How to Trade Forex on News Releases?

News trading is one of the practical strategies that by combining it with other methods, they can earn good profits by surfing the emotions of traders.

News releases can be powerful catalysts for market volatility, offering lucrative opportunities for those who know how to harness their potential.

In this blog, we’ll explore the fascinating world of trading Forex on news releases and provide you with the tools and strategies to turn breaking news into trading success.

Contents

What Are Forex News Releases?

Forex news releases are official reports or announcements that provide critical economic data. These releases can significantly impact currency values and market volatility. News about interest rate changes, inflation rates, or employment figures can cause rapid fluctuations in currency prices. Traders keep a close eye on these releases to make informed decisions and capitalize on market movements.

Imagine you’re a trader waiting for a major news release about the U.S. employment rate. If the report shows a higher-than-expected employment rate, it might boost confidence in the U.S. economy, leading to a stronger U.S. dollar. Conversely, a lower-than-expected rate could weaken the dollar. By understanding and anticipating these reactions, traders can strategically plan their trades to maximize profits.

In essence, forex news releases are the heartbeat of the forex market, providing vital information that can lead to significant trading opportunities.

Why Trading Forex on News Releases Can Be Profitable?

Trading forex on news releases can be highly profitable due to the significant market volatility these events create. When important economic data is released, such as interest rate decisions, employment figures, or inflation rates, it can cause rapid and substantial movements in currency prices. This volatility presents opportunities for traders to make quick profits by capitalizing on these price swings.

