Finding the best time frame to trade forex is one of the most common issues for traders who are trying to improve their trading performance.

In this practical guide, we clearly explain forex time frames, showing you how each one works, which ones suit different trading styles, and how to combine them using multi-timeframe analysis for better timing and higher-probability trades on the Trendo platform.

What Is a Forex Time Frame?

A forex time frame is the length of time represented by each candlestick on a chart, used to analyze price movements over different trading horizons. Choosing the accurate forex time frames is a critical skill that can significantly improve your trading results. In this article, we break it down simply so you can start using them effectively right away on your charts.

To accurately understand the concept of time frame in Forex, study the “Forex Trading Sessions” article on the Trendo website.

Technical Definition

A forex time frame is the specific duration each candlestick or bar on your chart represents. It shows the open, high, low, and close prices for that exact interval — nothing more, nothing less. Switch forex time frames instantly in the Trendo platform to match your trading style.

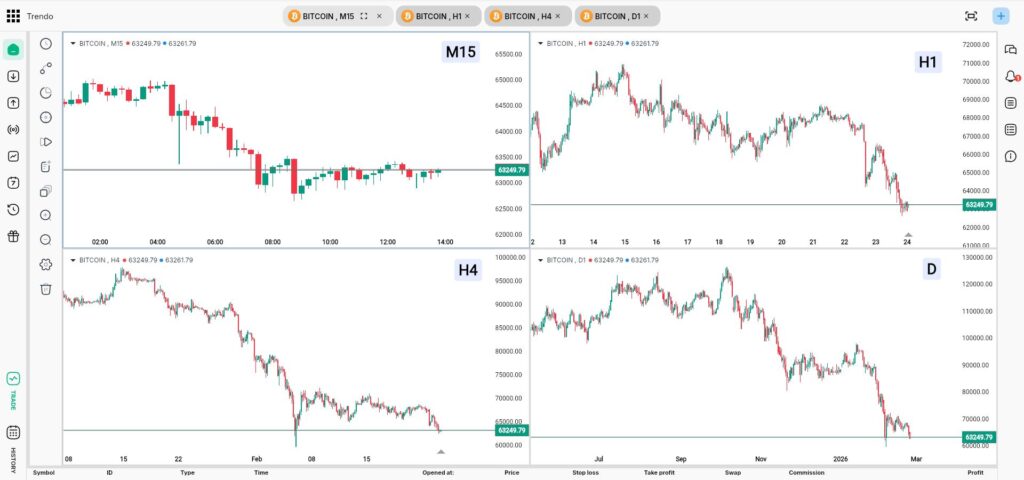

Example Charts (M15, H1, H4, Daily)

Here are the four most practical forex time frames traders use every day:

- M15: One candle = 15 minutes. Perfect for scalping quick entries and exits.

- H1: One candle = 1 hour. The go-to choice for clean intraday analysis.

- H4: One candle = 4 hours. Excellent for spotting strong trends with reduced noise.

- Daily: One candle = full trading day. Ideal for seeing the overall market direction.

Why Forex Time Frames Equal Your Market Perspective

Your chosen time frame directly shapes how you see the market. Lower time frames (M15, H1) show every small price wiggle and give more entry signals. Higher time frames (H4, Daily) filter noise and reveal the real trend, plus major support and resistance levels. Use this to your advantage: check higher time frames first for direction, then drop to lower ones for precise timing.

Forex Time Frames Explained for Beginners in Simple Language

Think of forex time frames like different zoom levels on a map. The Daily chart is the full-country view — you see the main highway (trend). The H1 or M15 chart is street view — you see every turn and traffic light (exact entry points).

Start simple: use the H4 time frame when you’re learning. It is the best time frame to trade forex for beginners. These charts are cleaner, easier to read, and help you avoid getting lost in noise. Once comfortable, add a lower time frame for entries only.

Read more about best forex time frames for beginners in the article below:

https://www.babypips.com/learn/forex/what-time-frame-should-i-trade

How Forex Time Frames Work

Mastering how forex time frames work is essential for reading the market accurately and improving your timing. On the Trendo platform, switching between time frames is fast and simple — use this flexibility to your advantage every day.

Candle Behavior in Different Time Frames

One price move can look very different across time frames. Lower time frames (M15 or H1) produce many small candles that often create choppy action and are difficult to analyze. On higher time frames like H4 and Daily, the same move forms larger, cleaner candles that are much easier to analyze.

Tip: Always wait for the candle to close on your main time frame before entering a trade.

How Volatility Changes Across Frames

Volatility looks much more intense on lower forex time frames because every small fluctuation is highlighted. What appears as sharp swings on M15 may look like normal market movement on the Daily chart. This is why trading news events on very low time frames is risky. Use higher forex time frames to understand true volatility levels before zooming in.

