If a trade remains open for more than a day, the Swap comes into effect, reflecting the cost or gain of carrying the position to the next trading day.

In the forex market, there are many points and terms that traders must master. Swap is also one of these terms. If a trade in the forex market is open for more than a day, it is subject to a swap, which can be positive or negative. Stay tuned to learn more about this topic.

What is Swap?

Swaps in the forex market arise from the variance in interest rates set by the central banks of the two currencies involved in a trade. When a position is held open for over a day, the swap can be either a credit or a debit, contingent on whether the trade is a buy or sell order.

For example, suppose a trader has made a transaction in the Euro-Dollar currency pair (EURUSD). If there’s a discrepancy between the interest rates of the European Central Bank and the US Federal Reserve, and the trader keeps the position open beyond a single day, a swap fee will be applied to the trade. This fee compensates for the interest rate differential over the period the trade is active.

Swap in the forex market is applied at the end of trading, that is, at 5:00 PM US time. In other words, a swap is charged to trades not closed before 5:00 PM.

Swap calculation formula

The calculation of a swap in the forex market is influenced by various factors, with the primary determinant being the interest rate differential between the two currencies involved in the trade. Due to the decentralized forex network, there are no specific institutions or rules for all brokers.

That is why the swap rate may differ slightly for brokers. In general, most brokers, including Trendo Broker, use the formula shown in the image below to determine the Swap:

In the forex market, brokers typically calculate the swap rates for each trading symbol in advance. Traders can easily access these rates through their brokerage platforms. There’s no necessity for individual traders to perform the calculations themselves, as the swap rates are readily available and can be applied automatically to their trades that remain open overnight.

One of the parameters in the formula is the difference between the interest rates of the two currencies. The interest rate of countries can change several times a year. However, the basis for determining the interest rate in the formula is the first interest rate of the year, and this rate remains constant until the end of the year.

The second factor that affects the amount of swaps is the trading volume. Therefore, the higher your trade volume, the higher the swap rate will be applied.

The third factor in determining the swap rate is the broker’s fee, which will be different for each broker. In this regard, Trendo Broker has optimized its infrastructure to minimize the costs associated with swaps. As a result, the broker’s fee is so nominal that it scarcely impacts the overall swap rates at Trendo Broker.

The difference between swaps in buy and sell trades

In calculating the swap rate, the difference between the Base Exchange rate and the counter currency is important. This difference affects the swap rate in two scenarios, depending on the currency’s position and whether the transaction is a buy or sell:

- Positive Swap

- Negative Swap

Let’s consider gold symbol as an example. When you engage in a buy transaction (also known as a ‘swap long’), the Swap value is negative. This means that if your gold buy transaction stays open for more than a day, the Swap amount will be deducted from your account.

On the other hand, in a sell transaction (referred to as a ‘swap short’), the Swap value is positive. So, if your gold sell transaction remains open for more than a day, the Swap amount will be added to your account.