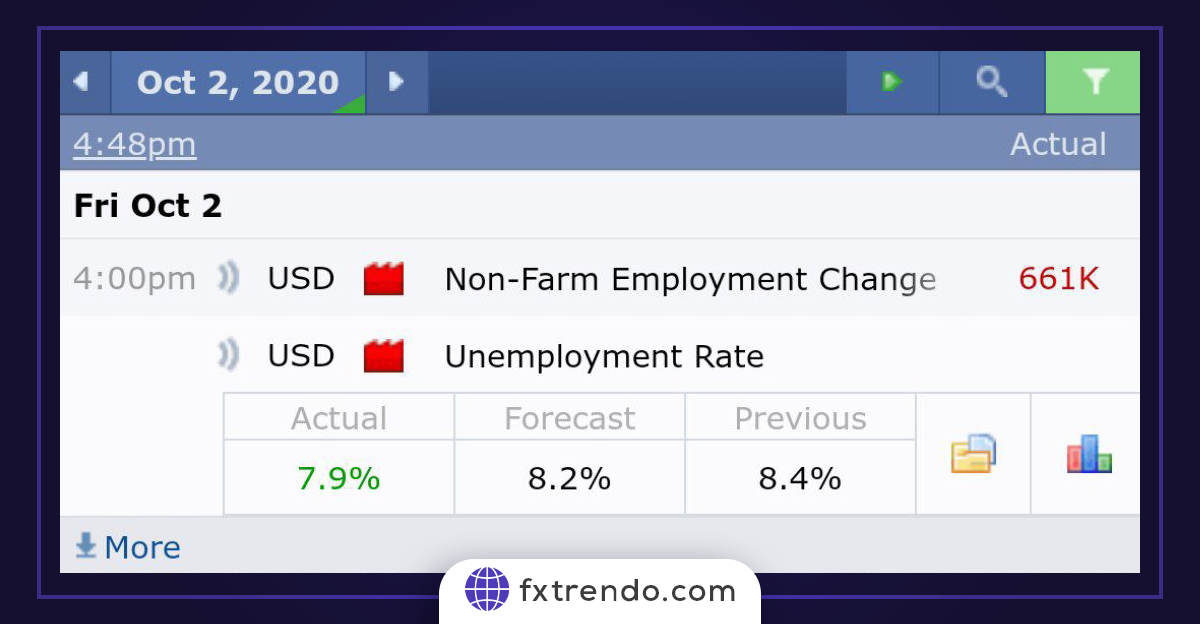

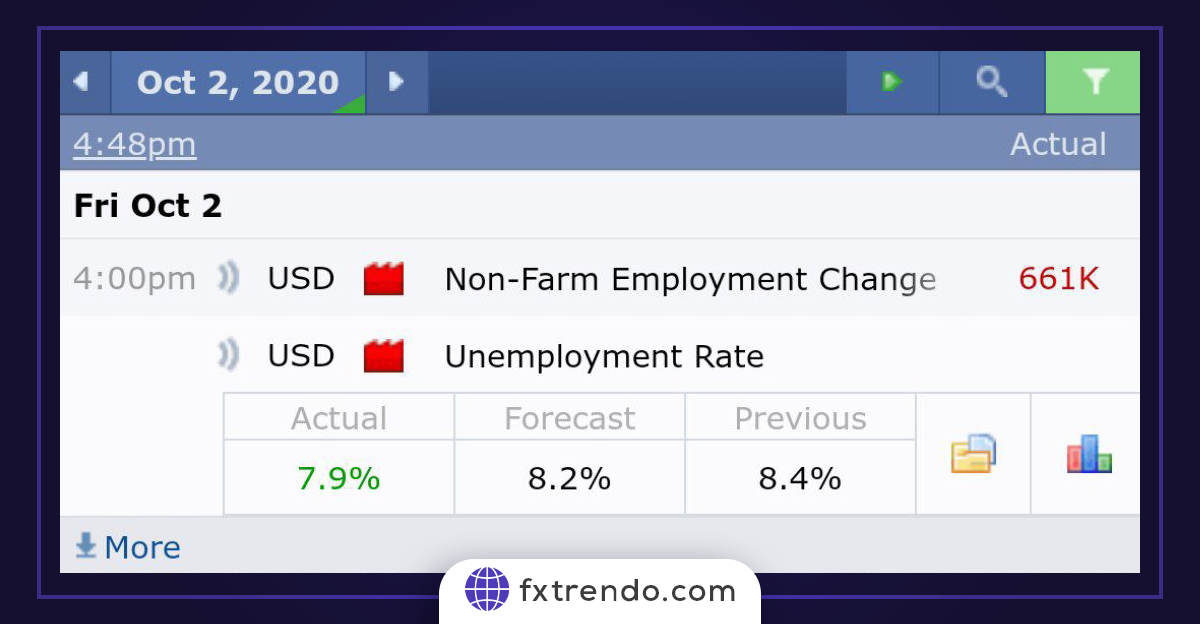

In the image, you can see that the published US unemployment rate number is 7.9%.

For instance, if a central bank announces an unexpected interest rate hike, the currency of that country might strengthen rapidly. Traders who anticipate this move can enter the market just before the announcement and exit shortly after, capturing the price movement for a profit. Similarly, negative news can lead to a sharp decline in a currency’s value, providing opportunities for traders to profit from short positions.

Moreover, news trading allows traders to leverage their knowledge of economic indicators and market sentiment. By staying informed and reacting swiftly to news releases, traders can make well-timed decisions that align with market trends. This strategic approach can enhance profitability and reduce the risks associated with trading in a less volatile environment.

How to Identify Important and Influential News?

Before preparing your trading strategy for news trading, you need to decide which news to trade on. As mentioned earlier, different economic indicators have varying impacts on the forex market. Since the goal of any trade is to maximize profit, it’s natural to focus on news that creates significant impact.

The main method to identify high-impact news releases is to determine which economic indicators provide a relevant, new, and comprehensive view of the economy. High-impact news typically covers the following topics:

Central Bank Monetary Policies: These policies can influence future economic growth in both the short and long term.

Labor Market Reports: These reports reflect changes from the previous month and indicate shifts in household demand, which significantly contribute to economic growth.

Manufacturing and Industrial Activities: These sectors are usually among the largest employers in the labor market. Monitoring their growth can be a key indicator of GDP growth and changes in unemployment levels.

Service Industry: This industry is the first to be affected by changes in consumer demand.