Connection Between Trend & Time Frame

The clearest trends appear on higher forex trading time frames. A strong daily uptrend will often include several small counter-trend moves on the H1 chart.

Practical rule: Always identify the main trend using H4 or Daily forex time frames first, then drop to a lower time frame to find high-probability entries in the direction of that trend.

Types of Forex Time Frames (Full Breakdown)

Choosing the right forex timeframe is one of the most important decisions you will make as a trader. Each group serves a different trading style and personality. On the Trendo platform, you can switch between all these forex time frames instantly with fast execution, making it easy to test what fits you best.

Lower Time Frames (M1, M5, M15)

These fast charts are designed for traders who thrive on high-speed action and want to capture small price movements multiple times per day.

Who should use them

Lower forex time frames are ideal for scalpers and extremely active traders who can stay focused in front of the screen for several hours. If you enjoy quick decisions and want many trading opportunities daily, these are your best tools.

Pros & cons

Pros:

- Plenty of trading signals and setups every session

- Tight stop-losses and excellent risk-reward ratios

With low spreads and high execution speed, the Trendo Broker is an ideal choice for scalping.

Cons:

- High noise and many false signals

- Mentally demanding with constant screen time

- Higher transaction costs

Scalping strategies

Focus on M5 and M15 for cleaner setups. Look for strong support and resistance levels combined with simple price action patterns. Enter during London or New York overlap when liquidity is highest. Use the 1-minute chart only for fine-tuning your exact entry. Trendo’s ECN execution ensures your orders fill exactly where you want.

Medium Time Frames (M30, H1, H4)

This group strikes the perfect balance between speed and clarity, making it the most popular choice among consistent traders.

Ideal for day trading & intraday trends

Medium forex time frames suit day traders who open and close positions within the same trading day. The H1 and H4 charts are particularly effective for catching intraday trends while avoiding the chaos of lower frames.

Pros & cons

Pros:

- Good mix of signals without excessive noise

- Manageable screen time (2–4 hours per day)

- Clearer trend direction and support/resistance zones

Cons:

- Fewer trades than scalping

- Overnight gaps can occasionally affect positions

- Requires more patience than M1–M15

Best indicators for these frames

- 50 and 200-period EMA for trend direction

- RSI (14) to spot overbought/oversold conditions

- MACD for momentum confirmation

- Bollinger Bands for volatility breakouts

Combine two or three indicators at maximum. For example, trade in the direction of the H4 trend using H1 pullbacks to the 50 EMA. This setup works exceptionally well.

Higher Time Frames (D1, W1, MN)

These charts show the big picture and are built for traders who prefer quality over quantity.

Best for swing traders & position traders

Daily, weekly, and monthly forex time frames are perfect for swing traders holding positions for several days to weeks, and position traders who stay in trades for weeks or months.

Pros & cons

Pros:

- Very clean charts with strong trends

- Less time required in front of the screen

- Higher average profit per trade

- Excellent risk-reward ratios

Cons:

- Fewer trading opportunities

- Wider stops required

- Requires strong patience and discipline

Psychological advantages

Higher forex time frames reduce emotional trading dramatically. You won’t get shaken out by normal market noise, which helps maintain discipline. This approach builds confidence as you focus on the real market direction instead of short-term fluctuations.

Mastering these different forex trading time frames allows you to align your strategy with your lifestyle and personality. Successful traders often combine multiple time frame forex analysis — using higher frames for overall direction and lower ones for precise entries in time frame trading.

Trendo Broker is a suitable choice for all trading styles. Trendo Broker offers a $100 Welcome bonus to start your trading journey. Register with Trendo now, give the bonus, and start trading.

https://my.fxtrendo.com/sign-up

Best Time Frame to Trade Forex for Beginners

Starting with the right forex time frames makes learning Forex much easier and helps you avoid costly early mistakes. Instead of jumping between every chart, focus on just two reliable options that give you clarity without overwhelming noise.

Why H1 & H4 are recommended

H1 and H4 strike the perfect balance for new traders. The H1 chart shows enough detail to spot clean entries and exits during the day, while the H4 chart reveals the bigger trend direction with far less noise than M15 or M5. These frames let you analyze the market in 1–4 hour blocks, so you don’t need to stare at the screen all day. On the Trendo trading platform you can switch instantly between H1 and H4, check the higher frame first for direction, then drop to H1 for precise timing. Most beginners see their win rate improve quickly once they stick to these two frames.

Common beginner mistakes

Many new traders start on M1 or M5, get trapped by constant fakeouts, and lose confidence fast. Others ignore the higher frame completely and trade against the real trend. Avoid both by always checking H4 first, then using H1 only for entries. Never revenge-trade after a loss, and always wait for the candle to close before deciding.