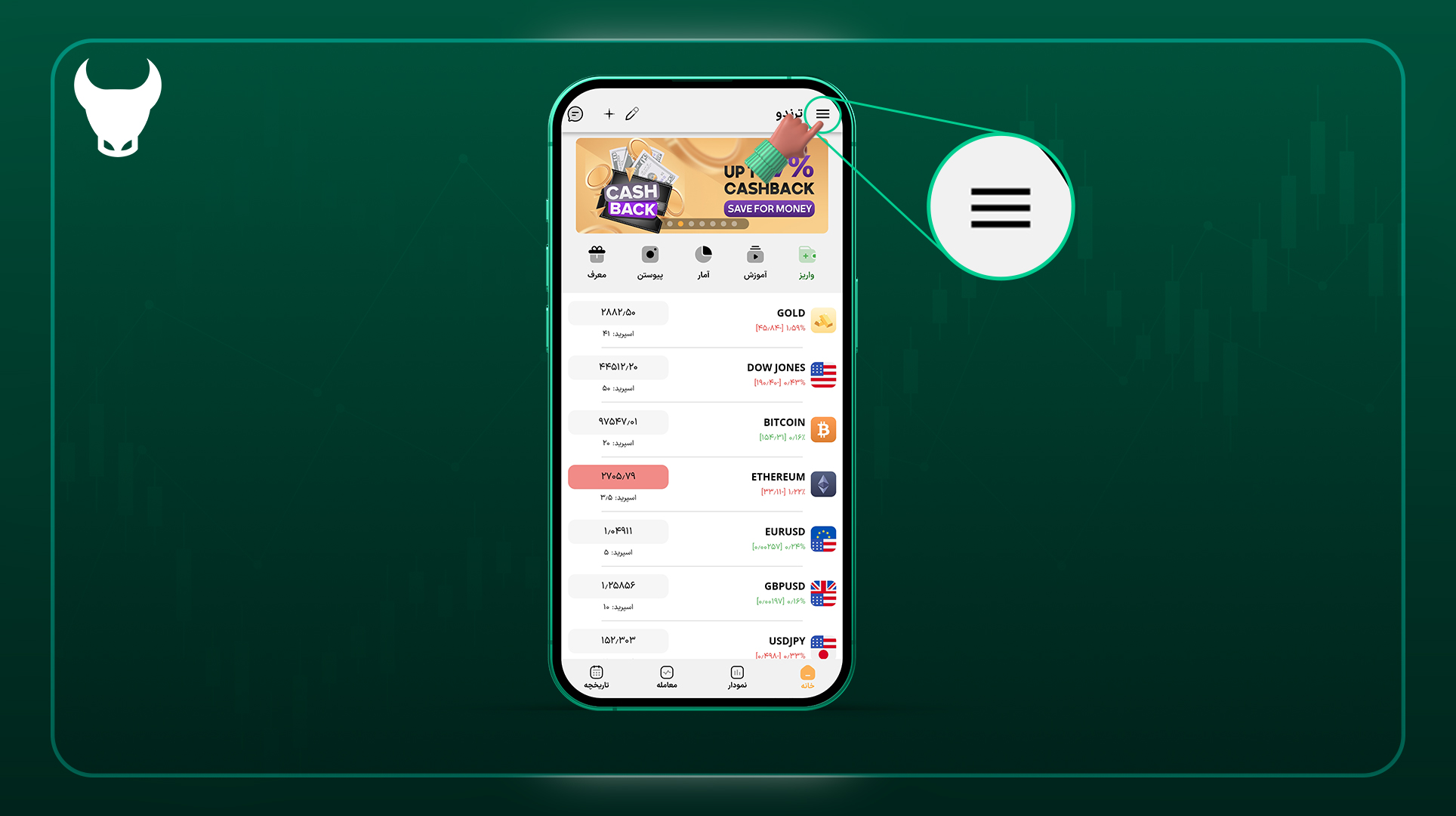

Swap in Trendo Broker

In Trendo Broker, you can view the details of the symbol, including buy and sell swaps, by clicking on and holding the desired symbol. As you can see in the image below, the details of the gold symbol (XAUUSD) are displayed. Currently, in Trendo Broker, the Swap Long is set at $-2.35 for each 1 lot, while the Swap Short is $1.04 for each 1 lot.

Swap on Wednesday

It’s important to note that the Swap rate on Wednesdays is tripled. This means that if you have a transaction open at the end of Wednesday, a Swap charge at three times the usual rate will be applied to that transaction.

This is due to the simultaneous settlement of three-day bank loan interest and forex spot market transactions that occur on Wednesdays, in anticipation of the weekend closure (Saturday and Sunday).

Keep in mind that there are no Swap charges on Saturdays and Sundays as the markets are closed on these days.

Swap in Cryptocurrencies

In cryptocurrencies, the concept of Swap as it exists in the Forex market doesn’t apply in the same way. However, there is a similar process in cryptocurrencies known as the ‘funding rate’.

It’s worth noting that the term ‘funding rate’ is no longer used in brokers offering cryptocurrencies for trading, and the term swap is used for cryptocurrencies along with forex symbols. Instead, the term ‘Swap’ is now commonly used for cryptocurrencies, in line with its usage for Forex symbols.

In contrast, in cryptocurrencies, the term ‘Swap’ refers to the exchange of one type of cryptocurrency for another. This process is fundamentally different from the concept of ‘Swap’ in the Forex market.

Islamic account (swap-free)

Some of the forex market rules do not fully comply with Islamic laws. One of these laws is the difference between interest rates and swaps. That is why some brokers offer Islamic accounts to their Muslim customers, which do not involve swaps.

In this regard, Trendo Broker has also offered Islamic accounts. If you wish to convert your existing account into a swap-free or Islamic account, you can do so by reaching out to the broker’s support team. It’s important to note that the Islamic accounts offered by Trendo Broker are identical to the standard accounts in terms of commission and spread, and only because of Islamic laws, the currency pairs and gold swaps are zero.

The difference between swap and commission

The commission and swap are two different components in trading. The commission is a set fee that the broker collects from each transaction, and it’s determined by the volume of your trade. It’s a constant amount, charged on all trades, regardless of the duration the trade is open.

On the other hand, a swap is the overnight interest rate applied to positions that remain open for more than a day. Unlike the commission, a swap can be either positive or negative. This means it could either be credited to or deducted from your account, depending on the nature of the transaction and the market conditions.

In essence, while commissions are a fixed cost incurred on every trade, swaps are variable costs that apply only to trades that are open for more than a day.

Summary

In our discussion, we delved into the concept of swap and its calculation formula. We learned that in the Forex market, swaps are applied to transactions that remain open for more than a day. These swaps can either be positive or negative, depending on the nature of the transaction and market conditions. However, swaps are not applied to trades in Islamic accounts.

We also reviewed the swap rate offered by Trendo Broker. Compared to other brokers, Trendo Broker’s swap rate was found to be quite low and insignificant, thanks to the broker’s minimal fee structure. This makes it an attractive option for traders looking for cost-effective trading solutions.

Lastly, we would like to emphasize the importance of considering the swap rate in your risk management strategy, especially if you plan on engaging in long-term trades. Remember, effective risk management is key to successful Forex trading.