Let’s briefly explain each:

Central Bank Monetary Policies: These policies can affect future economic growth, both in the short term and long term.

Labor Market Reports: These reports pertain to changes from the previous month and indicate shifts in household demand, which significantly contribute to economic growth.

Manufacturing and Industrial Activities: These sectors are usually among the largest employers in the labor market. Monitoring their growth can be a key indicator of GDP growth and changes in unemployment levels.

Service Industry: This industry is the first to be affected by changes in consumer demand.

You don't have to decide which economic indicators have a significant impact. The economic calendar analysis page of Trendo Broker shows the level of impact of various news events.

Key Economic Indicators to Watch

Understanding key economic indicators is crucial for making informed trading decisions. These indicators provide insights into the health and direction of an economy. Here are some of the most important ones to watch:

Gross Domestic Product (GDP): GDP measures the total value of all goods and services produced in a country. It indicates whether an economy is growing or contracting. A rising GDP suggests economic growth, while a falling GDP may signal a recession.

Consumer Price Index (CPI): The CPI tracks changes in the prices of a basket of consumer goods and services. It’s a primary measure of inflation. Rising CPI indicates increasing prices, which can lead to higher interest rates.

Unemployment Rate: This measures the percentage of the labor force that is unemployed and actively seeking work. A high unemployment rate can indicate economic distress, while a low rate suggests a healthy economy.

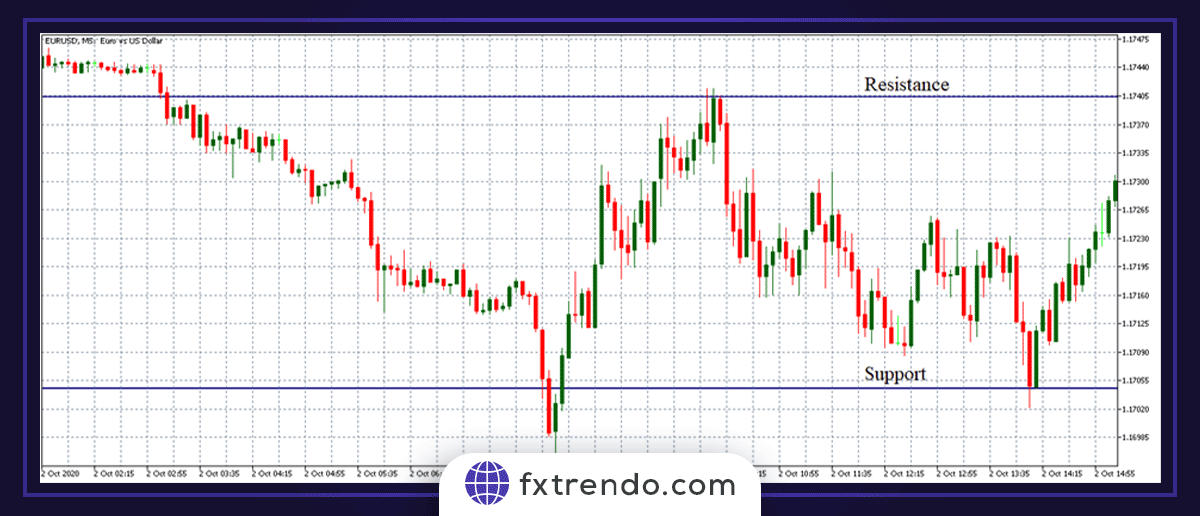

EUR/USD: Ahead of the October 2, 2020 US Unemployment Rate release, just before 8:00 AM EST

Nonfarm Payroll Report: This report provides data on the number of jobs added or lost in the economy, excluding the farming sector. It’s a key indicator of economic health and labor market conditions.

Consumer Confidence Index (CCI): The CCI measures how optimistic or pessimistic consumers are about the economy’s future. High consumer confidence can lead to increased spending and economic growth.

Industrial Production: This indicator measures the output of the manufacturing, mining, and utilities sectors. It provides insight into the industrial sector’s health and its contribution to GDP.

