص درباره ی عملکرد بازار سرمایه دارد. این اجزا با هم تشکیل دهنده ی شاخص وزنی نزدک بوده و درک صحیح از هر دو بخش به ما اطلاعات دقیقتری ارائه میدهد.

نماد معاملاتی شاخص نزدک(NASDAQ) در بازار فارکس

به طور کلی شاخص نزدک را می توانید با نماد NQ100 و یا US100CASH در بروکر خود پیدا کنید. اما در نظر داشته باشید که با توجه به بروکر یا پلتفرم معاملاتی که از آن استفاده میکنید، ممکن است نماد اختصاری نزدک نیز متفاوت باشد.

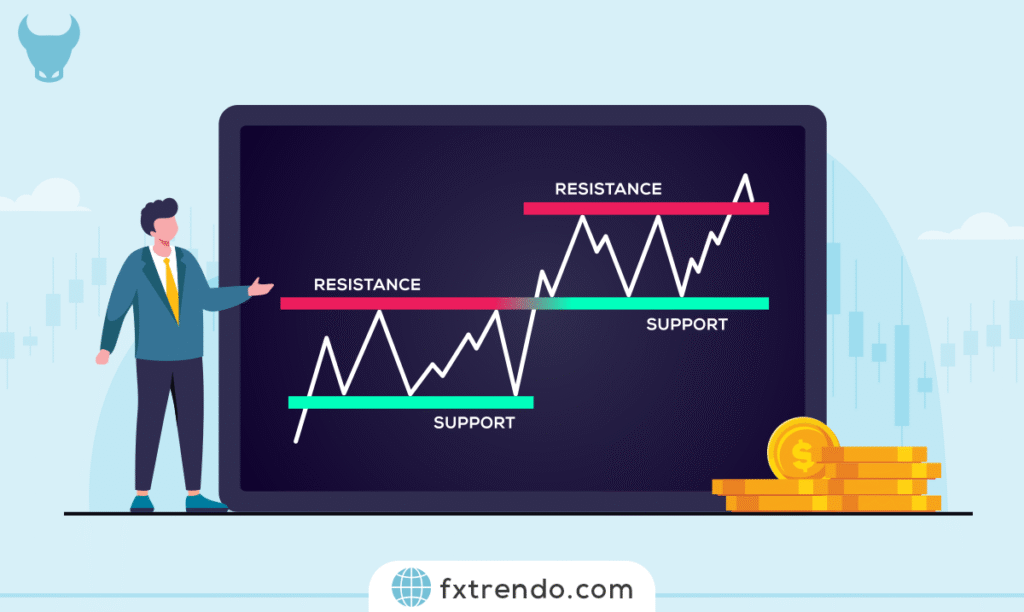

همبستگی شاخص نزدک با دیگر شاخصها

همبستگی در بازار سرمایه به معنی نسبت ارتباط و تاثیر متقابل بین دو یا چند دارایی مالی است. در اینجا به صورت خلاصه به مطالعه همبستگی شاخص نزدک با دیگر شاخص های مهم اقتصادی میپردازیم.

همبستگی NASDAQ با Dow Jones: شاخص داوجونز شامل ۳۰ شرکت بزرگ و مهم در بورس اوراق بهادار نیویورک است. شاخص داوجونز و نزدک ممکن است همبستگی نسبتا متوسطی داشته باشند.

همبستگی NASDAQ و بازار کریپتو: بازار کریپتو و شاخص نزدک دارای ارتباطات گستردهای هستند که تحت تأثیر عوامل مختلف است. تغییرات در این دو بازار ممکن است تأثیرات مستقیمی بر یکدیگر داشته باشند. این همبستگی میتواند تحت تأثیر عوامل متنوعی از جمله تغییرات اقتصادی، سیاسی، فناوری و جهانی قرار گیرد.

حتما بخوانید: مقایسه بازار فارکس و ارز دیجیتال؛ کدام بهتر است؟

سخن آخر

شاخص نزدک به عنوان یکی از مهمترین و معتبرترین شاخصهای بازار سرمایه جهان، تاثیرات و کاربردهای گستردهای دارد. از اندازهگیری عملکرد بازار و تصمیمگیریهای سرمایهگذاران تا تاثیراتش بر سایر بازارها. این شاخص به سرمایهگذاران اطلاعات دقیقی از شرایط حاکم بر اقتصاد ایالات متحده ارائه میدهد. همچنین، با تمرکز بر شرکتهای فناوری و حوزه اینترنت، نزدک به عنوان یک معیار اساسی در ارزیابی عملکرد این صنعت مهم و عمل میکند. تاریخچه و اجزای شاخص از جمله اطلاعات مهمی هستند که ما را قادر میسازند تا بازار سرمایه را بهتر درک کنیم. با در نظر گرفتن این توضیحات، مشخص است که شاخص وزنی NASDAQ نقش بسیار مهمی در تحلیل و پیشبینی عملکرد بازار سرمایه دارد و در تصمیمگیریهای سرمایهگذاران و اقتصاددانان مورد استفاده قرار می گیرد.