Master these two frames first, and you will build strong habits that work on any pair.

How to Choose the Right Time Frame for Your Strategy

Choosing the best time frame to trade forex is simple once you match it to your available screen time, risk tolerance, and personality. On Trendo, you can switch instantly and test everything risk-free on demo until it feels natural.

For Scalping

Scalpers should use M1, M5, and M15 forex time frames. These deliver frequent signals every session. Focus only on the London–New York overlap for maximum liquidity. With Trendo’s ultra-low spreads and lightning ECN execution, target about 8–15 pips per trade using near 5–8 pip stops. Enter on clear price-action patterns and exit fast; this style rewards speed and focus. Useful indicators for this trading style are VWAP, moving averages (9/20 EMA), and short-term RSI.

Note: Scalping requires full concentration and fast decision-making. Avoid higher forex time frames while they move too slowly for this style.

For Day Trading

The ideal choice for day trading is M30, H1, and H4. Check H4 first to lock in the intraday trend, then drop to H1 for clean entries and exits. Recommended to close position before the New York close to eliminate overnight risk. Expect 2–6 high-quality trades per day with comfortable screen time and solid 1:2 risk-reward setups.

Note: Day traders benefit from clear session volatility and don’t carry overnight risk.

For Swing Trading

Swing traders perform best on H4 and Daily charts. Use the Daily chart to spot the main trend and key levels, then switch to H4 to time entries during pullbacks. Hold positions 3–14 days on average. Wider stops (40–100 pips) give the move room to breathe while you enjoy higher average profits per trade.

Note: This trading style is the best for trend-following strategies while focused on market structure and support/resistance levels.

For Long-Term Position Trading

Position traders rely on Daily, Weekly, and Monthly charts. The Weekly and Monthly frames show the true market structure and major trends. Hold trades for weeks or months, combining technical levels with fundamental drivers (interest rates, GDP, central-bank news). This style demands the least daily monitoring and delivers the largest risk-reward ratios.

Note: Position trading reduces screen time but requires strong risk management and capital discipline.

Align your forex time frames trading approach with your real lifestyle, and you will trade with far more confidence and consistency on Trendo.

Multi-Timeframe Analysis (MTF)

Multi-timeframe analysis (MTF) is the fastest way to boost your accuracy and stop trading blind. Instead of guessing on one chart, you check 2–3 time frames for confirmation. This practical method works on every pair and fits perfectly into your existing trading routine.

The goal is clear: trade in the direction of the dominant trend and enter with better timing.

Top-down analysis (Daily → H4 → H1)

A practical structure many traders use:

- Open the Daily chart → identify the main trend and major support/resistance zones.

- Switch to H4 → confirm the shorter-term direction matches the daily picture and mark the best entry zones.

- Drop to H1 → Execute with confirmation (break of structure, candlestick pattern, or momentum shift).

Example: If the Daily shows an uptrend and H4 pulls back into support, you wait for H1 bullish confirmation to enter. This alignment improves probability and reduces emotional trades.

Avoiding false signals

Most losing trades come from signals that look good on one chart but fail on another. With MTF analysis, you simply skip any setup where the higher time frame disagrees. For example, if H1 shows a breakout but Daily is sitting at strong resistance, you stay out. This single habit alone removes most whipsaws and fakeouts.

Why professionals always combine time frames

Professionals combine forex time frames because it gives them huge advantages, including clear direction from the higher frame, perfect timing from the lower frame, filtering low-quality setups, and placing more logical stop-loss levels. The result? Higher win rates, larger average winners, and far less emotional trading. Whether you scalp, day trade, or swing, this one technique turns good setups into great ones.

Start using MTF today and watch your trading become calmer and more profitable.

Time Frames for Major Forex Strategies

Not every strategy works on every chart. The key is matching your trading method to a time frame that supports its logic, volatility requirements, and risk structure.

Here’s how to align them correctly:

Trend Trading

Stick to H4 and Daily charts for trend trading.

Start on the Daily to confirm the overall direction and mark major support/resistance. Drop to H4 to enter on pullbacks to the 50 or 200 EMA. Hold until the trend shows clear signs of exhaustion. This combination gives you high-quality setups per month with excellent risk-reward (minimum 1:2.5). Use Trendo’s fast chart switching to check both frames in seconds.

Breakout Trading

Use H1 and H4 for the best breakout results.

Watch for tight consolidation (usually 20–40 pips) on H4, then move to H1 to catch the breakout candle close above/below the range. Place stops just beyond the consolidation and target the next major level from the Daily chart. London and New York session opens produce the cleanest breakouts. Trendo’s ultra-low spreads and instant ECN fills make this style extremely profitable.