Retail Sales: Retail sales data shows the total receipts of retail stores. It’s an important indicator of consumer spending, which drives a significant portion of economic activity.

By keeping an eye on these key economic indicators, traders can better understand market trends and make more informed trading decisions. Each indicator offers a unique perspective on the economy, helping traders anticipate market movements and adjust their strategies accordingly.

How to Prepare for Trading on News Releases?

Preparing for trading on news releases involves several key steps to ensure you can make informed and timely decisions. Here’s a simple guide to help you get ready:

1. Monitoring Economic Calendars: Keep track of economic calendars to know when important news releases are scheduled. These calendars provide dates and times for key economic events, helping you anticipate market movements and plan your trades accordingly. Many trading platforms and financial websites offer economic calendars as tools and resources.

2. Analyzing Historical Data: Look at historical data for similar news events to understand how the market has reacted in the past. This analysis can give you insights into potential price movements and help you develop a strategy. By studying past reactions, you can better predict future market behavior and make more informed trading decisions.

3. Setting Up Alerts: Use trading platforms or apps to set up alerts for major economic news. This ensures you won’t miss any critical information that could influence your trading decisions. Alerts can be customized to notify you before, during, and after news releases, allowing you to stay on top of market developments.

4. Technical and Fundamental Analysis: Conduct both technical and fundamental analysis before the news release. Technical analysis involves studying price charts and patterns to identify potential entry and exit points. Fundamental analysis focuses on the underlying economic factors that could impact currency prices. By combining both approaches, you can develop a comprehensive trading strategy that takes into account both market trends and economic fundamentals.

By following these steps, you can prepare effectively for trading on news releases and increase your chances of making profitable trades.

Trading Strategies for News Releases

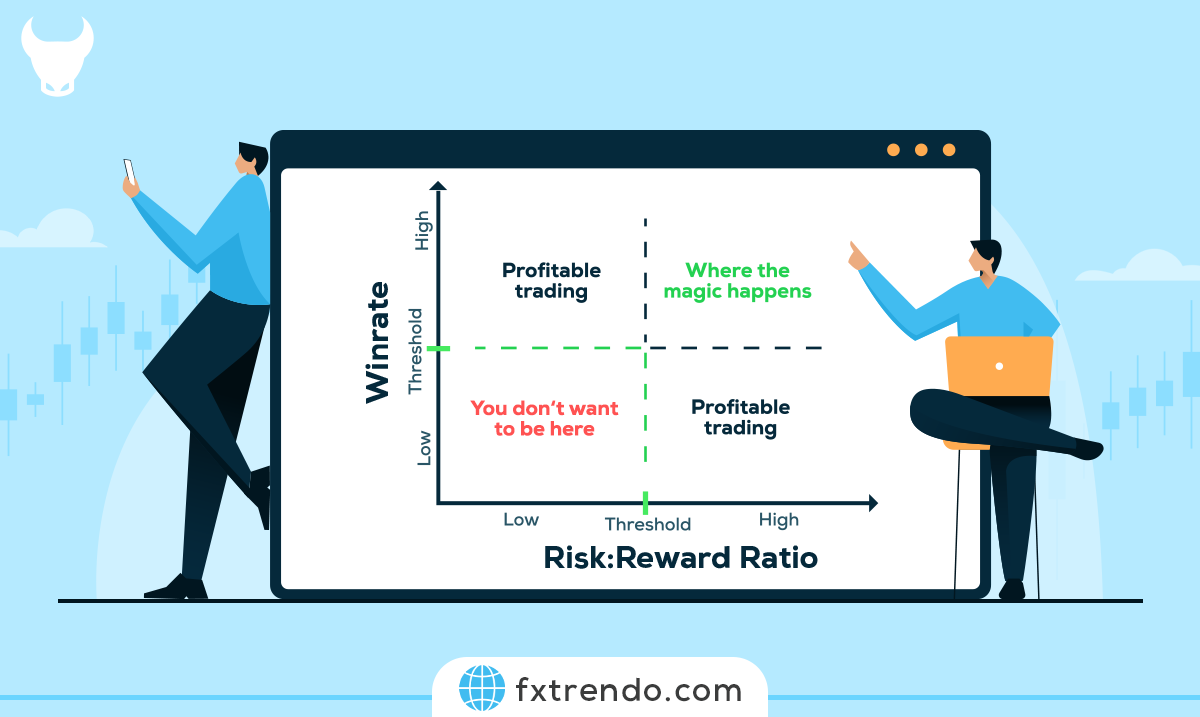

Trading on news releases can be highly profitable, but it requires a well-thought-out strategy. Here are some effective strategies to consider:

1. Breakout Trading: Enter a trade when the price breaks through a significant level of support or resistance following a news release. Set entry points just above resistance or below support levels and use stop-loss orders to manage risk.

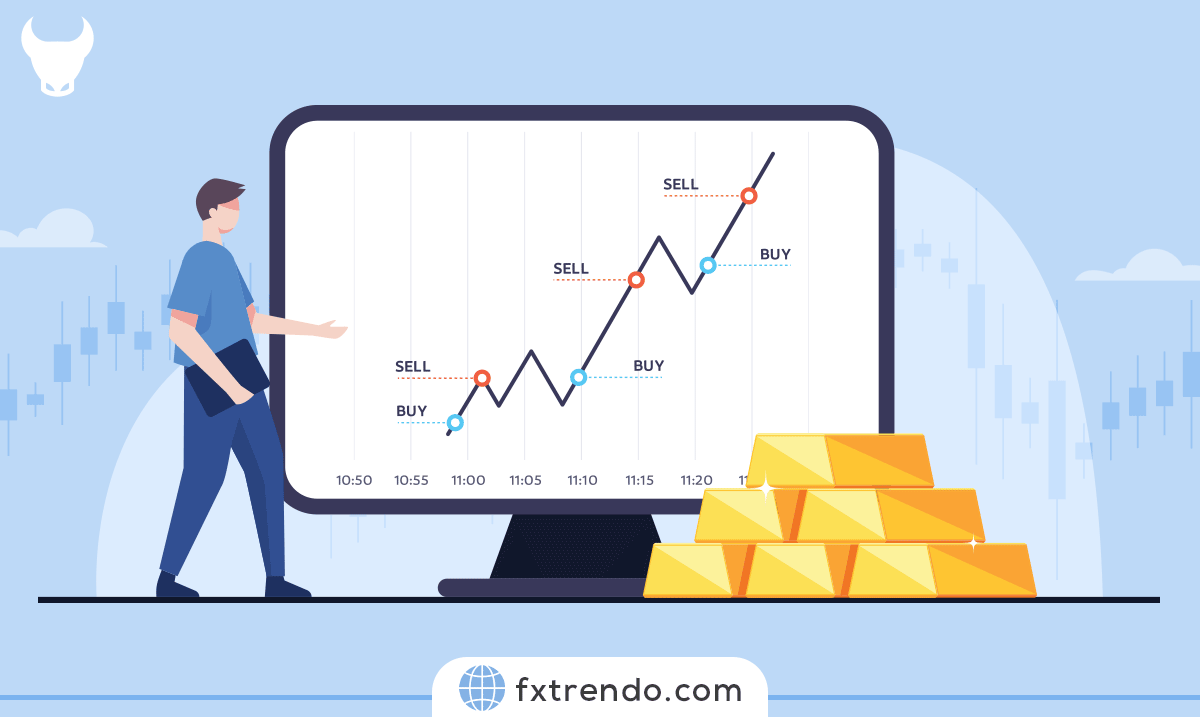

2. Fade the News: Trade against the initial market reaction to a news release. Wait for the initial spike or drop and then enter a trade in the opposite direction, aiming to profit from the correction.

3. Straddle Trade: Place both a buy and a sell order at key levels around the current price before the news release. When the news is released, one of the orders will be triggered, allowing you to capture the price movement regardless of the direction.

4. Scalping: Make multiple quick trades to capture small price movements following a news release. Use tight stop-loss orders and aim for small, consistent profits.