Note: Avoid trading breakouts on very low forex time frames (M1–M5) unless you are scalping because false breaks are frequent.

Range / Reversal Trading

M15, H1, and H4 are perfect for range and reversal setups.

On the H4 chart, identify strong horizontal support and resistance zones. Drop to H1 or M15 to trade bounces inside the range using RSI divergences or double tops/bottoms. For reversals at major levels, wait for a clear rejection candle on H1 after the price hits the zone. Keep risk tight and take partial profits at the opposite side of the range. This keeps your win rate high even in sideways markets.

Match your strategy to these forex time frames, test on the Trendo demo first, and you’ll immediately trade with more precision and confidence.

Best Time Frames for High-Volatility Pairs

High-volatility pairs move fast and reward traders who pick the right charts. However, it is worthmentioning that the correct choice of timeframe is entirely dependent on the trading style. We have provided general guidance on common timeframes for each currency pair below:

EUR/USD

H1 and H4. Perfect balance for clean intraday trends during London and New York overlap. Gives reliable entries with tight spreads.

XAU/USD (Gold)

Gold is sensitive to macro and news moves. Traders often use H1 and H4 time frames to capture both intraday swings and reactions to economic releases, with M15 for timing entries or exits.

GBPJPY

Due to large average daily ranges, experienced traders lean on H1 and H4 charts to catch trend moves without being overwhelmed by noise. These frames help filter false signals and give clearer trend structure.

USDJPY

USDJPY can trend cleanly but also reacts to session overlaps and economic data. H1 is popular for intraday strategies, while H4 helps confirm trend direction and avoid whipsaws during volatile moves.

Practical tip:

Always check the higher frame first, then drop to the lower one for entry. This simple habit works on every high-volatility pair and dramatically improves your results. Across high-volatility pairs, H1 and H4 time frames are widely used by experienced traders because they capture meaningful price movement while reducing noise compared with very low charts. Shorter charts like M15 are then layered in (multi-timeframe approach) to improve entry timing within those broader moves.

Mistakes Traders Make with Time Frames

Even experienced traders lose money because of simple but costly mistakes with forex time frames. Spot and fix these three common errors to improve your performance.

Overtrading Lower Time Frames

Many traders spend too much time on low timeframes (M1/M5/ M15) chasing every small move. These lower frames are full of noise and false signals, leading to overtrading, emotional decisions, and wiped-out accounts from constant small losses.

Practical fix: Use lower frames only for final entry timing. Always decide direction and key levels on H4 or Daily first.

Switching Forex Time Frames Too Often

Constantly jumping between charts during a trade creates confusion. You enter on H1, check M15, then panic and exit early, or move stops.

Practical fix: Choose your analysis and execution forex time frames trading setup before the London open and stick to it for the entire session.

Confirmation Bias

Traders often zoom into the time frame that supports what they already want to see while ignoring the higher-frame reality. A strong buy signal on H1 can still fail if the Daily chart is at strong resistance.

Practical fix: Always start top-down: higher frame first for direction, lower frame only for timing. This keeps your trading objective instead of being emotional.

Remove these three mistakes from your routine, and you will trade forex with far more discipline, confidence, and consistency.

Expert Insights

With years of experience in forex trading, I can say confidently that Multi-Timeframe Analysis (MTF) is the single biggest edge any trader can own. Most traders look at only one chart and get confused by noise. Successful traders always check higher forex time frames first for direction, then drop to lower time frames for precise entries. This top-down method is exactly what turned me into a consistently profitable trader.

Let’s check one of my profitable setups, based on MTF, the Daily → H4 → H1 top-down analysis on EUR/USD. As shown in the following image, Daily chart shows a clear uptrend with higher lows. H4 confirms pullback to 50 EMA. H1 gives a precise entry candle. So, this setup results in a winning trade.

The difference between amateurs and professionals isn’t better indicators or bigger accounts. It’s MTF discipline. Thus, I recommend that traders pick two core frames today and build every single analysis around them. Never take a trade until the higher frame agrees. Do this for 30 days, and your trading will transform. The market doesn’t reward complexity — it rewards clarity. MTF gives you that clarity every single day. Start applying everything you’ve learned here on your Trendo demo right now. The edge is waiting.

Conclusion

Mastering forex time frames is one of the most important skills for consistent profitability. This guide covers how different forex time frames suit scalping, day trading, swing trading, and position trading, as well as the critical role of multi-timeframe analysis in making better decisions. Remember, there is no single best time frame to trade forex. Success comes from selecting the right combination, employing top-down analysis, and avoiding common pitfalls. Start applying these strategies today.

Register with Trendo and practice MTF trading on the Demo account.