5. Swing Trading: Hold positions for several days or weeks to capture larger price movements. Analyze the impact of news on market trends and enter trades based on anticipated longer-term movements.

6. Using Technical Indicators: Combine news trading with technical indicators like moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify entry and exit points and confirm market trends.

Pros and Cons of Each Strategy

Straddle Strategy

Pros:

- Captures price movement in either direction.

- Useful in volatile markets.

Cons:

- Can result in losses if the market doesn’t move significantly.

- Requires precise timing.

Breakout Strategy

Pros:

- Capitalizes on strong trends.

- Clear entry and exit points.

Cons:

- Risk of false breakouts.

- Requires quick decision-making.

Fade Strategy

Pros:

- Profits from market corrections.

- Takes advantage of overreactions.

Cons:

- Contrarian approach can be risky.

- Requires understanding of market sentiment.

Scalping

Pros:

- Quick profits from small price movements.

- Reduced exposure to market risk due to short holding periods.

- High frequency of trades can lead to consistent gains.

Cons:

- Requires intense focus and quick decision-making.

- High transaction costs due to frequent trading.

- Can be stressful and time-consuming.

Swing Trading

Pros:

- Potential for larger profits from significant price movements.

- Less time-intensive compared to scalping.

- Allows for more thorough analysis and planning.

Cons:

- Exposure to overnight and weekend market risks.

- Requires patience and discipline to hold positions.

- Potential for larger losses if the market moves against the position.

Using Technical Indicators

Pros:

- Provides additional confirmation for entry and exit points.

- Helps identify trends and market conditions.

- Can enhance the accuracy of trading decisions.

Cons:

- Reliance on indicators can lead to over-analysis.

- Indicators may lag behind actual price movements.

- Requires understanding and experience to use effectively.

By employing these strategies, traders can navigate the volatility of news releases and increase their chances of making profitable trades.

Tools and Platforms for News Trading

To succeed in news trading, having the right tools and platforms is essential. These resources help you stay informed, analyze market movements, and execute trades efficiently. Here are some key tools and platforms to consider:

1. Economic Calendars: Provide a schedule of upcoming news releases and economic events. They help traders anticipate market movements and plan their trades accordingly. Many trading platforms and financial websites offer economic calendars with detailed information on each event.

2. News Aggregators: Compile news from various sources into one place, making it easier to stay updated on market-moving events. These tools provide real-time news feeds, ensuring you receive the latest information as soon as it becomes available. Popular news aggregators include Bloomberg, Reuters, and Benzinga Pro.

3. Charting Software: Allows traders to analyze price movements and identify trends. These tools offer various technical indicators and charting options to help traders make informed decisions. Some popular charting software includes TradingView, MetaTrader, and NinjaTrader.

4. Trading Platforms: Crucial for executing trades quickly and efficiently. Look for platforms that offer fast execution speeds, user-friendly interfaces, and advanced trading features.

5. Technical Analysis Tools: Help traders analyze price patterns and market trends. These tools include moving averages, Bollinger Bands, and Relative Strength Index (RSI). By combining technical analysis with news trading, traders can enhance their strategies and make more informed decisions.

6. Alerts and Notifications: Ensure you never miss important news releases. Many trading platforms and apps allow you to customize alerts for specific events, helping you stay on top of market developments.

By utilizing these tools and platforms, traders can effectively navigate the fast-paced world of news trading.

Conclusion

When trading on news releases, it’s crucial to remain cautious and consider broader economic trends and geopolitical events. Market sentiment can sometimes amplify or diminish the impact of news releases.

Remember, successful news trading requires a combination of preparation, analysis, and adaptability. Utilize the tools and strategies discussed to navigate the fast-paced world of forex trading effectively.

FAQ

How to trade forex using the news?

Can you trade based on news?

How to trade NFP news in forex?

Which news is best for forex trading?

What is the strategy of trading after news?

How long after news can you trade?

How do you analyze news for trading?

Related Post

most visited